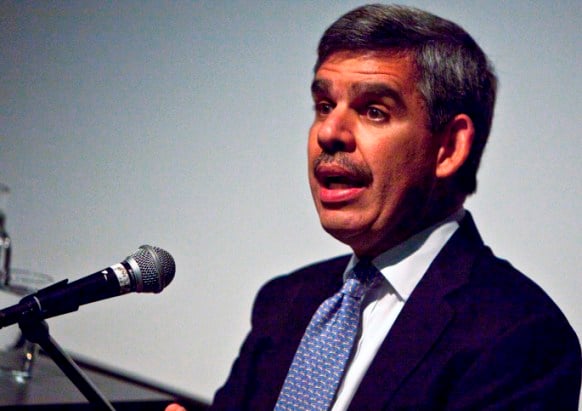

Pacific Investment Management Co. hasn't seen redemptions from Asia investors following last week's earthquake in Japan, Chief Executive Officer Mohamed El-Erian said.

Pacific Investment Management Co. hasn't seen redemptions from Asia investors following last week's earthquake in Japan, Chief Executive Officer Mohamed El-Erian said.

“It's too early,” as the immediate effect is to worry about the human consequences first, El-Erian said. “There is a period of shock until people fully understand the enormity of what happened.”

While there is still uncertainty about how Japan will finance rebuilding, Pimco anticipates the Japanese recovery will be paid for by “a mix of both borrowing by the government including monetization and repatriation,” El Erian said.

The yen strengthened for a fifth day on speculation Japan will delay intervention to limit the currency's advance to counter the repatriation of assets by insurers and investors seeking to pay for damages after the nation's worst earthquake.

Investors shouldn't take “shortcuts” and compare the economic fallout from the disaster in Japan with a 1995 earthquake in the city of Kobe, El-Erian said. The wider magnitude of this disaster, the increased debt load Japan holds and uncertainty about how the recovery will be paid for and the turmoil from the Middle East makes it incomparable, he said.

“This is a much bigger event,” he said. “Japan is in a different place.”

Major Development

Investors should not assume that the economic effects on global growth from the events in Japan will be temporary and reversible, he added. Pimco, based in Newport Beach, Calif., oversees more than $1 trillion.

“We should not assume” the disaster “has a transitory affect on the global economy,” El-Erian said. “This is a major development that has economic implications in addition to the human suffering.”

El-Erian, in an opinion article, said he's skeptical of the Federal Reserve's upgraded outlook for growth and inflation in the U.S. The Fed may not have commented on Japan because it lacked the information required for an informed outlook and the uncertainty that prevails after such disasters, he wrote.

Economic Outlook

“The economic recovery is on a firmer footing, and overall conditions in the labor market appear to be improving gradually,” the Federal Open Market Committee said March 15 in a statement. The inflation effects of increased commodity costs will be “transitory,” and officials “will pay close attention to the evolution of inflation and inflation expectations,” the Fed said.

The yen gained 0.6% to 78.09 per dollar at 2:33 p.m. Thursday after touching 76.36, the strongest level since the development of the current foreign-exchange system following World War II.

There have been more than 450 aftershocks since the magnitude-9 temblor and resulting tsunami killed thousands, left hundreds of thousands stranded without power, with disruptions to food and water supplies. The Japanese government has dispatched 100,000 troops to the northeastern region.

Tokyo Electric's failure to end the threat of radiation from the six-reactor Fukushima plant has prompted the U.S. to advise citizens to consider leaving Tokyo.

--Bloomberg News--