Updated January 10, 2024

Gender lens investing has shown considerable growth in recent years as more investors turn to sustainable investments to boost their portfolios. This emerging impact investment strategy factors in gender equality and social well-being in achieving financial returns.

But what exactly is gender lens investing and how does it work? What benefits does this investment approach provide? And what role do financial advisers play in helping promote this type of investment strategy?

InvestmentNews answers these questions and more in this guide. We encourage advisers to share this piece with their clients to help educate them about this growing arm of sustainable finance.

Gender lens investing, also called GLI, is an approach to impact investing that considers gender-based factors when making investment decisions. The main goal is to promote gender quality.

GLI is designed to help investors achieve better financial returns and address gender disparities by focusing on investing in companies that advance and support women.

There are many ways that can happen. These include investing in companies that directly provide capital to women-owned or co-owned businesses. Robo-adviser Ellevest Impact Portfolios are a form of gender-lens investing.

According to industry experts, gender-based investing is a way to leverage the markets to support gender equality without sacrificing risk and return metrics. The strategy is based on the idea that investing in gender equity will expand – instead of limit – the return on investment.

“The important thing to note with clients about gender lens investing, and something that I absolutely advocate for, is that we are not sacrificing currency,” explained Vicky Lay, partner and head of impact investing at Artesian Alternative Investments.

“In the same way financial institutions have integrated ESG factors into their analysis in order to determine risk and opportunities, we are doing the exact same thing, but applying a focus on gender.”

Lay was a speaker in one of Investment News’ Women Adviser Summits.

Gender lens investing operates under four core principles, which make it a powerful investment strategy, according to global professional services network Ernst & Young:

Women across the world are on the cusp of wielding immense investing power, with wealth reaching $18 trillion, based on the group’s 2021 research. This growth indicates the need for asset managers to align their strategies to accommodate women as an investor class.

Female representation in executive and senior management roles have become among the strongest foundational pillars of gender lens investing. This also encourages organizations to promote more women in positions of leadership to facilitate diversity in decision-making.

To establish gender-conscious investment strategies, a complete picture of a growing female workforce is necessary. For gender lens investors, this raises the need for practicing due diligence to ensure that they are choosing the right companies to invest in.

Investors have robust options when it comes to GLI. These include exchange-traded funds (ETFs), mutual funds, debt funds, separately managed accounts, private equity funds, and proprietary investments. The range of products is also constantly expanding to meet the needs and demands of gender lens investors.

With these core principles under consideration, the process of gender lens investing can begin. This involves several key stages:

Investors assess target companies in terms of several gender-based factors. These include female representation in leadership roles, workplace policies supporting female employees, and products or services that benefit women.

Gender lens investors require company leadership to commit to gender best practices and provide gender-disaggregated reporting for accountability.

Investors exercise their influence to push for gender best practices and structure management incentives that reward successful gender equality programs in the workplace and customer base.

To measure the social and financial impact of GLI, investors need to conduct rigorous data collection and analysis. These include getting gender-disaggregated data, which can provide insights into the experiences and outcomes of women within the investment portfolio.

This approach also helps companies track progress, identify areas for improvement, and collect important data on which to base management decisions.

Investors seek to lock in gender-based gains by ensuring new investors will continue to advocate for gender equality.

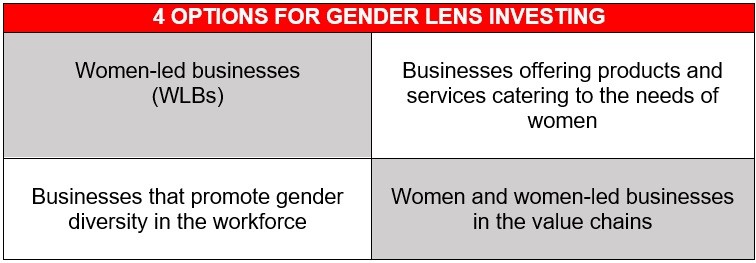

Gender lens investing comes with the intent to address gender issues and promote gender equality through investment choices. Here are some of the common GLI options for investors:

These are businesses that are majority-owned or led by women, or those with a significant percentage of female board memberships.

These are companies that promote gender equality by delivering products and services that improve the health, skills, and capabilities of women.

These businesses boast female staff and leadership representation. They also implement policies that support gender diversity in the workplace.

These are businesses that source from female producers or distribute their products through women-led companies or female sales agents.

As gender lens investing continues to grow, many industry players will claim that they are implementing considerable measures to promote gender equality. According to Esther Pan Sloane, former head of partnerships, policy and communications at the UN Capital Development Fund, it’s important for financial advisers to ensure that the impact is real.

“Women own 30% of all businesses in emerging markets,” said Sloane, who is currently the managing director at private equity firm Avenue Capital Group. “And we know that only 7% of investments from venture capitalists reaches women-led businesses.”

She added that there’s a way for financial advisers and wealth managers to check if the investment product truly has a gender lens. This involves looking at proceeds and ensuring that the product contributes to helping women grow businesses.

“For investors, we would like to ask those questions to combat the gender-washing or labeling of products and claiming they have impacts that really don’t,” Sloane said.

But there’s another step advisers can take, according to Lay. To ensure that their investor clients are correctly investing in GLI products that truly make a difference for women, she suggests advisers to check on the supply chain.

Among the due-diligence questions advisers can ask are: “How is the GLI product actually considering diversifying gender? How is it contributing to gender equality in their own supply chain? What’s within policies to promote pathways for women and equal pay?”

An adviser can also look at a firm’s public commitment to gender equality, Lay added. “For example, signing up to the global UN Women’s Empowerment Principles, or some other recognized gender equality commitment.”

There has been growing evidence that investing with a gender lens can have a positive impact on both the investor and investment. These include:

Companies with women in executive roles outperform their counterparts without female representation. The same is true for organizations with women on their boards.

Women represent an underutilized pool of talent in the workforce, limiting diversity within an organization. However, studies show that a diverse workplace contributes to employee engagement and retention. It also fosters creativity and leads to stronger financial performance.

As the purchasing power of women grows, so do massive opportunities for investors and businesses that are keen on accessing this capital. Companies that can effectively demonstrate their ability to empower women will be more successful in accessing these capital sources than those who cannot.

Asset growth in GLI products reached more than $12 billion in 2021, the latest figure from sustainable wealth management firm Veris Wealth Partners showed. This is a substantial increase from $3.4 billion in 2019 and $2.4 billion the year prior. These figures indicate a segment that’s primed for growth.

Despite this, key industry statistics show that there’s still a lot of work to be done to achieve gender diversity, equality, and inclusion:

However, growing demand from investors, increased data transparency, and improved impact reporting capabilities are creating more opportunities for investors to achieve equitable outcomes.

“[Investors] want to see diversity in order to see a peripheral understanding of the different risks that a company could face,” Lay said. “We also saw that gender lens investing has grown massively and that these funds had a track record of outperforming those funds that did not apply a gender lens in order to decrease risk and increase returns.”

Are you a female adviser dedicated to helping other women in the industry to grow and thrive in their careers? Get the opportunity to pick the brain of like-minded individuals in our Women Advisor Summit. The event is happening in Chicago this May. Visit the page regularly for updates.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound