Wall Street watchdogs and issuers of “complex” exchange-traded products are headed for a showdown as regulators weigh tough and far-reaching rules to curb retail investor access.

Market players are up in arms after the Financial Industry Regulatory Authority Inc. called for comments last month on whether strict measures should be introduced to raise the barriers to such products. Depending how Finra chooses to define the term, the crackdown could hit everything from leveraged and inverse vehicles to cryptocurrency-linked funds and defined-outcome strategies.

Enhanced disclosures, a “knowledge check” for retail customers and a requirement to seek Finra approval for the advertising of complex products are among the restrictions up for discussion, as well as controls on push notifications on digital devices and heightened supervision of investment recommendations.

“The restrictions on individual investors that Finra is considering are staggering and unprecedented,” ProShares Advisors, a leading issuer of inverse and leveraged ETFs, said in a statement to Bloomberg News. “For the first time ever, individual investors could be prevented or deterred from buying everything from target-date funds to closed-end funds, to all public funds that use futures contracts or are related to cryptocurrency.”

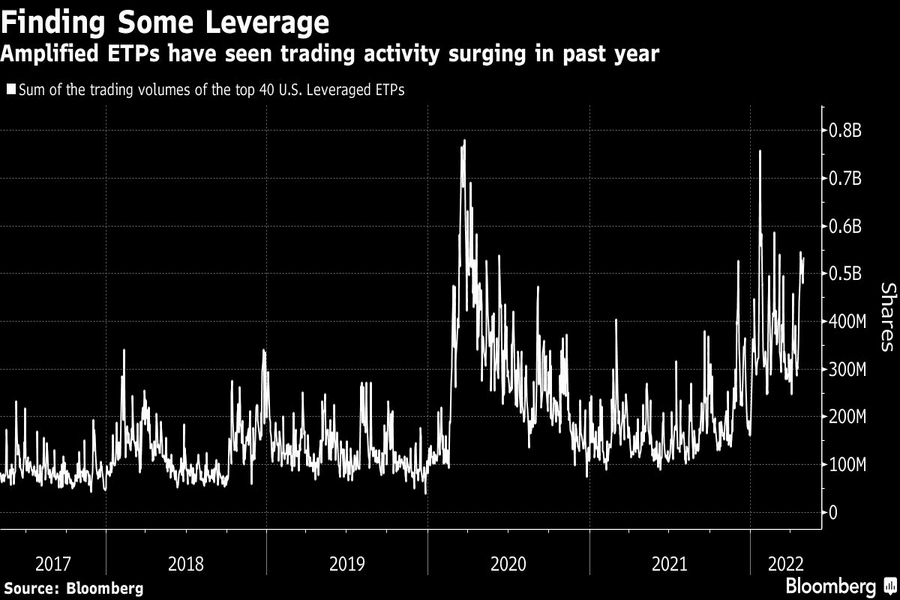

The consultation, which runs to May 9, comes as trading volumes in leveraged and inverse products surge, with retail investors thought to be behind the boom. Finra has already received hundreds of published responses, many of which oppose new measures.

“It will make our job more difficult,” said Bruce Bond, chief executive officer at Innovator, which manages $6.8 billion across a lineup of primarily defined-outcome ETFs. “Whenever you single out a certain group of products, especially when you call them complex, it scares people.”

Current regulations were adopted at a time when most individuals accessed markets through financial professionals. Now Finra is looking at whether the existing market regime adequately protects a new breed of “self-directed” retail investors, trading commission-free via apps like Robinhood.

A spokesperson for the regulator said it welcomed the responses and pointed out that the consultation contained no firm proposals.

“It is a broad solicitation of comments,” the spokesperson said. “We will evaluate the feedback we receive to determine what changes, if any, should be proposed.”

Finra isn’t alone in worrying about complex ETPs or the state of current rules.

The global association for regulators, the International Organization of Securities Commissions, also kicked off a consultation last month on updating the ETF principles and good practices it published in 2013. The proposed changes include encouraging watchdogs to consider the “appropriateness and adequacy” of disclosures made by products using complex strategies.

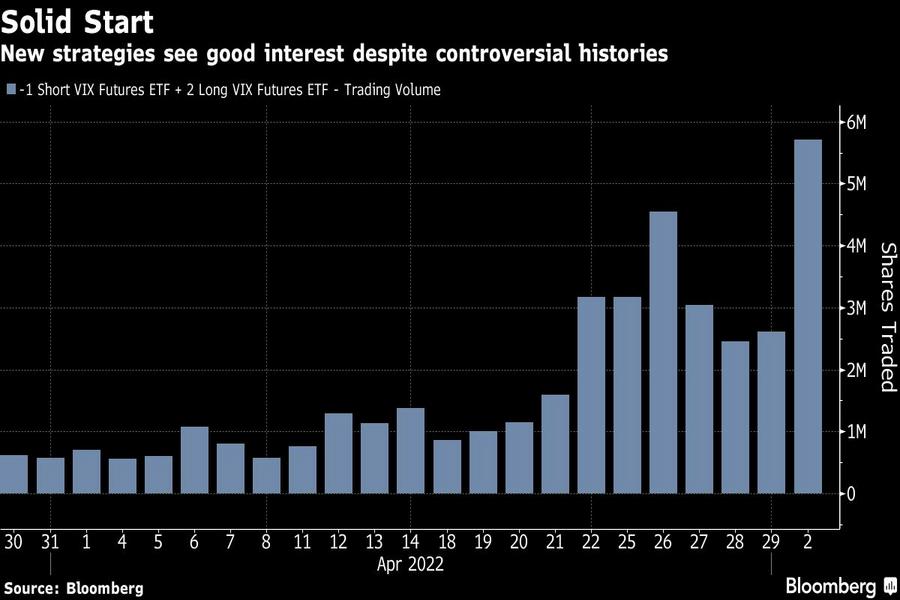

Meanwhile, the Securities and Exchange Commission in October said it is considering tightening the rules around leveraged and inverse ETPs. The regulator made the announcement after approving new ETFs that revived and revamped two infamous volatility-linked products that exited Wall Street in controversy.

The 1x Short VIX Futures ETF (SVIX) and 2x Long VIX Futures ETF (UVIX) have since made successful, if subdued, launches. The pair have attracted a combined $40 million after debuting just over a month ago, while trading volumes are steadily rising.

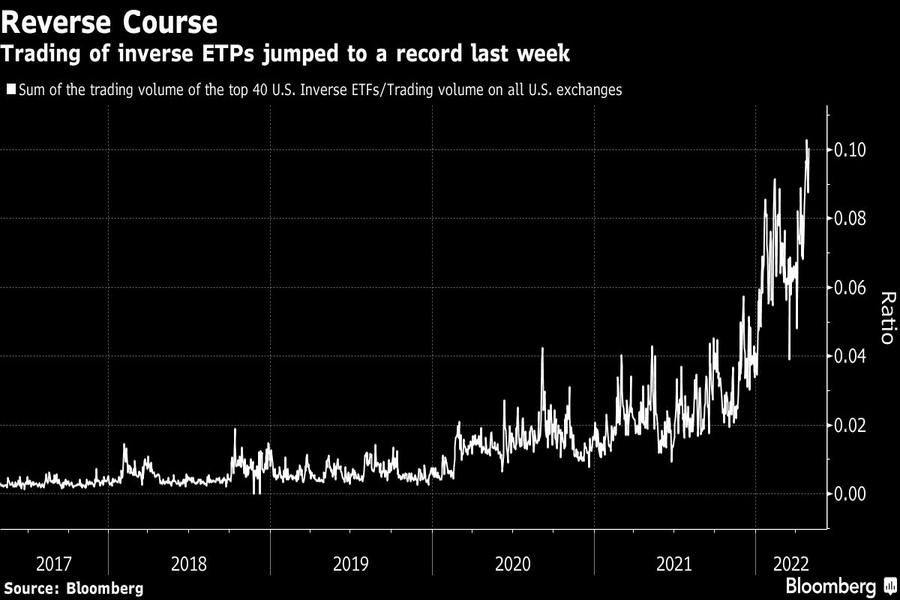

That’s part of a broader pattern where activity in leveraged and inverse U.S. ETPs has hit or approached records amid this year’s market turbulence. Trading volumes for inverse products rose to a new all-time high as recently as last Wednesday, with retail investors thought to be a key driver. Leveraged vehicles had their second-busiest day in January.

But the consultation by Finra — a private, self-regulatory body for brokerages and exchanges — goes beyond such vehicles.

The agency also pointed to the growth in defined-outcome ETFs as a concern. These so-called buffer ETFs shield holders against a certain percentage of declines in exchange for a cap on gains. They boast nearly $10 billion in assets after the first such products launched in 2018, Finra said.

While the scope of what’s considered complex is worrisome, Finra’s notice does raise some valid points, according to VanEck CEO Jan Van Eck. The potential for leveraged and inverse funds to go haywire has kept his firm from launching such products, he said, while the interaction of social media and trading is a trend worth discussing.

However, he warns it’s unlikely that Finra will be able to accurately assess an individual’s knowledge level.

“My main philosophical objection to the Finra proposal is the concept that individual investors are somehow less sophisticated and need protection from themselves,” said Van Eck, whose firm launched a Bitcoin derivatives ETF in November. “I am skeptical that regulations can differentiate between investors’ knowledge level.”

Requiring knowledge checks and other assessments for self-directed investors would be a departure from the U.S. regulatory status quo, which is a disclosure-based system.

“Generally speaking, educated investors are our best customers, regardless of the platforms they use to access our products,” said Dave Mazza, head of product at Direxion, which specializes in leveraged and inverse ETFs. “Rather than limiting investor choice, we believe that investor education, transparency and risk disclosure should be the industry’s primary focus.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound