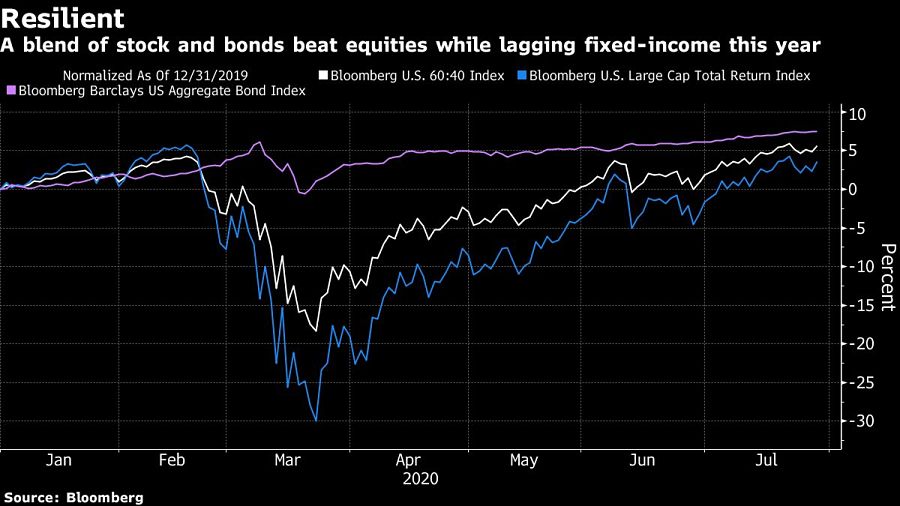

The staple U.S. portfolio of 60% equities and 40% fixed income proved resilient this year, but strategists are now considering alternatives to government debt after some bond yields reached historic lows.

Sanford C. Bernstein recommends taking more risk by favoring stocks and gold, and argues that the negative correlation between equities and fixed income is likely to unwind. Morgan Stanley said corporate bonds may be the best alternative to sovereign notes for curbing portfolio volatility and providing a level of income.

“I don’t think bonds can provide the standard historical returns investors are used to,” said Andrew Sheets, Morgan Stanley’s chief of cross-asset strategy in London. “The starting yield is at a point where that type of return is just not possible. Investors are going to have to lower expectations of 60-40 portfolios, and will have to look elsewhere for what can be in the 40%.”

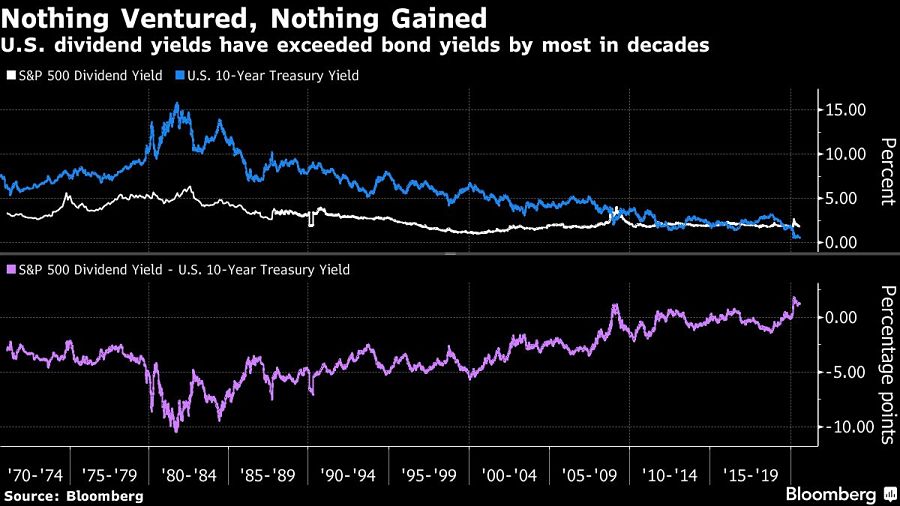

Blending stocks and bonds, a decades-old investment staple to balance risk and reward, is being tested by ultra-low yields. Five-year Treasury yields fell to a record after the Federal Reserve last week delivered a dovish message of support for the coronavirus-stricken U.S. economy.

The S&P 500 index is up about 1.3% in 2020 after rallying sharply from March’s pandemic-induced plunge. Governments and central banks have provided $11 trillion in stimulus and other support, including slashing borrowing costs and deploying unconventional policies to counter the impact of the health crisis.

Investors don’t have many other options to generate income aside from dividend stocks, with the gap between U.S. dividend yields and bond yields at the widest in more than six decades, said Inigo Fraser Jenkins, head of global quantitative strategy at Sanford C. Bernstein in London.

“If asset prices are high maybe income is more important, but then how to find that income?” he said. “We think the end result is investors will have to take more risk.”

“You’re going to have to think more creatively about asset allocation and potentially doing different things in your portfolio,” said Michael Moran, senior pension strategist at Goldman Sachs Asset Management in New York. Alternative asset classes and private markets are a way for retirement funds to boost risk-adjusted returns, he said.

For some analysts, the traditional 60-40 approach still has a role to play. JPMorgan Chase & Co. said in a note that government bonds continue to have a negative correlation with equities, adding that an allocation such as four-fifths in stocks would be insufficient to hedge overall equity risk.

Morgan Stanley’s Sheets said cash has some virtues. “With 60% equities, 40% cash, you can get a lot of the same volatility reduction and liquidity benefits,” he said. A portfolio with two-fifths in gold would likely look a lot more volatile, according to Sheets.

A portfolio of 60% U.S. shares and 40% bonds is up 6% in 2020. A variation, which holds the same amount of stocks and replaces bonds entirely with cash instruments such as short-dated Treasury bills, has gained approximately 3.7%, according to calculations by Bloomberg. That compares with a total return of roughly 2.4% for the S&P 500 index.

Investors will have to become more nimble because a “set it and forget it” balanced portfolio may not work as well, said Jason Brady, president at Thornburg Investment Management Inc., an asset manager overseeing $38 billion.

“We’re seeing a kaleidoscopic explosion of complexity,” Brady said.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound