From increasingly hawkish central banks to worries about a war that could exacerbate an inflationary spiral, the risks for stock markets are piling up.

Equity markets have reeled on signs that central banks will tighten policy far more aggressively than previously expected, disrupting a rally that had braved successive flare-ups of a once-in-a-century pandemic. Stocks are now contending with the uncertainty related to a potential military conflict, although Russia has repeatedly denied it plans to invade Ukraine.

While too many moving parts cloud the outlook for markets, some key themes are beginning to emerge: First, the era of an indiscriminate rally fueled by abundant liquidity is coming to an end. Second, investors may need to steer clear of lower-quality stocks that are vulnerable to a less forgiving macroeconomic backdrop.

Here are the basic outlines of a stock trader’s playbook for this new era based on conversations with investment managers and strategists and notes to clients from major brokers.

“Investors need to focus on higher quality, rather than more speculative investments that have benefited from low interest rates and high liquidity,” says Carin Pai, executive vice president and head of portfolio management at Fiduciary Trust International. They should seek out companies with “more stability and more predictability in earnings,” she said in an interview.

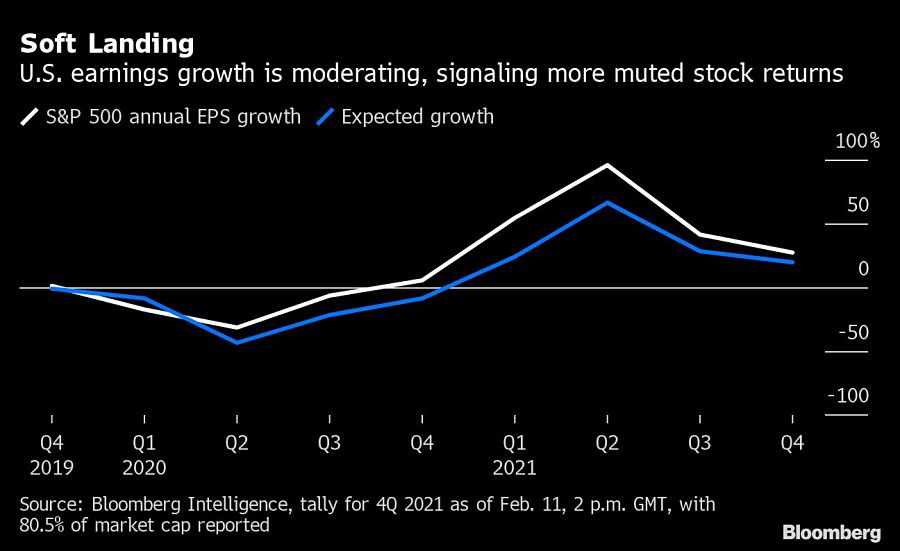

Those include cheaper, so-called value stocks, and also more expensive companies, Pai said. This earnings season saw markets reward some of the most expensive companies in the S&P 500 index for solid earnings, while severely punishing the misses.

The era of looking for returns in “just one market, factor or particular sector” might well be over, Goldman Sachs Group Inc. strategists led by Peter Oppenheimer wrote in a note. “This should mean a return to Alpha,” selecting stocks based on potential growth relative to price, they said.

The case for quality is reinforced by the return of geopolitical risk. With the U.S. warning that a Russian invasion of Ukraine may be imminent, Morgan Stanley’s chief U.S equity strategist Mike Wilson advised investors to maintain a defensive bias and seek haven in quality stocks.

While most strategists expect the impact of a potential conflict to be brief, volatility is expected in the near term. UBS Global Wealth Management advised clients Monday to manage downside risks while preparing for a rebound later in the year.

“Sectors like energy and financials, value stocks, and commodities are both positioned to benefit from robust economic growth and are relatively well insulated from the primary market risks,” the strategists led by Mark Haefele wrote in a note.

Going for quality also means picking stocks with lower debt and stronger balance sheets and cash-flow growth, according to Pai. Debt levels become more pertinent as rates rise and the taps of central-bank liquidity are being turned off.

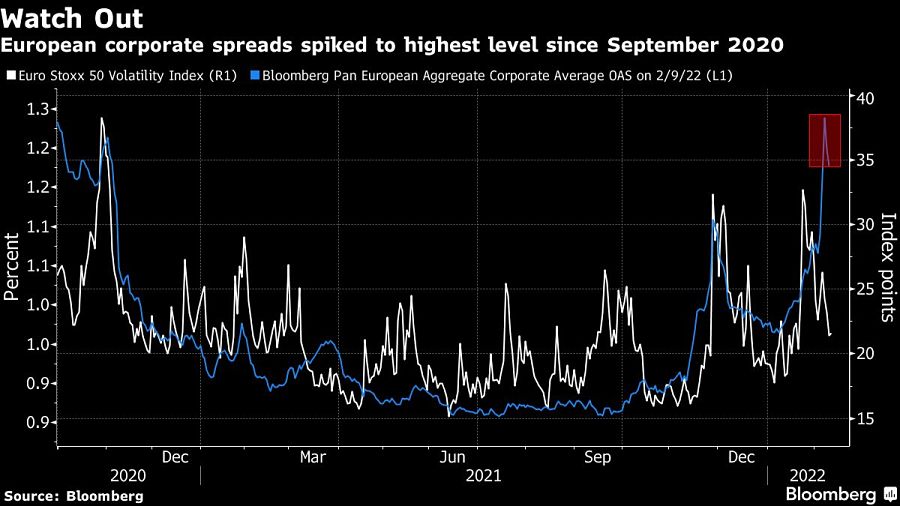

Utility Enel SpA, Italy’s largest listed company by market value, slumped after the ECB changed its tune on interest rate hikes. Fitch Ratings cut its long-term issuer default rating to BBB+ from A- on “an expected rise in leverage in the medium term.” Bank of America Corp. strategists place European banks and autos among the most vulnerable in periods of rising credit spreads. Personal care, drug and grocery stores, and health care tend to outperform the most, they said.

Weak-balance-sheet stocks are more vulnerable with spreads widening, Goldman’s Sharon Bell said in a note to clients. European health care stocks look especially attractive as they are both low leverage and positively correlated with credit spreads, she said.

Yield hunger led investors to companies with varying degree of credit risk in recent years, but in this new environment, “people start to see the risk they didn’t think about before,” Salman Baig, multi-asset investment manager and senior vice president at Unigestion, said in an interview. “If those investors run for the door, that could aggravate a downward spiral.”

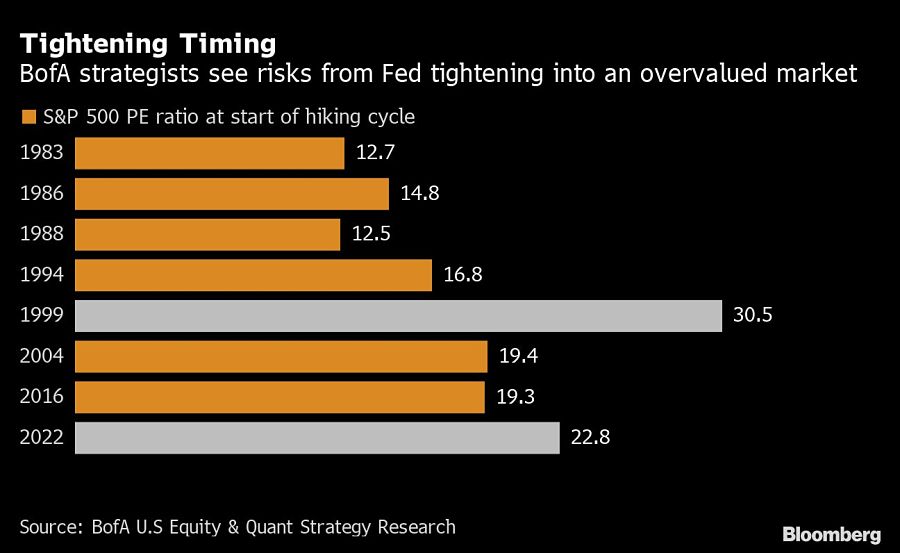

While equity strategists don’t see eye to eye on whether markets can continue rallying, most agree that the era of U.S. leadership may be coming to an end as the Fed’s tightening weighs on stretched valuations.

Bears like Morgan Stanley see a “winter” for U.S. stocks, but remain positive on Europe. Bulls like JPMorgan Chase & Co.’s Mislav Matejka see further upside to equities overall, but say U.S markets could “stall” relative to the euro area and the U.K.

Even loyal fans of U.S. stocks like HSBC’s Max Kettner have recently downgraded them, while Goldman’s Oppenheimer warned that the U.S. secular outperformance “is harder to sustain” with rates rising, the American economy not growing faster than others and investors seeking more value-asset exposure.

With even the most optimistic market watchers expecting muted returns this year, where should investors seek refuge?

“We do like emerging market equities,” including China, said Unigestion’s Baig. While the Chinese central bank is not particularly accommodative, it still “is in a very different place” than the Fed, Baig said, adding that last year’s underperformance means allocations in emerging markets are now “fairly light.”

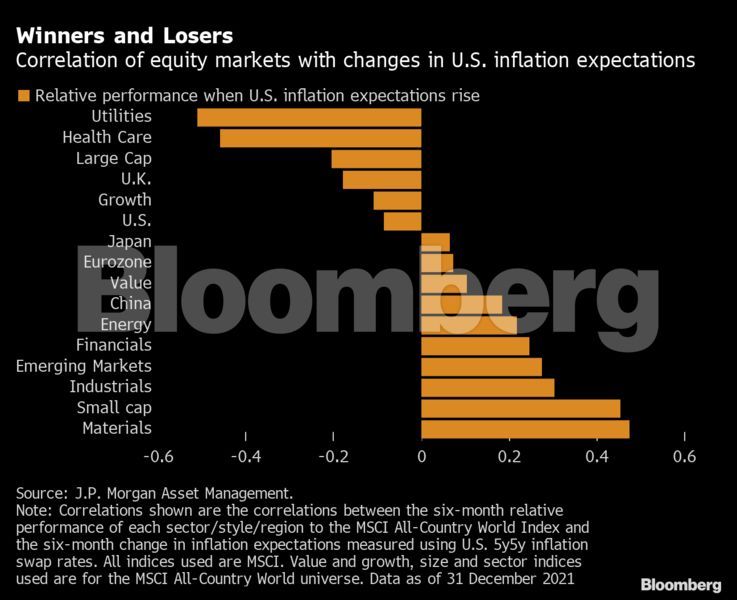

Fiduciary Trust’s Pai favors energy and financials “in the very near term,” amid persistent inflationary pressures.

“In the second half of this year, we’ll start to see some of the supply constraints ease and market expectations for Fed rate hikes subside, and in that case I do expect markets will rotate back into technology and longer-term growth areas that will continue to be driven by innovation and continue to show pricing power,” she said.

Some market segments like materials, industrials, energy, and banks perform better during rising inflation expectations and higher interest rates, JPMorgan Asset Management strategists told reporters on Friday. But the key is to invest in companies with resilient earnings, said Hugh Gimber, JPMAM’s global market strategist. Companies “need to demonstrate that they can maintain margins that can be resilient in the face of higher input costs,” he said.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound