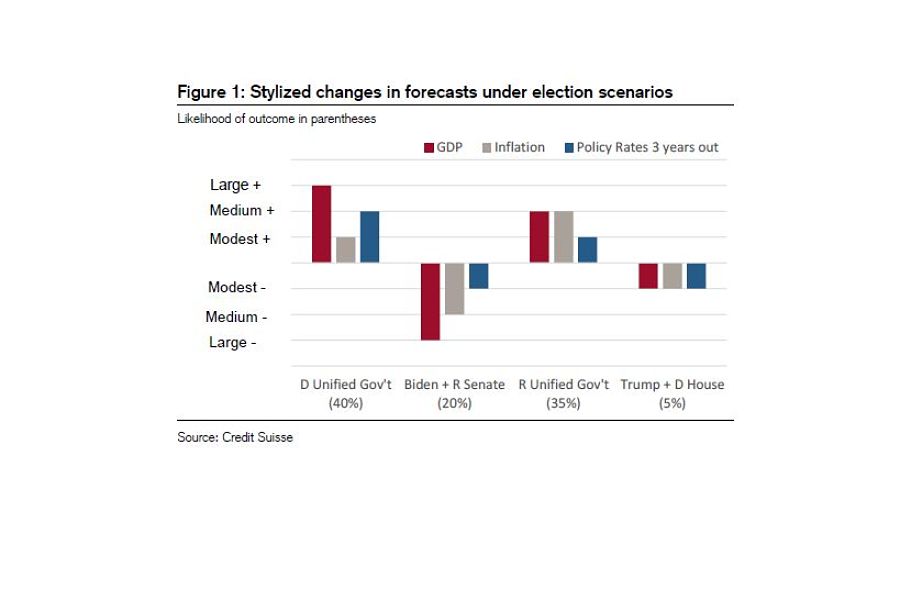

A potential Democratic sweep in the U.S. elections may be the rosiest scenario for risk markets like value and cyclical stocks.

Some strategists have cited the combination of Joe Biden in the White House and his party controlling the Senate and House as a potential downer for markets because it could lead to higher corporate tax rates. But to Credit Suisse Group, the chance for greater deficit spending under that scenario is “massively pro-growth” and outweighs other concerns for equities.

“The most positive outcome for risk markets is a Democratic sweep given the potential for significantly higher fiscal stimulus, and consequently, higher economic growth,” said Mandy Xu, Credit Suisse equity derivatives strategist. “Conversely, the most negative outcome is a Biden White House with a split Congress, in which case we see little prospect of further fiscal aid and increased probability of a stalled recovery/prolonged downturn.”

A Democratic sweep could lead to yields rising, cyclical stocks outperforming and a more pronounced rotation away from growth into value if there’s a bigger fiscal package, Credit Suisse said.

That outlook on yields matches the view of Goldman Sachs Group Inc. strategists led by Praveen Korapaty, who said on Sept. 25 that yields could jump in such a scenario.

The outlook led Xu to recommend a bearish put-option spread on the iShares 20+ Year Treasury Bond ETF expiring in January, as well as wagers on small stocks beating larger ones, plus a rotation away from technology shares.

In the scenario where Biden wins but there’s a split Congress, she sees a broad macro sell-off with a bid for havens and recommends buying a put spread on the S&P 500 while selling a call option.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound