The global sum of socially conscious debt is barreling toward $5 trillion as Wall Street’s pursuit of sustainable investments fuels demand for the bonds and loans.

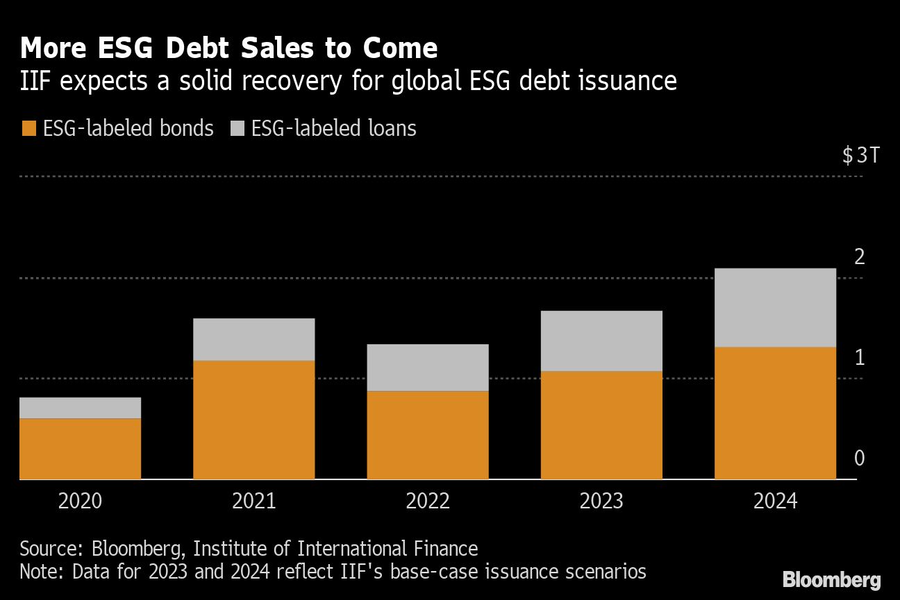

The Institute of International Finance expects $1.7 trillion this year in debt sales geared toward environmental, social and governance causes, a deluge that will vastly expand the $4.8 trillion universe of ESG debt. Another $2 trillion of the debt is forecast in 2024 as governments adopt a global biodiversity framework and commercial banks face pressure to decarbonize portfolios, according to the industry group.

“We anticipate a strong rebound in 2023 as demand for ESG debt continues to surge,” IIF economist Khadija Mahmood and Director of Sustainability Research Emre Tiftik wrote in a Thursday report. “With a softening U.S. dollar — and easier global financial conditions anticipated — international funding pressures should ease further.”

The IIF’s call comes even as conservative politicians in the U.S. push back against the industry, with Florida state officials going so far as to pledge a purge of such thinking from its pension funds.

While overall bond sale activity was tempered in 2022 as major central banks increased interest rates to combat inflation, ESG sales reached a record in emerging markets due governments including China, Turkey and Mexico, the IIF said.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

For several years, Leech allegedly favored some clients in trade allocations, at the cost of others, amounting to $600 million, according to the Department of Justice.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound