ESG investment strategies are being probed for deceptive labeling, criticized for excluding firms like Tesla Inc. and questioned as to whether they actually work. All this, some sustainable fund managers said, could be a good thing.

Tough scrutiny of loosely regulated funds with higher environmental, social and governance standards could help the industry, these managers said. Investors would welcome better ESG definitions, greater transparency and easier ways to find funds that match their own goals.

“I do think the silver lining is more product innovation rather than just saying, ‘oh, ESG leaders,’” said Todd Sohn, a technical analyst at Strategas Securities. “Let’s focus on minority leadership and other large scale, community-type opportunities that are out there,” like the Impact Shares YWCA Women’s Empowerment ETF (WOMN).

Governments are stepping up investigations into ESG claims. The Securities and Exchange Commission is examining whether Goldman Sachs Group Inc.’s ESG funds failed to meet their promised metrics. Deutsche Bank AG’s Frankfurt offices were raided by police in May over accusations of “greenwashing,” or overstating ESG capabilities.

Tesla’s removal from the ESG version of the S&P 500 Index sparked a debate about which companies do — and don’t — pass muster with socially aware investors. And some critics say environment-focused funds may not even be working, since global emissions continue to rise.

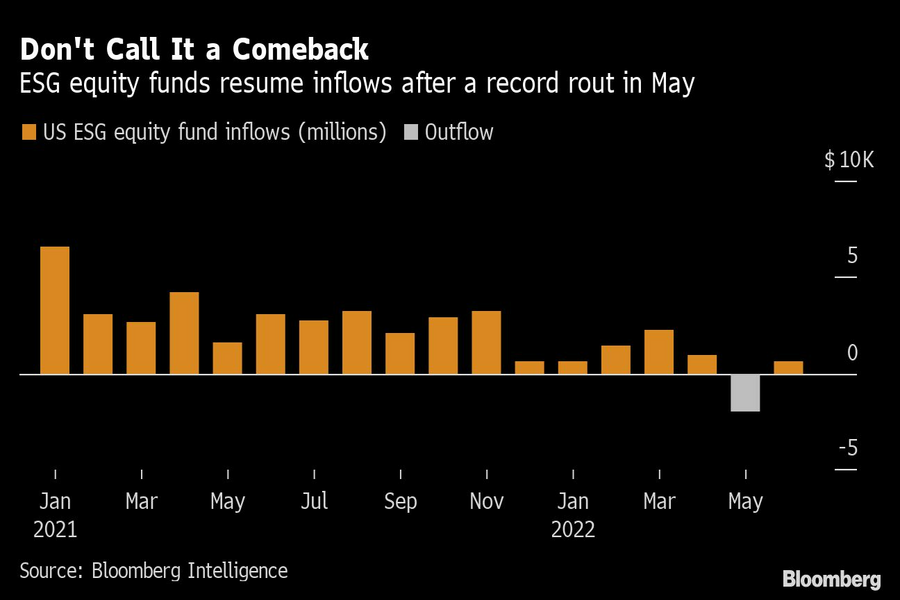

As questions swirled around ESG, the sector’s exchange-traded funds saw record outflows in May, according to data from Bloomberg Intelligence.

AXS Investments’ Greg Bassuk said this means investors have learned not to blindly “flock to the next big thing.”

“It’s not a lack of performance or not delivering on what the products are designed to do, but the lack of education and a mismatch in investor expectations with outcomes.” Bassuk, chief executive officer at AXS, said by phone.

Aoifinn Devitt, chief investment officer at Moneta, said that questions about ESG — an acronym coined in the mid-2000s — are to be expected for a still-evolving investment category.

“There will naturally be exaggeration, marketing hypes, overpromising, underdelivering. That’s going to be the nature of it. There’s been a lot of criticism of the whole category of ESG,” Devitt said by phone. “That is just an inevitable fallout or kind of a collateral damage when you have a massive transformational change in the industry like this.”

Lisa Langley, chief executive officer of Emerge Canada, expects that ESG flows will eventually stabilize.

“All of this is actually a healthy shakeout,” she said. “The outflows don’t really flip me out because we’ve seen outflows in the industry more generally, and it is possible that you don’t have to sacrifice performance. Communicating that message is going to give more energy into this space.”

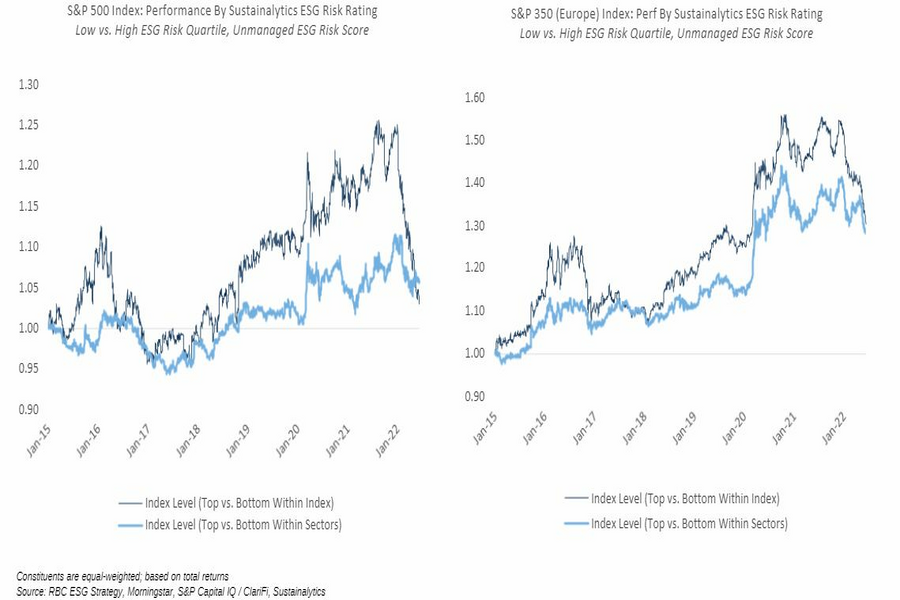

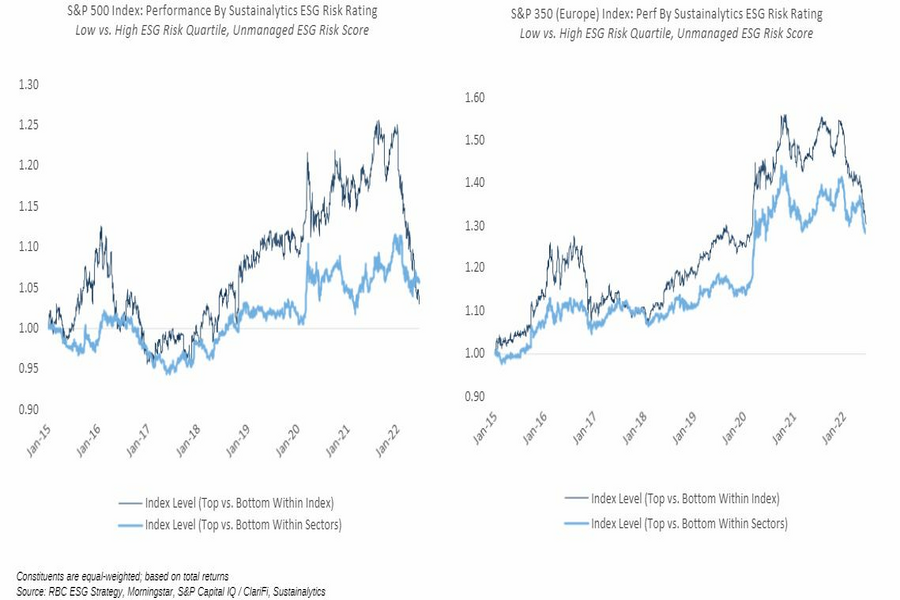

Data from RBC Capital Markets show that year-to-date, companies with better ESG risk scores have outperformed those with worse ESG risk scores within both the S&P 500 and S&P Europe 350 indexes as of June 9.

“Flows have not been as bad as the term ‘reckoning’ would imply,” Sara Mahaffy, ESG strategist for RBC Capital management, said by phone. “They have eased back from highs, but you’re still seeing inflows.”

RBC also found that while sustainable fund flows have fallen from their peaks, inflows still continue and, in fact, outperform their traditional counterparts. Some of that could be due to weaker performance and investor preference of value funds at the start of the year, Mahaffy said. “We also think some of the trend is reflecting a general easing that we’ve seen in equity fund flows,” she added.

Many fund managers welcome proposed SEC regulations that would prevent money managers from misleading investors on ESG investments.

“This could allow investors to make more apples-to-apples comparisons, which is pretty much impossible now,” said Amrita Nandakumar, president at Vident Investment Advisory.

More transparency could also help investors understand what is and isn’t ESG. The Tesla incident was “the perfect example for why it’s complicated,” Jake Jolly, senior investment strategist at BNY Mellon, said at Bloomberg’s New York office.

“It’s not, ‘oh, just take everybody like deals with crude oil, throw them out and then keep everybody that’s electric,’” he added. “It’s complicated.”

In fact, RBC found that ESG money managers have grown more accepting of fossil-fuel names. The firm found that inclusion of fossil fuel and energy companies in U.S. sustainable funds climbed 0.6% and 0.5% from the fourth quarter of 2021, respectively.

Kyle Harrison, head of sustainability research at BloombergNEF, said the energy-centric additions to sustainable funds reflect a growing appetite for ESG improvers. “The thought process is that an oil major that is working towards a climate goal and changing its business model will make a bigger decarbonization impact than a tech company that is already sustainable,” he said.

And greater investor education has finally helped point buyers toward opportunities beyond their old favorites, wind and solar. “One area where the inflows have been picking up this year have been for the sustainable agriculture and food-focused funds,” RBC’s Mahaffy said.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound