This month’s edition kicks off with the big news that BlackRock is making a billion-dollar bet on the future of direct indexing, acquiring the No. 2 player, Aperio, just weeks after Morgan Stanley acquired the No. 1 direct indexing provider, Parametric, which given BlackRock’s sheer mass and distribution capabilities, could quickly turn 2021 into the year that direct indexing really hits the map with financial advisers, either for its inherent tax advantages (of being able to tax-loss-harvest the individual stocks in the index, rather than just the index fund itself) or the potential to morph into a form of “customized indexing” in which advisers adapt “index” funds for each client based on anything from factor bets (e.g., overweighting small-cap and value) or ESG preferences (e.g., underweighting tobacco and overweighting renewable energy). Though from BlackRock’s perspective, it’s still not clear whether it really sees direct indexing as the great disruptor of ETFs — or simply wants to hedge against the risk that it might be (in light of its own multitrillion-dollar iShares ETF business).

From there, the latest highlights also feature a number of other interesting adviser technology announcements, including:

Read the analysis about these announcements in this month’s column, and a discussion of more trends in adviser technology, including former LPL CEO Mark Casady’s launch of Lefteris (the first SPAC specifically targeting Adviser FinTech companies for a potential IPO?), Commonwealth’s launch of a new “Connect” platform to facilitate virtual networking for its adviser community, Bill.com’s rollout of a new bill-paying solution allowing wealth management firms to offer concierge bill payments for their own clients, and ForwardLane’s launch of a new “personalization at scale” Next Best Action solution for RIAs (but do advice-centric RIAs with reasonable client/professional ratios actually need such solutions in the first place?).

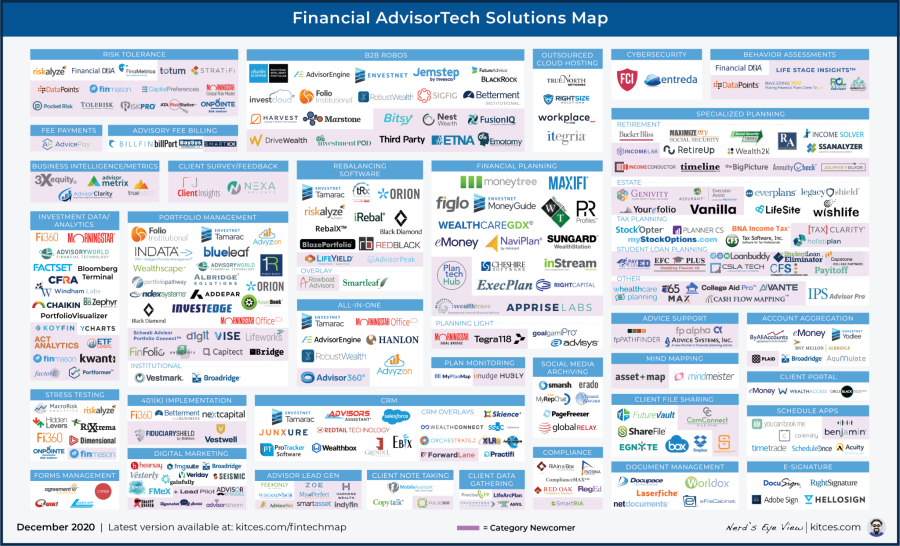

And be certain to read to the end, where we have provided an update to our popular Financial AdviserTech Solutions Map!

I hope you’re continuing to find this column on financial adviser technology to be helpful! Please share your comments at the end and let me know what you think!

#AdviserTech companies who want to submit their tech announcements for consideration in future issues, please submit to TechNews@kitces.com!

BlackRock bets big on customized direct indexing with $1.05 billion acquisition of Aperio. While the concept of “direct indexing” — in which an investor owns not an index fund like the S&P 500, but directly owns all the underlying stocks in the index — has been around for nearly 20 years since it was first pioneered for ultra-HNW investors by firms like Parametric. It wasn’t until robo-adviser Wealthfront launched its direct indexing solution for the masses in late 2014 with a mere $500,000 limit (later reduced to $100,000) that it became clear that technology had the potential to democratize the offering beyond its UHNW roots. However, in practice, Wealthfront had limited success in capturing the marketplace, leading some to proclaim that direct indexing was (still) the next big thing and a looming major disruptor of the ETF and mutual fund marketplace that just hadn’t hit yet, while others suggested that direct indexing was turning out to just be an overhyped niche solution. That all changed last month, when Morgan Stanley announced that it was spending $7 billion to acquire Eaton Vance, with a particular eye on its crown jewel, Parametric, the No. 1 player in direct indexing whose platform had become more than 50% of Eaton Vance’s entire $500 billion asset base (a 50X growth rate from when Eaton Vance acquired Parametric’s $5 billion of AUM in 2003). And now mega asset manager BlackRock has announced that it is acquiring Aperio, the No. 2 player in direct indexing (with just $36 billion in direct indexing AUM), in a $1.05 billion acquisition to position itself as a player in the rapidly growing direct indexing marketplace and further accelerate what had already been a 20% organic asset growth rate for Aperio over the past five years. Similar to Parametric’s own evolution, though, Aperio operated as more than just the tax-loss harvesting optimizer that Wealthfront built, but also as a solution that allowed investors to customize their own index funds through a direct indexing framework (e.g., buy the S&P 500, but without any of the tobacco stocks, and with an overweight to renewable energy stocks). In other words, direct indexing is not merely a more tax-efficient way to buy an index (at least in a taxable account where tax-loss harvesting is feasible), but also a framework for investors (or their advisers) to customize portfolio allocations and do so all the way down to the individual stock layer (and not just using ETFs as the portfolio building block). And while Morgan Stanley is largely expected to leverage Parametric within its own base of 16,000-plus brokers and nearly $2 trillion of AUM, BlackRock distributes its asset management solutions through a wide range of intermediaries … which likely means quickly starting to offer Aperio’s direct indexing solution to various financial services enterprises, along with independent broker-dealers and independent RIAs. From BlackRock’s perspective, though, the appeal is likely not only to grow itself in the emerging trend of direct indexing and expand its current SMA business but also to hedge itself against the risk that direct indexing really does dislodge its own multitrillion-dollar ETF business. From the industry’s perspective, though, BlackRock’s incredible distribution reach means its Aperio acquisition may mark the watershed moment when direct indexing began to actually go mainstream as an adviser solution for their clients. At a minimum, expect to hear a lot more about direct indexing in 2021, as BlackRock gears up Aperio for broader use by advisers!

Can Fidelity (re-)invent a paid RIA custody model through its new FMAX platform? For decades, independent RIAs have been able to access most RIA custodial platforms for “free,” because RIA custodians ultimately generated revenue from the brokerage services that were provided to advisers’ clients as their portfolios were managed. But in recent years, the traditional RIA custodial model has come under increasing pressure, from the emergence of “ZeroCom,” in which trading commissions on stocks, options and ETFs were slashed to zero, to declining interest rates (exacerbated by the Federal Reserve’s rate cuts in the pandemic), which has cut the spread that RIA custodians can generate on client cash. The end result is that margins have become increasingly squeezed, leading some RIA custodians to begin levying minimum fees or outright raising minimum asset requirements (to ensure that each advisory firm is at least minimally profitable for the platform). But in practice, it’s very challenging for RIA custodians to begin charging the mass of independent RIAs a platform fee for what has been provided for “free” for so many decades now, especially when RIA custodians are used to generating basis points of revenue on their assets on the platform, and advisers have been especially reluctant to pay basis points for the technology they use to run their businesses. At the same time, though, adviser technology itself has been going through a business model shift, from being a software solution to a distribution channel for asset management, where the revenue comes not necessarily from advisers as users paying software fees but from asset managers paying revenue-sharing basis points when advisers use the technology to implement their investment solutions. That’s driven the rise of AdviserTech solutions pivoting into becoming “model marketplaces” that get compensated by the asset managers whose funds are used in the models that advisers can select and implement. Now Fidelity appears to be trying to marry these two trends together in creating its own Fidelity Managed Account Xchange — FMAX — which went live this month, and will integrate both its eMoney financial planning software and Envestnet’s managed account engine, but with deeper integration into underlying Fidelity’s custody and clearing services, into a single unified wealth management offering. Some might characterize that as yet another model marketplace player, and others might frame it as a vertically integrated platform TAMP (that ties together the list of SMAs to use and the underlying onboarding, trading, custody and clearing platform to execute). However it’s positioned, though, the end goal is clear: Fidelity aims to charge a single basis point fee for its combination of technology, custody, clearing and advisory solutions, effectively trying to turn “free” custody and per-user technology fees into a (bundled) basis point fee for its (bundled) investment management solution, leaving Fidelity well-positioned to capitalize on the growing trend of financial advisers looking to outsource their investment management and focus on financial planning instead. It still remains to be seen whether advisers will be willing to pay an upfront basis point fee for a (bundled) model marketplace platform, as investment-centric advisers may prefer to “insource” portfolio management to capture the entire advisory fee, and non-investment-centric planning-oriented advisers may not be willing topay for a service that isn’t actually core to their own planning-centric value proposition.

Addepar raises $117 million Series E as its (alternatives) marketplace expands. When it comes to portfolio performance reporting, the traditional RIA marketplace has been dominated by a handful of players, like Orion Advisor Services, Envestnet’s Tamarac, Advent’s Black Diamond and Morningstar Office, that built integrations to all the major RIA custodians to facilitate reporting on a wide range of traditional brokerage assets like stocks, bonds, mutual funds and ETFs. However, when it comes to illiquid and nontraditional “alternative” investments, from private equity to hedge funds, timber and oil and gas partnerships, performance reporting has continued to be a challenge. That opened the door to newcomers like Addepar, which built a performance reporting solution specifically to handle illiquid alternatives and targeted the largest RIAs and family offices serving the ultra-high-net-worth clientele that most commonly purchase such alternative investments. Earlier this year, Addepar announced a $40 million Series D round and said that it was expanding beyond just reporting on those assets, and had developed a Marketplace to facilitate its advisory firms being able to invest directly intonew alternatives, through partnerships with alternatives provider Artivest (now owned by iCapital Network) and pre-IPO liquidity provider EquityZen. Similar to so many other AdviserTech platforms in recent years, the pivot from reporting on alternative investments into the outright distribution of alternatives created the potential for Addepar to generate not only software user fees from those who purchase the software, but asset management distribution fees (e.g., basis points) on assets that flow from its advisers and their clients to its (alternative) asset management partners. Which appears to be working quite well… as this month, Addepar announced a new $117 million Series E round (just eight months after its Series D) to further accelerate its recent growth. Skeptics have raised questions about whether Addepar is still struggling to find a product-market fit, given that it is stillraising substantial capital at this juncture (implying a massive cash burn, despite reporting trillionsof assets under administration on the platform). On the other hand, the implied recent success of Addepar’s Marketplace isn’t entirely surprising, as when the platform boasts a whopping $2 trillionof assets being aggregated and reported on and growth of nearly $10 billion per week — which, admittedly, is simply a reflection of the assets that its advisers’ clients are loading into the platform for reporting or aggregation (not even necessarily billing) purposes — there is sucha large base of assets running through Addepar’s systems that it would only take a few percentage points of aggregated assets converting intoMarketplace assets for Addepar to rapidly generate a very strong ROI. Which just emphasizes that for AdviserTech platforms that already have a strong connection to advisers and their clients, there’s a tremendous economic opportunity if the platform can pivot to being an asset management distribution channel by having anyimpact on steering advisers’ clients into their asset management (or in the case of Addepar’s niche, alternatives) marketplace.

CAIS alternatives investment platform raises $50 million Series B as AdviserTech increasingly drives asset management distribution. While the most obvious impact of the Federal Reserve’s quantitative easing after the global financial crisis was rock-bottom interest rates that drove cash yields close to zero and brought mortgage rates to record lows, the secondary ripple effect has been more nuanced but no less profound. As the reality is low interest rates impact not only the outright yields on cash and bonds but also drag down long-term equity returns (which functionally provide an equity risk premium on top of a now-below-average risk-free rate) as well. Though for most advisers, the greatest pain has been felt with bonds in particular, which have become increasingly challenging for advisers to hold in a world where the yield on bonds may be almost entirely offset by the adviser’s fee to manage the fixed income portion of the portfolio (i.e., it’s hard to charge a 1% AUM fee when intermediate bonds are paying 1% or less!). Either way, though, the end result is that advisers increasingly feel pressure to find alternatives to traditional stock and bond portfolios… which has led in recent years to explosive growth in the use of various “alternative” investments that have at least the potential for more appealing returns, and an accompanying explosion in new platforms that bring alternative investments to independent advisers, from iCapital to CAIS. And now, CAIS has announced a new $50 million Series B round to fund its continued growth in facilitating alternative investments for independent advisers, from private equity and private credit to real estate and hedge funds. What’s unique about CAIS, though — at least relative to alternative investments distribution of the past — is that its capital is not going into a new sales force of external wholesalers to call upon advisers in ever-greater numbers, but reinvestments into its technology platform that advisers can use to research, analyze, vet, select, and implement alternative investment solutions. In other words, while technically and legally CAIS operates as a TAMP for alternatives, in practice it functions more as an AdviserTech solution to facilitate alternatives investing (along with an alternatives education platform for advisers called CAIS IQ) … for which CAIS generates revenue from the alternatives providers that advisers ultimately implement with. That just further emphasizes how investment management distribution continues to shift from traditional wholesaler strategies to AdviserTech platforms as a distribution channel — and CAIS just received a $50 million bet that the trend is only going to continue to accelerate.

Oranj announces abrupt shutdown as its model marketplace fails to gain traction. When robo-advisers first hit the mainstream media in 2012, their self-professed vision was to replace human financial advisers with technology that could easily automate the process of onboarding and investing a client into a diversified asset-allocated portfolio. Yet the reality is that human financial advisers provide far more advice than just allocating and investing a client’s portfolio, and in practice even most human advisers don’t want to spend any more time than is necessary on the manual steps of onboarding and implementing a client’s portfolio. Accordingly, in the years that followed, a wave of robo-advisers-for-advisers and “digital advice” solutions began to emerge, which provided the onboarding and other digital client management capabilities of robo-advisers in a bid to make human advisers more efficient. Among that first crop of robo-for-advisers solutions was Oranj, founded in 2014 by former financial adviser David Lyon who sold his advisory firm to build the technology firm. Notably, Oranj was not only one of the first in the emerging digital automation trend for financial advisers, but an early player in the emergence of the model marketplace, with its decision to acquire the TradeWarrior rebalancing software in 2017 to integrate model trading capabilities and then shortly thereafter making the Oranj platform entirely free (to be paid instead via the revenue-sharing agreements from the asset managers in its model marketplace). Yet despite having been in the race early to capture the emerging trends of the adviser marketplace, this month Oranj announced that it was abruptly closing at the end of December, without even any indication that it was being sold or transitioned to another provider, or recapitalized with an external round of funding, and instead was just shutting its doors altogether. On the one hand, the fact that Oranj wasn’t able to be successful in gaining traction with advisers — even with a price point of free — emphasizes how, in the end, it’s not just the price point of software that dictates adoption (or not), but the switching costs of how difficult it is to go from one piece of adviser software to another… to the point that even Oranj’s “free” price point wasn’t able to sway a material number of advisers to adopt. On the other hand, it’s possible that even if Oranj was able to attract some free users, that just because an adviser will use the software doesn’t mean they’ll actually use its (model) marketplace for their client portfolios… as the irony is that the technology trading and rebalancing automation that makes model marketplaces possible also makes it very easy for advisers to self-manage their own models and eschew the marketplace altogether. And notably, some have simply suggested that Oranj never really found a clear value proposition and positioning for its technology, and lacked a clear direction on the particular segment of advisers it was pursuing in an already crowded marketplace. At a minimum, though, Oranj’s failure emphasizes that model marketplaces are not an “if you build it they will come” scenario — even at a price point of zero — and that in the end, it’s still necessary to have both a clear distribution strategy to gain a market share of advisers and a value proposition strong enough to overcome the perceived switching costs of changing software providers in the first place. In the meantime, though, the real question is where Oranj’s users will wind up going, and whether anyone will put in a bid for at least Oranj’s rebalancing software (formerly known as TradeWarrior), which continues to be a hot category of AdviserTech for adviser platforms that already have a base of advisers and simply need the technology to facilitate a model marketplace (e.g., LPL’s recent acquisition of Blaze Portfolio)?

DriveWealth raises $57 million to expand reach with fintech startups but not “complex” AdviserTech? The brokerage business is one that competes with mind-numbing scale, where the leading retail firms measure their platform assets in the trillions, and between the lack of economies of scale and the burdens of industry regulation, most startups have no chance to survive. In fact, much of the recent wave of fintech innovation over the past decade has been built on the back of a select few providers like Apex Clearing (which powered almost every early-stage robo-adviser), who are building their business by trying to be the platform that has the digital infrastructure and APIs necessary for fintech startups to build on top (increasing their speed to market, and allowing for economies of scale by aggregating together multiple startups onto a single centralized platform provider). More recently, other competitors like DriveWealth have also entered the fray, similarly seeking to be the full-stack API-based brokerage solution that powers other startups that want to reach consumers, facilitating modern investing pathways like rounding up spending to purchase fractional shares of stock, tipping someone in stock instead of cash, or allowing businesses to convert loyalty points into stock shares… to the point that in the second quarter, DriveWealth’s APIs facilitated more account openings than E-Trade, Schwab, and TD Ameritrade combined. Yet even as DriveWealth experiences rapid growth by facilitating a new generation of FinTech startups, last month AdviserTech startup Altruist announced that it was leaving DriveWealth (for Apex Clearing), noting that DriveWealth just didn’t support the breadth of investments and account types that financial advisers typically utilize with clients. And even as DriveWealth this month announced a new $57 million Series C round, the company emphasized that it sees itself as more of a savings and investment platform for those who want to own a select number of stocks or ETFs and more ‘thematic’ portfolios… not necessary as a full-suite brokerage platform or a solution for active traders. Which, on the one hand, continues to emphasize that AdviserTech is really a distinct category of technology, unlike fintech in general, with a unique (and admittedly more broad and complex) set of needs that reflects the reality of what consumers demand today of a comprehensive financial adviser. Yet, on the other hand, DriveWealth’s emphasis that, even with $57 million of new funding and more (retail) account growth than multiple other retail brokerage firms combined, it still doesn’t see the full breadth of AdviserTech needs as being worth developing for, suggests that AdviserTech startups may continue to struggle to find platforms to build with… but also leaves Apex Clearing increasingly well-positioned as the startup-friendly partner for new AdviserTech firms (especially with the fate of TD Ameritrade’s VEO looking increasingly uncertain under Schwab ownership).

Mark Casady’s Lefteris SPAC IPO raises $200 million for a new (adviser?) fintech IPO. One of the biggest structural challenges in investing today is the reality that startup companies are growing longer and larger as private enterprises before “going public” (and making their growth accessible to all as a publicly traded stock), a challenge that has been attributed to everything from the burdens of Sarbanes-Oxley (after the Enron scandal) to the general ‘burdens’ and costs of the initial public offering process. In recent years, an emerging workaround has become the SPAC — short for special purpose acquisition company — which is essentially a shell company that conducts an initial IPO for cash, with a stated plan to deploy that cash towards the acquisition of a particular type of company (thus the “special purpose” acquisition company). The benefit of this approach is that for a privately held company that wants to go public, doing so via a SPAC means simply conducting a reverse merger with the SPAC, effectively turning the privately held company into the publicly traded one, in a much less costly and more rapid transition than the traditional IPO path (but with some guardrails to return investor money if the SPAC deal is not consummated in a timely manner). In recent years, high-profile SPACs have included the ones that turned Virgin Galactic and Draft Kings public, but the SPAC has become so popular that there are now 251 active SPACs that have raised almost $79 billion in capital and are waiting to deploy, including 200 SPACs that raised $69 billion in 2020 alone. And now, the first SPAC for fintechs has arrived, as former LPL CEO Mark Casady, who most recently led the Vestigo Ventures venture capital firm investing in fintechs, has successfully led the IPO for a new SPAC called Lefteris, that raised $200 million for the special purpose of “revamping traditional financial services software, regulatory or compliance software, or those modernizing insurance software”. Ultimately, the point of a SPAC is to find a single company that is looking to become publicly traded, and/or wants access to (public markets) capital and would take a $200 million investment… which means in practice Lefteris will likely be shopping for firms with $50 million to $100 million-plus in revenue (and a market cap of $600 million to $1.3 billion). Which, relative to the companies in the world of Adviser FinTech, will not leave many options, as most AdviserTech companies measure their revenue in the millions or perhaps a few tens of millions. Still, though, with MoneyGuide financial planning software acquired by Envestnet last year for $500 million, and Orion Advisor Services rumored to have been seeking a $2 billion valuation earlier this year, there are certainly a subset of AdviserTech companies that are large enough to be a feasible partner for Lefteris. And while private equity capital is still very accessible as well, the irony is that private equity is so focused on short-term exits over five to seven years, that a long-term-oriented growing fintech might even prefer the publicly traded path (where the Street does focus heavily on quarterly returns, but also rewards the share price of those that successfully execute a long-term strategy). And if the SPAC pathway works, it’s likely that Lefteris will only be the first of more FinTech SPACs to come. For now, though, the question is simple: is there an AdviserTech company that actually wants the benefits (and challenges) of being the first publicly traded AdviserTech?

Commonwealth Financial launches networking platform to “connect” its adviser community. Even independent financial advisers don’t operate entirely independently. Whether it’s an RIA custodian, an independent broker-dealer, or an adviser network, virtually every independent financial adviser still has some kind of affiliation with some provider that offers infrastructure and support services… and a community of other financial advisers with similar needs and challenges (if only because they share a common platform that tends to result in advisers having a similar business model and size and structure). Which means it’s only natural for adviser platforms to facilitate networking amongtheir adviser community, whether to help create connections that could lead to mergers and acquisitions, partnerships and succession plans, or simply shared learning and collaboration on best practices. In the past, the most common nexus point for adviser platform community was the annual “platform” conference, from Schwab IMPACT to LPL Focus, Cambridge Ignite to XYPN LIVE, where advisers could come together for both facilitated and impromptu networking and community connections. But in 2020, the coronavirus pandemic shut down nearly all in-person conferences since the outbreak in March, resulting in a shift to virtual events — to the extent possible — but for many advisers, a growing feeling of isolation as month after month of work-from-home and social distancing have taken its toll. In this context, it’s notable that this month Commonwealth Financial announced the launch of its new “Connect” platform, which facilitates the ability of its 2,000 advisers to connect and (virtually) meet up by being able to search one another by location, niche clientele, interests, and hobbies. Thus, for instance, advisers who specialize in a niche like doctors or entrepreneurs can connect with one another to share best practices in their niche, or simply connect with others who share a common interest (e.g., sports or volunteerism). In the long run, Commonwealth’s Connect may ultimately help foster the kinds of relationships that lead to mergers and acquisitions, partnerships and succession — akin to the community connections that are made at conferences — which helps to improve adviser retention (as it’s harder to be recruited away when your friends and community would be left behind!) and promote growth through shared best practices. And ultimately, the growth of community through adviser platforms may continue to threaten prior waypoints of community for independent advisers like the Financial Planning Association. In the near term, though, Commonwealth deserves kudos for simply trying to solve the dominant problem of 2020: reducing the feeling of isolation so we all feel a little more connected to one another in a tough year of social distancing, through the power of community.

Can Planswell turn free financial planning software for consumers into (premium) adviser lead generation? From its earliest days, comprehensive financial planning has been used as a form of lead generation for financial advisers, in which the comprehensive financial plan was either free or a loss leader (charging a nominal fee) because the planning process inevitably demonstrated gaps in the client’s current financial situation that the adviser’s available suite of products could help solve (and for which the adviser would be paid at implementation). In recent decades, financial planning has undergone a shift, from being a loss leader for products to being the product itself — the client pays for the adviser’s comprehensive financial plan and the subsequent advice recommendations. Yet the fact remains that even as fee-for-service financial planning continues to grow, so too has the assets-under-management model for which financial planning is stillan excellent way to establish a relationship with a (potentially ongoing for decades) AUM client. Consequently, there has been a paradoxical rise in boththe cost of a comprehensive financial plan andthe availability of free financial planning software, amplified this year in particular as Schwab launched a free version of MoneyGuide for its clients, Bank of America launched its own LifePlan free financial planning solution, and financial planning software providers are increasingly offering tools for advisers to offer planning software themselves for free to their prospects, from Orion Advizr’s Market*r to MoneyGuide’s MyBlocks, and more recently, eMoney’s new Incentive app. Of course, the caveat is that free financial planning software still only helps generate a client if the adviser can get a stream of prospects to engage with the software in the first place. That’s where most financial advisers struggle, lacking the depth and scale to execute systematized marketing strategies to bring in a steady flow of prospects to engage with such tools. That’s what makes Planswell so notable — a Canadian financial planning software provider that is looking to enter the U.S. market by running social media and digital marketing campaigns to get consumers to use its (free) financial planning tools, and then turning over interested prospects to financial advisers (who pay an ongoing subscription fee to have access to Planswell leads). In a world where so many financial advisers struggle with differentiation and growth, incur an average client acquisition cost of over $3,100 per client, and have shown a willingness to pay as much as 25% of ongoing revenue indefinitely for a new client (e.g., via RIA custodian referral networks), the reality is that if Planswell can generate any flow of new clients for advisers, there will unquestionably be a market of advisers willing to pay well for such leads. However, the reality is that the US marketplace for clients is so competitive, it’s not clear if Planswell will be able to scalably acquire enough prospective client leads to be able to grow its business, where the bottleneck is not whether offering (free) financial planning software can engage a prospect but the cost to get the “top of funnel” traffic to try out the software in the first place. In other words, like most adviser lead generation tools, Planswell in the end will live or die not by its planning software, but its ability to cost-effectively generate a steady flow of leads into its software in the first place. And Planswell will have to be cautious about whom they resell their leads to, in a world where investment-centric firms may not follow through on the financial planning recommendations its software offers, and planning-centric firms may feel threatened that their value proposition will be undermined if the prospect already got a “free” plan from Planswell. Nonetheless, with adviser lead generation increasingly heating up as a new category of Adviser FinTech, from SmartAsset’s SmartAdvisor to Zoe Financial, Indyfin to AdvisorBid, there is clearly adviser demand for whichever company can figure out how to scale client acquisition cost-effectively. We’ll see if Planswell can crack the code and compete against a growing number of financial services firms like Schwab and Bank of America already giving away financial planning software for free to generate their own leads.

Are services the next big AdviserTech opportunity as eMoney pilots outsourced paraplanner solution? One of the most common practice management themes of recent years has been the need for scale, and the idea that independent advisory firms must merge and acquire one another to obtain the necessary economies of scale to remain competitive. Yet the irony is that, in practice, the solo financial adviser has never been more profitable than in recent years, driven by the incredible efficiencies of AdviserTech solutions for independent advisers, turning what once might have been an advisory firm with two to three full-time support staff into a solo adviser with a handful of $29, $49, and $99/month software solutions. Yet as technology increasingly improves the efficiency of back-office tasks and makes it feasible for advisers to serve even more clients successfully and profitable, the new challenge is the middle-office support on more complex tasks, from investment management to financial planning support. Which helps to explain why at its recent annual Advisor Summit, eMoney Advisor announced that it has spent the past 18 months developing (and the past six months piloting) a new paraplanner support service that will allow eMoney users to outsource much of the financial plan preparation process to eMoney. Dubbed “Collaborative Planning Services,” the new eMoney service is not intended to be client-facing (i.e., plans will be created for the adviser, but it’s still the adviser’s responsibility to communicate and deliver the plan and its recommendations to clients), but is intended to go beyond mere data entry and actually collaborate with the adviser in what might be multiple iterations of the plan creation process. For advisory firms struggling with having the capacity to do financial plans because they’ve grown to a critical mass of ongoing clients to service — but not necessarily with enough size to hire a dedicated paraplanner — the new eMoney pay-for-only-what-you-need paraplanner solution may be very appealing, especially as the pandemic’s forced-work-from-home environment has demonstrated the feasibility of incorporating virtual part-time team members. And even larger advisory firms may find the solution appealing to handle a wide range of temporary issues, from sick or vacationing team members, to those on extended absences (e.g., maternity/paternity leave), or when the firm needs coverage in the face of turnover (i.e., when someone leaves and their replacement hasn’t been hired, onboarded, and trained yet). eMoney also anticipates that the offering may be appealing to some larger adviser platforms (e.g., broker-dealers) that want to support their advisers on financial planning but don’t want to build their own internal financial planning service desks. Notably, there is some irony to the fact that a technology company that ostensibly is supposed to make the financial planning process more efficient with technology is now offering a service solution to help advisers actually use the relatively complex software. But in practice, Kitces Research shows that advisers don’t ultimately get faster and more efficient with financial planning software in the first place; instead, they tend to go deeper and build more sophisticated financial plans for clients, which would suggest a likely need for (experienced paraplanner) support to fully harvest the value of the software for a time-constrained adviser (and also helps to explain the recent rise of solutions like SimplyParaplanner). And from a financial perspective, when human time still prices a lot higher than (scaled) technology, the reality is that eMoney may actually experience more revenue growth from leasing paraplanners to use its software than it does in selling the software itself. That raises the question of whether the next big market for AdviserTech is not fully automating away the adviser’s back and middle offices, but instead providing outsourced servicing solutions to help also cover the human tasks that can’t yet be automated away?

Will paying bills for clients gain momentum as a value-added service as Bill.com launches concierge bill payment platform for advisers? As technology increasingly commoditizes the raw implementation of asset-allocated diversified portfolios, advisory firms that cannot afford the impact of fee-compression have instead been more and more focused on what other value-added services they can layer on to justify the fees they already charge. Of course, the caveat is that doing morefor the same fees that the advisory firm already charges can still be problematic — it may not result in fee compression, but it does result in margin compression as costs rise to deliver those additional services — which means it’s absolutely crucial that any additional services themselves leverage technology effectively. And ideally, any value-added services will be offerings that are not just a one-off, but something that can be done on an ongoing basis and can actually tie the client even more deeply to the firm (i.e., make them sticky). For which the client-stickiest granddaddy of them all is arguably bill paying for clients. As numerous banks have now shown, once consumers get accustomed to having their bills automated, theswitchingcosts of changing to a new provider (and setting up allof those bill payments again) become so high, it’s just no longer worthwhile to leave, such that even banks that have been the subject of repeated consumer scandals have still been able to retain the bulk of their banking customers. Yet when it comes to financial advisers, the challenge is that bill paying for clients is not automated as it might be for banking services, and instead it is still an extremely manual process. In practice, paying bills for clients is usually only a concierge service provided by a select number of multifamily offices working with ultra-high-net-worth clientele. But now the popular Bill.com — which provides bill-paying software for small businesses to make it easy for them to manage their accounts payable and accounts receivable — has announced a new version of its bill-paying services specifically for financial advisers who want to handle bill-paying on behalf of their clients. The new Bill.com Wealth Management solution itself is fairly straightforward, leveraging Bill.com’s existing infrastructure to create advisory firm workflows to review and approve various payables for clients, which can be executed via check, ACH, credit card or even wire transfer (for the bill that just has to be paid today!), with a dashboard to manage all clients from one central location. Of course, even with technology to facilitate the process, client bill-payment services are still time-intensive — in the process to review and approve each invoice for payment, to ensure only the right bills are paid — which means in practice, firms are perhaps more likely to offer concierge bill paying as an add-onservice (rather than just bundling it in as a value-add), at least for those not already serving ultra-high-net-worth clients (where it can more readily be bundled into an aggregate fee). And, of course, the irony is that as automated bill payment services — from bank platforms to Bill.com — become more ubiquitous, it’s likely that more consumers will find it easy enough to manage their own bills and not see as much value in outsourcing in the first place. Nonetheless, the reality is that not all households are the best at managing their own day-to-day and week-to-week bills, and the clients of financial advisers tend to be delegators already. Which means the combination of a delegation client mindset and technology to help automate the process behind the scenes, such as solutions like Bill.com’s Wealth Management offering for concierge client bill-paying, are likely to gain more traction in the coming years.

New Product Watch: ForwardLane aims to bring ‘personalization at scale’ to advisers … but only if they already have too many clients to advise? One of the biggest limitations to the financial success of any advisory practice is the productivity of the individual financial adviser. As in the end, advisers can only handle servicing so many clients (and so much associated revenue) before there are just too many clients, which can result in reduced client communication, weaker client relationships and ultimately lower client retention. To help address this challenge — and increase the adviser’s client capacity — a growing number of AdviserTech tools have emerged to help advisers keep track of the myriad details of a full client base, going beyond just capturing that information (e.g., in a CRM system) and actually using the client data to prompt advisers on the “Next Best Action” to take, from Morgan Stanley’s program by the same name, Merrill Lynch’s Client Engagement Workstation (CEW) and Envestnet’s Opportunities To Engage. The newest entrant in this category is ForwardLane, which similarly seeks to scan information from the adviser’s CRM system (currently Salesforce) and related adviser software (e.g., portfolio performance reporting systems), and provide prompts directly in the client’s CRM record of potential talking points with clients. For instance, if recent meeting notes indicate that the client was considering whether to buy a new home, ForwardLane might prompt to ask the client if they’ve built up enough savings or if there’s a discussion to be had about mortgage financing. If the client’s accounts show recent trades in Netflix or Facebook, then ForwardLane might prompt the adviser with articles that mention those companies that could be shared out with clients. In essence, the goal is to create so many salient touchpoints for each and every client — not just the adviser’s top few — that even C clients feel as heard and connected as A clients. Yet while this concept of personalization at scale seems appealing, the caveat from the adviser’s perspective is that the 80/20 rule — where 80% of profits come from the top 20% of clients — tends to hold true in most firms, which means A clients are A clients for a reason. And software that helps advisers be more proactive with C clients — who are still only paying what C clients pay — can actually result in a firm that is less profitable, as more engagement with those clients inevitable creates more questions, more conversations, more meetings, more work … and not necessarily any more compensation for the additional work for the adviser! By contrast, for brokerage firms that are more transactional — where each new customer interaction creates the potential for a new sale and new revenue — talking points that let the broker probe for new business opportunities really can create a positive ROI for those conversations. But the irony is that for advisory firms that generate ongoing revenue, often the most productive approach is not to try to create more opportunities to engage the clients who pay the least, but to be more proactive in engaging the A clients who pay the most… the ones that advisers are most likely to already know the best and are least likely to need software to augment. (If an adviser didn’t know that an A client who’s buying a new house might need to talk about saving for the down payment or qualifying for a mortgage, they’re probably not going to last long as an adviser!) In other words, for advisers who do have too many clients to keep track of them all — especially when operating on an AUM or other recurring revenue model — the best practice management approach may not be finding software to help connect with more of them more frequently, but in figuring out how to transition more of them away to focus on the firm’s best clients who drive its financial success. Which means that at this point, notwithstanding its professed RIA focus, ForwardLane may ultimately be a better fit for transactionally oriented brokerage firms (or perhaps a subset of asset-gathering-oriented RIAs), and not necessarily advice-centric firms. At least until ForwardLane — or some new upstart competitor — figures out how to make “Next Best Action” solutions not about finding the next sale, but the next moment of actually meaningful advice… for the A clients that the adviser already knows best?

In the meantime, we’ve updated the latest version of our Financial AdviserTech Solutions Map with several new companies, including highlights of the Category Newcomers in each area to highlight new fintech innovation!

So what do you think? Will BlackRock be able to accelerate the growth of direct indexing among advisers? Will advisers pay basis points for Fidelity’s custody services if it’s attached to the new FMAX managed accounts platform? Will Planswell be able to turn free financial plans into adviser lead generation? And what company might Lefteris pursue for a potential AdviserTech IPO? Please share your thoughts in the comments below!

Disclosure: Michael Kitces is a co-founder of XY Planning Network, which was mentioned in this article.

Michael Kitces is the head of planning strategy at Buckingham Strategic Partners, co-founder of the XY Planning Network, AdvicePay, and fpPathfinder, and publisher of the continuing education blog for financial planners, Nerd’s Eye View. You can follow him on Twitter at @MichaelKitces.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

For several years, Leech allegedly favored some clients in trade allocations, at the cost of others, amounting to $600 million, according to the Department of Justice.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound