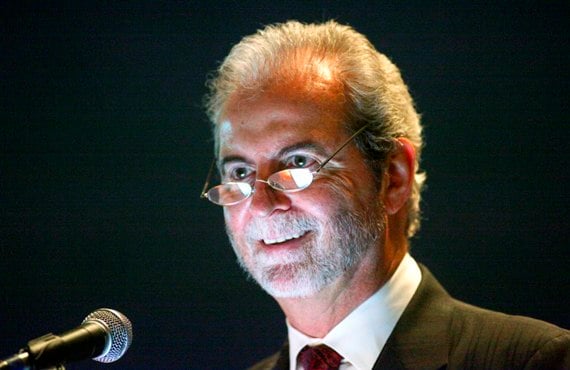

Allocating for growth stocks and keeping a close eye on bond durations are prime considerations for noted investor John Calamos, chief executive of Calamos Asset Management Inc.

The behavior of the stock market is disturbing to investors, Mr. Calamos said today at the fall meeting in Omaha, Neb., of Peak Advisor Alliance, a coaching and support organization for financial advisers. “Clients and shareholders are depressed,” he told advisers. “But with the market bouncing off new highs, why does it feel so bad? It's a really strange market rally that we're having.”

Mr. Calamos added: “We all have to remember that volatility creates opportunities.”

Investors are pessimistic about the prospects for growth companies, but equities are the most attractive asset class in the current environment, Mr. Calamos said.

“We're in a slow-growth environment; we're not in a recession,” he said. “What we're seeing is increasing earnings, so the [price-earnings ratios] have actually come down.”

“Growth equities are very cheap” in the current market, he said. “What typically happens in a recession period like the one we've been through is that the market doesn't tend to look out for earnings more than one quarter,” he said. In such a short-term environment, “growth equities are not valued very well because the market is fearful of” the future, he said.

If the general market were to climb rapidly, growth equities as a group could outpace the broad market, he said. “Growth equities don't beat the market by 100 basis points; they beat it by 1,000 basis points.”

Not surprisingly, Mr. Calamos' firm is overweight growth equities in its asset allocation.

In such a market, bondholders need to be wary, Mr. Calamos said.

“The equity markets have priced in increasing interest rates,” he said. “And people sitting in bonds think they're in a safe haven but could get crushed pretty easily if we had a sharp rate increase.”

“The worst-performing asset class during the 1970s was bonds,” Mr. Calamos noted. “And that's where people were hiding” because of falling values of stocks at the time.

“The inflation-reflation play is something we really need to think about in our asset allocation,” he said.

Investors should look for investment-grade bonds with very short durations, he said.

Meanwhile, Mr. Calamos said he has a positive outlook on global investing in general, in large part due to the rising middle class in emerging-markets countries.

Calamos Asset Management had $33.4 billion in assets under management at the end of June.