Jump to Winners | Jump to Methodology | View PDF

It’s happening and will continue to do so, but it’s not without challenges. That’s the converging relationship between wealth and tech.

Advisors widely acknowledge the need for innovative platforms and products, but simply can’t access enough that deliver what they require.

A paper authored by KPMG states, “The industry overall is striving to adapt to the new reality. There are few, if any, asset or wealth management firms that don’t have a significant ongoing digital transformation initiative, where they’re building modern technology stacks, centralizing their data, and developing digitally enabled distribution networks.”

The importance of tech is evident on two fronts.

Advisors considered heavy users of technology tend to outperform others in new client and AUM growth rates, according to research by financial market intelligence firm Cerulli. The study also found that nearly 30 percent of heavy technology users are higher-growing practices in terms of new client acquisition over a three-year period, compared to just 9 percent of light users.

The other major driver is client expectations. KPMG’s research also shows the average age of customers in the mass affluent sector is 56, but as assets move between generations, “many digital natives stand to inherit this wealth and will likely require licensed professional expertise to address complex needs and interactions. And while digital hybrid models exist today, future differentiation calls for a clear value proposition for each client type, and a customer journey that blends digital scalability with a human touch and personalization”.

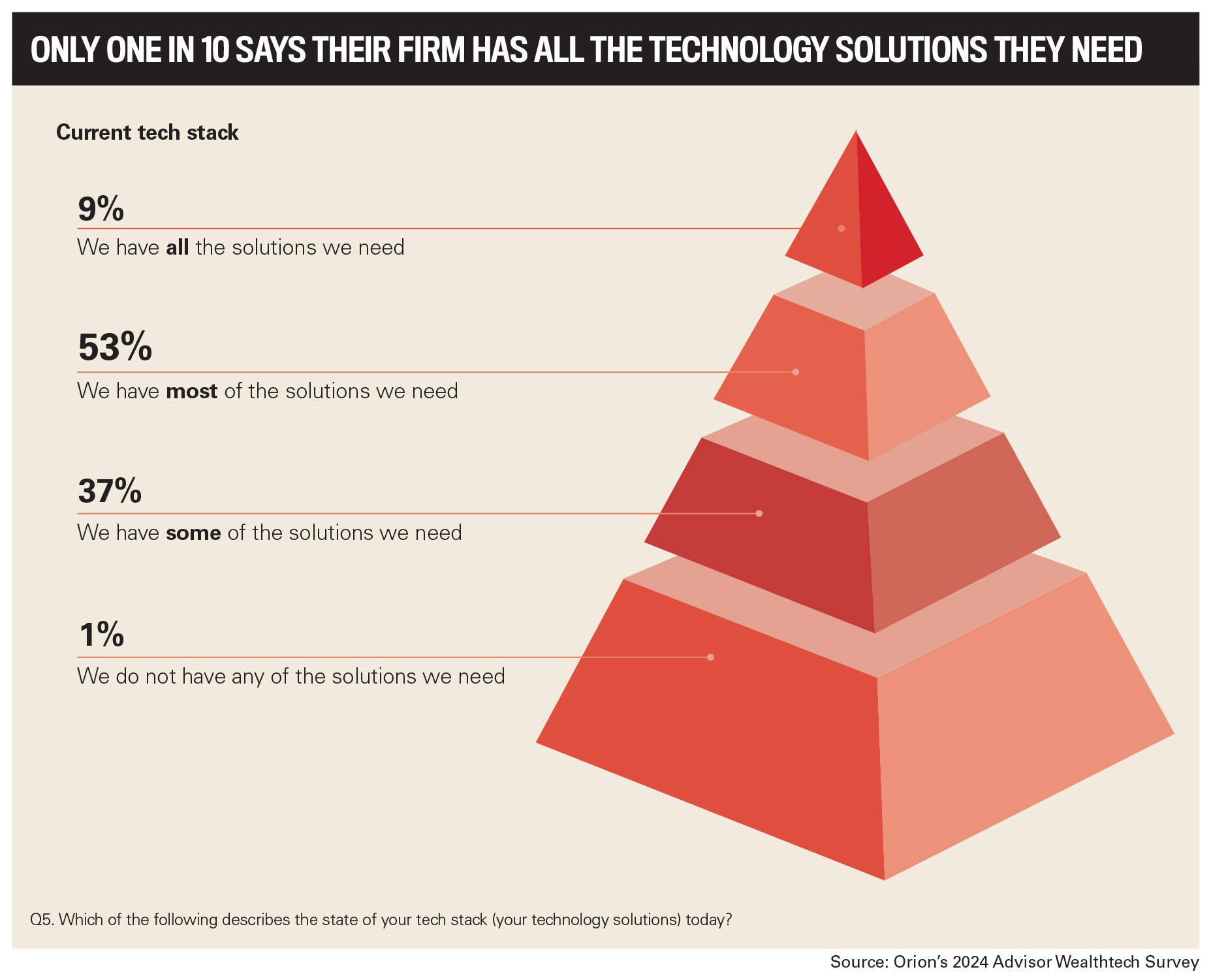

This underlines the outstanding performance by InvestmentNews’ New Technology Report winners of 2024 as they are enabling the industry to embrace current demand and move into the future. Their performance is key as additional stats presented by Orion show that 91 percent of firms don’t have all of the tech solutions they need.

Vestmark, one of IN’s New Technology Report winners, agrees there are not enough solutions in the market to satisfy demand.

“As advisors’ needs become more complex, they simultaneously demand the ability to execute these more complicated transactions in an intuitive and scalable way. This presents tremendous opportunities for solution providers willing to take risks on the leading edge of innovation,” explains Rob Battista, CFA, head of advisory solutions.

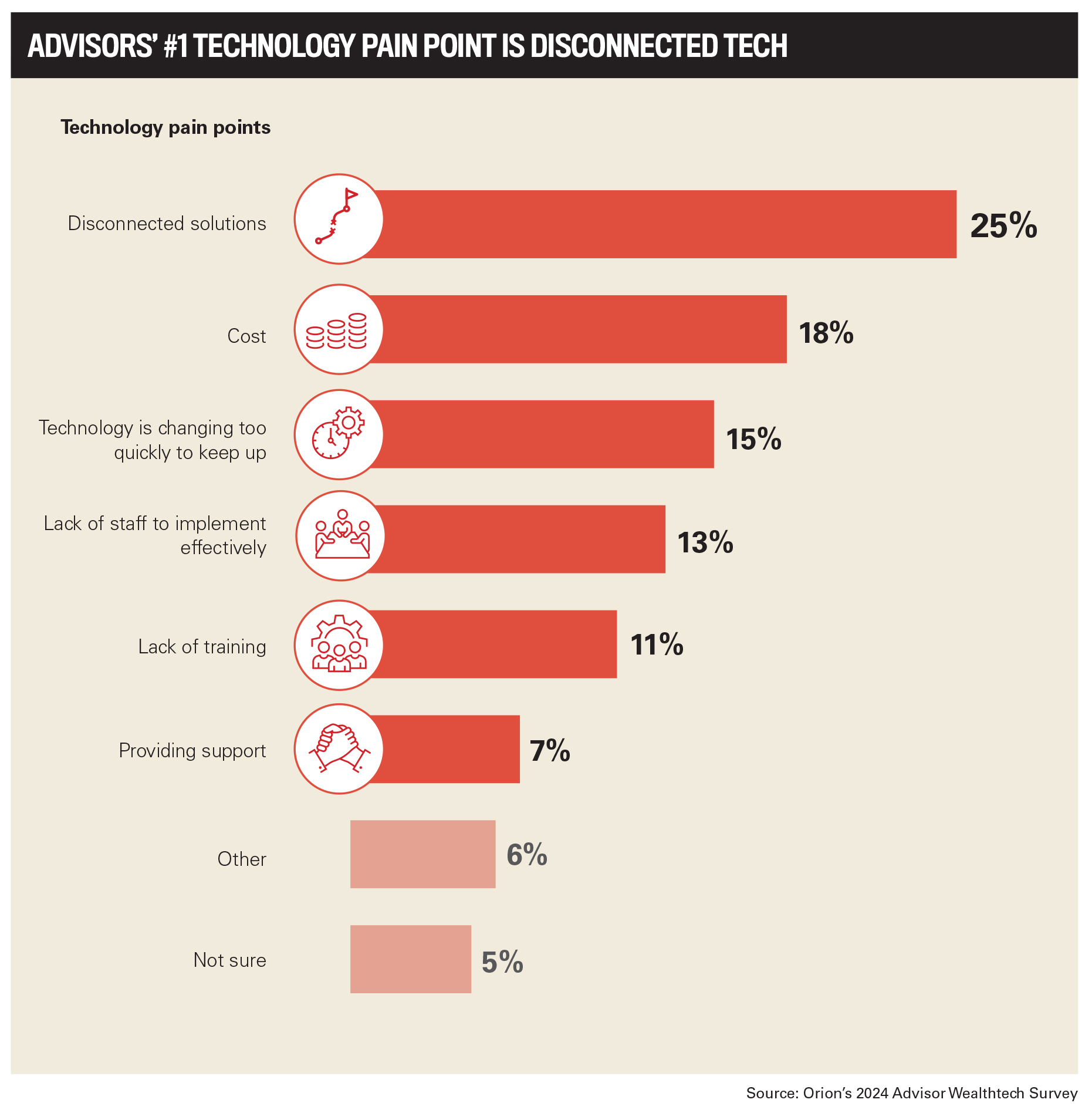

Other data points revealed that advisors only utilize 62 percent of the tech they have, which is only approximately 50 percent integrated, and advisors are also spending a third of their day on low-impact tasks, which can be aided by better tech. Using data to create solutions is the blueprint that The Sycamore Company has followed, as the firm offers a fully integrated front-to-back-office solution, which is specifically designed for RIAs and independent broker-dealers (IBDs) and supports various financial services, including brokerage, advisory, and insurance sectors, with modules for compensation, compliance, recruiting, and account onboarding.

IN recognizes Sycamore's standout offering, Surveillance Manager, built and designed over seven years. It provides configurable alerts and access to normalized data, enhancing business intelligence and operational efficiency. Sycamore’s platform offers standard broker-dealer surveillance alerts and normalized data at half the price of legacy systems. As a cloud-based, native Salesforce application that allows for easy adjustment of rules, eliminating expensive customization costs, Surveillance Manager enables users to slice account, trading, and commission data with ease.

President and founder Mike Overdorf says, “As we’re a Salesforce reseller, they said, ‘Here’s some great tools, go do something with it.’ It just so happened these are the perfect tools to come up with these surveillance alerts. Then, we got some beta users and design partners, and it’s really doing very well.”

While Surveillance Manager aims to help advisors, the intended users are compliance officers. Overdorf highlights how Surveillance Manager is one of the leading lights when it comes to introducing much-needed tech into the sector.

“Some of our users weren’t even using software at all. They were printing out real long trade blotters and eyeballing, trying to find these alerts on their own. This tremendously speeds that up or catches things that were never caught in the first place, just because a computer can go through millions of records that a human just can’t.”

Similarly gearing advisors to perform at a higher level is IncomeConductor Pro, a retirement income technology based on a bucketing/time-segmented approach to distribution in the marketplace today. By pulling in account and industry data from leading institutional providers into a single intuitive screen, the mechanism decreases the number of technologies and data sources that an advisor needs to create and manage a retirement income plan. Tracking features also increase efficiencies of scale, allowing an advisor to manage hundreds of plans without adding to staff.

IncomeConductor tackles the clear pain point of the Baby Boomers moving into retirement and was created by three professionals from that very generation.

One of the co-founders, Sheryl O’Connor, says, “Advisors close prospects faster because they’re engaging the client right in the first meeting with the plan. We find that planning time has been cut down significantly because of this partnership, so they don’t have to go through multiple meetings. They can do everything in real time with the client and IncomeConductor helps them track the performance of the plan every single day of the year. It gives them analytics and data to make decisions on when things change.”

The firm has a suite of sales and marketing materials, including presentations, brochures, and videos, which are all branded. Each advisor has their logo and name/disclosures as part of their subscription. There are also sales and marketing materials to train advisors, plus monthly roundtables on certain aspects of the system.

“We also do case consultation support, so an advisor can engage our experts and say, ‘Here’s a client case that I inputted. Can you help me with it?’ We give them advice on how to optimize the plan to meet the client’s goals,” shares O’Connor.

The firm also understands the need to respond to what advisors need as client expectations change.

“We’re always enhancing the system. Usually, it’s a combination of things that we see the industry needing and what are the gaps out there that we need to fill, as well as what our users are telling us they would like to see in the software,” adds O’Connor. “The latest significant enhancement was on Roth conversion analysis with new graphics, charts, and reports.”

Vestmark similarly responds to advisors seeking efficiencies. Its portfolio management solution VAST uses a single custody account, eliminating the need to manually maintain an asset allocation across accounts, and journal cash between different custodial accounts to rebalance to the target allocation. Additionally, client requests such as withdrawals, tax harvesting, or other common actions need only be done in one account versus manually calculating across multiple accounts.

Battista says, “Given the lag in time between cash being moved and being visible in a trading platform, doing all of this in a single account leads to faster, near real-time trading capabilities.”

He further stresses the time saved, which advisors can use to focus on critical areas for their clients as VAST streamlines the implementation of the portfolio, removing the need for an advisor to do so. Combined with an intuitive interface to run tax transition analysis and the near real-time feedback on the analysis, this saves follow-ups with the client and allows the advisor to service more client relationships without taking on the inefficiency of implementing the portfolio.

“While we haven’t quantified these time savings yet, we believe they are significant based on the work that is being eliminated,” adds Battista.

InvestmentNews invited technology service providers from across the United States to submit nominations, detailing the problems or pain points their offering is designed to solve or relieve for wealth management professionals and how their solution differs from those offered by competitors.

Eligible for inclusion in the New Technology Report were only those technologies and software introduced within the past 24 months that cater to financial advisors and the financial management industry.

The IN team conducted an objective evaluation of each entry, assessing the detailed information provided, the degree of true innovation, and the overall benefits to the industry. This evaluation also involved benchmarking against other submissions to determine the winners.