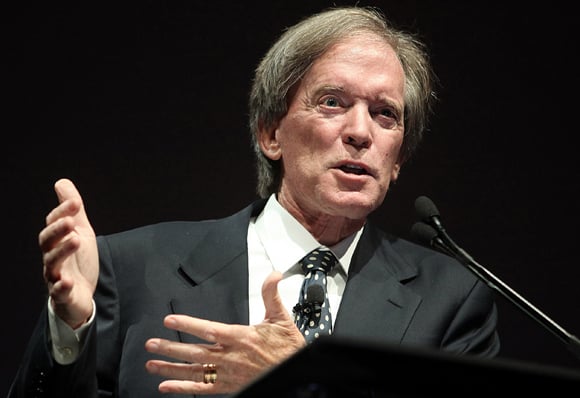

Bill Gross said it still bothers him that high brokerage-firm minimums stopped his mother from buying shares of Pimco Total Return Fund (PTTRX), the mutual fund he runs that became the world's largest in 2009.

Size limitations for small clients have prevented many investors from owning Pacific Investment Management Co.'s flagship fund, Gross said in a telephone interview yesterday from his office in Newport Beach, California. That will change as Gross's Pimco Total Return Exchange-Traded Fund opens today under the ticker symbol TRXT, allowing investors to buy shares for as little as a few hundred dollars.

“Small investors don't always have access to active management with a higher yield and a higher total return,” said Gross, who is co-chief investment officer at Pimco. “We are hoping ‘mom and pop' can do a little bit better than the bond market at a time of historically low yields.”

Gross's new vehicle, designed to blend the trading flexibility and accessibility of ETFs with the stock- or bond-picking ability of active management, tests investor appetite for a niche that has attracted less than 0.5 percent of the $1.13 trillion in U.S.-registered ETF assets. The potential for growth has spurred Pimco, along with at least two dozen other money managers including BlackRock Inc. (BLK) and Legg Mason Inc. (LM), to vie for a slice of the active ETF business, which would compete with the $9.41 trillion mutual fund industry.

“Pimco's entry was the most important development in the industry over the past couple of years,” Loren Fox, senior research analyst at New York-based research firm Strategic Insight, said in a telephone interview. The ETF will attract “price-conscious small investors,” according to Fox.

RELATED ITEM Top muni bond ETFs in 2011 »

ETFs typically hold baskets of securities while trading throughout the day like stocks, instead of being priced once a day like most mutual funds.

Active versions seek to combine the skill of fund managers in selecting securities with the lower fees, market trading and tax advantages of ETFs. Passive products, which track broad market benchmarks such as the Standard & Poor's 500 (SPY) Index, dominate the business.

Total ETF assets have surged more than 10-fold since 2001, according to the Washington-based Investment Company Institute (RICA), making them the fastest-growing product in the money-management industry.

Bear Stearns Cos., the now defunct investment bank that was acquired by JPMorgan Chase & Co. (JPM), was the first firm to open an actively managed ETF in March 2008. The fund was liquidated that year after the firm was sold.

State Street, JPMorgan

Money managers including Janus Capital Group Inc. (JNS), State Street Corp. (STT), T. Rowe Price Group Inc. (TROW) and JPMorgan Chase have since sought permission from the U.S. Securities and Exchange Commission to open their own actively run ETFs. Active ETFs have gathered about $5.1 billion in assets in four years, according to data compiled by the ICI.

One reason active ETFs haven't grown as quickly as index products is that brokers don't have the same financial incentive to sell them as they often do with mutual funds on their own platforms, Matt Hougan, president of ETF Analytics at IndexUniverse.com, said in an interview.

Strategic Insight's Fox said fund companies are still trying to understand the target audience, given that a big portion of investors in the market are institutions and hedge funds who frequently trade in and out of ETFs.

RELATED ITEM

Bogle: ETFs great for trading, not so great for investors »

The Pimco Total Return ETF (TRXT) is opening at a “seminal moment” for the fund industry, said Scott Burns, managing director of ETF Research at Morningstar Inc. (MORN) in Chicago. Investors have been pulling money out of active mutual funds and moving into ETFs, in part because of the lower fees. Last year, a net $118 billion of ETF shares were issued, compared with redemptions of $130 billion from U.S.-registered equity mutual funds and deposits of $125 billion into bond mutual funds, according to the ICI.

“The industry is looking for ways to reverse that trend, and one of the ways is by lowering the fees and lowering the hurdle rate,” Burns said.

Pimco's new ETF may not attract sizable assets immediately because “most advisers will take a wait-and-see approach to see if, in fact, the active-management component of this fund provides alpha and outperforms the benchmark,” said Tom Lydon, editor of ETF Trends in Irvine, California.

Gross was born in 1944 in Middletown, a steel-company town in Ohio. His father, Sewell “Dutch” Gross, worked at Armco as a sales executive; his mother, Shirley, was a homemaker.

Gross, 67, said he is aware of the obstacles ETFs face before they catch on with investors.

‘Challenge Is Obvious'

“We've had two to three years of internal discussions,” Gross said. “The challenge is obvious. We could fall flat on our face or we could roar like a lion in a year or two or three and become the largest ETF.”

Pimco already oversees the industry's biggest active ETF, the $1.4 billion Pimco Enhanced Short Maturity Strategy (MINT), which began in November 2009.

The Pimco Total Return (GAZ) ETF will be similar in strategy to Gross's $250 billion Total Return Fund. Pimco, led by Chief Executive Officer Mohamed El-Erian, in 2009 began a push into ETFs as part of the firm's move to diversify its products.

Unlike the Total Return mutual fund, which uses a combination of options, futures and swap agreements, Gross's ETF can't invest in such derivatives. The SEC said in March 2010 it wouldn't approve new ETFs that make significant use of derivatives, pending a review of the practice that is continuing. Should the SEC lift the freeze, the Total Return ETF would invest in derivatives, Pimco said in its filing last year.

Use of Derivatives

Gross said the inability to invest in futures and swaps is less of a handicap as they've become more expensive to buy and the spreads have shrunk since he started the total return strategy in 1987.

“Our performance has been due to secular positioning in terms of duration and risk spreads rather than the use of derivatives over the past few years,” he said.

The institutional share class of the Total Return mutual fund, which requires a minimum investment of $1 million outside of retirement accounts that make it available, has an expense ratio of 0.46 percent, or $46 a year for each $10,000 invested. The fund's most widely used retail share classes charge fees ranging from 0.75 percent to 0.85 percent. The Total Return ETF will charge fees of 0.55 percent, Pimco said in a July filing with the SEC.

Rebounding Performance

The Total Return Fund has advanced at an annual rate of 8.4 percent in the past five years, beating 98 percent of rivals, according to data compiled by Bloomberg. Last year, the fund trailed 69 percent of rivals after Gross missed a rally in Treasuries. The fund has since rebounded, rising 2.9 percent this year to beat 96 percent of the competition.

Investors should embrace a defensive strategy that includes emphasizing income, de-emphasizing derivative structures that are fully valued and being willing to accept returns lower than historical averages, Gross said in a commentary posted on Pimco's website this week.

Pimco may appeal to investors now because bond management “could get tricky” and returns could decline as interest rates rise from historic lows, IndexUniverse.com's Hougan said. “You're entrusting Gross to navigate what could be a reversal of a 30-year decline in rates,” he said.

One reason equity managers haven't opened more active products is that ETFs reveal their holdings daily because institutional investors need to know a fund's composition to create new blocks of shares. That process also keeps an ETF's share price aligned with the value of its assets. The requirement has discouraged companies from opening stock-picking ETFs because it would allow other investors to copy their trades.

BlackRock's Request

So far, Pimco's actively managed ETFs have focused on highly liquid markets, including Treasuries, where other investors mimicking the trades are less likely to affect prices. Fixed-income investments are also more difficult to copy because transactions don't occur on an open exchange.

BlackRock, the largest provider of ETFs, has a filing pending with the SEC to offer 13 actively managed equity ETFs that don't have to disclose their holdings daily. The firm received initial SEC approval a year ago to offer actively managed ETFs that disclose their holdings each day. Christine Hudacko, a spokeswoman for New York-based BlackRock declined to comment on the filings.

--Bloomberg News