New York City REIT Inc. (NYC), managed by the Nicholas Schorsch-led partnership AR Global, has taken a severe hit to its share price in the weeks since it listed on the Nasdaq, with investors seeing the value of their holdings drop as much as 80% from the initial sales price.

The REIT was launched in 2013 as one of a bevy of nontraded real estate investment trusts managed by AR Global. Dozens of independent broker-dealers sold the high-commission REIT at its offering price of $25 per share. Such illiquid REITs were often sold with the promise of high yields and a listing of shares, known as a liquidity event in the industry, that would allow investors to cash out and get back all or a good portion of their principal.

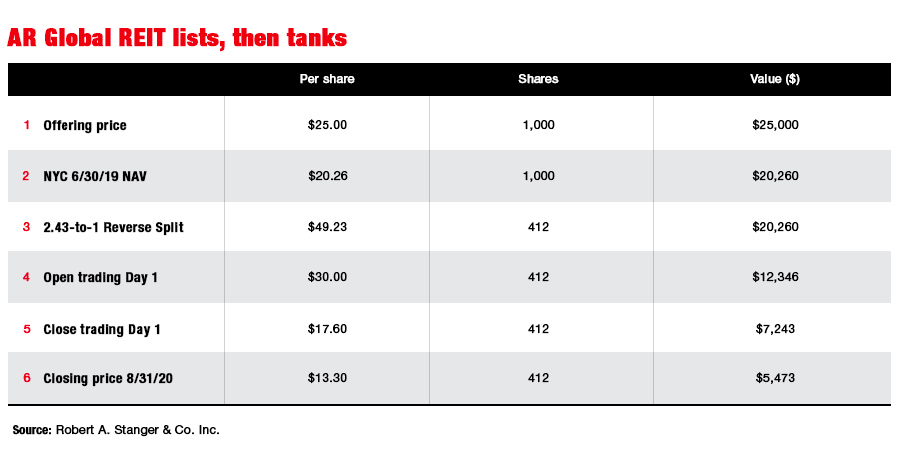

After a 2.43-to-1 reverse split in July and its August listing, the REIT's shares were trading at close to $12 last Thursday afternoon.

According to Robert A. Stanger & Co., an investment bank and REIT watcher, a client's initial purchase in 2014 of 1,000 shares of the REIT had a value of $25,000. After the reverse stock split, the number of those shares was reduced from 1,000 to 412, according to Stanger. That means the client who invested $25,000 now has an investment worth close to $5,000, a staggering decline of 80%.

AR Global's chief corporate counsel, Michael Anderson, did not return calls this week to comment.

The results of New York City REIT's reverse split and listing could also be bad news for broker-dealers that sold the REIT as clients may file investor claims seeking damages. Brokers and advisers typically collected commissions of 7% for those sales, and firms received commissions of 1% to 2%.

"This was the big listing investors were promised, but that $25,000 is down 75% or 80%," said Scott Silver, a plaintiff's attorney who is getting calls from investors about the REIT's precipitous decline in value. "The client's broker told him six years ago to buy it and get the dividend."

"The average investor never had a fighting chance to evaluate what they had," Silver added.

New York City REIT, which is focused on New York commercial real estate, started trading at $30 per share on Aug. 18. It closed that day at $17.60 and by the end of the month had fallen further, to $13.60 per share.

Investors in other REITs offered by AR Global, formerly known as AR Capital, have fared better, particularly those who bought the investments in the wake of the 2008 credit crisis, when commercial real estate was a beaten-up sector and valuations were cheaper.

Schorsch and AR Capital last year agreed to pay $60 million in penalties to settle Securities and Exchange Commission charges that Schorsch, the firm and a partner wrongfully obtained millions of dollars in connection with REIT mergers that were managed by AR Capital.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound