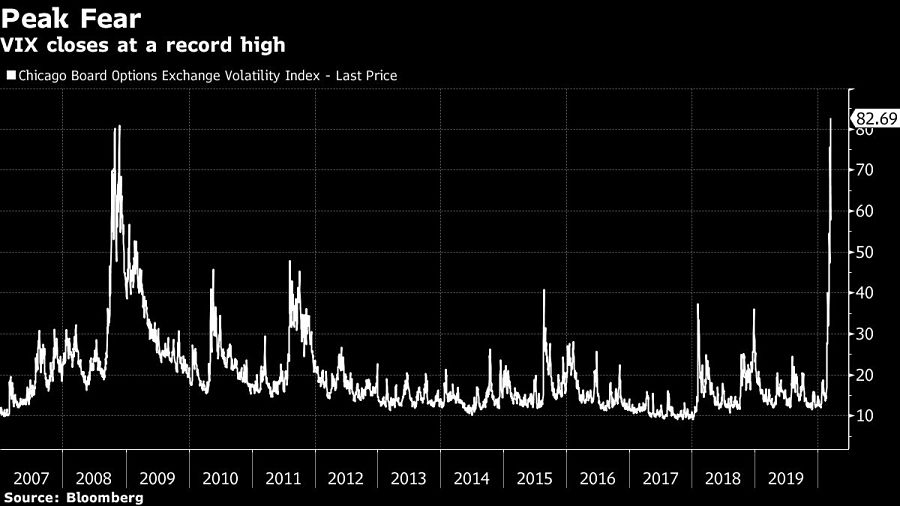

Volatility in U.S. stocks surged to a record after benchmark indexes suffered the biggest rout since 1987.

The Cboe Volatility Index ended Monday at 82.69 as the S&P 500 Index tumbled 12%. The fear gauge’s prior closing high was 80.86 on Nov. 20, 2008, after lawmakers postponed a vote on a plan to save the auto industry.

The gauge’s rose as high as 83.56 during Monday's session, short of its intraday record of 89.53 reached on Oct. 24, 2008.

“In 2008, you pretty much knew it was banking system breaking down, but didn’t know exactly how, and now it’s everything breaking down and how that spills over,” said Steve Sosnick, chief strategist at Interactive Brokers. “The latter is worse, I’d argue -- this is dislocating everything.”

The VIX Index measures the 30-day implied volatility of the S&P 500 Index based on out-of-the-money options prices. The current level implies daily swings of more than 5% are in the offing for the benchmark equity gauge, which is lower than what’s been realized over the past 10 sessions.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

For several years, Leech allegedly favored some clients in trade allocations, at the cost of others, amounting to $600 million, according to the Department of Justice.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound