LPL has once again extended its reach in New York state with the addition of a three-decade veteran advisor from Osaic.

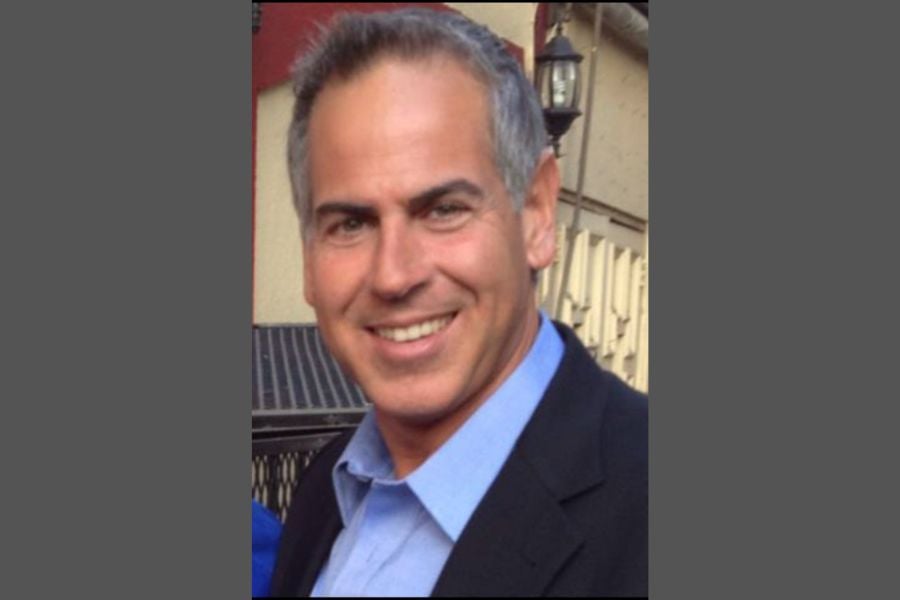

On Monday, the firm announced that financial advisor Jerry Rizza has joined its broker-dealer, RIA, and custodial platforms. Rizza previously worked with Osaic, where he reportedly oversaw approximately $250 million in advisory, brokerage, and retirement plan assets.

With a diverse background spanning 31 years in financial services, Rizza’s career includes a stint in the Oakland A’s minor league baseball system and over three years as an accountant in New York City.

He shared his passion for financial planning, stating, “As I learned more about the financial services industry, I fell in love with the idea of helping families plan for a more secure financial future,” the veteran advisor said in a statement Monday.

Based in Melville, New York, Rizza leads Rizza Financial Services with the support of two experienced assistants, Rachel Beneventano and Jessica Weich. His practice focuses on retirement planning and behavioral investment counseling, aimed at helping clients build and manage wealth for retirement.

His decision to affiliate with LPL was motivated by a desire for improved service, efficiency, and advanced technology, with an “advisor-centric model [that] offers the support we need to serve our clients more efficiently and effectively.”

Beyond day-to-day operations, Rizza believes the transition will benefit his practice in the long term.

“This move has been years in the making, and I believe it’s a strategic investment in our future,” he said.

The news of Rizza’s transition to LPL comes shortly after the firm welcomed another veteran-led team from Osaic, Investment Advisors Financial Group. That team, headquartered in New Jersey, reportedly managed $1 billion in assets.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound