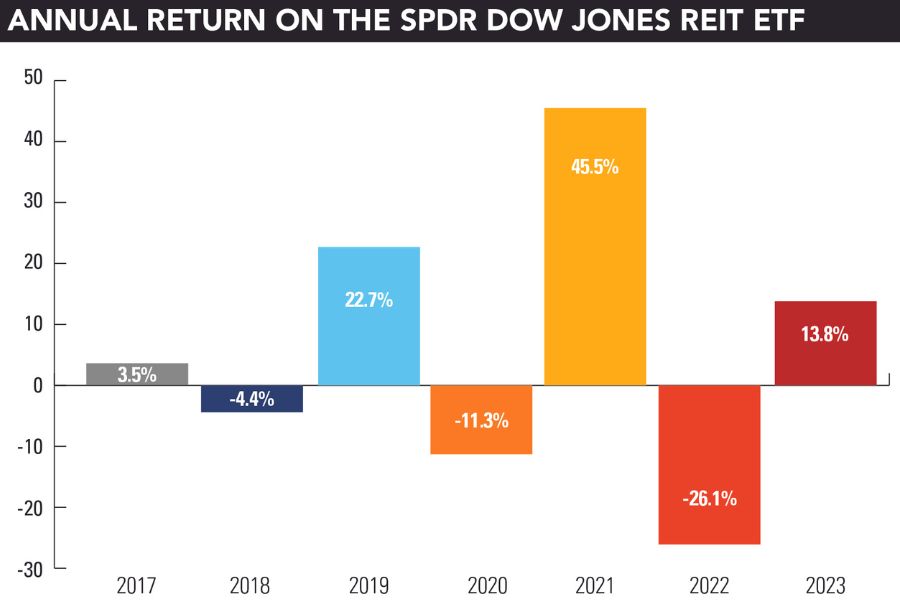

Will 2024 finally be the year when REIT investors can rest their aching necks? After watching their stocks bounce up and down these past few years, the whiplash must be killing them.

The SPDR Dow Jones REIT ETF, which features such real estate investment trust heavyweights as Prologis, Equinix, and Public Storage, offered a hearty total return of 13.8 percent last year. While that represented a welcome turnaround from the 26.1 percent shellacking the exchange-traded trust took in 2022, it was still down 70 percent from the 45.5 percent surge that sucked investors into the sector in 2021, which, of course, followed the 11.3 percent drop in 2020 that came on the heels of the 22.7 percent jump in 2019.

When it comes to buildings, it used to be that elevators were the only things that rose and fell so regularly. Now it’s the shares of the companies that own them.

Eric Diton, president of The Wealth Alliance, is bullish on REITs this year, primarily because of the recent pullback in long-term interest rates, combined with an expectation that the Fed will cut short rates multiple times this year. Nevertheless, he does not see all REITs as being equal.

“There are sectors that we try to avoid, and others that we feel are particularly attractive,” Diton said. “An overall housing shortage makes multifamily rental housing a logical choice. The continued shift to e-commerce makes industrial properties an exciting investment as the need for more warehouse space grows.”

Diton is also a fan of REITs that focus on factory space due to deglobalization trends, and grocery-anchored shopping centers in areas where he sees population growth. He says he allocates anywhere from zero to 10 percent of client assets to REITs, both private and public, depending on their income needs and risk tolerance.

Brian Hartmann, partner at Granite Bridge Wealth Management, part of Osaic, agreed that investors should pay close attention to sectors when it comes to REITs, especially with residential real estate souring in many markets, big swings in interest rates, and a subculture of work-from-home employees.

“Someone looking for exposure to commercial real estate may choose to invest in an REIT that holds warehouses or medical offices rather than a multifamily apartment complex,” Hartmann said.

Robert Pearl, co-founder and wealth advisor at G&P Financial, is another advisor who chooses to be choosy when it comes to REITs in 2024. In his view, lower rates and an economic soft landing will help subsectors such as luxury retail, self-storage, and industrial. On the negative side, he fears there could be a record number of traditional mall foreclosures this year, while office space is still affected by hybrid work.

“For our clients with an existing REIT position such as the Apollo Diversified Real Estate Fund (GRIFX), we do not intend to add to those positions at this time,” Pearl said. “There are other asset classes that we are more excited about than REITs.”

Scott Bishop, managing director at Presidio Wealth Partners, says REITs can play an important role in a long-term, well-diversified portfolio. In his view, real estate serves as a good long-term hedge against inflation, as in rising rents, and historically has provided solid returns compared with a portfolio made up solely of stocks and bonds.

That said, Bishop believes not all REITs are equal. Many have legacy issues because the properties were acquired when prices were higher, such as office REITs. Or they may face financing issues because of the step-up in interest rates in the past few years. As a result, Bishop is worried that those issues will weigh on REIT performance going forward.

“Rather than REITs bought and sold on public exchanges, I tend to favor privately held real estate that offers investors the same exposure to real estate without some of the volatility and legacy risks that can come with funds traded on public markets. Typically, most of the real estate deals we look at are new-issue deals in a limited partner format,” he said.

Matt Chancey, certified financial planner with Micel Financial, also prefers private real estate deals to publicly traded REITs, especially for high-net-worth investors who can afford to go private. He sees REITs as expensive compared with other equity products, and often more volatile because of their interest-rate sensitivity.

“The next two years, 2024 and 2025, will have more commercial real estate debt due to be refinanced in the history of CRE, that will cause some assets to be lost as values have decreased as interest rates have gone up,” Chancey said. “We are already seeing some defaults where big public REITs are giving back assets to the bank. That won’t be good for those retail REIT investors.”

That may turn out to be true. But Steven Rodriguez, portfolio manager at American Century Investments, said REIT investors will have a very powerful force on their side in the Federal Reserve and its recent policy

“As we saw in late 2023, historically, when interest rates peak, listed property has strong relative and absolute performance in the following 12 months,” Rodriguez said. “2024 shouldn’t be any different as inflation trends continue to moderate, putting downward pressure on rates and providing a strong investment tailwind for publicly traded real estate.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound