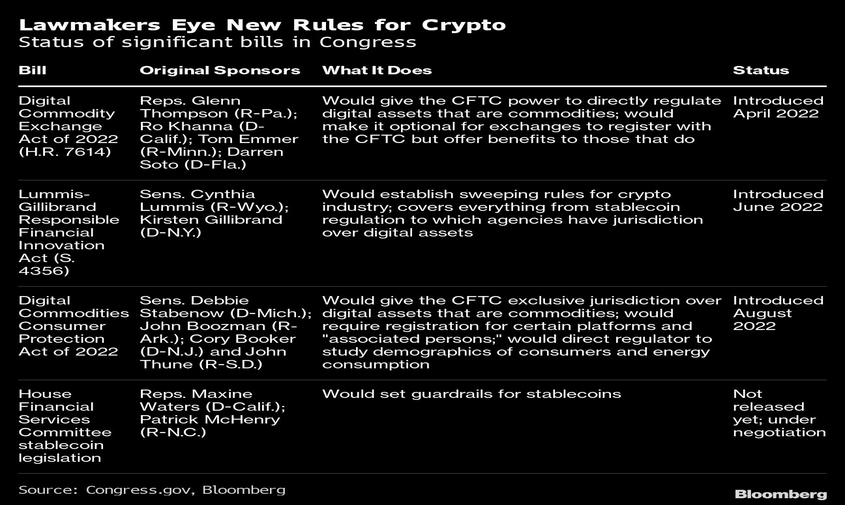

A push in Washington to transform the U.S. derivatives regulator into a top crypto watchdog is gaining steam with a Senate bill that would give the Commodity Futures Trading Commission sweeping new powers to oversee the asset class.

The CFTC, whose purview is now mostly limited to crypto derivatives, would get the ability to police trading in the largest digital assets under the plan introduced Wednesday by Democrat Debbie Stabenow and Republican John Boozman. The legislation backed by the two top members of the Senate Agriculture Committee carries particular heft because their panel oversees the regulator. Senators Cory Booker, a New Jersey Democrat, and John Thune, a South Dakota Republican, are also original cosponsors of the bill.

“One in five Americans have used or traded digital assets — but these markets lack the transparency and accountability that they expect from our financial system. Too often, this puts Americans’ hard-earned money at risk,” Stabenow said in a statement. “That’s why we are closing regulatory gaps and requiring that these markets operate under straightforward rules that protect customers and keep our financial system safe.”

Stabenow and Boozman said Wednesday on a call with reporters that they want to advance their bill through the agriculture committee as soon as possible, potentially as early as September.

Crypto executives have been pressing for the CFTC to get more power as they resist Securities and Exchange Commission Chair Gary Gensler’s assertions that many digital coins are securities under the SEC’s purview. Industry trade groups, including the Blockchain Association and the Crypto Council for Innovation, put out statements in support of the senators’ efforts.

The new proposal would give the derivatives regulator direct oversight of tokens that qualify as “digital commodities,” which according to a summary of the plan include Bitcoin and Ether — the two largest digital assets.

Rostin Behnam, the chairman of the CFTC, has said his agency is well-positioned to take on a greater role. The agency has also been working with lawmakers crafting the plan, which is just one of a spate of crypto bills. To become law, it would require multiple votes in the Senate and a version would also need to pass the US House.

In addition to new powers, the senators’ bill would direct the CFTC to undertake a number of studies.

The regulator would have to write a report on energy consumption and sources used to create and trade digital commodities, and publish the findings on its website. Democrats have increasingly raised concerns about the amount of electricity used in crypto mining and how it might exacerbate climate change.

The regulator would also have to study the racial, ethnic, and gender demographics of customers participating in digital-asset markets to inform rulemaking, outreach efforts, and other related activities.

The “digital commodity” label would certainly be welcomed by crypto enthusiasts who have been desperately trying to avoid assets getting hit by the security tag, which carries a range of strict investor-protection requirements at the SEC.

Concerns that the SEC will assert more jurisdiction have been rising since last month when the agency took the unusual step of identifying nine assets that it considered to be securities as part of an insider trading case.

The senators’ plan would have the CFTC impose a series of new oversight measures. The requirements would preempt state rules, according to the overview of the bill.

Digital-commodity platforms, including brokers, custodians, dealers, and trading facilities, would have to register with the CFTC. “Associated persons” of dealers and brokers working with those assets would also have to meet registration requirements.

At the same time, the bill would require the CFTC to put in place customer-protection rules. Platforms would have to disclose major conflicts of interest and trading risks, as well as face marketing and advertising standards.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound