The record-pace outflows from US sustainable mutual funds and ETFs abated in April and May, as investors were slower to pull their money from them.

For the year-to-date as of June 27, about $11.3 billion had poured out of such funds, with about $7.2 billion flowing out of actively managed products and $4.1 billion from passive ones, according to data from Morningstar Direct. US sustainable funds have seen net redemptions every quarter since the second quarter of 2022, and outflows have accelerated over the past three. That has largely been a story about investors fleeing from equity funds and showing a slight preference for fixed income, which has also been the case for the wider non-ESG mutual fund and ETF market.

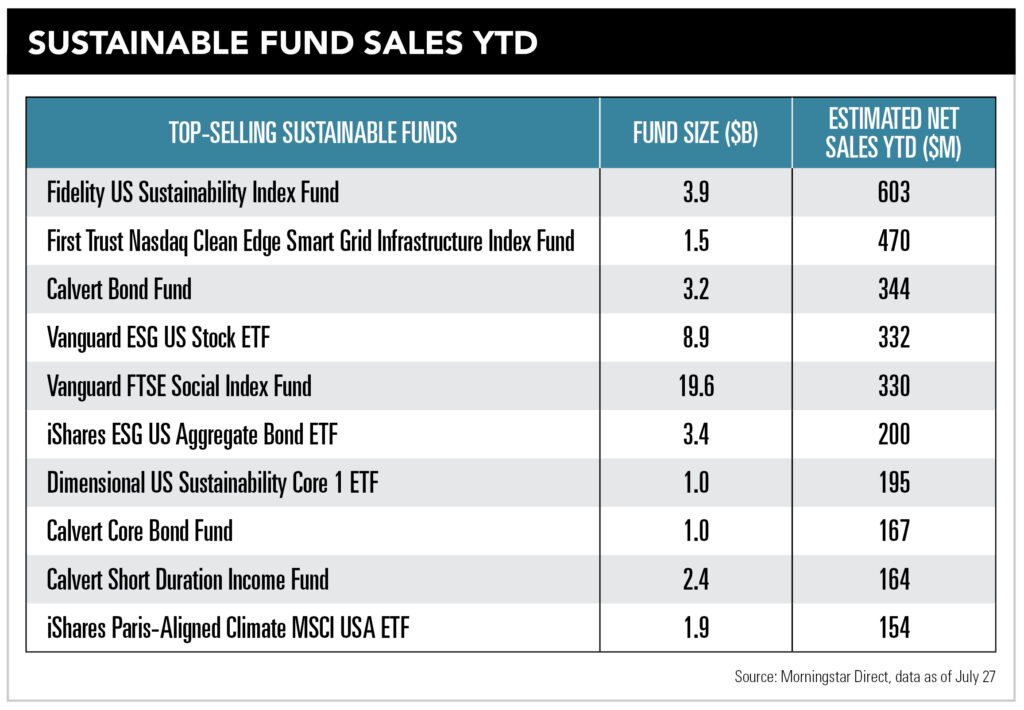

But even across asset classes and management style, people appeared to show preferences for some companies, and some of the biggest products on the market saw investors depart fastest. The biggest winner was Fidelity’s US Sustainability Index Fund, which raked in $603 million this year through June, followed by the First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund ($471 million in net sales) and the Calvert Bond Fund ($344 million). Of the biggest five funds on the market, three saw net outflows in 2022, 2023, and in 2024 through June. The largest, the $29 billion Parnassus Core Equity Fund, saw $863 million depart, while the $12.8 billion iShares ESG Aware MSCI USA ETF had nearly $1.9 billion leave, and the $8.6 billion Pioneer Fund reported $109 million in net redemptions, according to Morningstar data. Meanwhile, the $19.6 billion Vanguard FTSE Social Index Fund brought in $330 million of new money, and the $9.6 billion Brown Advisory Sustainable Growth Fund had $140 million in net sales.

“We had a bad Q1 with record outflows.… We’re still seeing outflows in April and May, but they are much lower,” said Hortense Bioy, head of sustainable investing research at Morningstar. About $2.7 billion left sustainable funds in April and May, she noted. “Assets are up – they continue to go up because of market appreciation.” Total money in the category is about $336 billion.

While sustainable funds had some performance challenges in 2022 and 2023, there are issues that have since “flipped into opportunities,” said Sampurna Khasnabis, research analyst at Nia Impact Capital. Interest rates hampered clean energy projects, but the Inflation Reduction Act is shifting into an implementation phase this year, and tax credits could bolster it, Khasnabis said. Nia provides two SMAs and a mutual fund, the latter of which has about $75 million in assets.

The Inflation Reduction Act is “more incentive-focused than mandate-focused,” Khasnabis said. “That enables a lot of creativity and innovation with these companies.”

She also said that a couple of holdings poised to benefit from higher standards from the Environmental Protection Agency on synthetic chemicals in water are Mueller Water Products and Xylem Water Solutions.

“Those holdings have been performing very well, and we’re expecting this year to be very solid for them,” Khasnabis said.

The opportunities made available because of regulations and government incentives make sustainable investing “very real for people who were on the fence,” she said. “It makes the business case stronger for why you should invest in these areas.”

Amid the record outflows in the first three months of the year, asset managers were quiet about how they were addressing products and their marketing as conservative politicians in Congress and in the states continued anti-ESG campaigns.

It's unclear who has been pulling money from sustainable funds, but the outflows more likely come from retail investors than institutional ones, as the latter take a longer view of performance. And in any case, demand from ESG-focused investors does not appear to be changing, as they have a higher affinity for the category and are less concerned with short-term returns.

“We haven’t seen demand go down,” said Peter Krull, director of sustainable investing at Earth Equity Advisors, noting that people seek out his firm specifically for its sustainable options.

In 2022, sustainable funds hit a wall amid a shift from a growth bias to a value bias, he noted.

“We’ve seen some comparable returns this year, I don’t think we’ve seen underperformance for the most part. One thing I’ve learned about sustainable investors is that they take the long view,” he said. “They understand this is a generational economy shift,” he added, speaking of a change in resource use and the need to decarbonize the economy.

That firm has five main portfolios, including an independent stock separately managed account with a 12-year track record and four asset allocation options that invest in a mix of mutual funds. Since his firm was acquired in 2022 by Prime Capital Investment Advisors, 200 financial advisors now have access to those portfolios, Krull said.

“A lot of them have never thought about putting sustainable investments in clients’ portfolios,” he said. The average asset level of clients is about $1 million, up from about $500,000 before 2020, he said.

The biggest factor that seems to get people interested in sustainable investing is climate change, the effects of which are more apparent than ever – and that will likely draw more people in, he said.

“It’s starting to hit people in real time now. It’s not something that’s going to happen down the road,” he said. “The people we’re talking to are the believers, the ones who have known it was coming. Our biggest competition is inertia.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound