JPMorgan Chase & Co. is planning to close a handful of ETFs that echo strategies used by hedge funds.

The $22.6 million JPMorgan Long/Short ETF (JPLS), the $53.9 million JPMorgan Managed Futures Strategy ETF (JPMF), the $53.8 million JPMorgan Diversified Alternatives ETF (JPHF) and the $25.1 million JPMorgan Event Driven ETF (JPED) will be liquidated in June, the bank said in a statement Friday.

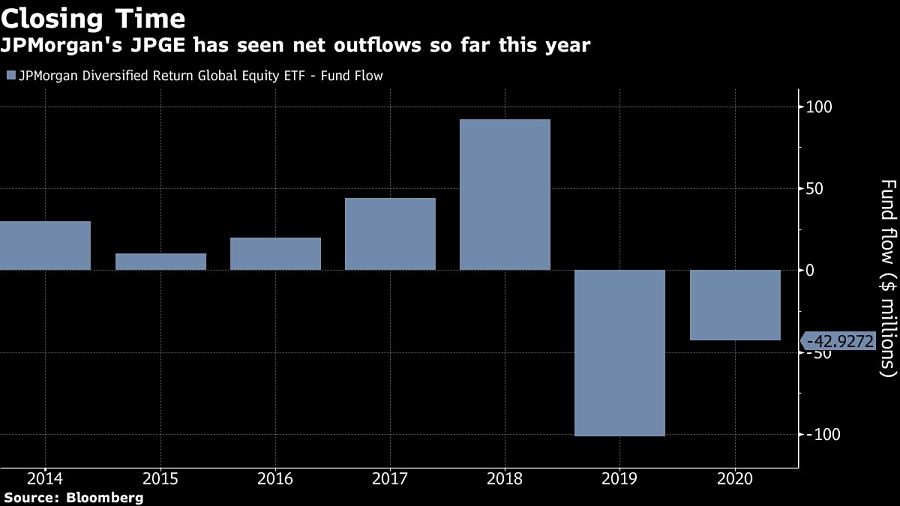

In addition, JPMorgan will close two other funds: the $14.2 million JPMorgan Diversified Return Europe Equity ETF (JPEU) and the $60.8 million JPMorgan Diversified Return Global Equity ETF (JPGE).

Alternatives can help diversify portfolios because their returns aren’t necessarily correlated with the movement of the stock or bond markets, where most investors deploy the majority of their capital. But some of these strategies can be hard to access, hence the appeal of a daily-traded ETF -- or even mutual or closed-end funds -- to make investing easier.

“Investors don’t understand them and, more importantly, they don’t understand how to use them well in a diversified portfolio,” said Ben Johnson, co-head of passive strategy at Morningstar Inc., referring to alternative funds in general.

Still, alternative ETFs have steadily gathered assets this year, despite a drop in March as the coronavirus pandemic roiled global markets. So far in May, the funds have added $157 million.

JPMorgan has had more success with its BetaBuilders series, which eschews more specialized strategies for broad developed-market benchmarks at low prices. Following their June 2018 release, the bank’s ETF assets jumped to near $30 billion within a 14-month span. JPMorgan has also filed to start its first actively managed ETF with partially concealed holdings.

“We regularly monitor and evaluate our product lineup as market and economic conditions evolve,” Bryon Lake, head of Americas ETF for J.P. Morgan Asset Management, said in the statement. “This process allows us to optimize and scale our product offerings to better meet client objectives and market demand.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound