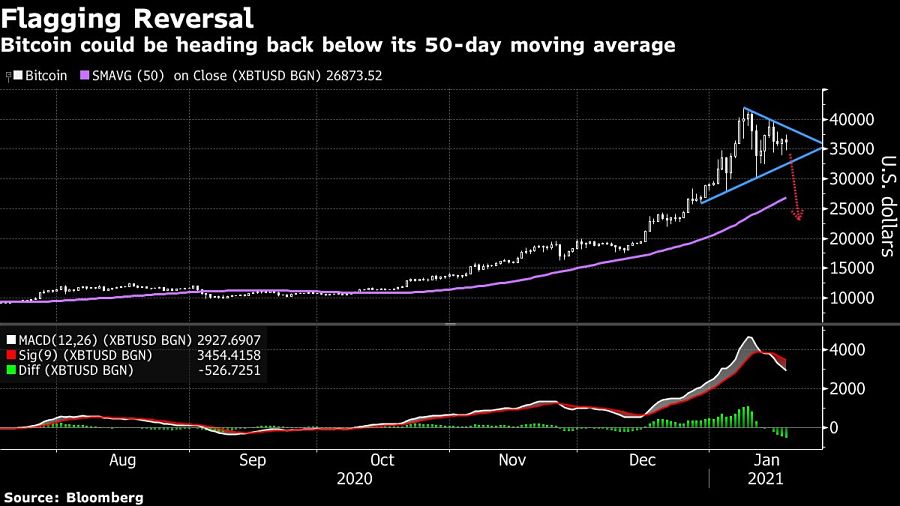

The Bitcoin fever is starting to break as worries about a market bubble discourage investors from buying in.

Prices for the largest cryptocurrency dipped as much as 6.8% on Wednesday and traded below $35,000. Ever since the market shot through all-time highs in early January, Bitcoin has been beset by volatility and skepticism that the run-up has been excessive.

Analysts have pointed to $40,000 as the key level that Bitcoin needs to surpass in order to draw fresh money from investors riding cryptocurrency momentum. They argue that recent gains could prove fleeting if the rally stalls and traders looking for quick returns shift their money elsewhere.

“Many cryptocurrency traders are diversifying into other coins in fear that Bitcoin could see another collapse if $41,500 is not reached sometime soon,” said Edward Moya, senior market analyst at Oanda Corp.

There are also concerns among Wall Street pros that Bitcoin’s 400% rally in the past year makes it too dangerous for them to jump in. In Bank of America Corp.’s monthly survey, fund managers called Bitcoin the world’s most crowded trade -- the first time it’s held that title since 2017.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound