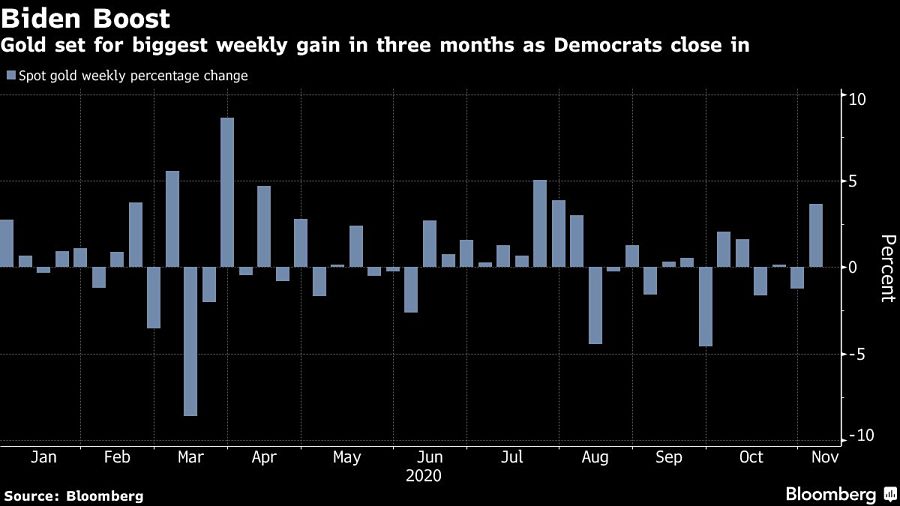

Gold and copper headed for the biggest weekly gain since July as Joe Biden tightened his grip on the race for the White House, while investors also weighed prospects for further Federal Reserve stimulus.

Bullion broke out of a narrow trading range seen over the past month as uncertainty over the election and renewed stimulus hopes boosted demand for the safe haven. Biden, who needs a win in one more state to be elected president, overtook Donald Trump in Georgia and also expanded his lead in Nevada.

Trump meanwhile said the election was being stolen from him, though he presented no evidence of widespread voting irregularities. The president’s campaign peppered courts with legal complaints, aimed at slowing or pausing counting of the votes, which were generally unsuccessful.

Fed Chair Jerome Powell opened the door to a possible shift in the central bank’s bond purchases in the coming months, saying that more fiscal and monetary support is needed. The Fed kept its stimulus steady at its meeting this week, but a Republican Senate hamstringing government aid efforts may force it to step up and fill the gap soon.

“You could argue precious metals also gained from concerns about how a contested election plays out,” said Marcus Garvey, head of metals strategy at Macquarie Group.

Spot gold added 0.1% to $1,952.19 an ounce by 12:26 p.m. in London, taking this week’s gain to 3.9%. The Bloomberg Dollar Spot Index declined 0.2%, on course for a weekly slump.

In base metals, copper turned higher as European trading got underway, and was last up 1.6% at $6,960 a ton in London. It’s also heading for the biggest weekly advance since July on the back of recent dollar weakness. Zinc reversed an earlier loss to reach the highest since May 2019.

While a contested election ending with a divided government would be the least bullish of all possible outcomes for commodities markets, copper could still hit fresh highs next year on the back of faltering supply and robust demand, Morgan Stanley analysts Susan Bates and Marius van Straaten said in a note.

“Once initial volatility has passed, we expect increased focus on the market fundamentals, which remain broadly supportive for base metals,” the analysts wrote. “Copper still features the strongest fundamentals on a tepid supply growth outlook through 2021.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound