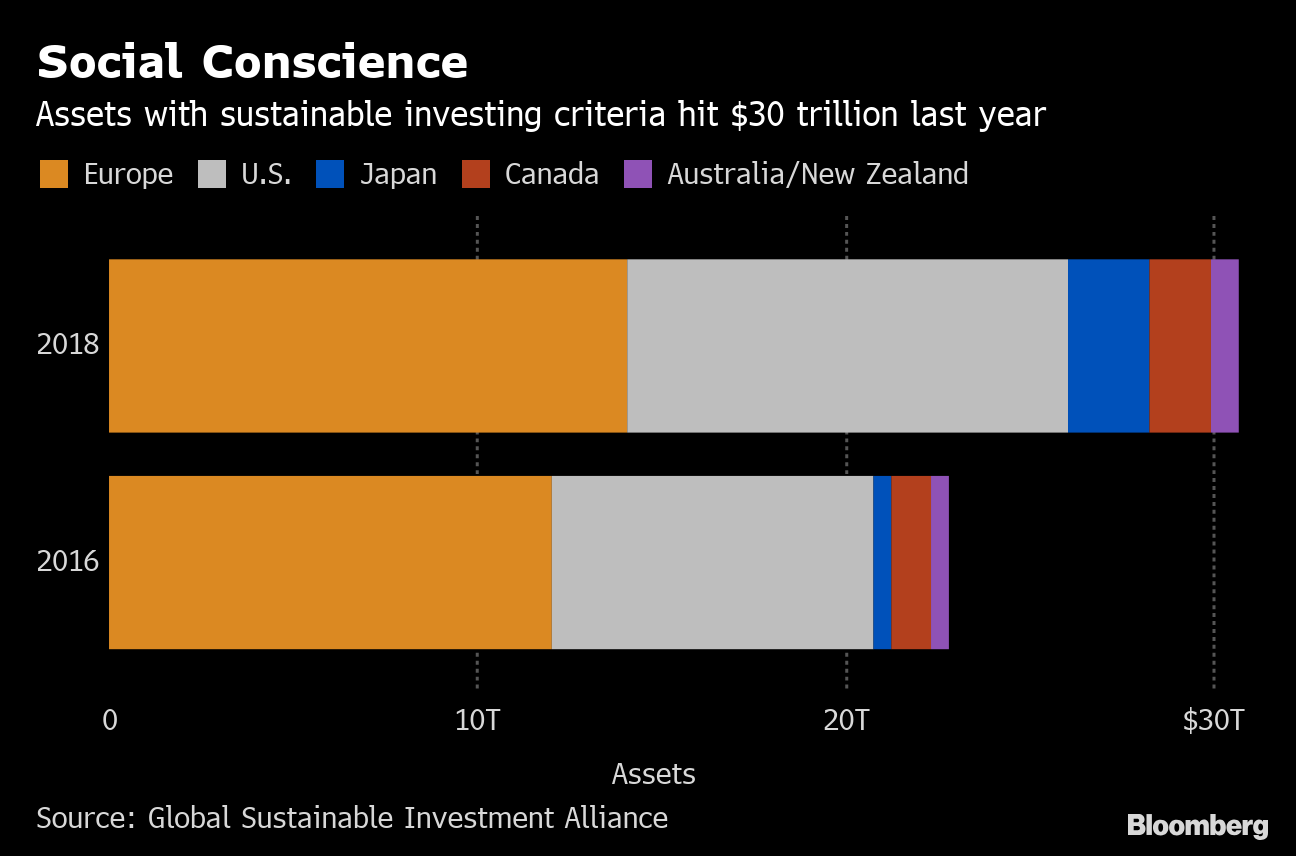

Issues often overlap. Investors who integrate environment, social and governance principles into their portfolios, now represent about $17.5 trillion, up 69% from 2016. Assets that focus on corporate engagement and shareholder activism around environmental and social issues rose to $9.8 trillion in 2018, up from $8.4 trillion.

Issues often overlap. Investors who integrate environment, social and governance principles into their portfolios, now represent about $17.5 trillion, up 69% from 2016. Assets that focus on corporate engagement and shareholder activism around environmental and social issues rose to $9.8 trillion in 2018, up from $8.4 trillion.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound