Will offer the KKR Alternative Corporate Opportunities Fund and the KKR Alternative High Yield Fund, according to SEC filings

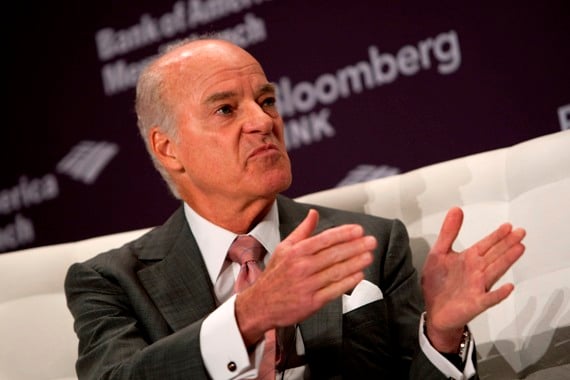

KKR & Co. LP, the private-equity firm run by Henry Kravis and George Roberts, plans to open two debt funds for individual investors, according to government filings.

KKR will offer the KKR Alternative Corporate Opportunities Fund and the KKR Alternative High Yield Fund, according to filings with the U.S. Securities and Exchange Commission. Both funds will be managed by KKR Asset Management, the firm's San Francisco-based unit focused on public investments.

The funds, along with the existing KKR Financial Holdings vehicle, would bolster KKR's efforts beyond leveraged buyout funds, which require accredited investors to commit capital for about a decade. Kravis and Roberts, who created New York-based KKR in 1976 with Jerome Kohlberg, have expanded the firm's businesses in real estate, hedge funds and energy investing in recent years.

The Alternative High Yield Fund is a mutual fund that plans to buy non-investment grade debt, according to one of the filings. The Alternative Corporate Opportunities Fund is a closed-end fund that will pursue debt investments as well. While some closed-end funds sell a fixed amount of shares to raise money for investments and then trade on an exchange like stocks, KKR's version won't be listed on an exchange. Liquidity will be provided by quarterly repurchase offers, according to the filing.

European Crisis

The firm cited turmoil in the financial industry and the European debt crisis as providing opportunities to invest. The filings, dated yesterday, don't give details on the expected sizes of the funds or minimum investments.

KKR created the asset management unit, known as KAM, in 2004, the firm said. Kravis and Roberts hired William Sonneborn, who serves as the unit's chief executive officer, in 2008 from money manager TCW Group Inc. Sonneborn has overseen the opening of KKR's first equity hedge fund, as well as a pool dedicated to mezzanine loans.

--Bloomberg News--