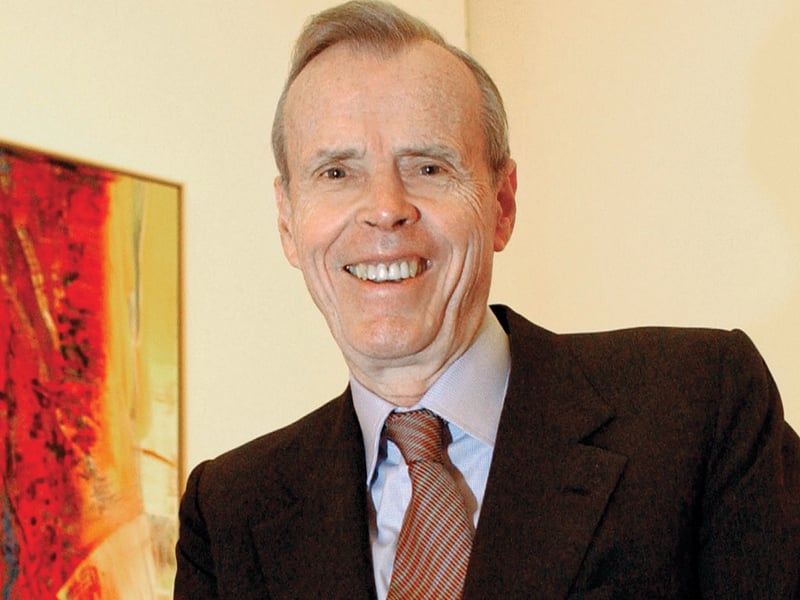

For the second time since the credit crisis, noted private equity investor Donald Marron is making a hard charge to acquire the AIG Advisor Group.

In the summer of 2009, Mr. Marron was minutes away from acquiring the broker-dealer network before American International Group's incoming chief executive, Robert Benmosche, pulled it off the table at the last moment of negotiations.

Undaunted, Mr. Marron then purchased the broker-dealer network of Dutch insurer ING, spiffed it up, renamed it Cetera Financial Group and sold it to RCS Capital Corp. and Nicholas Schorsch in 2014 for $1.15 billion in cash.

Now Mr. Marron, 81, is back in the running for AIG Advisor Group.

A veteran financial adviser with AIG Advisor Group said Wednesday morning that Lightyear Capital, Mr. Marron's private equity firm, was clearly in the running to buy the AIG Advisor Group, a network of four broker-dealers that are home to close to 5,000 registered reps and financial advisers. Another adviser added that no deal to buy AIG Advisor Group had been set, but he expected an announcement by the end of the year, if not sooner.

“Lightyear is one of the firms,” said the first AIG adviser, who asked not to be named. It's not clear who the other bidders are except that they are also private equity firms.

A spokesman for AIG, Matthew Gallagher, said the company had no comment.

Mr. Marron did not return a phone call to comment.

InvestmentNews last month reported that AIG

had begun the process of selling the Advisor Group. However, a glut of firms for sale is creating a buyer's market for independent broker-dealers and could put pressure on the prices

sellers are able to attract.

A website, RIABiz.com, reported earlier Wednesday that Lightyear Capital was on the verge of inking a deal to buy AIG Advisor Group.

The four firms that comprise the AIG Advisor Group are FSC Securities Corp., Royal Alliance Associates Inc., SagePoint Financial Inc. and Woodbury Financial Services Inc.

Combined, they had 2014 revenue of $1.3 billion.