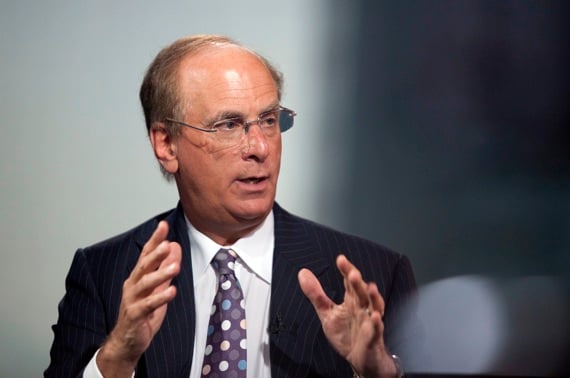

Laurence D. Fink, chief executive officer of BlackRock Inc. (BLK), stepped up his criticism of some exchange-traded funds such as those provided by Societe Generale SA, saying he didn't want them to damage the industry.

So-called synthetic ETFs, offered by firms including Societe Generale's Lyxor Asset Management and Deutsche Bank AG, introduce a layer of complexity and counterparty risk that investors may not be aware of, Fink said yesterday. Synthetic funds generate returns through derivatives contracts rather than owning underlying securities as traditional ETFs do.

“If you buy a Lyxor product, you're an unsecured creditor of SocGen,” Fink, who heads the world's largest asset manager, said at a conference held in New York by Bank of America Corp.'s Merrill Lynch unit. Providers of synthetic ETFs should “tell the investor what they actually are. You're getting a swap. You're counterparty to the issuer.”

BlackRock, whose ETFs are almost all backed by the stocks, bonds or commodities they seek to track, has been campaigning for more disclosure by derivatives-based funds and has urged regulators to ban the use of the term ETF for those funds. The effort has drawn counter-attacks from competitors in Europe, where derivatives-based products capture about 40 percent of ETF assets.

Lyxor Chairman Alain Dubois said in an interview last month that BlackRock's warnings ignored risks associated with securities lending by physical ETFs.

RELATED ITEM ETFs with the biggest net outflows »

Physical ETFs “expose their holders to undisclosed levels of counterparty risk to typically undisclosed counterparties,” Nizam Hamid, deputy head of Lyxor ETFs, said in an e-mailed response to Fink's comments. “The unregulated use of securities lending has resulted in meaningful losses in the past.”

BlackRock's iShares unit is the world's largest ETF provider with $612 billion in assets as of Oct. 31, according to BlackRock data. In Europe, Lyxor is the third-biggest with $40.1 billion, behind Deutsche Bank's $48.5 billion and iShares' $111.1 billion.

Synthetic ETFs have lost popularity among investors in Europe his year, reporting $1.86 billion in withdrawals in October, compared with $3.11 billion deposits for physically backed funds.

The U.K. Financial Services Authority in a June report raised concerns about counterparty risk and the quality and liquidity of synthetic ETFs' collateral. The International Monetary Fund and the Bank for International Settlements have also raised concerns about the funds' risks.

‘Street Brawl'

“The European market has turned into a street brawl for the soul of exchange-traded products,” Dave Nadig, director of research at San Francisco-based ETF research firm Index Universe, said in a telephone interview.

Nadig said that while Fink had a “fair point” to make about synthetic funds, “there's a self-serving component to that because BlackRock's product line happens to match up with the most favorable interpretation of his argument.”

In the U.S., synthetic ETFs are largely limited to funds that use leverage to amplify returns or obtain returns that move in the opposite direction of a chosen index. Some commodity- based ETFs also use futures contracts to generate their return. The Securities and Exchange Commission suspended approvals for new derivative-based ETFs in March 2010.

Fink reiterated his criticism of leveraged and inverse ETFs, saying he was surprised that some were approved by U.S. regulators. He compared leveraged ETFs to the financial engineering that ultimately lead to the collapse of the U.S. mortgage market in the subprime crisis.

RELATED ITEM Top 10 dividend-paying ETFs »

“I do believe we have some responsibility for making sure that the market does not morph itself, the same way when I started in the mortgage market 35 years ago, watching a great market morph into a monster,” Fink said at the conference.

Fink was a pioneer in the mortgage industry while at First Boston, which was later acquired by Credit Suisse Group AG. There, he traded bonds in the 1980s, helped slice and pool mortgage bonds that were then sold to investors as collateralized mortgage obligations. The CDO market has since grown to about $2 trillion.

BlackRock, in an Oct. 5 paper, called for clearer labeling of exchange-traded products to help investors better understand what they are purchasing. The firm proposed to U.S. lawmakers on Oct. 19 that derivative-based products be banned from calling themselves ETFs.

Fink's comments about Lyxor refer to the fact that its funds contract with its Paris-based parent company for the total return swaps that generate their return. If Societe Generale (GLE) were to fail, the funds would generate no return.

“There are obviously a lot of stresses with banks in Europe,” Fink said, adding he wasn't suggesting that SocGen is an example of such a bank.

To protect investors, European rules require that synthetic funds be collateralized to at least 90 percent of the value of net assets. Lyxor typically overcollateralizes its funds.

--Bloomberg News--