Crypto investment scams come in various forms but work on the same principle – they promise huge returns to entice you into investing, with the intention of stealing your crypto assets. In the end, you lose everything that you put in. To avoid falling victim to such fraudulent schemes, it helps to be aware of the warning signs and patterns of deception.

In this article, InvestmentNews delves deeper into the world of cryptocurrency scams. We will give you an overview of the common types of fraud and the tactics scammers use to lure unsuspecting investors. We also talked to a crypto forensic expert who broke down the red flags and explained what to do if you’ve been scammed.

If you’re looking at cryptocurrency as an investment option, this guide can prove handy. Read on and pick up practical strategies on how to keep your crypto assets safe and secure.

Investing in cryptocurrency presents lucrative opportunities but it also comes with inherent risks. While you can make lots of money, especially when there’s a surge in demand, there’s also the possibility of losing everything. As with all risky investments, cryptocurrencies can be a good investment option if you know what you’re doing and if they are a part of a diversified portfolio.

A safer but potentially less profitable alternative is purchasing stocks of companies with exposure to cryptocurrency. Some Bitcoins, for instance, are available as spot-price exchange-traded funds (ETFs), including those from BlackRock, Fidelity, and Invesco.

This beginner’s guide to ETFs can give you an idea if investing in exchange-traded funds is the right move.

Investors can find plenty of legitimate opportunities in crypto assets. The digital currency’s profit potential and technological loopholes, however, also attract those with malicious intent. Here are some of the top reasons why crypto investments are vulnerable to scams:

Just like other types of investment fraud, cryptocurrency scams are meant to trick you into parting with your digital assets. They take on different forms and often play on emotions such as greed.

“The most common theme when it comes to crypto investment scams are the perpetrators telling their potential victims that they make a lot of money by investing in a specific platform,” said Joshua Cooper-Duckett, director of investigations at CF Investigators Inc.

He added that scammers would often lure unwitting investors by providing inflated profits supposedly from trading assets and encourage them to do the same. They would also share screenshots as proof and volunteer to guide their victims throughout the investment process.

“There are a few variants, each of them different in a sense and perpetrated by different threat actors, but they all have the same outcome – the victims send a bunch of money, purportedly make profits in most cases, and then when it comes to withdrawing, they’ll be asked to pay taxes or fees.

“The fraudsters will continue to make up more bogus fees to extract more money from the victim. But in reality, the profits never existed, and the taxes and fees are just another way to extract money. The victim will never be able to withdraw their ‘profit’ or initial ‘investment.’”

Cryptocurrency scams share certain similarities, but each has its unique aspects. Here are the five main types of crypto investment scams, according to the crypto forensic expert.

In a pig butchering scam, fraudsters “fatten up” their victims by gaining their trust and encouraging them to invest more crypto assets. Once the victims have made significant investments, the scammers “slaughter” them by disappearing with their money. This scam is also called “sha zhu pan,” a Chinese phrase that literally translates to “killing pig plate.”

Cooper-Duckett describes these scams as brutal as they tend to last months or even years. Here’s an overview of how this type of crypto investment scam works:

Learn more about how investment scams work in this guide.

A rug pull scam occurs when developers withdraw support for a cryptocurrency project, leaving investors with worthless tokens.

“This is where somebody creates a new token to take advantage of some sort of hype and coins it a new ‘meme token,’” Cooper-Duckett said. “They then add some liquidity to a liquidity pool – essentially on a decentralized exchange – to enable people to purchase the tokens.

“When the token price is inflated, the creator will essentially ‘rug’ the protocol by withdrawing the liquidity and dumping their own tokens on the new investors. They basically pull the rug from under the victims; hence the term rug pull.”

This type of crypto investment scam often rides on the hype train and is heavily marketed on social media to reach as many people as possible. A recent example is the Squid Game token rug pull, which cost investors millions worth of cryptocurrency.

In this type of crypto investment scam, the perpetrators use YouTube and social media group chats like Telegram to share purported profitable trades they have pulled off, coupled with screenshots of the fake deals. They then try to scam potential victims in a few ways:

Once the scammers have secured the funds, they remove the victim from the group and keep their digital assets. Scammers rotate groups every so often and use bots to make it seem like there are many participants to gain a potential victim’s confidence.

Ponzi schemes work with organizers paying existing investors with money collected from new investors. A popular form of investment fraud, Ponzi schemes are not common in the cryptocurrency world, but they can be successful once they take off.

Among the most notable are Bitconnect and OneCoin. These crypto Ponzi schemes defrauded investors out of an estimated $2.4 billion and $4 billion, respectively.

Rip deals target companies, venture capitalists, and startups rather than general consumers and have been gaining traction recently, according to Cooper-Duckett.

“We’ve seen a few different spin offs of this type of scam,” he said. “Some involve companies that offer a specific service or product, others involve start-up companies themselves that may be looking funding.”

He then breaks down how this type of crypto investment scam works:

“The method of compromise has not been fully identified,” the crypto forensic expert explained. “But there is speculation that the perpetrators had possession of victims’ devices even for just a few seconds in which they were able to compromise the credentials, or that there are cameras somewhere at the location in which they meet.”

Curious about the biggest investment fraud in recent history? We have them ranked in this guide.

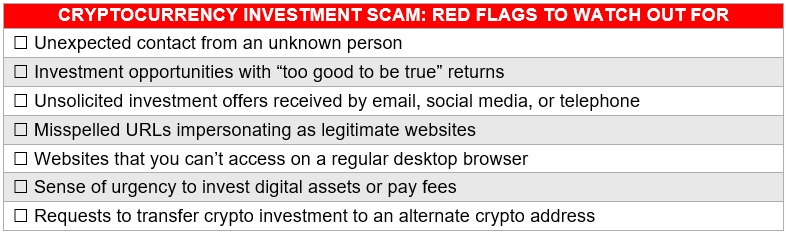

One of the best ways to avoid falling victim to a crypto investment scam is identifying the warning signs. Here’s a checklist:

It also pays to perform due diligence. A simple internet search often yields eye-opening results.

“Education is key,” Cooper-Duckett said. “Before even considering investing in something, individuals should do their own research. Do they know how cryptocurrency works? Do they know how a cryptocurrency wallet works? Have they performed due diligence themselves rather than taken somebody else's word for it?

“Even somebody that they know and have met could accidentally lead them to a fraudulent investment because they themselves are being defrauded but just don’t know it.”

The industry expert added that one of the biggest mistakes victims make is letting the scammers know that they have become aware that they are being scammed.

“Once a victim knows it’s a scam, they should never give away that they know or suspect it’s a scam,” he said. “Keeping communication open has investigative value and can yield clues. Additionally, if the victim can convince the scammer that they will likely ‘invest’ more in the future, some victims have success in getting the scammer to send them a small portion of the money back.”

Victims should also stop sending funds immediately and file a report with authorities in their jurisdiction. Here’s a list from CF Investigators:

|

Region |

Authority |

|

Internet Crime Complaint Center (IC3) |

|

|

Canadian Anti-Fraud Centre (CAFC) |

|

|

Australian Cyber Security Centre (ACSC) |

|

|

Action Fraud |

Cooper-Duckett reminded investors to remain vigilant because once lost, very little can be done to recover their crypto assets.

“Blockchain transactions cannot be reversed, and there is nobody that can guarantee recovery,” he said. “It is wise to be skeptical about anyone claiming that they can recover the entirety of the stolen funds – that rarely happens.”

If you like this guide on how to avoid crypto investment scams, you can check out our other guides on how to make sound investment moves

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound