Jump to Winners | Jump to Methodology

The industry’s leading young professionals have had to contend with and adapt to a series of challenges over the past 12 months.

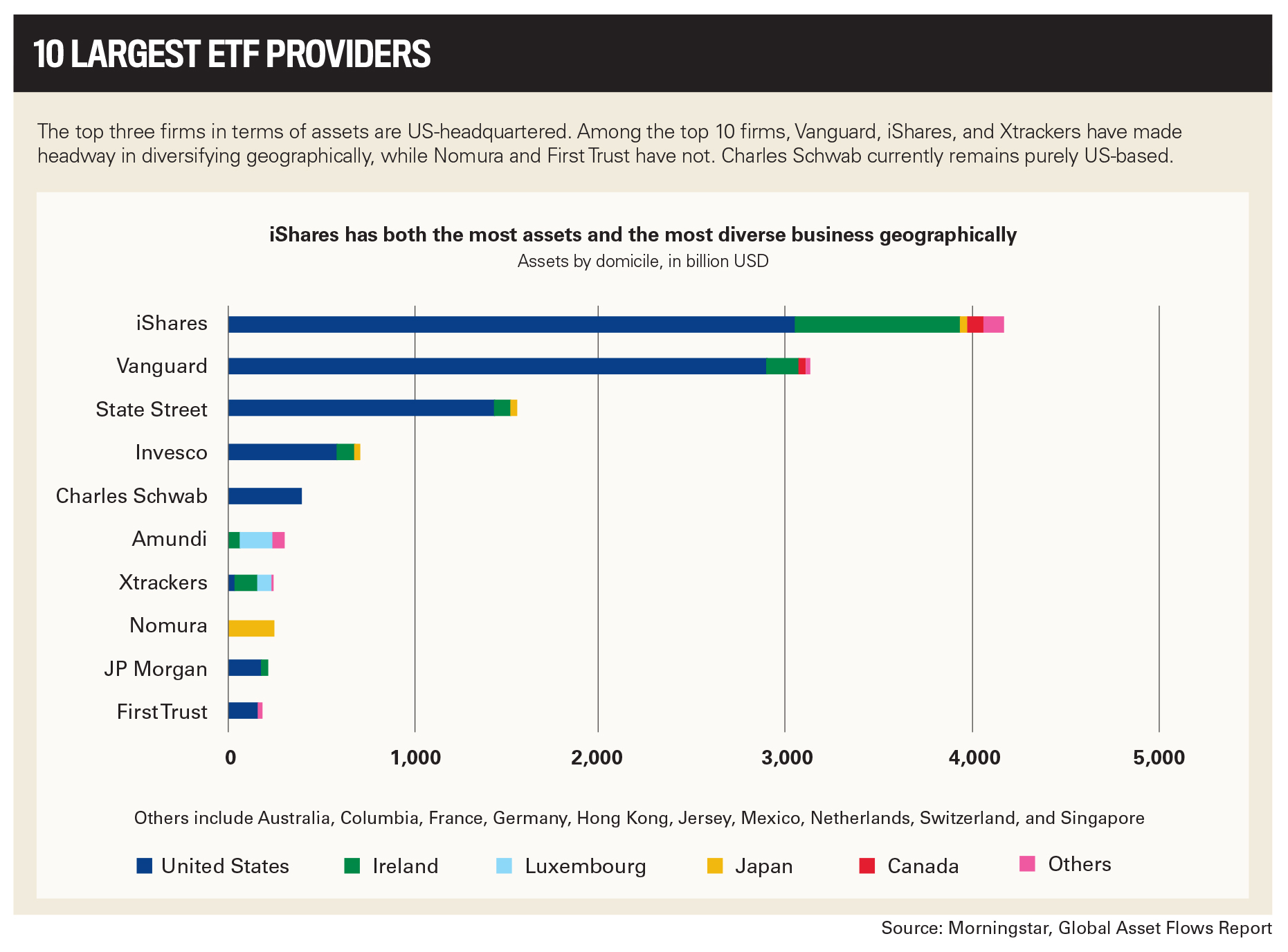

There has been increasing investor appetite for low-cost funds, with money market funds and ETFs accounting for the majority of inflows and net outflows occurring in long-term mutual funds.

Over the last two years, there has been more than US$1.8 trillion of net funds in active mutual funds, compared to US$2.1 trillion cumulative net outflows between 2014 and 2021, whereas ETFs have done the opposite and cumulatively received a net inflow of more than US$3 trillion in the last five years.

In addition, there has been an expansion into hybrid fund structures, geopolitical warfare concerns, and greater interest in sustainable investing and ESG.

Along with adapting to shifting client preferences, the leading young advisers have had to integrate AI into their operations and use it to drive revenue. This, coupled with more tech, also brings an increased vigilance around cybersecurity.

InvestmentNews’ Rising Stars of 2024 have coped admirably, earned the industry’s respect, and been named to the prestigious list by an independent panel of industry leaders.

One of these standout performers, Austin Storck, had a career as a Naval Special Warfare radio operator in two combat deployments, which prepared him for changeable conditions.

“For me it was, ‘How do I continue to serve?,’” he says. “I looked at different avenues and thought about wealth management. During an interview, a gentleman told me that he worked with his father but wasn’t a fan of it because it was too interpersonal. He wanted to work on bigger deals, but it was the opposite for me. I wanted to be more interpersonal, working with individuals and families.”

Fellow Rising Star, Brandon Zureick of Johnson Investment Counsel, is satisfied by how he’s handled the recent disruptive period.

“I’m most proud of helping our clients navigate what has been a really uncertain and at times tumultuous investment climate,” he explains. “My area of expertise lies in fixed income. I sit on an investment committee in charge of setting asset allocations across the firm. Over the past few years, diversification hasn’t necessarily been rewarded and my greatest achievement over the past 12 month has been being a steady voice.”

Storck, an advisor at Borza Wealth Management Group of Raymond James in Virginia, has taken lessons from those ahead of him.

“People always talk about the word honor, and I think it’s living a life that those who have gone before you would appreciate. It’s recognizing those advisors who have been working with families and individuals for decades and developing. I’ve learned from those older advisors how to cultivate relationships and how to make sure that I’m truly serving the client at the end of the day,” he says.

This sentiment is shared by Zureick, whose firm is composed of a cross section of experienced advisers and younger professionals. He comments, “Some folks have deep experience through a lot of different market cycles and a lot of knowledge they can impart to younger folks like myself, but at the same time, there’s a younger generation who’s growing in importance and willing to jump in and offer ideas to try to evolve and push forward. I like being on the cutting edge of what I call the next generation.”

The biggest asset Storck feels he brings is mindset – the ability to listen to a client and take a holistic overview.

“You can see where they are today and where they want to go, and any gaps that you can fill from there. We have a one percent ‘better every day’ mentality, not necessarily from a return perspective, but on improving from a knowledge standpoint, our market research, a planning standpoint, so we can provide the best service to our clients,” he says. He also speaks of the “stigma” of not going to the golf course to network.

Storck adds, “If we hear from a client that day, we might not be able to get back to them at that moment, but by the end of the day, we get back to them. We make sure that their needs and wants are serviced to the best of our ability.”

The rise of tech is something all the Rising Stars have had to deal with.

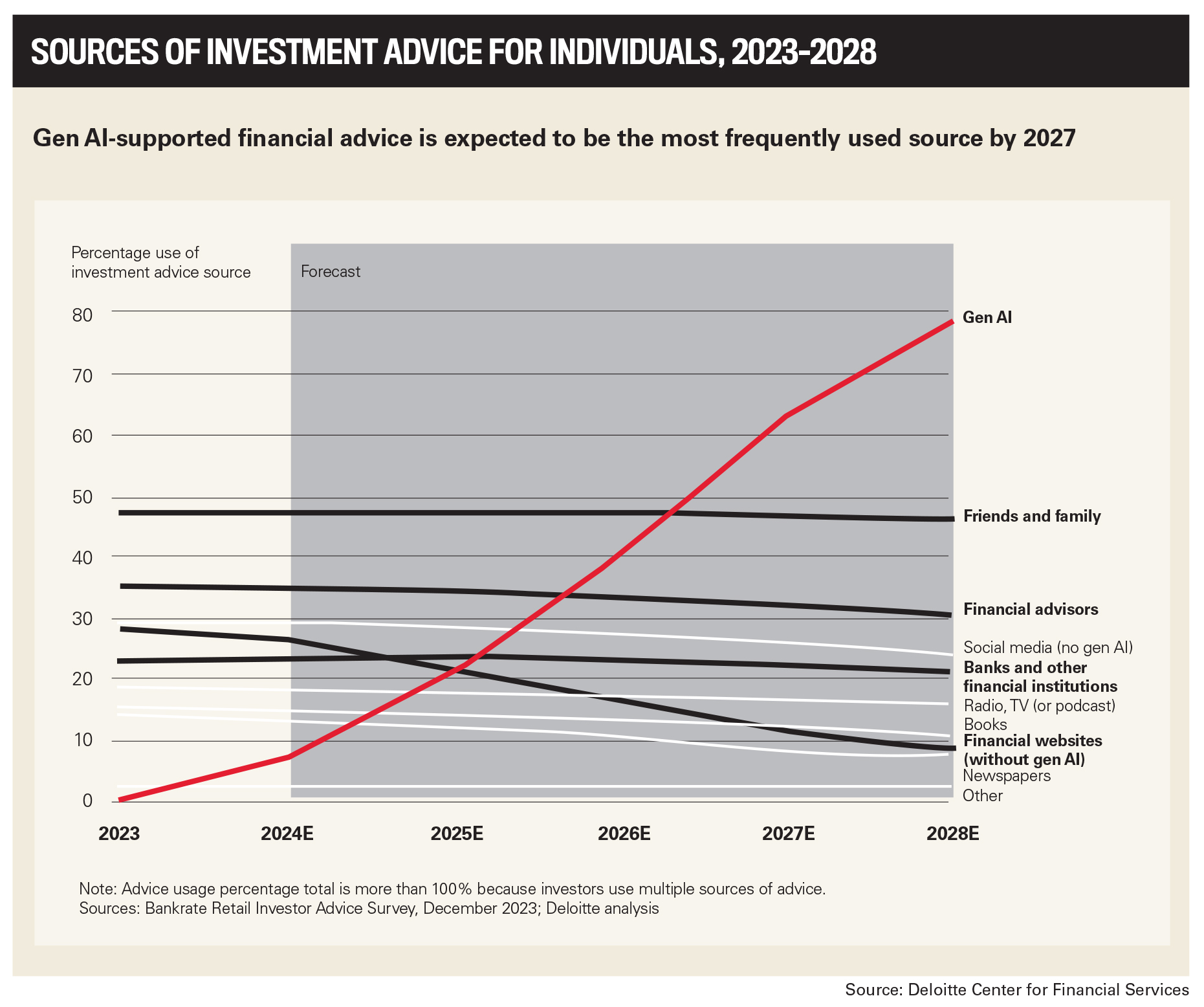

The Deloitte Center for Financial Services predicts that gen AI-enabled applications will likely become the leader in the advice mind-space for retail investors, growing from its current nascent stage to 78 percent usage in 2028, and could become the leading source of retail investment advice in 2027.

Being forward-thinking is one of the attributes of another of 2024’s Rising Stars, Brandon Silvia, CFP®, managing partner at Silvia McColl Wealth Management.

“We utilize financial planning software, eMoney, so we’re gathering financials, plugging things in there, then meeting the clients to start tightening the plan. It’s kind of a ‘perpetual rough draft’ as we call it, but the dependent variable in that is producing a probability of success score for a client so they can meet their financial objectives.”

And he continues, “We run financial models, getting into the weeds. We keep things more on the value side and don’t chase those Magnificent Seven tech stocks. We’re mostly ETF mutual fund investors trying to match indexes. We believe in consistently being good rather than being occasionally great.”

Silvia, based in San Diego, is acutely aware of the responsibility his clients place in him, after growing up in foster homes and even living in a car with his mother, along with being the first in the family to attend college.

“What separates me, besides my background, is this continuous hunger to just be better, not for myself but for my clients and my family. I show up every day and put in the work, and as I like to say, ‘sharpening the sword.’ There’s no substitute for hard work,” he says.

Another winner, Tori Samuel of Cognitive Wealth Management, has gone from strength to strength since leaving his previous firm when he was in the top 10 percent of producing advisors.

“I needed to go into a larger pool with more resources, more technology, and more investment options for my clients. That’s really why I made that transition to go independent, and from there, it’s been about leading with education, seminars, and showing people my expertise by teaching them the things that they didn’t know,” he says.

Samuel has since added a vice president to his firm and opened a second office in Rancho Cucamonga along with acquiring retiring advisor’s practices.

“The average person in my position is in their 60s and a lot of them are looking to retire in the next 10 years, which gives a lot of opportunity for the transition of those assets that are being managed to younger advisors,” he says. “I have a team in place that makes it very attractive for clients because they know that we’re going to be here for a really long time. Even retirees always tell me, ‘Tori, I’m really happy I’m working with you because I know you’re going to be here for the entirety of my retirement’.”

Like all advisors, Samuel lets his clients know he can’t guarantee returns but can promise to guide them appropriately.

He says, “We always take a very diversified approach and make sure that our clients are properly asset allocated for what their risk tolerance and time horizon is. Even if someone is a long-term investor, but is nervous about the markets [and has] a lower risk tolerance, we take that into account when we’re investing their money. We always customize our portfolios, not just on time horizon but the comfortability of the client.”

Deciding to go out on his own was also a risk for Nick Lalonde, who founded Third Act Wealth Management LLC in March 2023. The firm’s name sums up what it aims to do.

“A lot of people do retirement planning, but third act planning is unique. I feel like I’m doing my best planning in the 10-plus years that I’ve been doing this, as I now have the resources, tools, and technology to do that. We use Trust & Will for estate planning, we use Holistiplan on the tax planning side, we have Nitrogen, which is considered some of the best risk assessment software. We’re able to plug all of these really cool technologies into the financial planning process for our clients,” he says.

Despite being a relative youngster, Dallas-Fort Worth metroplex-based Lalonde considers his youth a strength.

“From an advisor’s perspective, the industry is changing so rapidly. Think about what AI has done to almost every industry and how fast technology is evolving. I’m in my 30s and change is welcome. We’re always updating our process and improving for our clients, and I think that gives us a competitive advantage,” he says. “The other thing is, I’m not thinking five years down the road or pressing the retirement button in 10 years. I’m thinking about doing this for multiple decades longer and, because of that, it changes my mindset about how I approach everything.”

Also leveraging the ability to connect with his clients is Rising Star Jordan Jobe, who works with a lot of business owners.

“My father was an entrepreneur, so I very much understand the mindset. I understand the chaos, where things list on priorities for entrepreneurs, and really how to help them get out of their own way at times,” he explains.

This is the bedrock of Jobe’s firm, NextGen Advisors (Raymond James), based in Arizona. And like his fellow winners, he stresses the benefits of his age and connecting to clients from the same generation.

“My team is not retiring anytime soon, so these longer-term plans that we’re proposing and implementing, we’ll be here to see through. We’re implementing strategies where it’s really long term and, with the younger generations, you can relate more by saying, ‘Here’s how my estate plans are set up. Here’s how my taxes are being done. Here’s how my investments are being allocated and these are the things I researched for myself and my own family.’ All of that can immediately be implemented to our client base.”

What sets Jobe apart is his determination, which permeates his firm.

“One of our core values is going to war for clients, where we get on the same side of the table and say, ‘Here’s how we attack this problem,’” he explains. “An example was trying to get a rollover from a government plan, but there were 13 different locations within the state, and we didn’t know which one [to get it from]. The solution was to send a form to all 13 locations, saying, ‘Please send us the money.’ Finally, the municipality got back to us, saying, ‘As long as you don’t send us any other forms, we’ll make sure the client gets their money.”

Starting in July, InvestmentNews invited financial advice and wealth management professionals across the country to nominate their most exceptional young talent for the inaugural Rising Stars list.

Nominees had to be aged 40 or under (as of November 30, 2024) and be committed to a career in wealth management, with a clear passion for the industry. Nominees were asked about their current role, key achievements, and career goals, as well as the contributions they’ve made to shaping the industry. Recommendations from managers and senior industry professionals were also taken into account.

The Rising Stars were determined by an independent panel of industry leaders composed of:

Cary Carbonaro, Ashton Thomas Private Wealth

Rana J. Wright, Oakmark Funds