For someone running a wealth management firm best known for its detailed number-crunching and tax expertise, Avantax president Todd Mackay sure likes to talk about relationships.

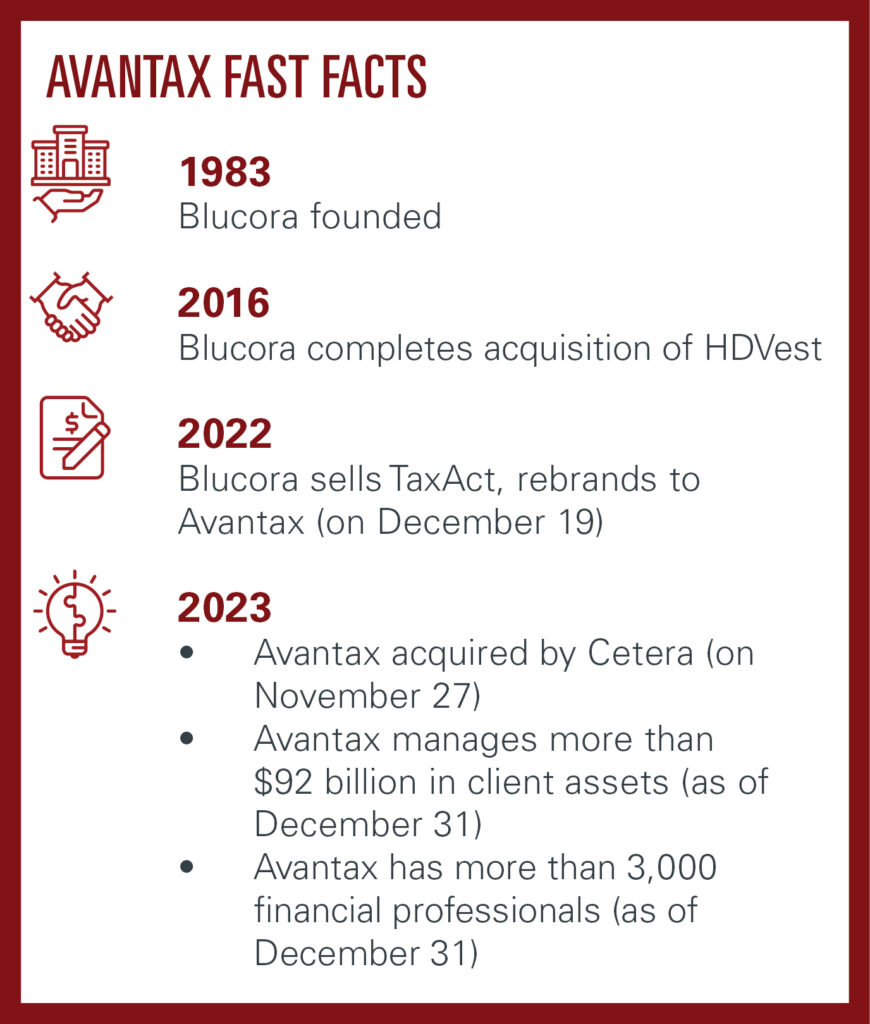

Founded by a CPA in 1983, Avantax helped pioneer the concept of tax-smart investing and planning. Many owners and iterations later, including its acquisition by broker-dealer giant Cetera for $1.2 billion last September, the firm still conjures visions of advisors-cum-accountants in green eyeshades scouring the latest IRS tax codes for loopholes.

While Mackay isn’t running from the firm’s legacy of adding alpha through its proprietary tax-harvesting programs, the language emanating from Avantax lately is more about creating connections rather than finding deductions.

“It can’t be said often enough – wealth management is a relationship business,” Mackay said. “And when you ask advisors what they want the most, their first answer always is ‘more time with clients.’ So Avantax created technology that puts time back into advisors’ hands by automating manual processes.”

Along similar lines, Mackay staunchly contends that despite Avantax’s reputation for a laser focus on tax-smart investing, the firm has always practiced “holistic” wealth management, the latest touchy-feely term sweeping the industry.

“There’s not a dollar that Uncle Sam doesn’t tax, so we’d argue that failing to consider taxes in wealth management isn’t truly holistic. In that vein, Avantax has practiced holistic wealth management for decades,” he said.

Instead, Mackay refers to holistic wealth planning as “Avantax intelligent planning,” whose elements include tax-optimized asset location and allocation, tax-focused investment strategies, retirement planning and withdrawal strategies, family risk management, business planning, legacy planning, education planning, and cash-flow management.

“Advisors want to be aligned with a wealth management firm that can help provide their clients with complex situations, tax-intelligent financial planning, and tools that help minimize unnecessary tax payments,” he said.

Avantax managed more than $92 billion in client assets as of year-end 2023 and boasts more than 3,000 financial professionals. And now, as part of Cetera, Mackay has even more firepower at his disposal to expand the company and compete for talent against deep-pocketed, private equity-backed RIAs seeking to grow, quite literally, at any cost.

While Mackay’s language makes it sound as if the firm is taking a warm-and-fuzzier approach to the marketplace, he firmly grasps why Avantax has enjoyed recruiting success in recent years amid these talent battles – the company’s conviction about tax-focused financial planning.

“Advisors come to Avantax because they want to offer clients financial planning through the lens of tax, chasing that extra 1.2 percent of tax alpha we believe we can add every single year,” said Mackay.

That’s right. Advisors know that when Avantax boosts their clients’ bottom lines through its tax wizardry, this will eventually trickle down to their own.

That said, Avantax has been through a few internal tussles of its own to reach this point.

In the wake of an unpopular $60 annual fee on advisors’ accounts at outside money managers that it announced in 2020, Avantax saw hundreds of advisors exit the firm. It staunched the bleeding the following year by paying bonuses to new recruits of up to two to three times the industry norm as part of a package to get them to move to the firm.

The appeal to advisors’ pocketbooks appears to have worked for Avantax, and the firm is once again a magnet for talent. And Mackay says the Cetera purchase won’t undo those advances.

“One of the first phrases we as leaders of Cetera and Avantax said to our teams was our commitment to ‘do no harm,’” he said. “What that means is we’re taking a thoughtful approach to everything, with the goal of creating the least disruption possible for our financial professionals and their clients, and the home office teams supporting our advisor community.”

Mackay adds that much of financial planning has become commoditized over the last decade. However, what has not and won’t become a commodity in his view is the ability to combine tax planning and financial planning together in a personalized way for each client.

“That is the true differentiator that Avantax brings to advisors and clients,” he said. “Additionally, advisors come to us for the ability to partner with more CPAs and tax professionals to help serve those tax clients more holistically and have a captive pipeline of new client prospects.”

Look at it this way. According to the October 2023 Herbers & Co. Service Market Growth Study, tax advice is the No. 1 thing clients want, but aren’t getting, from their financial professional.

So call him holistic or realistic – it doesn’t matter. Mackay knows exactly what clients and advisors want. And he’s intent on giving it to them.

The Cetera deal now behind him, Mackay says he finally has more time to look to the future, not just of Avantax but of the entire wealth management industry. What he sees down the road is a massive push toward greater personalization.

“The biggest winners will be those that can offer the most personalized experience for the end client and leverage the technology advancements and in-depth knowledge of the clients’ needs to do so,” he said. “Clients ultimately want to know that an advisor is looking at their financial plan at a personal level that is unique to them and making sure that the solutions that are provided are just as unique.”

Advances in technology will also free Mackay to meet more with advisors, one of his favorite things to do. He says he already spends an inordinate amount of time every day on phone calls and formal home-office visits talking with advisors and clients about the challenges they face.

On the flip side, Mackay says the worst part of his work is dealing with the unexpected death of an advisor who didn’t have a succession plan in place. Amid personal tragedy and turmoil, not having a succession plan can put the advisor’s family, partners, and clients in a tough spot.

“It’s a tough topic to broach because no one wants to confront their mortality, but I’m passionate about urging each and every one of our financial professionals to work with our succession planning team so if there’s an unforeseen event, the value of their lifetime of work can be realized for the benefit of their family, and their clients can be transitioned to someone who shares the advisor’s approach to client service,” he said.

In the meantime, tucked in between life, death, and taxes, Mackay is bent on helping Avantax advisors grow their businesses, whether organically or by consulting with them about transactions with other firms.

“It’s rewarding to know that we’re making great progress expanding tax-intelligent financial planning to the masses, not just high-net-worth clients,” he said.

Of course, those high-net-worth clients didn’t get that way by overpaying their taxes, now, did they?

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound