Fear gauges for the S&P 500 and Nasdaq 100 indexes may be providing reasons for caution about the rally in U.S. stocks.

The S&P 500 and Nasdaq 100 scaled new peaks Wednesday, but their respective measures of implied volatility also rose in tandem. Simultaneous increases in equity and volatility gauges are unusual, and a reason for concern for some. The pattern was repeated for the S&P 500 on Thursday.

Wednesday was the first time in about two decades that the Cboe Volatility Index -- or VIX -- rose more than 5% as the S&P 500 rose over 1% to a record, Jason Goepfert, president of Sundial Capital Research Inc., wrote in a note. History suggests stocks tend to decline a median 1.2% in the following month when that happens, he added.

“This might be the weirdest market I’ve ever seen,” Goepfert said, adding he’s seen market oddities for weeks, and so far “they haven’t mattered.”

That’s underscored by a surge in U.S. stocks that defied convention and skeptics alike. The Nasdaq 100 has rebounded 71% from the virus-induced lows in March, and the S&P 500 is up 56%. The rally has stretched valuations and faces risks from stalled U.S. fiscal stimulus talks. But investors are taking comfort from the Federal Reserve’s plan to retain accommodative monetary policy and shift to a more relaxed approach on inflation.

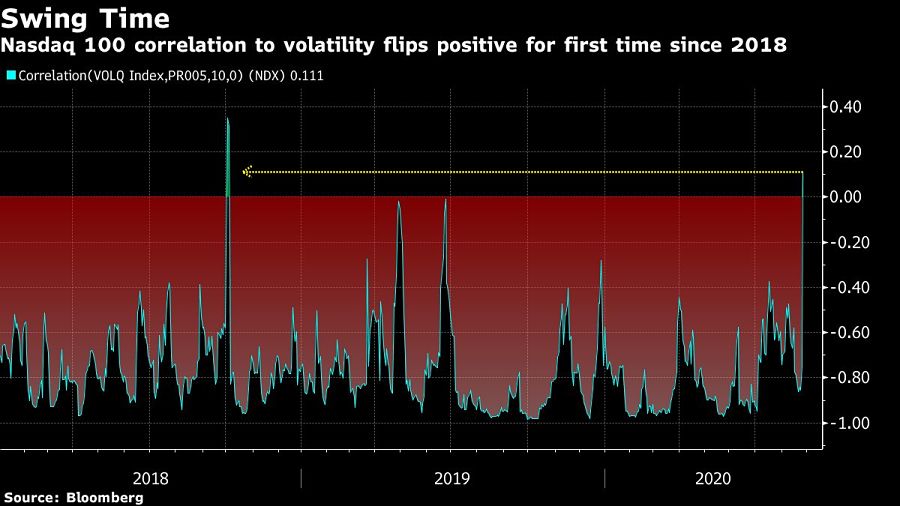

Wednesday’s session also saw a 2.1% rise in the Nasdaq 100 Index, accompanied by a more than 10% increase in the Cboe NDX Volatility Index. Both have climbed in August, but the move in the volatility measure may be due to investors chasing the stock rally, according to Susquehanna Financial Group.

“We are seeing more ‘upside panic’” in the Nasdaq, Chris Murphy, a derivatives strategist at Susquehanna, wrote in a note.

A range of uncertainties are set to be resolved in the months ahead, such as those related to stimulus spending, November’s presidential election and the possible introduction of a COVID-19 vaccine.

That’s going to bring VIX down to about 16, from about 24 currently, said Michael Kelly, head of multi-asset at PineBridge Investments. “It’s extraordinarily unusual for the VIX to stay above 20 for an extended period of time without a crisis situation going on,” he said.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound