This month's edition kicks off with the big news that SmartAsset has achieved unicorn status with a $1 billion-plus valuation, driven primarily by its pivot to using its consumer financial media content as a lead generation channel for financial advisers, which has quickly grown to generate $1.5 billion a month in new asset flows for advisers and has become the “key driver of revenue growth” as the platform approaches $100 million of annual revenue. Of course, the caveat is that “cold” leads from third-party media sites don’t necessarily have a high conversion rate, leading to a game of numbers that requires sifting through a large number of nonqualified leads to find the few that are a good fit, necessitating dedicated business development staff to be able to nurture the opportunities. That in turn is making such lead generation services especially popular among the largest independent advisory firms, which are struggling to otherwise scale their organic growth, but do have free cash flow to invest in new leads (and a business development team to convert them).

From there, the latest highlights also feature a number of other interesting adviser technology announcements, including:

Read the analysis about these announcements in this month's column, and a discussion of more trends in adviser technology, including:

Be certain to read to the end, where we have provided an update to our popular Financial AdviserTech Solutions Map as well!

#AdviserTech companies that want their tech announcements considered for future issues should submit to TechNews@kitces.com!

The biggest blocking point to successfully launching and growing an advisory business is getting the clients who will actually pay the adviser fortheir advice. Of course, the reality is that in anybusiness, getting clients or customers is essential for growth. But when it comes to financial advice, in particular, Kitces Research shows that the average client acquisition cost is over $3,100 per client, which in practice is so expensive that most financial advisers can’t even afford to spend dollars on marketing to get clients at that cost (and instead spend their time in various time-intensive marketing endeavors like networking).

However, once an advisory firm reaches a certain level of size and scale, the reality is that there are so many clients to serve that the adviser doesn’t have much timetospend on business development. That means either hiring more advisers to do business development (which is expensive, because if they’re good at it, they could go hang their own shingle as an adviser, which means they have to be paid very well to stay with the firm), or delegating their clients to service advisers and going to get more clients themselves (which isn’t scalable as a sole adviser founder can’t sustain the growth rates of an ever-larger firm with the same fixed amount of time that anyone/everyone has).

The irony is that marketing is actually one of the few parts of the adviser business model that isscalable, at least once advisers are willing to allocate substantive resources toward it (which is feasible once they are large enough to havedollars to reinvest into marketing!). As a result, in recent years the ongoing growth of larger multibillion-dollar advisory firms (that have the free cash flow to invest but lack scalable marketing systems) has stoked a newfound hunger for adviser lead generation services from which they can buy an increasing volume of new clients, including not only the very popular RIA custodian referral programs from Schwab, Fidelity, and TD Ameritrade, but also a number of stand-alone providers including Fee-Only Network, WiserAdvisor, Harness Wealth, Zoe Financial, and SmartAsset’s SmartAdvisor.

And the model is working. In recent months Zoe Financial raised $10 million of Series A funding, Harness Wealth raised $15 million of Series A funding, Tifin Group raised $100 million to acquire consumer financial media sites for lead generation and now SmartAsset has announced a massive $110 million Series D round (and earned itself a greater than $1 billion market valuation in the process). As notably one of the biggest challenges for any new entrant to the world of adviser lead generation is that while advisers themselves may pay well for client leads — with the going rate as much as 15% to 25% of revenue as an ongoing share ofrevenue for the lifetime of the client — it’s still incredibly difficult (and capital intensive) to getleads to sell to advisers in the first place.

In this regard, SmartAsset is unique, in that the platform had already built out a large range of financial tools, calculators and other widgets for consumer media sites over the past decade, to the point that it is already seen by 100 million consumers every month, providing it with a natural connection point to generate consumer leads for financial advisers. And even with this flow of consumer leads, SmartAsset reports “only” about 1 million matches that it has made over the past several years, which amounts to “just” a few hundred thousand consumers (who are each “matched” to multiple advisers) across what may be more than a billionSmartAsset pageviews. In turn, even SmartAsset’s matches still close at a relatively low rate, with what is reported to be a 5% conversion rate on leads that were emailed to advisers, and more recently increased to 20% via SmartAsset’s “Live Connections” solution that vets prospects directly by SmartAdvisor via telephone before they are transferred as a “live connection” phone call directly to the financial adviser to talk to on the spot. Nonetheless, with a conversion rate of 5% to 20% on prospects that themselves may be converting at well below 0.1% of all of SmartAsset’s traffic, when it starts with 100 million(!) monthly pageviews of SmartAsset’s tools, the end result is a reported $5 billion-plus of adviser referrals in 2019, over $10 billion in 2020, and a pace of $1.5 billion a month in 2021, driving SmartAsset up to $100 million in revenue, of which the company reports that “SmartAdvisor has been the key driver behind revenue growth.”

At the individual adviser level, where leads cost $90 to $190 each (depending on assets), have a 5% to 20% conversion rate and may be sent to multiple advisers (such that any particular adviser may only benefit from a portion ofthose converted prospects), the end result is still a total cost that can add up to several thousand dollars per client. Which means that, in the end, SmartAdvisor may not necessarily be driving lead generation at a significantly lower cost than what it takes for advisers to generate leads themselves.

The difference, though, is that for larger (e.g., $1 billion-plus) advisory firms in particular — which have the dedicated business development teams to be available to answer a Live Connections call immediately (though IndyFin is now providing a similar service for small-to-midsize advisory firms that need business development support), and have the available cash flow to deploy and are just looking to ways toscalably deploy it to drive growth — SmartAdvisor provides a pre-built marketing channel for firms that want to invest in marketing to be ableto scalably invest into marketing. In the long run, the only question is whether SmartAdvisor itself will be able to sustain and grow the volume of leads to meet the adviser demand.

While the rise of the robo-adviser didn’t disrupt human advisers, their robo-onboarding experiences did throw into stark relief just how far behind traditional financial services platforms had lagged in their digital transformation. Which in turn stoked a massive wave of reinvestment into the digital transformation of major broker-dealers and RIA custodians through the rest of the 2010s, a transformation that has only been accelerated further by the Covid-19 pandemic, as advisers proved that they could successfully work with their staff and clients remotely. But many still lacked the digital tools in place to accomplish their operations efforts as effectively as they’d have liked, which is why in most recent surveys, digital client onboarding has been one of the top priorities for firms going into 2021 and 2022.

Starting in July, Schwab announced that it will be making a new digital client onboarding tool available to its advisers (an improvement over its existing digital account opening tool, which has lagged other RIA custodians in capabilities). The new Schwab tool allows account funding, via ACATs or ACH, to be accomplished within a single envelope, and most account types can be opened in minutes. In addition, Schwab’s new onboarding workflows will have a collaborative feature where advisers can send incomplete envelopes to clients and fill out the remaining information together, which also appears to open Schwab to integrations with outside e-signature tools (e.g., the adviser’s own DocuSign envelopes).

Yet while Schwab’s progress on digital onboarding is a positive, what is also notable about Schwab’s announcement is what it lacks: a discussion of expanded support via APIs. While the new Schwab tools may be great for those that operate solely on the Schwab platform, if advisory firms that want to open an account in Schwab from their favorite third-party tech partner (e.g., a CRM system), all they get is an SSO login right back to Schwab’s account opening tool at the moment. Which is especially important for larger advisory firms that tend to be multicustodial and won’t necessarily want to rely solely on Schwab’s Schwab-only digital onboarding process.

While the majority of advisory firms do simply adopt a single custodian for the administrative simplicity of doing so, larger RIAs that have the operations depth to be able to effectively support multiple RIA custodians have increasingly chosen to do so and not put all of their eggs in one basket in case that partner gets acquired by a competitor (*cough* TD Ameritrade *cough*). And given the volume of M&A among larger RIAs, most also prefer to have at least a toehold on all major RIA custodial platforms, simply because it is typically smoother when acquiring another firm to just leave the assets where they are and manage them there, rather than re-paper the entire client base.

Custodians have been fighting this trend for years with the idea that if they just offer better tech and service, firms will have “no choice” but to put all of their business with that custodian. It is the same style of walled garden approach that Microsoft tried for decades — that really frustrated its customers.

Historically, RIA custodians were the core “operating system” for wealth management firms, which meant they often couldcompel advisers to live entirely on their platforms. But as advisory firms shift to more holistic wealth management models (rather than being purely investment management firms), the center of the advisory firm’s operations is shifting from the RIA custodial platform to the firm’s own CRM system, precisely because modern CRM systems can connect to outside providers via API to function as that central dashboard. At least for firms that provide their capabilities via API.

In fact, TD Ameritrade’s success in the independent RIA marketplace was heavily attributed to its open-architecture API-driven approach via VEO. Which means that as Schwab folds TD Ameritrade in and increasingly appears to be taking a less open and more walled garden approach, the door is opening once again for a new RIA custodian to make headway by being willing to meet RIAs where they increasingly are — which is in their CRM systems as the central operating system of the advisory firm.

Schwab’s acquisition of TD Ameritrade continues to have ripple effects throughout the industry, with multiple current and prospective competitors viewing the potential unhappiness of RIAs at TD Ameritrade being merged into Schwab as an opportunity to gain market share. And this month, the rumors proved true in spades, as both Goldman Sachs and LPL, long said to be eyeing the opportunity to launch stand-alone RIA custody platforms, both announced that they have officially thrown their hats into the ring with new stand-alone offerings.

In the case of Goldman Sachs, the firm has been building out a suite of APIs for institutional trading and a host of other functions for years. Then last year, Goldman acquired Folio Institutional, a fully digital RIA custodian that lived under the radar as a second tier player (behind the Big Four of Schwab, Fidelity, TD Ameritrade and Pershing) for a long time. Now the combination of Goldman’s investments in Marcus, plus its institutional API efforts, combined with the acquisition of Folio and its suite of APIs, have allowed the firm to quietly put together a very intriguing RIA custody offering from a technical perspective. (Not to mention having an inside track on what large RIAs really want as a result of Goldman’s own acquisition of United Capital.) That apparently was enough to land a head-turning launch partner, with $10 billion Steward Partners announced this month as the first Goldman-custodying RIA.

In the meantime, LPL — which has been in the RIA custody business as a solution for its hybrid RIAs since 2008 and the aftermath of the FPA vs SEC lawsuit that ended the broker-dealer exemption for fee-based accounts — also announced its new offering for fee-only RIAs. From its perspective as the country’s largest independent broker-dealer by adviser head count, LPL launching a fee-only RIA platform was a surprise to many. But as the broker-dealer business itself turns increasingly fee-based, the reality is that LPL already has extensive experience supporting independent solo advisers with $20 million to $50 million (the typical experienced LPL adviser) operating on the AUM model. At the least, the offering allows LPL to retain now-entirely-fee-based brokers who would otherwise terminate their Finra licenses and transition to the RIA channel. But with many “smaller” TD Ameritrade advisers also voicing concerns about going to Schwab, there is clearly a new (for LPL) business opportunity as well.

In practice, Goldman and LPL (and the other recent RIA custody “upstart,” Altruist) won’t necessarily compete heavily with each other. Goldman is most likely to focus on breakaway brokers from wirehouses (where the Goldman brand has significant curb appeal, and its ultra-HNW capabilities come to bear), while LPL will be more oriented toward advisers transitioning from broker-dealer to RIA (who may even want to park wind-down commission trail business with LPL’s broker-dealer as they transition to LPL’s RIA), and Altruist has thus far been primarily focused on the more tech-savvy next-generation startup adviser.

Still, from the AdviserTech perspective, while the central adviser dashboard is increasingly shifting from the RIA custodian to the adviser’s CRM system, the RIA custodians still heavily drive and control the AdviserTech ecosystem. That means new entrants create new opportunities for enterprise deals for AdviserTech firms, and from the adviser’s perspective, a healthy new level of competition to drive AdviserTech innovation as RIA custodians increasingly look to technology as their own differentiator in a commoditized marketplace for pure custody services.

All the way back in 2016(!), Pershing’s Mark Tibergien announced that Pershing would take a page from the TD Ameritrade VEO playbook by shifting the firm to adopt a more open-architecture API approach for its RIA custodial platform. But in the years since, Pershing’s actual rollout of API capabilities has been a slow stutter-step process. At this month’s Pershing INSITE annual conference, though, the firm announced the next stage of its open API initiative, with the rollout of a new NetXServices hub for developers to build more, faster and deeper integrations to Pershing.

The timing of the announcement is significant, as it ties both to the accelerated digital adoption push of RIAs over the past year (in the midst of the pandemic and its forced transition to virtual), and the ongoing integration of TD Ameritrade into what increasingly appears to be a less-open, more walled-garden approach at Schwab… effectively trying to position Pershing as the new open-architecture API platform to VEO for AdviserTech firms that are looking for an integration pathway to new RIAs.

Pershing’s ongoing shift to a more open platform is likely also being pushed by the growth of Apex (and the buzz about Altruist), leading Pershing to take additional steps in opening everything up to become a true API platform for third-party AdviserTech firms to build on. (And trying to undo Pershing’s historically hard-to-shake reputation that the firm was not very “tech-first” in its approach, lying in the shadow of the conservative BNY Mellon.)

Still, while Pershing has been slower to get as deep into technology, its accelerated catch-up efforts are now notable, including the fact that it even seems to be fully embracing that multicustody isn’t going away, and instead is aiming to offer a solution that will support multicustodial RIAs. That’s especially significant given that most of Pershing’s clients are very large broker-dealers, a space that is far less fragmented than serving RIAs, and where it’s far less common to be multicustodial (or multiclearing). In other words, Pershing appears to be trying to accommodate the multicustodial approach specificallyas a new strategy to connect with larger RIAs, in line with Pershing Advisor Solutions’ focus for the past decade on the midsize-to-large RIA.

Ultimately, for the most independent-minded among the RIA community, Pershing’s message shift to being the firm that is most open and friendly to RIA tech partners is likely to resonate, as it certainly did in fueling TD Ameritrade’s growth over the past 15 years. Though in the end, many firms over the years have claimed to be supportive of open architecture, only to revert to a more closed approach after they gained initial traction (and a newfound hunger to capture 100% wallet share of firms that were only giving them a portion of assets). Only time will tell whether Pershing’s NetXServices developer hub is really as friendly as it seems, and whether the tech partners will be able to build on top of Pershing as easily as it claims.

In the mid-2010s, as it became clear that not only were robo-advisers failing to take market share from financial advisers, but that financial advisers actually wanted“robo” onboarding tools for their own operational efficiencies, a slew of asset managers began to acquire robo-adviser-for-advisers platforms as a pathway to reach new advisers, especially independent RIAs who are notoriously resistant to traditional wholesalers.

The basic idea was either that RIAs would use the technology and thus become more familiar with and upbeat about the asset manager’s brand and investment offerings. Or alternatively, that the asset manager would take a page from the BlackRock-FutureAdvisor acquisition and outright include some of its asset management solutions in the platform’s model marketplace. Or at a minimum, the asset manager would effectively outsource its own technology R&D to AdviserTech startups, similar to the way that large pharma companies allow small drug companies to research and develop new drugs and, once they prove their model and get FDA approval, acquire them to scale up the distribution.

Included in this robo acquisition spree was Principal buying RobustWealth in 2018, which was viewed as a two-prong approach of giving Principal a technology offering to distribute to RIAs to burnish its brand (and where Principal funds could be leveraged in a RobustWealth model marketplace), and also leveraging the robo offering more directly with Principal’s own $673 billion AUM “retail” businesses (as the top provider of defined-benefit retirement plans, top record keeper for ESOPs, top provider of NQDC plans and No. 3 provider of group benefits, in addition to its massive 401(k) business).

But now Principal appears to be admitting failure and shutting down RobustWealth, at least as an RIA offering. Sadly, that isn’t entirely surprising, as in practice other asset managers that acquired robo-advisers have similarly struggled to capitalize on the acquisition (with WisdomTree taking an outright loss on AdvisorEngine). In the end, once again robo-advisers are not an “if you build it, they will come” model — not for consumers, nor for RIAs (that ultimately expect their RIA custodians to provide better digital onboarding tools, rather than looking to third-party solutions anyway).

In addition, it’s not hard to imagine that, as with so many acquisitions in which incumbents buying startups, it may have been much harder for RobustWealth to continue the rapid iteration it needed to compete once it was operating in a larger, more bureaucratic environment. Not to mention the other harsh reality, that really great engineers would often rather work at a small nimble firm like RobustWealth, instead of a large firm like Principal. That means at best, acquisitions and cash can be a tool for Principal to acquire and lock up talent for a few years to accelerate R&D efforts. But after that time window, the firm has to be able to stand on its own with whatever has been built.

In that vein, it’s actually highly unlikely that Principal is just throwing RobustWealth in the trash can and moving on to the next project. Instead, it’s likely that Principal has simply absorbed the RobustWealth tech and talent that they want into its core platforms — akin to how Northwestern Mutual ultimately capitalized on its LearnVest acquisition — where robo-tools are still valuable to reduce the friction of a wide range of Principal onboarding activities (or even for “offboarding” those retiring and withdrawing assets from Principal’s retirement offerings, which via RobustWealth’s tools could more easily be rolled over into another retail solution that Principal can retain?).

Time will tell whether the RobustWealth technology reappears somewhere else in the Principal ecosystem — perhaps as infrastructure for its own insurance agents. Either way, the wind-down of RobustWealth is yet another reminder that robo tools were, and are, a fine operational efficiency tool, but it takes more than operational efficiency alone to attract consumers (or advisers) to switch platforms.

When robo-advisers first arrived on the scene nearly 10 years ago, there was a veritable explosion of providers, as a select few early pioneers — most notably, Betterment, Wealthfront and FutureAdvisor — obtained eye-popping valuations as venture capital investors declared that they thought robo-advising would be the Next Big Thing, and invested accordingly (fueled by the “fundraising acceleration” thesis, which says if an emerging category appears, the new-category leader tends to dominate, which means it’s especially important to have the most funding and be the best capitalized to outcompete the rest and win the crown). And in fact, while robo-advisers themselves didn’t really quite turn out to be the Next Big Thing, it was the case that FutureAdvisor ultimately exited for a tidy $150 million sum, Wealthfront continues to fight on, and Betterment remains the leader with more than $30 billion in AUM, affirming that even if (and especially if) all the players in a new category don’t survive, the early leaders that have enough funding to win early market share and be able to pivot do ultimately tend to emerge as the victors that earn virtually all of the spoils (as nearly all other robo-advisers have been sold for a pittance or simply shut down altogether).

While robo-advisers was the Next Big Thing theme of the 2010s, though, it is increasingly becoming clear that direct indexing has become the Next Big Thing of the 2020s, experiencing the same cycle of acquisitions and hyperfunding that dominated the robo-adviser landscape a decade ago, from Eaton Vance acquiring Parametric, BlackRock buying Aperio, Ethic Investing raising $29 million (at 65X revenue!?), and Vise raising $65 million of capital at a $1 billion valuation (on barely $1 million of revenue!?) as both investors and incumbents make their direct indexing bets and put the pressure on other major firms to establish their direct indexing strategy.

Accordingly, it is not surprising that in June, JPMorgan revealed its own direct indexing play by acquiring OpenInvest, which had taken a particularly ESG-centric “values-based” approach to direct indexing (where clients can have their portfolios adapted with overweights, underweights and screens, based on their own values and preferences). Notably, though, JPMorgan is telling the advisers holding about $100 million of assets at OpenInvest that they’ll have to find a new home in the next few months, as JPMorgan sees more opportunity to distribute the OpenInvest technology internally across its $4 trillion of assets under advisement within the JPMorgan ecosystem rather than to trying to sell it externally to other advisory firms.

More generally, though, the JPM acquisition of OpenInvest highlights an emerging split between direct indexing strategies, with one group increasingly focusing on the tax benefits (i.e., the ability to do stock-level tax-loss harvesting of the portfolio to pick up incremental tax alpha along the way, as was done by players like Parametric and Aperio and newcomers like Canvas), and those leveraging direct indexing as a way to do ESG and other values-based “custom indexing” strategies (e.g., Ethic Investing, Vise and OpenInvest), along with a few (e.g., JustInvest) that are highlighting both. That makes sense, as ultimately the target markets are substantively different, with tax-loss-harvesting-centric direct indexing especially appealing to more affluent clients who face top capital gains tax brackets (whereas the mass affluent are often eligible for 0% capital gains tax rates, which makes loss harvesting a moot point or even harmful!), while ESG and values-based investing is increasingly popular with next-generation clients (who are by definition younger, and thus on average tend to be less affluent and less able to benefit from direct indexing’s tax alpha).

Accordingly, expect to see different incumbents adopt different direct indexing strategies based on their clientele (e.g., Morgan Stanley pursuing Parametric for a tax-centric direct indexing offering for their tax-sensitive ultra-HNW clients, but JPM pursuing OpenInvest for a more ESG-centric custom indexing offering for their mass affluent banking clientele).

Either way, though, with the hyperfunding of direct indexing now getting underway, it appears increasingly that the 2020s will be the decade of direct indexing… though as with robo-advisers, the question still remains which players will be the survivors and winners, and whether the industry will really adopt direct indexing as currently constituted, or if the concept itself morphs in the years to come (just as robo-advisers themselves in most cases evolved to be operational solutions more than actual asset management providers).

When it comes to portfolio management and performance reporting for independent RIAs, the marketplace is dominated by just four players: Orion, Black Diamond, Tamarac, and (for former-IBD-reps-turned-RIAs) Morningstar Office, each of which have for years hovered around 10% to 15% market share. There’s a massive smattering of nearly 50other portfolio management competitors (and undoubtedly a large number of homegrown Excel spreadsheets) that have all struggled to gain any substantive market share against the big four.

Running in parallel to the growth of the big four, though, has been Addepar, which launched more than a decade ago primarily as a portfolio performance reporting solution for family offices. Despite the crowded marketplace, Addepar has been able to thrive by solving for the unique challenges with performance reporting for ultra-HNW clients, given their often private-market, illiquid and complex investment vehicles (from privately held stock to options to hedge funds and venture capital and private equity funds with unique capital call and distribution provisions).

Yet over the past year, Addepar appears to be gaining traction even faster. As a result, just seven months after raising $117 million in Series E funding, Addepar announced in June that it had raised another $150 million to propel its business forward, boasting over $2.7 trillionin assets passing through its platform.

At this point, it’s not entirely clear where Addepar intends to deploy its newfound capital, though. On the one hand, in such a favorable fundraising environment, if Addepar was able to raise a large amount of capital with minimal dilution, it may simply be planning to start outspending Orion, Black Diamond and Tamarac to gain market share among the more down market (below Addepar’s family office) RIAs. Though notably, because the typical RIA more commonly trades investments directly through its RIA custodian — which means they don’t have a high demand for Addepar’s unique capabilities in reporting on illiquid nontraded private investments — it’s not clear what Addepar will do to gain market share. The most likely pathway would be to build out more portfolio management capabilities (on top of its deep performance reporting layer) to better appeal to the RIAs serving the mass affluent and “merely HNW” (e.g., $1 million to $10 million) clientele.

On the other hand, Addepar’s last round was also tied to the launch of its Marketplace alternatives platform, and it’s possible that Addepar — similar to CAIS and iCapital — is seeing rapid growth in the adoption of alts (and generating distribution fees via its marketplace), and is simply raising new capital to expand its alts Marketplace, and/or expand its market share because its Marketplace is monetizing so well. After all, while we’ve seen a lot of efficiency gained in trading normal equities and fixed-income products via trading and rebalancing tools, alternative investments and private placement offerings are still stuck in a paper-laden past with little innovation because it’s extremely fragmented and hard. It’s an area where Addepar has already proven itself well.

More generally, Addepar’s unique success in figuring out how to better normalize and standardize data movement across the industry — especially for alternative investments — opens a number of related doors in the future. As the rise of platforms from Coinbase to Rally Road continues to signal a tidal wave of new alternative products over the next decade, ranging from securitizing collectibles to securitizing SaaS revenue, Addepar is best positioned to do the performance reporting (and portfolio management?) of these offerings as they pop up.

Still, with Addepar’s total funding coming in at $475 million and a current valuation at $2.17 billion — compared to Envestnet’s current market cap of just about $4 billion — it appears that Addepar’s next likely stop will be an IPO. Which would be especially notable in demonstrating that there really are unicorns and IPO-capable growth opportunities in the world of AdviserTech… potentially helping to fuel the next round of venture capital investments into AdviserTech innovation.

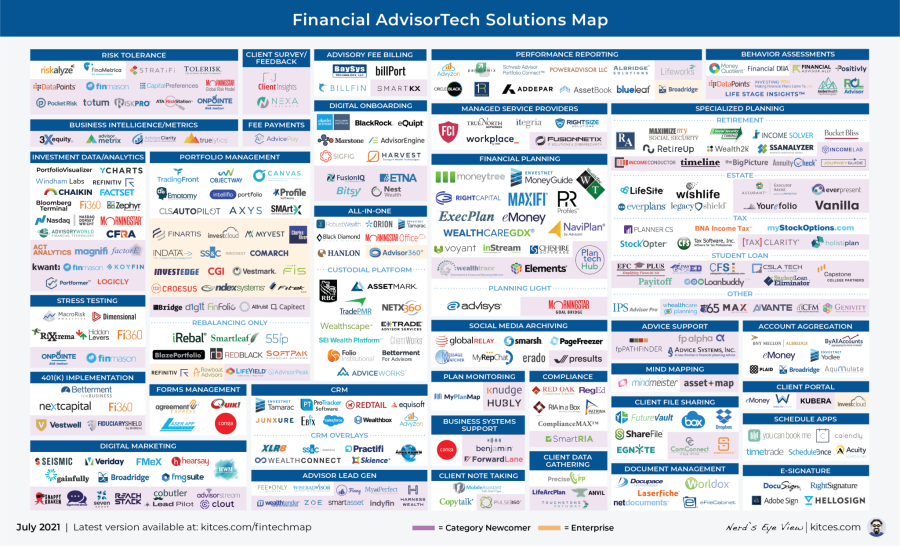

One of the great virtues of the internet is that “anything can integrate with anything” by opening up APIs that connect one software platform to another and allow the data to flow. In practice, though, making an API-based integration actually work means someone has to determine the actual use case, and make sure that each side passes the right data and can generate the right action based on that data, which requires the two software providers to work together in a focused manner to achieve that outcome. But with a massive proliferation of adviser technology tools — with the Kitces AdviserTech Map now tracking more than 300(!) solutions — the sheer number of point-to-point integrations from one platform to another amounts to (300 x 299) / 2 = 44,850, which is an impossible number of integrations to manage.

The end result is that certain tech companies have formed alliances and especially deep integrations with one another to form various adviser hubs, and other providers then begin to integrate into that ecosystem, in what ultimately has become a form of balkanization of the AdviserTech ecosystem. Historically, such adviser ecosystems have evolved from the adviser platforms themselves — e.g., broker-dealers and especially RIA custodians — because advisers who rely on a particular broker-dealer or RIA custodian mustuse the technology that integrates with that platform (or it literally can’t be used, or at least not in an efficient integrated manner). However, the rise of adviser networks — from Hightower and Dynasty Financial to XY Planning Network — has created a new player that can set a new ecosystem of AdviserTech tools, where advisers all build common tech stacks around whatever the adviser network provides.

Accordingly, it was notable that in June, Betterment announced the launch of a new RIA Tech Suite, where advisers will get 15% discounts by using Wealthbox CRM and RightCapital’s financial planning software, along with RIA in a Box for compliance, and Betterment’s own Advisor TAMP solution. That effectively replicates XYPN’s own tech suite, which has included Wealthbox since 2014, RightCapital (which actually launched its platform fromthe XYPN LIVE conference in 2015), and XYPN’s own partnership with Betterment since 2015, but substituting RIA in a Box for XYPN’s own Compliance solution.

Ultimately, the significance of this isn’t about competition between XYPN and Betterment for offering similar tech suites. Ultimately, XYPN focuses on fee-for-service advisory firms that aren’t trying to build AUM-centric firms, while Betterment isa TAMP for advisory firms looking to charge on assets under management, and XYPN includes its tech tools for a monthly membership fee, while Betterment is providing discounts on the tech that advisers must still purchase separately. Instead, what’s notable is simply that Wealthbox and RightCapital are themselves becoming an AdviserTech hub of tools that are increasingly paired together, akin to how firms using Redtail CRM disproportionately use Orion over Black Diamond, but Salesforce firms are relatively more likely to use Tamarac over Black Diamond or Orion, and that the two are paired together in the absence ofa portfolio management solution (in a world where up until now, portfolio management platforms were the defining characteristic of AdviserTech ecosystems).

Which highlights more broadly how the AdviserTech ecosystem, and the overall landscape of adviser platforms, is shifting as the advisory business itself increasingly transitions from products and portfolio management to the business of advice itself, to the point that now, instead of CRM systems and financial planning software pairing with an investment platform to get access to the platform’s advisers, it’s an asset manager or TAMP that’s pairing with CRM and financial planning providers to get access to their users instead?!

Twenty years ago, estate planning was a staple of the comprehensive financial plan, driven by the fact that the federal estate tax exemption was just $600,000 for most of the 1990s, which meant that any substantive accumulation of assets (or even just a family with children and a reasonable amount of basic life insurance) had “an estate tax problem,” which in turn queued up planning strategies from the use of irrevocable life insurance trusts (ILITs) to second-to-die permanent life insurance (with the lucrative commissions that accompanied such large life insurance sales for estate planning purposes).

However, as the federal estate tax exemption climbed from $675,000 in 2001 to $11.7 million in 2021, the number of Americans potentially subject to federal estate taxes has collapsed by more than 95%, and estate planning has shifted from estate taxplanning to the actual planning of the estateitself — which assets will to whom, when and under what conditions. Which in practice is much more difficult to get clients to engage with — as there’s nothing like “you’ll pay hundreds of thousands or even millions of dollars in estate taxes if you don’t engage in this planning!” to get clients to engage! And it can also be even more time consuming, as such estate planning entails a detailed review of clients’ existingestate planning documents to understand what actually will happen to the client’s estate as currently written.

In this context, it is notable that in June, FP Alpha announced the launch of a new Estate Planning Lab, which will scan clients’ existing wills and trusts, and map out on behalf of the adviser an estate planning schematic of how assets will flow to the client’s heirs, akin to Holistiplan’s popular solution that automates the reading of a client’s tax return, turning an especially time-consuming step of the estate review process into instant technology automation. In addition, similar to Holistiplan’s tax return scanner, the FP Alpha estate document scan will then identify potential planning ideas and opportunities that emanate from the plan, from noting clients who may have state estate tax issues (given their state of residence or the situs of their trust) to the potential need to use trusts for young (minor) beneficiaries. And in an environment of tax uncertainty — given various legislative proposals to change the estate tax system — FP Alpha will also show how a client’s current estate plan may be impacted by the Biden proposals or Sanders’ “For The 99.5% Act.”

However, FP Alpha isn’t necessarily intended to replace advisers and their estate planning advice; instead, it expedites the process of analyzing a client’s documents and quickly identifying the planning issues to delve into further and discuss with clients, which can make estate planning more appealing toprovide as a service to clients when it becomes less time-intensive to deliver.

Ultimately, though, FP Alpha’s biggest challenge will simply be to prove to advisers that it really canread often-complex and opaque estate planning documents to develop its schematic of how assets will flow, which is no small feat for financial advisers themselves (not to mention teaching a piece of software to do it on advisers’ behalf!).

Kitces Research shows that the average financial adviser spends 26% of their time meeting with clients and prospects every week, which amounts to about eight to 12 meetings every week, at one to two hours per meeting. Yet the reality is that what makes a meeting “good” isn’t just a function of the meeting itself, but how prepared everyone is for the meeting, and how diligent they are in following up on the necessary takeaways from the meeting. As a result, the average adviser alsospends 24% of their time every week handling pre-meeting prep and post-meeting client servicing tasks. nearly doubling the average time it really takes to engage with each client or prospect.

And despite the sheer time-intensiveness of meeting prep and follow-up — which consumes more of the average adviser’s time than their investment work, their administrative duties and their management time combined — there are actually remarkably few tools that help advisers be more efficient with respect to meetings themselves. Seeking to fill this void is Pulse360, which positions itself as a client communications tool that pulls together what in practice is usually a combination of emails, Word docs, PDFs, client vault files and CRM notes into a single central hub.

Now Pulse360 has announced the launch of its own Meeting Intelligence Dashboard, which wraps together all the key aspects of client meeting prep and follow-up in a single place, including the meeting agenda (and which clients have received the agenda or not), post-meeting summary notes (to ensure that meeting notes are captured for compliance purposes), client to-dos (that the adviser has given the client to implement, which makes it easier to check-in for the next meeting to see what was done), and items to discuss at the next meeting (to ensure that nothing falls through the cracks before the next meeting).

Of course, the reality is that much of this information is already captured in an adviser’s CRM, typically in the form of attached emails and client notes. But it’s often jumbled in with everything elsethat is being done for and on behalf of the client and captured in the CRM, and not configured in a manner that allows for easy reference and recall (as instead, it’s often necessary to scroll back through prior emails since the last meeting just to get caught up for the next). And because the financial services business is highly regulated — necessitating thorough record keeping after meetings — and in general service businesses need detailed notes to ensure that top-tier service is provided — no software will ever likely eliminate the need to take time for meeting prep and follow-up altogether.

Nonetheless, when the average adviser spends 10-plus hours every week on meeting prep and follow-up, it takes remarkably little in efficiency improvements to generate a significant time savings for the financial adviser. Which Pulse360's new Meeting Intelligence Dashboard is well positioned for, as its integrations to popular adviser CRM systems means that advisers won’t need to worry about double-duty note-taking but instead can simply use Pulse360’s client communication dashboard to have a more efficient path to keep up with it all and ensure that nothing slips through the cracks.

While social media exploded as a major (or for many, primary) pathway to get news and find information, when it comes to financial advisers the ROI of social media as a digital marketing channel has been questionable at best. In fact, a recent Kitces Research study found that considering the investment of the adviser’s time (not just the hard-dollar cost), pure social media marketing had the worst(most expensive) client acquisition cost of any adviser marketing strategy. Which isn’t to say that social media shouldn’t have a partof an adviser’s marketing strategy… but that in the end, consumers aren’t going to give a financial adviser their life savings based on one amazing Facebook post or 280-character tweet. Establishing a relationship with a prospect requires connecting with them on an ongoing basis, a domain where old-fashioned email continues to dominate.

Accordingly, over the past year, there has been a growing focus on adviser tools that can either help capture prospect email addresses, or drip market content to the adviser’s mailing list, from FMG Suite acquiring Twenty Over Ten and its Lead Pilot email marketing system, to Snappy Kraken’s recent $6 million Series A round. Now Broadridge is adding to the mix with the acquisition of AdvisorStream, which similarly administers advisers’ email marketing lists and assists them by populating the emails with licensed content from consumer media outlets (e.g., New York Times, Forbes, Barron’s, Bloomberg and the WSJ) that clients can click on and see without hitting a paywall.

With the Broadridge acquisition, AdvisorStream gains instant access to an incredibly deep base of existing Broadridge customers, especially in the independent broker-dealer channel, where Broadridge already has deep penetration with some of the best infrastructure and plumbing in the financial services space.

If it commits to integrating the AdvisorStream offering into its platform, Broadridge could build some great workflows for advisers at the large enterprises that its serves, from supporting email prospecting lists for growth as well as ongoing email content for advisers’ existing clients. For instance, an advisory firm could use AdvisorStream to curate relevant content and distribute it with its commentary on the value, it could flow into a digital information-gathering tool with context of the content that a prospective client was engaging with and what made them want to have a conversation with the adviser, then that data and context could inform financial planning systems and help open accounts via the Broadridge infrastructure.

Alternatively, AdvisorStream could also be used in a completely different manner to serve the asset managers that partner with Broadridge for proxy votes and similar infrastructure. Asset managers could use AdvisorStream infrastructure to help inform shareholders on the companies they are invested in, and to help shareholders buy other equities or funds as well.

At the same time, though, while Broadridge is a tremendous firm for what it does, it has acquired a handful of piecemeal solutions around adviser content and marketing that don’t appear to have gained much market share, ostensibly struggling with the clash that happens when a startup is integrated into a large established company and the associated bureaucracy that inevitably accompanies it.

Which means ultimately, the fate and success of AdvisorStream, from its opportunity to be expanded into independent broker-dealers via Broadridge (or for Broadridge to expand into the red-hot RIA space via AdvisorStream’s existing clientele), will largely be a function of how effectively Broadridge can execute the post-acquisition integration to truly harness AdvisorStream’s value?

Notwithstanding its growing popularity, one of the biggest constraints of the assets under management model is that “AUM” only works when there’s A to M, which means both that the client has to be willing to delegate the assets to be managed, and also simply that the assets have to be ableto be managed. That’s straightforward for those with traditional investment accounts or rollover IRAs — and very problematic when it comes to dollars held in employer retirement plans (e.g., a 401(k) plan), as traditional broker-dealer and RIA custodial platforms typically don’t have access to assets held by 401(k) record keepers (except for a handful of special programs that open 401(k) plans to brokerage accounts, like Schwab’s PCRA).

The end result is that historically, most financial advisers would either manage the client’s available investment accounts and hope to capture the additional 401(k) dollars over time as the client eventually retired and rolled the assets over, or simply wouldn’t be able to work with the prospect until they retired and had their rollover opportunity (which is why financial advisers have historically been so focused onworking with pre-retirees making the transition into retirement — because that’s when the 401(k) dollars are in motion!).

More recently, though, advisory firms have begun to shift from an assets under management model to assets under advisement instead, where advisers provide advice on all of a client’s assets — including those held away in a 401(k) plan — and charge clients for the advice they’re received across the entire household balance sheet. However, in practice, advisory firms often bill a lower fee on held-away AUA than they do on the AUM they manage directly, given that almost by definition, held-away assets can’t actually be managed, but only advised upon with instructions for the client to implement (which makes it hard to charge the same fee when the client still has to actually dothe trading/implementation themselves). In turn, some advisory firms have tried to trade clients’ 401(k) plans on their behalf by actually obtaining their login credentials to their employer retirement plans… except having direct access to client accounts, which often includes the ability to closethe account and disburse a check, can trigger RIA custodyrules.

But now FeeX is aiming to solve that problem by developing a solution that allows advisers to manage and tradeheld-away accounts, and has announced the integration of the new offering with Orion’s portfolio management tools. At its core, FeeX facilitates trading of 401(k) plans (and 403(b) plans) by having clients give their login credentials directly to FeeX. Advisers can log into FeeX and set up trades via the FeeX interface, which FeeX then implements (ensuring the adviser never has direct access to credentials they shouldn’t have). In turn, the Orion integration will enable advisers to utilize the FeeX order management system from directly within Orion, allowing firms that want to trade both their managed accounts and held-away accounts all within the Orion system, while also facilitating integrated billing on all “managed” accounts (direct and held-away) via Orion’s billing system. That will also likely reduce future scrutiny for advisory firms that may be focused on 401(k) rollovers, as if advisers already charge the same fee on the client’s 401(k) plan as their other managed accounts, they don’t face a fiduciary conflict for recommending a rollover that might otherwise result in a higher fee for the client.

The caveat is that FeeX charges 25 bps for its own held-away assets order management system, which means advisers will face a nontrivial additional cost to facilitate held-away trading (and may still find it more profitable to roll client assets out of 401(k) plans and into directly managed accounts), though for advisory firms that are charging significantly less to just advise upon held-away assets, or aren’t managing outside accounts at all, the incremental opportunity to expand the relationship is significant enough that the FeeX fee on “something” is more appealing to the advisory firm than simply not managing (and billing on) the account at all. And having an integrated management and billingsystem via Orion may be especially appealing, as 401(k) plans also generally are not configured to sweep an adviser’s fee from the plan, while billing centrally via Orion makes it more feasible to administratively manage the task of billing the client’s taxable managed account for the advisory fee for their managed-but-not-billable 401(k) plan.

Ultimately, though, the key point is simply that as advisory firms feel more pressure to advise clients more holistically, and want to provide more service to justify the fees that they’re charging, there is significant pressure to expand existing client relationships by capturing and managing (and billing upon) held-away accounts — which FeeX, with its new Orion integration, is well positioned to facilitate!

In the meantime, we’ve updated the latest version of our Financial AdviserTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will direct indexing really be the Next Big Thing, and will it gain more traction as a tax-alpha solution or for its value-based investing custom-indexing capabilities? Will RIA custodians finally fulfill the promise of robo onboarding that robo-advisers initiated a decade ago? Will advisers manage more held-away 401(k) plans now that FeeX makes it possible to do so?

Disclosure: Michael Kitces is the co-founder of XYPN, and Kyle Van Pelt is the executive vice president of sales at Skience, both of which were mentioned in this article.

Michael Kitces is the head of planning strategy at Buckingham Strategic Partners, co-founder of the XY Planning Network, AdvicePay and fpPathfinder, and publisher of the continuing education blog for financial planners, Nerd’sEye View. You can follow him on Twitter at @MichaelKitces.

You can connect with Kyle Van Pelt via LinkedIn or follow him on Twitter at @KyleVanPelt.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

For several years, Leech allegedly favored some clients in trade allocations, at the cost of others, amounting to $600 million, according to the Department of Justice.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound