Rockefeller Capital Management, which has seen strong net gains of hundreds of financial advisors over the past several years, started 2024 by hiring two teams, one from Merrill Lynch and the other from UBS, which combined had worked with more than $5 billion in client assets at their previous firms.

The hiring come on the heels of another strong year for recruiting and hiring at the wealth management firm, which was a longtime family office before launching itself as a wealth management firm in early 2018.

Greg Fleming, a former senior executive at both Merrill Lynch and Morgan Stanley, is CEO of Rockefeller Capital Management, which at the end of December managed $122 billion in client assets across its various businesses and is known to be among the most aggressive firms on the Street when it comes to offering recruiting bonuses to financial advisors.

Last week, Rockefeller Capital's family office group said it had hired a team in Michigan led by longtime Merrill Lynch advisors. Based in Grand Rapids, the new 26-person team, Axiom Wealth Partners, is led by Jeffrey Towner, David Lund, Brett Howell, and Craig Sharp, who have the titles of managing directors and private advisors.

According to Forbes.com, the Towner Lund Group had $5.1 billion in assets with Merrill Lynch as of March 2023. On Wednesday morning, David Lund declined to comment about the team's decision to join Rockefeller Capital.

Andrew Tate, who's based in Charlotte, North Carolina, started working at Rockefeller Capital on January 9 after spending more than nine years at UBS Financial Services Inc., according to his BrokerCheck profile. Tate did not respond to a call Wednesday morning seeking comment about his move. According to industry news website AdvisorHub, Tate managed between $400 million to $600 million in client assets.

A spokesperson for Rockefeller Capital Management declined to comment.

Last year, Rockefeller Capital Management said it had sold a 20.5% stake for $622 million, putting the firm's valuation in the neighborhood of $3.1 billion. IGM Financial Inc., a member of the Power Corp. of Canada, made that investment in Rockefeller Capital. Viking Global Investors is the firm’s majority investor.

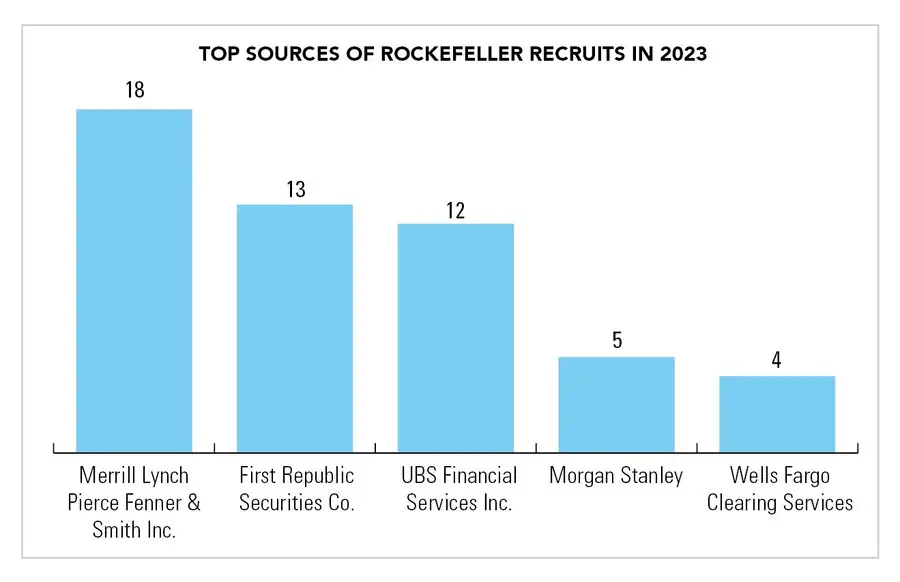

The hiring of the groups from Merrill Lynch and UBS is nothing new for Rockefeller Capital. It's been picking off financial advisors from those firms for years. Last year alone, Rockefeller hired and recruited 18 financial advisors from Merrill Lynch and 12 from UBS, according to InvestmentNews data.

It also hired 13 from First Republic Securities Co., which was acquired by JPMorgan Chase after last year's credit meltdown killed a handful of banks, five from Morgan Stanley and four from Wells Fargo Advisors, according to InvestmentNews data.

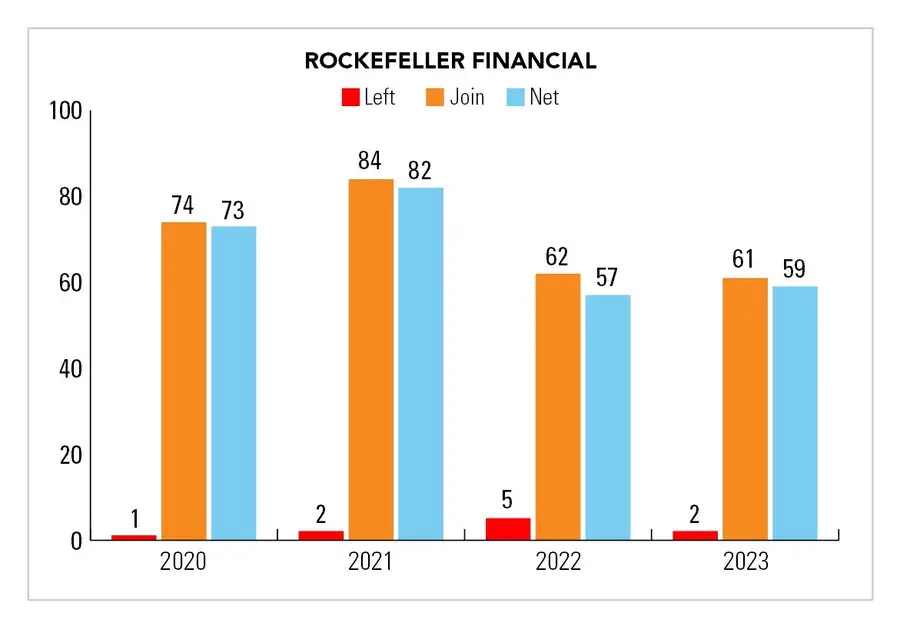

Rockefeller Capital's broker-dealer has seen a net gain of 271 financial advisors since 2020, according to InvestmentNews research, with very little attrition.

"That‘s a lot of people," said one industry executive, who asked not to be named. "Rockefeller is really one of the most dynamic players in the industry. It launched with a mission to make sure it was providing financial advisors with a platform where they lose nothing from the big firm they used to work at but gain the open architecture of an independent RIA and family office. It's been a competitive force for years."

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound