Demand from investors to decarbonize their portfolios coupled with a shrinking pool of investments that align with the goals of the Paris Agreement may leave investors in the year ahead with little choice but to call on companies to exit some businesses altogether, according to MSCI's 2021 environmental, social and governance (ESG) trends to watch report.

Investors in 2021 can also expect a more nuanced understanding of when and how ESG delivers financial benefits, alarm bells on biodiversity, a deluge of ESG disclosure, and a focus on addressing social inequality.

“Climate. ESG bubbles. Disclosure. Social inequality. Biodiversity. The topics don’t get much bigger or more systemic,” write Linda-Eling Lee, Meggin Thwing-Eastman and Arne Philipp Klug of MSCI ESG Research, who co-authored the report.

Here’s a rundown of the five trends.

Climate reality bites

The look-ahead arrives at the outset of a year that will see investors getting serious about tackling climate change as a series of limits envisioned in the Paris Agreement start to take hold. The lion’s share of companies, meanwhile, continue to send more greenhouse gases into the air than the agreement would allow.

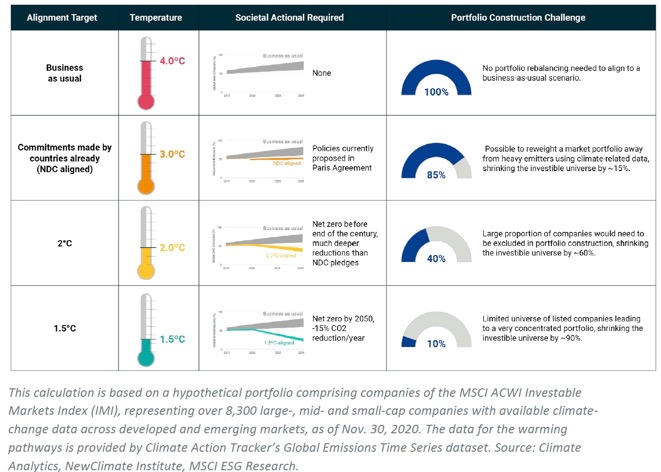

Of roughly 8,300 companies in the MSCI ACWI Investable Market Index (IMI) as of Nov. 30 2020, just 16% were aligned with the limit of a 2° C rise in global temperature targeted by the accord. Only 5% aligned with a limit of 1.5° C, the more ambitious of the two Paris targets.

CHART: How different climate scenarios might impact equity investment opportunities

Though many companies have reduced their emissions, the next five years could leave society with significant challenges and push investors into more difficult terrain. The authors note that besides calling on companies to change, investors could shift to private investments or contend with concentration in their portfolios caused by a scarcity of suitable investments.

ESG investment finds its footing

Investors in 2021 can look forward to a more nuanced understanding of when and how ESG has shown financial benefits, and when it hasn’t. “Simplistic explanations for the performance of ESG strategies are no longer tenable,” write the authors, who note that investors are turning to tools that allow them to cut through conjecture and act based on evidence.

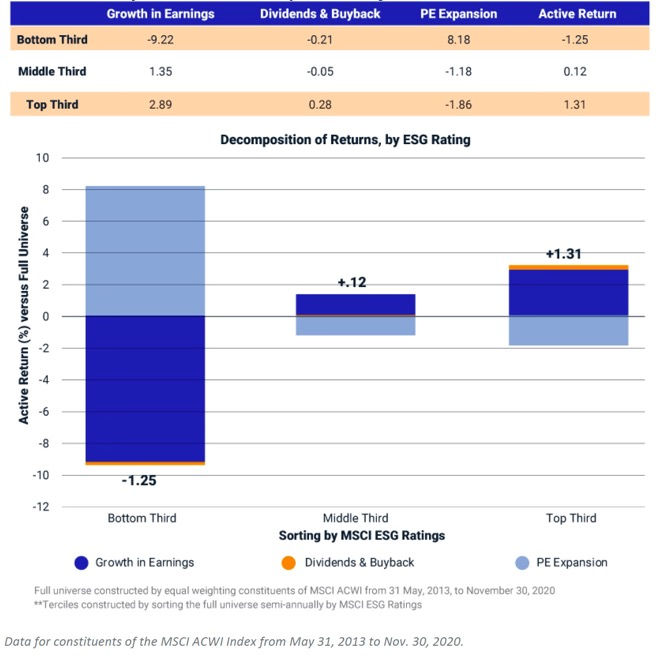

An examination of the data does away with the supposition, for example, that ESG investing represents a stock bubble. The authors compared companies with top MSCI ESG Ratings against their bottom-rated peers over seven-and-a-half years that ended Nov. 30.

CHART: Decomposition of returns by ESG rating

The top third of companies by ESG rating outperformed the bottom third by 2.56% a year, according to the analysis. The outperformance was driven mainly by greater earnings growth of the higher-rated companies over time, followed by a higher reinvestment return from dividend payouts and share buybacks.

Market participants themselves also are becoming more rigorous in distinguishing what a given ESG strategy targets. The authors note, for example, that a self-declared “sustainable” strategy might aim to do anything from aligning investments with the requirements of the United Nations (U.N.) Global Compact to targeting innovations that address an environmental challenge such as climate change.

Investors tackle the biodiversity crisis

Policymakers and investors in the year ahead will heed the alarm about threats to the health of Earth’s ecosystems. A U.N. conference on biodiversity slated to be held in Kunming, China this May could mark a tipping point for biodiversity much as the Paris Agreement did for the climate in 2015.

Understanding what biodiversity loss means for portfolios will start with mapping of companies for both their impact and dependence on ecosystems. Food producers, for example, depend on healthy soil, crop diversity, pollinators, fresh water and climate stability. At the same time, agriculture contributes to roughly 80% of deforestation globally.

The authors compare the mapping of companies for biodiversity to mapping the carbon footprint of portfolios that paved the way for detailed modeling of climate risk. “Measuring a portfolio’s biodiversity footprint is a similarly logical starting point for biodiversity protection,” they write.

A deluge of ESG disclosure

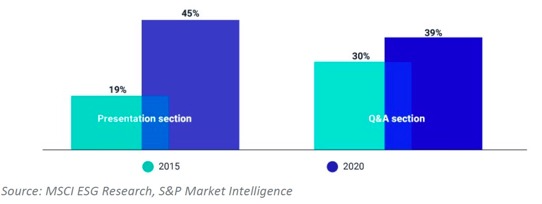

Demand for ESG disclosure will continue to grow in 2021, with more requirements becoming mandatory. Investors also should expect companies to continue stepping up both their reporting and outreach, say the authors.

CHART: Sustainability-related keyword mentions in earnings call transcripts -- global top-100 companies

The European Union’s Sustainable Finance Disclosure Regulation (SFDR), if finalized in its current form, would require financial institutions to report starting in 2021 on whether portfolio companies operate in our around areas of high biodiversity value, as well as the difference in wages between men and women those companies employ. The authors note that as of their review only a handful companies in the MSCI ACWI IMI reported all of the data needed to fulfill the draft company-level SFDR requirements (as of Nov 12, 2020).

Social inequality will test investors’ creativity

Though investors who aim to influence social issues typically lobby companies to change practices, that may not be enough in the wake of inequality made worse by the pandemic. “We see investors waking up to that reality and beginning to shake things up,” write the authors, who predict an uptick in demand for social bonds and other financing vehicles designed to address challenges that exist beyond the boundaries of individual companies.

The outcome matters for investors and society. Companies that fall short on social issues like workforce management can get hit with both negative events such as lawsuits and strikes, together with the gradual erosion of productivity and stifled innovation. “Racism has continually degraded the long-term potential for individuals, businesses and whole economies,” the authors note.

Investors may find their appetite for risk tested as they weigh the unknowns of innovative investments against potential benefits, according to the authors. They point for example to social bonds issued by Bank of America to provide financing for the health care industry and by Pfizer to help fund development of a COVID-19 vaccine as illustrations of the range of purposes such issuances can serve.

Related links

You can also learn more about wealth management solutions from MSCI here.

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound