Senior brokerage executives continued to shrug off the potential impact of the Department of Labor's new fiduciary rule, which many believe may be legally contested by the insurance industry at some point.

Stifel Financial Corp. CEO Ron Kruszewski on Wednesday morning during a conference call with analysts called the new rule "less restrictive than what was proposed."

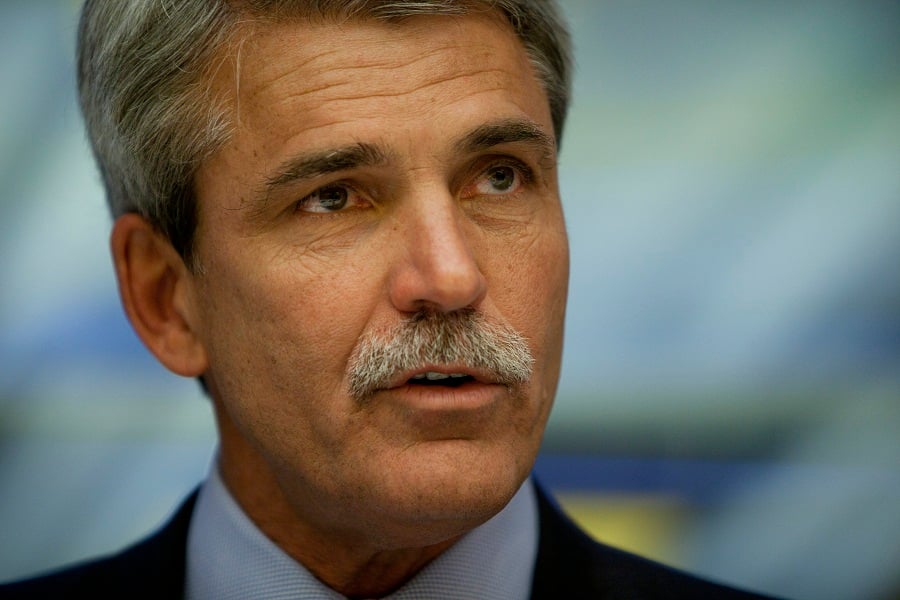

Later that same day, Raymond James Financial Inc.'s CEO Paul Reilly, who will be replaced by current chief financial officer Paul Shoukry next year, echoed those sentiments.

"The rule itself is, I think, much more manageable than the draft rule was," Reilly said in a call with analysts to discuss the earnings for the calendar year's first quarter. "That's an early read. The devil's always in the detail, but I don't think the rule itself and what it will require us to do today is – it doesn't look too problematic at all."

Senior officials at large, retail broker-dealers like Stifel and Raymond James sound relatively at ease with the new sales standards for employee retirement plans; released Wednesday, it is an overhaul of a 1975 regulation that the insurance industry has fought tooth and nail, as it will for the first time subject many agents selling fixed annuities to the Employee Retirement Income Security Act.

The early thinking from senior industry executive is that the rule will be more problematic for insurance companies that sell products like fixed annuity, which is an insurance contract and not a security.

"The big change is that the Department of Labor is redefining who is a fiduciary under ERISA," said one senior industry executive who spoke anonymously to InvestmentNews. "And the problem for insurance firms is that they are not accustomed to disclosing compensation and conflicts."

"Insurance companies right now are not fiduciaries because they sell through independent insurance agents," the executive said. "Under the new rule it is much more likely for an issuer to be regarded as a fiduciary."

"It's not a big deal for the large firms like Stifel or Raymond James because they have the ability to allocate resources on the compliance side of their businesses right away," said James Heavey, operations partners at Barton, a law firm. "Of course, the potential for confusion with respect to who is a fiduciary is one of the big concerns, particularly for compliance teams at smaller shops. Those are the financial advisors who should be concerned."

The new rule and its accompanying prohibited transaction exemptions address investment advice made to retirement savers.

Financial professionals who hold themselves out as providing individualized, reliable recommendations will be held as fiduciaries, and will have to give “prudent, loyal, honest advice free from overcharges,” according to the DOL. Financial institutions that oversee advisors will have to have policies to address conflicts of interest and will be responsible for compliance.

The new rule takes effect September 23, although many provisions will not be enforceable until April 2025.

Meanwhile, during the quarter, Raymond James said it recruited to its domestic independent contractor and employee channels financial advisors with approximately $80 million of trailing 12-month production and $12.8 billion of client assets at their previous firm.

Fiscal year to date, trailing 12-month production of recruited advisors at Raymond James is up 45% and related assets up 77% over the prior six-month period, according to the company.

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound