Like clockwork, the disappointingly correlated market returns of 2022 have sparked renewed interest in alternative investments.

Anyone embracing anything remotely in line with the classic long-only portfolio of 60% stocks and 40% bonds is likely hoping to shrug off as an anomaly last year’s performance, which was the worst for the 60/40 model since 2008. Much of that sad milestone was due to the fixed-income side of the portfolio, which recorded its worst year ever in 2022.

Thus, the tilt toward less correlated strategies could be described as a predictable reaction even for the most seasoned investors and financial professionals. But while the tendency to fight the last war probably goes back to the dawn of investing, the appeal of diversifying beyond traditional allocations right now appears to be grounded at least in part on what lies ahead for 2023 and beyond.

“The correlation between public equities and fixed income is positive, unstable and will remain higher than it has historically,” said Stuart Katz, chief investment officer at Robertson Stephens.

Katz cites lingering macroeconomic factors that continue to threaten the financial markets, including stubbornly high inflation, a Federal Reserve policy of higher interest rates to combat that inflation, and the increasing likelihood of a recession as a by-product of it all.

Add to that simmering geopolitical unrest, including the war in Ukraine, and a fresh battle over whether lawmakers should set another record for U.S. debt, and you’ve got a wildly dicey outlook for the financial markets.

While the first three weeks of 2023 showed glimmers of hope for the classic 60/40 portfolio, which posted a 2.3% gain, the financial advisory community might require a bit more convincing.

According to data compiled in late December and early January by Devin McGinley, director of InvestmentNews Research, financial advisors are showing ever-increasing interest in alternative investments.

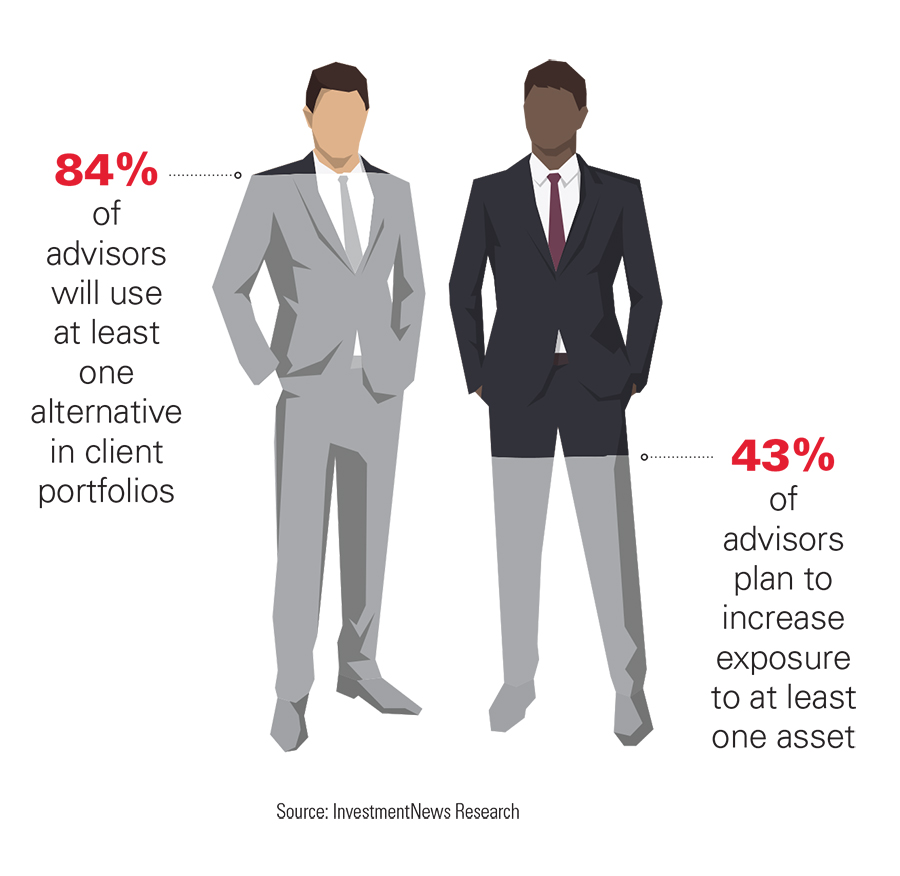

McGinley’s survey of more than 200 advisors and financial professionals showed 43% plan to add exposure to at least one alternative asset class this year, and 46% anticipate increasing their average allocation to alternatives over the next three years.

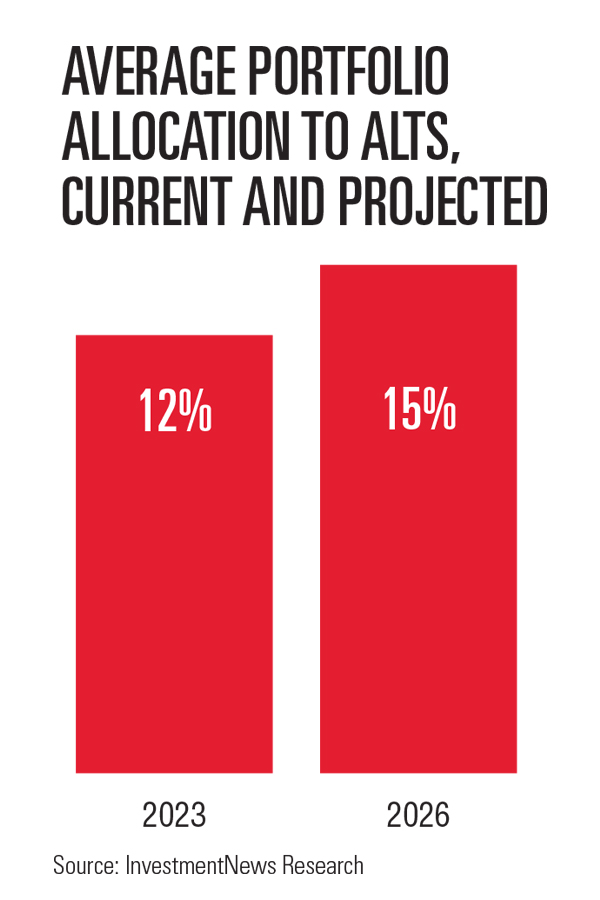

The message gets clearer when considering that advisors surveyed said their average allocation to alternatives over the next three years is expected to rise to 15% from a current average of 12% of client portfolios.

What’s driving the increasing appeal of alternatives, McGinley explained, is partially an uncertain economic outlook and partially a recognition of the long-term benefits of diversification.

For instance, among the advisors McGinley surveyed, 61% said they expect the S&P 500 Index to finish 2023 with a gain, compared to 25% who expect a loss, and 14% who expect a flat market.

But when asked about their outlook for the U.S. economy, 43% expect it to improve this year, while 57% expect it to decline or remain unchanged.

Even though it’s the responsibility of advisors to help clients navigate investment strategies, McGinley sees increasing pressure from investors.

More than a third of advisors surveyed said they’ve had clients asking about alternative investments over the past six months. When discussing alternatives, the two biggest investor concerns were down markets and inflation.

“Clients are asking about alternatives because they’re nervous,” McGinley said.

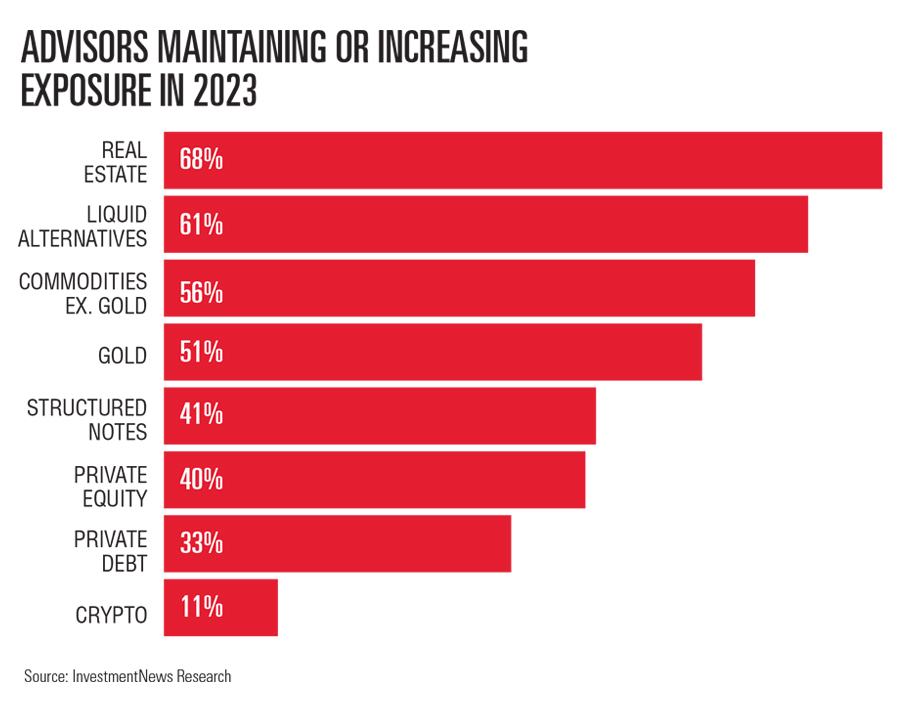

In terms of the alternatives clients are asking about, the research lists the following in order of the asset classes most asked about: real estate, gold, private equity, liquid alternatives, cryptocurrency, structured notes and private debt.

Meanwhile, financial advisors are still generally playing it close to the vest when it comes to alternatives. When asked how they discuss alternatives with clients, only 5% of advisors said they talk about alternatives with all their clients, and 20% said they rarely discuss alternatives.

An overwhelming majority, 62% of advisors, said they discuss alternatives on a case-by-case basis.

Amy Hubble, principal investment advisor at Radix Financial, would be counted in the camp of not following the herd toward alternatives at this time.

“This environment also does not bode well for alternative asset classes which rely heavily on leverage to deliver returns, including real estate,” she said. “While they may be negatively correlated, in this environment, we do not believe that leveraged-based alternatives provide any reduction in risk to an overall portfolio.”

In addition to her concerns over excess leverage, Hubble is avoiding alternatives in exchange for pure exposure to an anticipated market run.

“We are strategically not invested in any alternative asset classes within our portfolio strategies, feeling that the opportunity for a recovery rally in the liquid equity markets, coupled with higher yields in the investment-grade bond markets, together present a higher potential for risk-adjusted return at a lower cost,” she said.

Matt Chancey, an advisor at Micel Financial, also sees a move to alternatives now as a bad strategy.

“Turning to alts when other, more traditional asset classes are down is a loser’s game,” he said. “That is chasing returns, and academic and behavior research suggests it doesn’t work.”

Then, there’s the flip side, which includes a growing chorus of how and why alternatives might finally become an all-weather portfolio allocation.

“We recommended alternatives over the last decade when large-cap growth outperformed every other asset class and will continue to recommend alternatives as part of a more diversified portfolio for our clients,” said Tyler Whitehouse, director of financial planning at RMR Wealth.

“We even built out a digital asset platform in 2022 to give clients access to cryptocurrency and blockchain technology through a managed model,” he added.

Whitehouse said his firm exposes clients to a broad range of risk-based alternative strategies, including buffered notes, nontraded REITs, private equity and private credit.

“These strategies generally have liquidity restrictions and are only appropriate for long-term investors with sufficient assets,” he added. “We believe these investment offerings are a critical component of a well-diversified portfolio, and their lack of correlation to public markets can help reduce overall portfolio volatility while not impacting potential returns.”

The trend is definitely toward more, not less, allocations to alternatives, said Chayce Horton, research analyst at Cerulli Associates.

Horton’s latest research shows a steadily growing appeal of alternatives. A survey of advisors last year showed a 9.1% average client allocation to alternatives, which had hovered around 7% during the two previous years. And those advisors expect client allocations to alts to be averaging 9.6% by next year.

Horton’s research, which looked primarily at wealthy investors, discovered a growing appetite for allocations to private equity, venture capital, private debt and hedge funds.

But as the demand for alternative strategies expands to include more mass affluent and retail-class investors, Horton said the financial services industry is expected to respond.

“Suppliers are tailoring product launches toward the retail client segment versus just the institutional segment,” he said. “That paired with increasing demand is a two-headed monster driving growth.”

Across the broad universe of all things beyond plain vanilla stocks and bonds, most of the focus these days is on reducing risk, as opposed to seeking out new avenues of outsized returns. That craving for risk aversion is why so many believe the current trend toward alternatives has a solid foundation and staying power.

“In the present environment, with outsized rate hikes and beyond super inflation, rents are bumping up at historic rates, which makes real estate a classic hedge,” said Jeff Schwaber, chief executive of Bluerock Capital Markets.

Bluerock offers access to real estate investments with an interval fund that offers limited quarterly liquidity and is sold through a network of 200 broker-dealers.

Limited liquidity, which is often viewed as a strike against many alternative strategies, is an important part of driving success, Schwaber said.

“Nontraded REITs, as an asset class, has averaged about 9.8% over the last 44 years, with just four down years, and there have been eight rising-rate and inflationary cycles since the [NCREIF] index came out in 1978,” he said. “That’s why we’re bullish.”

Aaron Veldheer, managing partner at Strategies Wealth Advisors, said alternative allocations make up between 20% and 30% of client portfolios and that “2022 was a phenomenal proving ground for our clients. Now there’s going to be a good business cycle.”

The advisory firm relies on private real estate as an inflation hedge and plans to use its private equity exposure to help clients navigate a coming recession.

“If you look at what happened in 2008 when you had market dislocations, a recession is a favorable event to these acquisition companies, because they will be buying at discounts,” Veldheer said.

“Ten years ago, the hunger for alternatives was almost nonexistent ... Now it’s the complete opposite.”

Deron McCoy, chief investment officer, Signature Estate & Investment Advisors

Deron McCoy, chief investment officer at Signature Estate & Investment Advisors, sees both the growing demand for alternative investments and the challenges that come with traversing the category.

“People are worried, rightfully so, about a U.S. recession and maybe a global recession, as well as the valuations and earnings projections for equities,” he said. “Looking around the world, the question becomes can we allocate elsewhere with less risk that can still earn 9% to 11%, and the answer is yes.”

In the truest spirit of diversification, McCoy said the goal is to “fund the alternatives bucket with your least favorite idea,” suggesting a reliance on alternatives for risk management as opposed to enhanced performance.

But sometimes clients view alternatives through a different lens.

“You’re seeing increasing demand for alternatives and clients are asking, ‘What else is there; what am I missing?’” McCoy said. “Ten years ago, the hunger for alternatives was almost nonexistent. We were having trouble just talking about equities when the risk-to-reward for stocks was great. Now it’s the complete opposite, and we’re not coming out of recession, we’re heading into recession.”

Assuming both advisor and client have moved past any preliminary debates about whether alternatives are the right fit at this time, the next steps don’t need to be overcomplicated.

Nadia Papagiannis, head of multi-asset class portfolio solutions at Northern Trust Asset Management, said the best alternative strategies are often the easiest to explain to clients.

“The hardest part of using alts is explaining why you have them in your portfolio and being able to explain exactly what they are,” she said.

With that in mind, Papagiannis takes a straightforward approach to alternatives by categorizing them as either part of the portfolio’s growth engine or part of the risk control.

Beyond that, she said, there’s no reason to overcomplicate things.

“For many investors, the best alternative investments are liquid, long-only stock and bond investments that are not your typical stocks and bonds,” she said. “And the reason for that is, most of the strategies that are long-short in nature and illiquid, sometimes they work, sometimes they don’t.”

While the case is often made that less liquidity is part of the secret sauce of an alternative strategy because it frees up the manager to invest without having to worry about investor redemptions, Papagiannis believes the market is flush with available liquid investments that can act as alternatives.

Her simple solution for introducing alternative investment exposure can be boiled down to high-yield bonds, real assets such as natural resources, infrastructure and real estate companies, and Treasury Inflation Protected Securities, also known as TIPS.

In a traditional 60/40 portfolio, Papagiannis said the high-yield bonds and real assets can be used to diversify the growth engine on the equity side, while the TIPS enhance risk control on the bond side.

She said a key to her strategy, which includes gaining exposure through the public markets, is not having to be accredited to invest in them, “and you don’t have to be accredited to understand them.”

“These aren’t things that investors have to be scared of,” Papagiannis said. “They are stocks and bonds; they just act differently.”

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound