Casey Harrell, the campaigner whose sustained pressure was instrumental in pushing BlackRock Inc. to act against climate change, approaches his work as if locked in a race against time. That was true even before the 42-year-old environmental activist was diagnosed last year with amyotrophic lateral sclerosis, also known as Lou Gehrig’s disease.

Harrell’s latest effort, focused on Vanguard Group Inc., is likely to be his last.

“My diagnosis has put me on the ALS clock, which is a different clock than most people live,” said Harrell, who resides in Oakland, California, with his wife and young daughter. He works as a senior strategist for the Sunrise Project, an Australian nonprofit that fights against climate change. “I feel really connected to the urgency that others feel around a need to act on climate now, not by 2050, in a real visceral way.”

The result is a determination to do something about Vanguard, which ranks only behind BlackRock among the world’s largest money managers, overseeing about $7.2 trillion of assets. Harrell’s working with nongovernmental organizations, including Sierra Club, Friends of the Earth and Amazon Watch, to raise awareness about the fund manager’s climate record.

The plan is to enlist Vanguard’s massive base of individual investors in the campaign, getting them to express their disquiet directly to the firm and fund advisers. That way, Harrell hopes to make climate change an unavoidable daily topic of conversation with which Vanguard has to reckon.

There’s plenty to say. The asset manager, whose late founder John Bogle invented index investing, is the biggest institutional investor in coal companies, according to Urgewald, an environmental nonprofit in Germany. Vanguard recently held $86 billion of the debt and equity of companies involved in thermal coal, compared with $84 billion held by BlackRock.

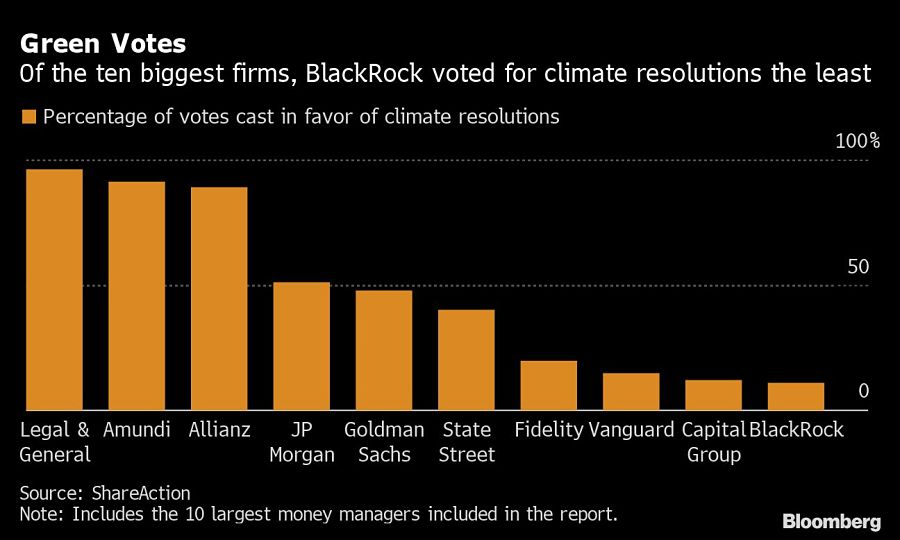

It’s also the largest investor in the 350 companies that Global Canopy, a U.K. nonprofit, has identified as having the greatest exposure to tropical deforestation in their supply chains, through sourcing items such as palm oil and timber. And that’s only part of the problem. Beyond its stakes in climate-destroying companies, Vanguard is widely criticized for not using its influence to push for lower emissions, snubbing shareholder climate resolutions and votes against recalcitrant boards.

“Vanguard cares deeply about the impact of climate risk and welcomes input from all parties on how we can best address it,’’ said John Galloway, global head of investment stewardship at the Valley Forge, Pennsylvania-based firm. “Core to our mission is a fiduciary duty to maximize long-term investment returns for our shareholders, and climate change and other ESG risks are critical factors that impact the ability of companies into which our funds invest to create that long-term value.''

As a predominantly index-based investor, divestment of carbon-intensive companies isn’t an option for Vanguard, Galloway said. Engaging with companies is the best way to encourage positive change, with proxy voting seen as the “tip of the iceberg,’’ he said.

“Proxy voting records are often misperceived or misused,’’ Galloway said. “As much as we care about climate change, simply because a proposal has the word climate in the title doesn’t mean, that in our careful analysis, we will decide that the proposal is in the right long-term interests of shareholders.”

It’s been almost three years since Harrell started what became known as BlackRock’s Big Problem, a network of organizations pressing the New York-based firm to divest from fossil-fuel companies, including coal, in its actively run funds. For its passive funds, the campaign has been pushing BlackRock to support climate resolutions and vote against directors at laggard companies.

BlackRock’s Big Problem has held dozens of protests outsides the company’s offices from Brussels to San Francisco, has arranged for people indigenous to the Amazon rainforest to speak at the money manager’s annual shareholder meeting and has circulated reports on the firm’s climate record to some of its biggest clients.

Harrell insists he isn’t done with BlackRock. That’s even after the asset manager has pledged to put climate change concerns at the center of its strategy.

Officials at BlackRock declined to comment for this story.

Harrell, who sports a beard and dark cropped hair, now relies on a mobility scooter to get around outside the house. ALS is a progressive neurodegenerative disease that affects nerve cells in the brain and spinal cord. The rate at which ALS progresses varies. Although the mean survival time is three to five years, some people live five, 10 or more years.

Change could come faster at Vanguard, Harrell predicts, now that the connection between asset managers and emissions is more clearly understood. His criticisms of Vanguard are similar to those he levelled against BlackRock, as are his demands, which include supporting climate resolutions.

Tolerating climate change is incompatible with Vanguard’s mission of responsible stewardship of clients’ savings, said Michael Frerichs, state treasurer of Illinois, which has more than $5 billion invested with Vanguard. He said he has raised his concerns and Vanguard has indicated it will be more supportive of climate proposals in the 2021 proxy season.

“Bogle’s vision was to create a safe way for everyday people to invest in the markets for the long term, but there is a real big juxtaposition with how that same company is approaching the existential threat of climate change,’’ said Diana Best, senior strategist at the Sunrise Project in Denver, who works with Harrell on his asset-management campaigns.

Harrell’s activism stretches back to his days at Duke University in the late 1990s, when he was was part of a student group that lobbied against sweatshops and pressed Nike Inc. into disclosing information about the factories where it made university-sponsored sports apparel. He then worked for Greenpeace on campaigns targeting Big Tech companies, including Apple Inc., to remove toxic chemicals from their supply chains and power their data centers with renewable energy.

Harrell joined the Sunrise Project in 2017 to focus on the finance sector and that’s when he discovered BlackRock would be an ideal candidate for an ambitious campaign: It’s a giant money manager led by Chief Executive Larry Fink with a powerful lobbying machine that has friends in governments around the world.

“Larry has a particular `je ne sais quoi’ and sees himself as the CEO of Wall Street in a way that no other asset manager does, and thus we felt BlackRock was the right place to start,” Harrell said. “When BlackRock decides to do something, they go all in and they shift the market.”

Vanguard is different. It promotes itself as closer to Main Street than Wall Street. It’s designed with mom-and-pop investors in mind, is run from a suburb of Philadelphia, not a Manhattan skyscraper, and keeps a comparatively low profile.

If this is to be his swan song, Harrell is going to make it loud. He said the retail campaign that will target Vanguard also is being designed to reach the customers of rival money managers Fidelity Investments, Capital Group Cos. and State Street Global Advisors. There’s also a plan to pressure brokerages Charles Schwab Corp. and ETrade, as well as app-based investing outfits such as Robinhood Markets Inc. and Stash Investments.

“I am lucky to have a job I love and I hope to do be doing it for a long time, but the reality is I might not,” said Harrell, who has tried a wide range of potential ALS treatments and is currently exploring some experimental options. “And if this is my last campaign, it’s going to be a good one.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound