The three heavyweights sitting at the top of the $6.7 trillion exchange-traded fund industry are losing their hold on the market in a slow but steady sea change.

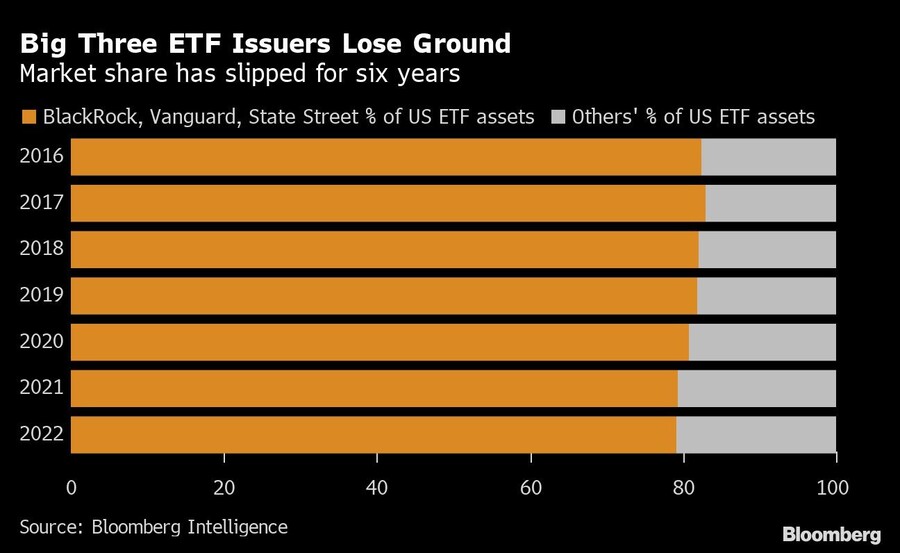

While Vanguard Group Inc., BlackRock Inc. and State Street Global Advisors still command about 79% of all U.S. ETF assets, their combined market share has slipped for six straight years, Bloomberg data show. Their slice was as high as 91% in 2006.

A stream of new entrants along with record fund launches are shifting the sands. Asset management giant Capital Group unveiled its first nine ETFs this year, which already command nearly $6 billion in assets. Meanwhile, quant pioneer Dimensional Fund Advisors’ footprint continues to grow after converting billions of dollars’ worth of mutual funds into ETFs, a tactic employed by J.P. Morgan Asset Management as well, while Morgan Stanley’s debut funds are gearing up to launch.

“There’s a lot of hungry, deep-pocketed, innovative issuers coming to market each and every month at this point,” Bloomberg Intelligence senior ETF analyst Eric Balchunas said. “Between the innovation and legacy active management moving their own money over, you’re going to have that market share continue to erode.”

Of the more than 400 new ETFs that began trading in 2022, the top 10 largest debuts are from Dimensional, JPMorgan, Capital Group and Goldman Sachs, according to data compiled by Bloomberg, with two mutual fund conversions topping the list. BlackRock’s February debut of its $900 million iShares Paris-Aligned Climate MSCI USA ETF (PABU) was the lone fund from the big three to crack into the top 20.

Of course, Vanguard, BlackRock and State Street still control the lion’s share of the ETF universe. Vanguard, founded by Jack Bogle, is still set to grow its market share for the 21st straight year, while BlackRock and State Street have grown both their ETF assets by about $900 billion and $400 billion on an absolute basis over the past six years, respectively.

But novel ideas will lessen their grip over time, said Tidal Financial Group’s Cinthia Murphy. The trio’s dominance in index-tracking ETFs has fueled a hunt among issuers for remaining white space, leading to several first-of-their-kind launches, including the first U.S. single-stock ETFs and maturity-specific bond funds.

“All that innovation energy, those new ideas — ‘let’s disrupt something’ — it’s not coming from your top three providers,” Murphy, Tidal’s director of research, said on Bloomberg Television. “Now, can they really dent that market share leadership? It’s going to take a million years to get there, but they’re doing a little bit at a time, and I think that’s really exciting.”

The rolling bear market has also pushed investors outside of passive benchmark index-tracking funds. Actively managed products have taken in nearly $81 billion so far this year, led by a record $12 billion haul for the JPMorgan Equity Premium Income ETF (JEPI).

“A more volatile market and the presence of relatively new ETF providers has helped actively managed ETFs gain market share this year,” said Todd Rosenbluth, head of research at ETF data-provider and research consultant VettaFi. “The big three firms have much more limited active management lineups and are driven primarily by their broad market index-based products.”

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound