The SEC recently passed a groundbreaking rule that will require many big public companies to report their climate-related business risks and their greenhouse gas emissions.

But the rule the Securities and Exchange Commission finalized was significantly pared down from what it proposed two years earlier, walking back the overall burden on businesses while nonetheless getting some progress on climate reporting on the books.

“This is not the rule I would have written. While these are important steps forward, they are the bare minimum. Ultimately, today’s rule is better for investors than no rule at all, and that is why it has my vote,” commissioner Caroline Crenshaw said before voting in favor of it. “Although I am loath to leave for future commissions those obligations that I see as our responsibilities today, I’m afraid that is precisely what we are doing.”

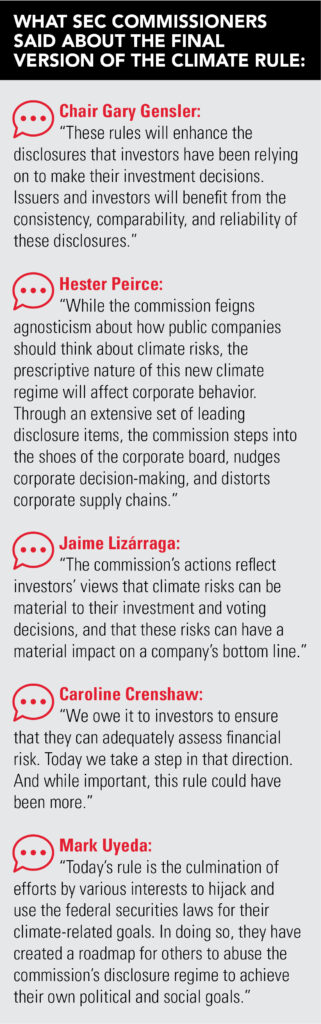

Commissioners Hester Peirce and Mark Uyeda voted against the rule, while Crenshaw, chair Gary Gensler, and commissioner Jaime Lizárraga voted in favor of it.

Not many parties appear to be happy with the level of compromise. In fact, the commission has since been sued by both conservative and progressive groups over the rule, in addition to numerous Republican-leaning states that have sought to block it. On the political right, the US Chamber of Commerce has added itself to an existing case brought by Liberty Energy, filing a petition for review with the Fifth Circuit Court of Appeals. On the left, the Sierra Club filed a petition for review with the US Court of Appeals for the DC Circuit.

Under the new rule, many large companies will have to report some of their greenhouse gas emissions as well as their material risks related to severe weather events like hurricanes and floods. There are also requirements, called “attestation,” that some of the biggest companies have third parties evaluate the figures they provide and the methods used to calculate those.

Opponents of the SEC’s rule have contended that even with the agency’s significant revisions, the final rule will be overly burdensome for corporations and that the regulator doesn’t have the authority to impose regulations on climate-related issues. And those who wanted to see the SEC go much further were disappointed that the final version requires companies to only disclose risks related to Scope 1 and 2 emissions, or those related to the greenhouse gases they emit directly and those from the energy they use. Lacking are Scope 3 reporting requirements, which would have covered the indirect emissions from companies’ supply chains and end users, which by most accounts constitute the majority of businesses’ greenhouse gases.

“Stepping away from the requirement to quantify Scope 3 emissions, which are difficult to measure in the best scenario, we believe the SEC will ultimately make climate risk assessment and disclosure reasonably achievable and more consistent,” said Karen Ogden, partner at Envest Asset Management, a financial advisor specializing in sustainable investing.

“Certain industries will naturally carry a heavier burden than others, and all impacted companies may experience increased costs, but in an investing ecosystem that has driven untoward attention to short-term results, this rule will begin to require a longer-term view of decision making, and that is a critical step in the right direction,” Ogden said in an email. The SEC will likely refine the rule and expectations after it has gone into effect and had time to evaluate companies’ approaches, she said.

A critical defect in the final rule, according to environmental and sustainable investing groups, is that companies must report emissions only if they decide on their own that they are financially material to business or if they have publicly set goals or targets for reducing them. That could give corporations significant flexibility as to whether they want to report emissions.

While critics have cast the SEC’s rule as an effort to regulate climate issues, the commission has held that many, if not most, big companies already provide climate-related figures to investors. A rule is necessary to make the methods for reporting that data consistent, so that comparing figures among companies is apples to apples, proponents have said.

“Investors like information. They tend to find this information helpful in making investment decisions,” said Lance Dial, partner at K&L Gates, during a March 13 presentation the law firm held on the new rule. “I’ve never met a portfolio manager who said, ‘No, I don’t need that – I can make a decision based on my feelings.’ Information dissemination is at the bedrock of our securities laws.”

The SEC didn’t come up with the idea of climate data reporting, and other jurisdictions, such as the European Union, already require some aspects of it, he noted.

Sean Jones, another partner at the firm, said that additional guidance from the SEC is all but necessary for showing companies what “materiality” means for the sake of greenhouse gas emissions – the word "material" appears 1,000 times in the rule, which runs more than 800 pages. A big potential drawback of the rule is that it could dissuade companies that voluntarily disclose climate data from doing so once it’s in effect, as reporting could be viewed as an admission that the risks and figures they report are financially material, he said.

“The challenge is that it’s an all-or-nothing decision,” he said. “Either you disclose them, or you don’t.”

While the lawsuits are pending, it would be unwise for companies to plan as if the rule won’t go into effect next year, the lawyers said. Dial said companies should use a “snow-day rule,” or the assumption that students hoping for a snow day should still plan to have their homework for the next day completed.

“You can’t just sit on the sidelines and hope it goes away,” Jones said.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound