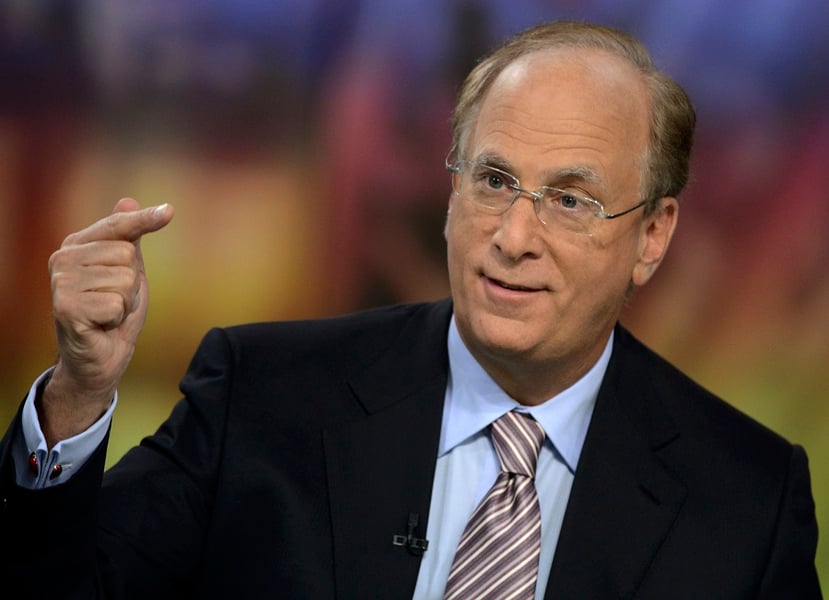

BlackRock CEO Larry Fink has said the economy is facing the “biggest capital arbitrage of our lifetimes” unless private-sector companies follow public firms and step up their climate commitments.

Speaking at the virtual Global Horizon Summit on a panel titled "Mobilising private capital in the transition to net zero," Fink told Lord Mayor William Russell of the City of London that there is an urgent need to bring together public and private financing in order to reach net zero.

He highlighted the work of the Glasgow Financial Alliance for Net Zero, where financial institutions are collaborating with other sectors – airlines, steel, industrials and construction, for example – on accelerating their position in decarbonizing the economy.

“The key issue is finance is very important, it drives everything in society. But we have to look beyond finance to get it done," Fink said. "I am very impressed with how public companies have moved forward on this. But if we are serious about getting it done, we can’t just ask public markets to do it, we would be fooling ourselves if we believed that.”

Russell noted that Fink had praised companies for following the Taskforce for Climate-related Financial Disclosures on a voluntary basis in his annual letters, and suggested the BlackRock CEO would support making this mandatory for private companies – it is to become law for public companies in April 2022.

“We all understand that time is running out and it is our fiduciary duty towards net zero, and we are rapidly building on that,” Fink said. “But if we don’t focus on the private sector we will see the biggest capital arbitrage of our lifetimes – it has already begun. We need a much better holistic solution to try to navigate all this.”

Much of the COP26 conference so far has focused on how developing countries can transition to a more sustainable future, and this week India and Brazil have both announced net-zero commitments.

But to really bring these countries along with developed economies for the transition, Fink said investors need to “reimagine” their approach when it comes to investing in emerging markets. “If we are serious about climate change in the emerging regions we have to focus on a reimagination of the world.”

He noted that there is a certain amount of trepidation, particularly when it comes to private capital investing in emerging markets, due to “political or brown-field risk.”

To tackle climate change and ensure a just transition, this needs to be changed, Fink said. “I’ve been enthusiastic about addressing climate change from a global level, not just in one specific country. We are urging the equity owners in all major countries to reimagine how we finance this in an emerging world."

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound