With clouds looming over the commercial real estate market, sales of non-traded real estate investment trusts started 2024 with a downturn, as widely expected, with last month's non-traded REIT fundraising and sales by financial advisors down 47% compared to January 2023, according to new research by Robert A. Stanger & Co. Inc., which tracks sales of illiquid alternative assets.

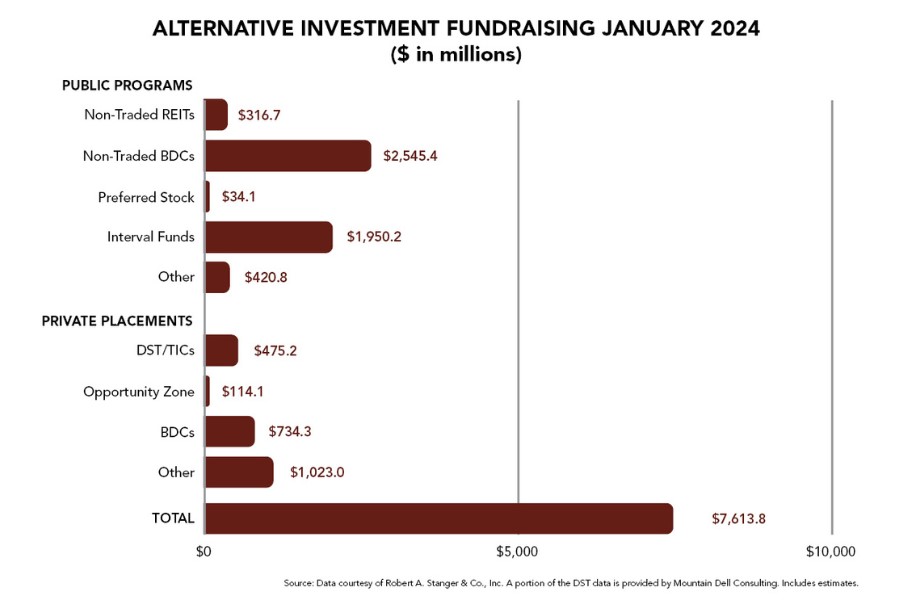

On the other hand, sales and fundraising for non-traded business development companies, which raise money from investors to buy higher-yielding private company loans, continued their steady pace, with BDCs generating $2.5 billion in sales last month, according to Stanger, which says BDC fundraising has surpassed $2 billion each month since September.

Financial advisors' clients are turning to BDCs and other alternative investments such as interval funds instead of real estate for better yields, industry observers said.

"The BDC market is in favor right now as an asset class," said John Cox, CEO of Cox Capital Partners, which invests in non-traded alternatives in the secondary market via a proprietary fund. "Across all the various product structures, the BDCs as an asset class are having a resurgence. The market used to be a few non-traded BDCs but it's now much more numerous."

BDCs blend attributes of publicly traded companies and closed-end funds, giving holders exposure to high-yielding, private equity-like investments. As a result of those higher yields, however, BDCs also tend to carry additional risk and can sell off quickly.

Traded BDCs posted strong performance last year, with the S&P 500 BDC Total Return Index increasing by 27.6%, with about half of that return coming from capital appreciation.

“Retail investors continue to revise their allocation strategy to non-traded BDCs, interval funds, and private placements, including Infrastructure funds, due in great part to a generally higher yield on

BDCs and interval funds, along with a simpler regulatory environment,” wrote Kevin Gannon, chairman and CEO of Stanger.

Investments in alternative assets totaled $7.6 billion in January, according to Stanger.

Still, it was a bad start of the year for non-traded REITs, for 20 years the most popular alternative investment sold by retail financial advisors. REIT sales have been hurt over the past year by sharply rising interest rates, headlines about half-empty office buildings, and investors pulling money from products through a process called redemptions.

In January, nontraded REITs "reported just $317 million of fundraising, as compared to nearly $4.6 billion of fundraising one year ago in January 2023, which included a $4 billion investment from the

Regents of the University of California in Blackstone’s BREIT," according to Stanger. "Without this investment, January 2024 non-traded REIT fundraising is down 47% as compared to January 2023 fundraising.

"In addition, heightened levels of redemption activity continue," according to Stanger. Net asset value REITs "satisfied an estimated $4.6 billion of requests in the fourth quarter of 2023, equal to approximately

4.6% of net asset value at the beginning of the period."

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

For several years, Leech allegedly favored some clients in trade allocations, at the cost of others, amounting to $600 million, according to the Department of Justice.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound