This month's edition kicks off with the big news that Zoe Financial has raised a $10 million Series A round to accelerate its lead generation service for advisers, as the pandemic hastens the consumer shift away from finding a local adviser in their area to instead going online and finding the best adviser to solve their particular financial challenges. With an average client acquisition cost of more than $3,100 for the typical adviser to get a single client, and a lifetime client value for a mass affluent client that is still 10 times that cost or more, there is a significant market opportunity in driving new leads to advisers. In fact, the only real question is how many consumers are actually in the market for an adviser at any particular time, and whether there’s enough room for Zoe (and other adviser lead generation startups entering the same at the same time) to grow and scale.

From there, the latest highlights also feature a number of other interesting adviser technology announcements, including:

Read the analysis about these announcements in this month's column, and a discussion of more trends in adviser technology, including:

Be certain to read to the end, where we have provided an update to our popular Financial AdviserTech Solutions Map as well!

#AdviserTech companies who want their tech announcements considered for future issues should submit to TechNews@kitces.com!

According to Kitces Research, the average financial adviser spends more than $3,100 (in some combination of hard-dollar marketing spend and the cost of their time) to get a single client. Relative to the lifetime value of a client – which in a recurring revenue subscription or assets-under-management model can amount to tens of thousands of dollars – the reality is that a client acquisition cost of $3,100 can still be a remarkably good deal. Yet, in practice, most advisory firms are capital constrained – they don’t have much cash available to spend on marketing – and consequently end out primarily spending their time instead, which is finite, limited and unable to scale as the advisory firm grows. And of course, some advisers just aren’t naturally inclined toward prospecting to find new clients in the first place.

As a result, there has been growing interest in recent years for advisory firms to find ways to proactively spend dollars on marketing to generate more new clients, for which the economics are remarkably compelling for lead generation firms. After all, RIA custodians have long since set a benchmark that a 15% to 25% revenue share on recurring advisory fees is reasonable and has shown that at least some advisory firms will pay it, which can amount to a lifetime value of thousands of dollars for a single referred client relationship! Given these economics, it is not surprising that adviser lead generation has become one of the hottest categories of AdviserTech in recent years.

The latest news is Zoe Financial announcing a new $10 million Series A round to fuel its own adviser lead generation service. Launched more recently than some others in the category, like SmartAsset and WiserAdvisor, the lead generation service from Zoe Financial is unique in that the firm only charges a success fee for clients who actually close (rather than the pay-per-lead approach of the others), but in turn requires a revenue-sharing payment from clients that do close (for the lifetime of the client in the case of AUM fees, or for five years when the advisory firm charges retainer fees). In turn, the success-fee approach also strongly aligns Zoe with the firms that it serves to ensure both that the leads themselves are “quality” (qualified by assets and likely to close), and that it works with “quality” firms (that have a strong offering and will close the qualified client, which also helps to ensure that Zoe gets paid!). Accordingly, Zoe will only permit fiduciary RIAs to participate (no advisers from broker-dealers) and has skewed toward larger advisory firms that tend to have more systematized service and sales processes (with the average RIA in Zoe’s network managing $1 billion of AUM).

Thus far, Zoe reports having referred $12 billion of assets across “tens of thousands” of households (which at 30,000 referrals would suggest the typical prospect is a respectable mass affluent household with $400,000 of investible assets), though it remains unknown what percentage of leads are actually closing (albeit clearly it's enough to attract the interest of SoftBank!).

Also notable in the deal is the role of SoftBank itself, which has previously invested in a number of major disruptors, including DoorDash, Kabbage, OpenDoor, SoFi,and WeWork, and more recently allocated a massive $100 billion Vision Fund to fuel innovation around the world, with a particular focus on supporting founders from underrepresented populations (which Zoe founder Andres Garcia-Amaya specifically noted as an important factor in choosing SoftBank). Although the focus on supporting founders from underrepresented groups also raises questions of whether Zoe will similarly hold spots in its adviser network for newer advisory firms founded by advisers from underrepresented populations (of which there are very, very few among the $1 billion-plus RIAs that Zoe is currently attracting).

Ultimately, though, the real question will simply be whether Zoe can truly scale the reach of its lead generation, in a world where SoftBank ostensibly sees a big market opportunity in adviser lead generation (and the chance to earn a revenue-sharing referral-fee slice of an estimated $85 billion of AUM fees), and where after the pandemic more and more consumers are willing to work with an adviser virtually (leading them to search online for an adviser, instead of just via a local referral), but there are only so many consumers who are actually actively looking for a new financial adviser at any particular time.

One of the biggest challenges in marketing is simply figuring out how to get in front of prospective customers or clients who might be interested in buying your product or service. As a result, the major focus in advertising technology over the past decade has been figuring out how to leverage the data of the internet to get the right ad messages in front of the rightpeople (leading to explosive growth for platforms like Facebook and Google that have the most data to leverage to get in front of the right prospects).

When it comes to the financial services industry, the matter is further complicated by the fact that the majority of affluent consumers already have a financial adviser, and the typical financial adviser has a 95% retention rate, which means it’s especially difficult to find a prospective client who doesn’t already have a financial adviser. Accordingly, it is perhaps not surprising that one of the most popular paid lead generation channels in recent years has been referrals from RIA custodians like Schwab, Fidelity and TD Ameritrade, who get compensated for steering their retail customers to become the clients of advisers on their platform, effectively turning a self-directed investor (who was previously using their online self-directed brokerage services) into an advised client.

In this context, it is notable that Tifin Group announced in May the acquisition of the Adam Mesh Trading Group (AMTG), publisher of dozens of financial education and investing newsletters (that reportedly had more than 11,000 paying subscribers and over 1,000,000 registered users) with the express intent of trying to identify some subset of AMTG’s self-directed investor readers who may be ready to start working with an adviser, and get paid for referring them to an advisory firm. Alongside the acquisition of AMTG, the Tifin Group announced that it was aiming to deploy as much as $100 million of capital (following on the heels of its $22 million Series B round in April) to acquire more financial media sites targeting self-directed investors to find those who might be ready and willing to begin working with an adviser.

Of course, the reality is that even those owning a financial media property that may have some self-directed investors ready to make a change still have to figure out howto engage them. Tifin Group indicated that it plans to leverage some of the fintech tools already under its umbrella – from Totum Risk for risk assessments to Magnifi for investment comparisons and Positivly for behavioral finance – which may be embedded via API into the targeted financial media sites as a way to attract prospects (similar to the way SmartAsset leverages its Captivate tool to embed some of its calculators and other data visualizations into media sites to drive engagement and lead generation).

Ultimately, the question will be whether Tifin Group can actually convince self-directed investors engaged with various niche financial media sites to work with an adviser, given that those who read and especially purchase newsletters from self-directed investor services (like AMTG) are likely the most hard-core of the self-directed and the least likely to ever engage an adviser. Nonetheless, given the incredible economics of adviser referrals, where the lifetime value of a single mass affluent client can be worth thousands of dollars to the referrer, the reality is that Tifin Group needs to convert only a remarkably small percentage of readers from its media acquisitions to drive a phenomenal ROI. Time will tell.

In 2019, Altruist first launched what it suggested could become the next Charles Schwab for advisers (i.e., the next major RIA custodian), and in the process built one of the most amazing waitlists of any AdviserTech company.

In the beginning, Altruist was aiming to compete with the big behemoths by providing a better custodial technology experience and to be the first zero-commission fractional-share RIA custodian. But just weeks after its formal launch, much of this unique value proposition was cut off at the knees by Schwab’s ZeroCom announcement, even as shortly thereafter, Schwab announced the acquisition of TD Ameritrade (and the likely wind-down of its popular open-architecture VEO hub for advisers) and opened an opportunity back up for Altruist.

CEO Jason Wenk has run a large RIA and a large TAMP using the best-of-breed software in our space, and he learned what we have all learned — integrations to today’s custodians just don’t cut it. This is why they are losing their place as the central dashboard and operating system for most firms. However, custody is a crucial and required piece of the stack for advisers.

I’ve seen it in our space, and I believe.

Still, though, an interesting thing has happened in the past 12 months. Not only has Altruist raised a lot of money, but it has shifted its messaging away from being a custodian to being an all-in-one platform for RIAs instead, as nearly two years of discussions with its adviser base appears to be leading to the conclusion that custody isn’t actually as big of a pain point as the lack of a modern platform to match modern custody.

Altruist has built a bunch of really great custody-related features that sit on the infrastructure of Apex Clearing. Apex has been a sleeping giant alongside the adviser space for a while, having powered most of the early stage robo-advisers with a superior custody and clearing technology infrastructure, but one that required advisory firms to build their own technology layer on top, such that Apex didn’t have a platform to offer to RIAs out of the box and had to rely on other robo-for-adviser partners instead.

Yet even after Vanare/NestEgg/AdvisorEngine, RobustWealth, Trizic, InvestCloud and FolioDynamix all announced Apex integrations in recent years that never seemed to gain traction, Altruist seems to have found a pathway to RIA adoption by leading with its low-cost ($1/account) portfolio performance reporting tools (chipping away at a particular high-cost pain point for RIAs). Still, though, while Altruist offers a very elegant RIA experience on top of Apex for portfolio management, and allows advisers to pull their legacy accounts at legacy custodians into their elegant modern platform to use going forward, there is no other custodial option on Altruist. The experience is built on Apex, and that’s it.

Which ultimately raises the question of whether/how Altruist will be able to sustain its momentum. Older, more established firms will likely be multicustodial at best, and may not necessarily be willing to move and consolidate to Altruist/Apex (though clearly, Altruist hopes it can entice them to do so, and Apex would be happy to see that outcome!). On the other hand, Altruist can, and already has, pursued younger next-generation advisers who expect a modern platform, and either may just be starting and not have a custodial relationship yet, or who may be feeling left in the lurch after the TD Ameritrade acquisition and ongoing concerns that Schwab is most focused on (and providing the most service to) to its largest RIAs.

At best, it appears that Altruist’s race to scale will be a function of continuing to build features that move it upmarket to at least midsize RIAs, and of whether Altruist can build what RIAs want to see not just to use Altruist’s technology but to actually move their existing assets from other RIA custodians to Apex Clearing. Which is where Altruist’s latest $50 million capital round comes into play. This is not about the next one to two years, but rather the next 10 to 12.

How is advice going to change over the next decade? What is the TikTok generation going to expect when it comes to adviser technology platforms? No one has a crystal ball, but Altruist has targeted the advisers of those generations, who will serve those generations. For which even Vanguard (as a participant in Altruist’s latest funding round) wants a seat at the table to future-proof its own business!

One of the most startling pieces of news in AdviserTech in May occurred when the relative newcomer TAMP, Vise, announced a new $65 million Series C round of capital, on a whopping $1 billion valuation, with a mere $250 million of AUM and barely over $1 million of revenue (at its 0.50% fee schedule), which is on par with what successful solo lifestyle advisers can generate!

To be clear, though, the firms putting money into Vise are quite sharp. Its initial round was led by Sequoia, one of the most successful venture capital firms ever, period. Ribbit Capital, who led this most recent round of funding, has been the most prolific and successful fintech investor in the game as of late. They know what they’re doing, and they look at the world with very long time horizons – long enough for “things to change from the way they are today.”

Direct-to-consumer fintech has been beyond red-hot, but it only contains a fraction of the amount of assets held by financial advisers globally. Venture capital firms appear to be realizing that while direct-to-consumer has the head count, financial advisers drive the assets (and therefore the real economic opportunities). Consequently, a shift is occurring, where VC firms are starting to back the companies that are aiming to deliver disruption to (or at least, through) the adviser space.

There are three opportunities at play regarding Vise in particular. First, direct indexing is perceived to be the next big thing, and recent acquisitions (e.g., Morgan Stanley acquiring Parametric via Eaton Vance, and BlackRock acquiring Aperio) have validated it. The natural extension of goals- and values-based investing is to customize portfolios down to the stock level to be as personal as the individuals investing in them, and technology makes this easy now. Second, there is arguably no digital-first TAMP in the industry, and it’s long overdue. Vise doesn’t bill itself this way, but it’s what it is. Third, even though Vise itself may not look substantively different from other TAMP competitors, this can still play out in a similar manner to the ultimate dominance of Dropbox. That was a commoditized product where Dropbox won big because it had the best engineers and the best investors, and it received the support of Y-combinator. Its product wasn’t different from Google Drive or Box or any of the thousand other file-sharing companies, but it was the coolest (and it had the capital to get the word out accordingly).

At this stage, Vise is the type of company that will either be wildly successful or will flame out in a big way, so in all actuality, valuations don’t matter. If it is someday a $10 billion-plus company that dominates direct indexing the way Dropbox did file-sharing, the valuation will end up looking very cheap. The market for SaaS and software is proving to be bigger than anyone ever imagined it would be. Who in their lifetime would have thought that we would see a company with a $1 trillion market cap, let alone several? In a few years, a $5 billion or $10 billion valuation for a company won’t seem as crazy as it does today.

If ETFs become a thing of the past and everything goes to direct indexing, buying individual stocks, meme stocks, and cryptocurrency personalized to each investor, isn’t it feasible that Vise could become as large as BlackRock or Vanguard? Not in a year or two, but in 20? Who knows? It is more than possible. Which is enough of a case for firms like Sequoia and Ribbit to place a bet and want to be part of the action, and give Vise enough capital that, if direct indexing is the next big thing, it will be able to pay for the talent it takes to figure it out.

At some point in their career, virtually every financial adviser experiences the pain of trying to migrate from one technology solution to another, from the limitations on moving data to the pain of retraining and reintegrating into the advisory firm’s workflows. Yet in the end, independent advisory firms are still relatively small and lean and far more capable of making technology changes than large-scale enterprises, where the switching costs can quickly add up to hundreds of thousands or even millions of dollars.

The end result of this phenomenon is that legacy software often becomes deeplyentrenched in large-scale enterprises, to the point that even newcomers with more features and benefits at lower costs cannot unseat legacy enterprise deals with the existing incumbents. For which at least one final strategy is: If you can’t beat ’em, buy ’em.

That’s the strategy InvestCloud appears to be pursuing with yet another major acquisition of a legacy AdviserTech player. Having acquired Tegra118 earlier this year, in May it announced the acquisition of Advicent and its substantial base of NaviPlan enterprise users as well. Advicent and its NaviPlan financial planning software have been losing market share for some time, but that narrative has been more overblown than most realize; they still boast an impressive roster of enterprise clients -- quite similar to Fiserv/Tegra118, in fact.

Still, though, InvestCloud’s acquisition strategy appears to be about far more than just acquiring legacy incumbents and their market share (and ostensibly deploying capital into those players to help further modernize their offerings). InvestCloud also rebranded its Tegra118 purchase to become InvestCloud Financial Supermarket, where Tegra118’s enterprise chassis can be used not just to track and account for various financial assets, but to outright facilitate their distribution.

In other words, InvestCloud is taking a page from the current Envestnet playbook (and its various managed-account, insurance/annuities, credit and services Exchanges), shifting its business model from one of traditional SaaS software sales into a more classic platform model where the company can actually facilitate the distribution of financial services products itself -- and earn a small cut of every transaction. In fact, InvestCloud’s marketing for Financial Supermarket expressly positions it as an Amazon-like cloud-based marketplace for financial products (for which InvestCloud, like Amazon, can earn a platform cut of every purchase).

That’s where NaviPlan comes in. Because ultimately, every supermarket still needs a storefront through which its goods can be sold, whether it’s a physical storefront or a digital one. And when financial advisers are the ones who drive the volume of financial services product purchases (whether as commission-based brokers or fiduciary advisers who still have to make recommendations to clients), the pathway to financial adviser recommendations for implementation is through their financial planning software.

Again, the strategy is not unique. Envestnet acquired MoneyGuide in large part to turn it into the digital storefront for its own financial supermarket of exchanges, embedding the ability for advisers to purchase insurance and annuities for their clients directly into the financial planning software. Now InvestCloud will have the same opportunity with NaviPlan (along with an existing base of enterprise customers into which its Supermarket storefront can be deployed), as financial planning software increasingly continues to become the driver of not just the adviser-client relationship, but a vertical integration of the adviser, client, platform and vendor?

Human beings are social animals, hard-wired to act in a manner that is consistent with the herd, and we often look to what others are doing in moments of uncertainty. As a result, it’s long been recognized that one of the most powerful tools in marketing is to leverage “social proof” – to try to reassure a prospective customer that they’ll be happy with the product or service by highlighting how others who already made the purchase were happy with their decision. Ironically, the reality is that testimonials can actually be so persuasive that for decades they have been banned among investment advisers as regulators feared that advisers might cherry-pick the few most compelling testimonials and omit the rest (in a manner that could be deemed misleading about the adviser’s overall quality of services and results).

However, in late 2020, then-SEC Chairman Jay Clayton announced that for the first time in nearly 50 years, the SEC marketing rules for RIAs were being updated, and would allow advisers to share and highlight client testimonials, a new rule that officially took effect at the beginning of May. The caveat is that while testimonials are now permitted, most advisory firms don’t have any tools or templates to facilitate the collection, dissemination, and oversight ofthese testimonials (to be certain they are still used in an appropriate and SEC-compliant manner).

Accordingly, in May a number of adviser marketing platforms began to announce their new support tools for testimonials, which take varying approaches. In the case of adviser website provider FMG Suite (and its recently acquired subsidiary Twenty Over Ten), the offering includes new Testimonial Page Templates that advisers can configure on their websites, a homepage carousel to rotate through client testimonials and a button to connect visitors to the firm’s Google Reviews page to view or leave a review.

On the other hand, newcomer WealthTender is launching a more centralized “Advisor Reviews” platform, where advisers can sign up for a page on WealthTender that centralizes all of their Google, Yelp and other third-party website reviews and repackages them as “Certified Advisor Reviews” (reviewed by WealthTender) for which the adviser can add a Reviews badge to their website (linking to their WealthTender profile).

It remains to be seen whether advisory firms will have more success highlighting client testimonials on their own website (FMG Suite-style), or centralizing them in a single location (WealthTender-style) — and whether clients will even be interested enough to leave enough adviser reviews to reach a critical mass of testimonials for marketing purposes.

Nonetheless, the reality is that because testimonials have long been recognized as such a powerful marketing tool — including in financial services, where for decades they were only banned because they were deemed tooinfluential and at risk for abuse! — it seems inevitable that client testimonials will soon become a core part of adviser marketing. The only question is how, exactly, advisory firms will find it best to collect and share them for the (right) prospects to see?

After years of suggesting that cryptocurrency is nothing more than a fad or the latest tulip bubble, a recent FPA Trends In Investing survey finds that after years of less than 2% of advisers looking to recommend cryptocurrency into client portfolios, suddenly 15% are making crypto recommendations to clients, and 26% are looking to increase their crypto allocations. Furthermore, a recent Kitces survey found that nearly 50% of advisers are at least open to letting clients invest their own dollars into cryptocurrency (and aren’t actively trying to dissuade their clients anymore).

Enter OnRamp, which is positioning itself as one of the first cryptoasset integration platforms for financial advisers.

Similar to Altruist, OnRamp Invest has been another recent AdviserTech launch that generated substantial prelaunch buzz. Not coincidentally, it’s led by CEO Tyrone Ross, who was previously director of community for Altruist and likely learned quite a bit in his time there about building anticipated launches. Consequently, OnRamp already has a long waitlist of folks who want to see what it’s all about.

Given the broader media buzz about investing into crypto, many people seem to think that the goal of OnRamp is to get advisers into a position to actively help clients acquire crypto for their own clients. Yet while that may be a useful feature down the road, there is a much more immediate pressing need that OnRamp is solving for.

It is estimated that 46 million Americans currently own at least one share of Bitcoin, let alone any of the other cryptocurrency products. Therefore, there are 46 million people who need financial advice around one of the most volatile (and for many, confusing) asset classes to ever come about.

OnRamp’s initial launch aims to help advisers bring their clients’ crypto holdings into view of the rest of the portfolio, as well as educate those advisers on the ever-changing tides of crypto.

It also seems as though OnRamp aims to allow “fiat” technology platforms to integrate cryptocurrency data into their more traditional advice tech offerings. Advyzon is the first out of the gate to integrate with crypto via OnRamp, so that advisers can perform performance reporting activities on those holdings in view of the rest of the portfolio.

Ultimately, it remains to be seen if OnRamp will be a long-lasting player in facilitating the integration of cryptocurrency into traditional adviser portfolios, if only because at some point the major players in the traditional space may attempt to compete by way of offering their own direct integrations with Coinbase, Gemini and Prime Trust (the primary cryptocurrency custodians). Nonetheless, the reality is that OnRamp has launched and already built the first round of integrations, while existing incumbents continue to tread slowly — which means as client demand for crypto continues to build with advisers, and adviser demand to at least facilitate held-away crypto reporting rises, OnRamp is well-positioned to capture the early leader market share as existing AdviserTech providers look for a way to quickly implement such integrations.

In the meantime, though, OnRamp does appear to be positioning itself as a longer-term play to advisers proactively investing into crypto as well (and not merely accommodating clients who want to buy it themselves), with a separate announcement that WisdomTree was partnering with OnRamp to offer crypto-based model portfolios. But are financial advisers really ready en masse to start investing in something with cryptocurrency-level volatility?

Long before adviser technology (or computers themselves) were available to help facilitate it, regulators required that brokers and advisers must Know Your Client (KYC) and understand their financial circumstances and tolerance for risk before making any recommendations, with a particular focus on ensuring that investors do not receive a recommendation to take on more risk than they are willing. Because these KYC requirements predate the rise of AdviserTech, though, in practice such assessments were historically either enshrined on the new account forms to open a brokerage account (with a series of basic questions about time horizon, need for income, investor experience and willingness to take risk), or accompanied them as a stand-alone risk tolerance questionnaire designed by the firm’s compliance department. Yet risk itself is a challenging concept for most to intuitively understand, and recent research has highlighted that most homegrown risk tolerance questionnaires do a remarkably poor job of actually assessing the client’s tolerance for risk.

With the rise of AdviserTech, though, has come a new wave of tools that both analyze the risk of a portfolio, illustrate those risks and help assess a client’s tolerance for them. That’s resulted in three broad categories of risk tolerance assessments: risk preferences tools that provide clients with a series of risk trade-off to assess their preferences (e.g., Riskalyze and Capital Preferences); stress-testing tools that highlight the risks that clients may be exposed to in times of market stress to ensure that they’re comfortable with the risk (e.g., Hidden Levers and RiXtrema); and psychometric questionnaire tools that assess risk tolerance without specifically framing it in terms of investment trade-offs (e.g., FinaMetrica and DataPoints), under the reasoning that how investment trade-offs are presented can itself taint the objectivity of the assessment.

In this context, it was notable that in May, Riskalyze launched a new marketing campaign, tied to a Riskalyze-controlled website UnhiddenLevers.com, that criticizes portfolio stress testing tools like Hidden Levers and RiXtrema as employing "predictive guesswork" that Riskalyze claims is "wildly inaccurate" in predicting how markets would react in various economic environments. In response, RiXtrema highlighted how its stress-testing methodology has been vetted via peer-reviewed journals, and Hidden Levers noted that ultimately its tool is designed to highlight to clients the potential risks they may be exposed to but not to specifically design portfolios for those scenarios (as most advisers hold broadly diversified portfolios anyway). Riskalyze subsequently updated its critique later in the week, stepping back from calling out individual competitors by name but continuing to highlight the differences between the various risk tools on a new "Guesswork" page on Riskalyze's own website.

At its core, though, the debate really highlights the fundamental differences in views about the purpose ofrisk tolerance software in the first place. After all, Riskalyze notes that in March 2020, competitors’ stress testing tools predicted that markets would fall farmore than they actually did (instead they were upfor the year!), and that showing clients such negative scenarios could scare them out of the market; yet on the other hand, if clients werecomfortable with the risks as highlighted in the stress test, and the portfolios in practice performed better than predicted, then clients clearly did not experience losses in excess of what they could tolerate (the original regulatory purpose of the RTQ in the first place).

More generally, though, when in practice the T3 Advisor Technology Survey shows that only 1-in-3 advisers use any risk tolerance software in the first place, and Riskalyze’s software already holds the dominant portion among advisers who do use risk tolerance software, arguably the real opportunity for Riskalyze is not whether advisers use their risk preference offering versus a competitor’s stress testing approach to assessing risk tolerance, but highlighting that anyof them are better than the status quo for the majority of advisers still using a likely-not-well-written prepackaged questionnaire their compliance department ostensibly provides.

One of the biggest fights that has been simmering just below the AdviserTech surface over the past decade has been the battle for the adviser dashboard. Historically, advisers were in the business of selling products, which meant their dashboard was controlled by the insurance company or broker-dealer that facilitated the products that they had for sale, or in the case of RIAs, by the RIA custodian through which they traded for their clients.

But as advisers increasingly shift from products to advice, and the service model shifts away from a product or portfolio focus toward more holistic advice, the reality is that managing an advisory firm itself spans far beyond just logging into the adviser’s broker-dealer or RIA custodian platform. Instead, the advisory business is more and more about systematizing and scaling an ongoingservice delivery, which increasingly lives in the adviser’s CRM system. Accordingly, adviser CRM systems like Redtail, Wealthbox and Junxure have been building out workflow management capabilities, and a number of adviser-specific providers, from XLR8 to Skience, have facilitated the same via Salesforce overlays.

Now Skience has announced it is going one step further, with a new platform called SkienceONE that is intended to function as a stand-alone “wealth management operating platform” that is CRM-neutral (i.e., can be integrated with and overlaid onto any adviser CRM system, not just Salesforce). Notably, because SkienceONE is meant to be an open-architecture overlay tothe adviser’s CRM system, it doesn’t replace the CRM; instead, it primarily supports client workflows that feed into the adviser’s CRM (e.g., account openings, transfers and other repapering tasks), as well as serving as a consolidating hub to be the single source of truth for the advisory firm’s data (given that advisory firms may draw in data from multiple custodians and broker-dealers, performance reporting and trading tools, financial planning software, etc.).

In turn, though, this means that SkienceONE will add an additional cost layer to the adviser’s tech stack, which means it is more likely to attract larger advisory firms (where the additional cost is worthwhile to achieve better scalability of the firm’s data and workflows), or adviser platforms that want a unifying hub for advisers who may themselves be using multiple different CRMs, multiple custody/clearing firms, and multiple other data systems (e.g., independent broker-dealers or various adviser aggregators and networks).

Ultimately, though, the real significance of SkienceONE isn’t simply that Skience is shifting from overlaying Salesforce to any/all adviser CRM systems, but that the demand for technology to automate the back-office workflows of advisory firms is helping to drive an entire shift in the central dashboard that advisory firms use, from their broker-dealers and RIA custodians to the adviser’s CRM system (and CRM overlay) as the adviser technology hub of the future?

When robo-advisers first launched, they declared that they would make financial advisers irrelevant and that they could deliver (and automate) the value that advisers provide at a fraction of the cost. Now nearly a decade later, it has become clear that robo-advisers were not going to replace human advisers, and instead primarily gained adoption with self-directed investors who didn’t want to hire a financial adviser and preferred to self-serve directly from a technology platform, along with a subset of advisers who adopted robo tools (including Betterment’s own adviser platform) because they wanted to automate the purely administrative investment-related tasks so that they could spend even more time giving advice to their clients!

Yet just having more time for clients isn’t necessarily an advantage for financial advisers unless they can focus that time in a manner that actually adds value to clients. Just having more meetings isn’t something that clients are even receptive to if the reality is that there’s nothing relevant to actually talk about or plan for!

Yet several years ago, Morgan Stanley began to pioneer a new technology solution to support this. Dubbed Next Best Action, the software scans all available data about clients to spot potential opportunities for advisers to reach out and have specificconversations with their clients about timely and relevant topics that impact those clients directly. Now Betterment has announced its own “machine-assisted technology offering,” dubbed Co-Pilot, to help advisers using its Betterment for Advisors platform know what their next best action is with their own clients.

Such Next-Best-Action style offerings are increasingly becoming a hot new area in AdviserTech. However, in practice, they are incredibly difficult to execute without robust and clean data. That’s why thus far they’ve largely been built by either proprietary platforms that own all the data (e.g., Morgan Stanley), or overlays to the adviser’s CRM that tend to house the most data (e.g., ForwardLane).

Betterment has a lot of portfolio data, and potentially even goals-based data on clients that go through some of its onboarding tool, but it doesn’t necessarily have the rich CRM data that is typically required for successful Next-Best-Action execution. Accordingly, even Betterment acknowledges that its initial Co-Pilot offering is mostly just about facilitating actions related directly to (just) the client’s Betterment accounts, including reminding clients to accept invitations to open accounts, sending reminders to approve account openings, prompting advisers to get the clients’ missing beneficiary information, and notifying the adviser of pending and failed ACAT transfers. All of those certainly are relevant Next-Best-Action prompts to come froman investment platform like Betterment, but they won’t necessarily support the entire holistic adviser-client relationship.

On the other hand, one could also make the case that Betterment would argue that it’s incredibly difficult for one platform to provide a comprehensive next best action offering in the first place, and that it will need to be segmented (where each software solution in its category surfaces actions in its category, to feed into a centralized location like the adviser’s CRM). Betterment is at least trying to position itself to own its segment.

Still, though, the struggle for Betterment – not unlike the woes that Apex has seen – is that while it is investing quite a bit into its platform for advisers (as it has Altruist as a very fierce competitor now!?), advisers have been hesitant to trust some of the most critical components of their business and livelihoods to a company that doesn’t primarily focus on them and began as a direct-to-consumer adversary. That means Betterment may still struggle to gain interest and adoption, even if the Next-Best-Action approach is philosophically and directionally correct about where the adviser business is going. Though if Betterment can implement a version that executes well and has a real impact for advisers, perhaps its Co-Pilot feature can begin to sway more adviser adoption?

One of the most unique aspects of the independent RIA model is that even a solo advisory firm is permitted to operate with the founder/owner overseeing themselves as their own chief compliance officer. Yet the fact that an independent RIA founder can be their own CCO isn’t a free pass when it comes to compliance oversight. The SEC and/or state securities regulators still expect firms to implement, and be able to document that they have implemented, appropriate compliance policies and procedures.

Nonetheless, the practical constraints of being a solo adviser (or one with a half dozen to a dozen employees) mean that most RIA founders struggle to shoulder their compliance duties alone, and in practice outsourcing and leveraging technology for compliance efficiencies is very popular.

RIA in a Box has increasingly become a leader in this space, particularly for small to midsize RIAs, and steadily continues to build out a very robust offering so that firms can have one contract, one vendor and a tightly integrated solution where their compliance tools integrate to all of their other key technology platforms. In fact, the irony is that while most AdviserTech firms are fighting over the incredibly valuable real estate to be the screen that advisers use when they are meeting with a client to deliver advice, or are fighting over the real estate to be the screen where an adviser executes the plan, RIA in a Box has quietly found an adjacent vertical – to be the technology that oversees it all – and continues to expand its capabilities to capture more compliance-related technology functions.

Its latest move is not simply to offer more tech-savvy compliance tools, but to actually becomethe outsourced IT provider that supports those tools, with its acquisition of Itegria.

Given the growing regulatory scrutiny of cybersecurity, the deal makes sense. In practice, cybersecurity lives squarely at the intersection of IT support and compliance oversight, for which Itegria offered both a secure virtual desktop approach (AdvisorCloud), and a full outsourced-IT option (AdvisorCare), along with a stand-alone cybersecurity monitoring service (AdvisorGuard). With the acquisition, RIA in a Box expands itself more squarely into the supported-cybersecurity world, and it gains a natural partner both to cross-sell its existing firms the Itegria virtual desktops and outsourced IT solutions, and to offer RIA in a Box compliance capabilities to Itegria’s RIA clients.

Bear in mind that RIA in a Box is funded by private equity firm Aquiline, which means it has access to capital, such that Itegria will likely not be its last strategic acquisition as the firm continues to expand capabilities beyond its compliance core.

While the world of fintech has exploded in popularity over the past decade, from the rise of robo-advisers like Betterment and Wealthfront to next-generation investing platforms like Robinhood and Acorns and lending-oriented platforms like SoFi and Credit Karma, not to mention the growing domain of payments (Stripe) and blockchain and Bitcoin, the reality is that AdviserTech has remained a relatively small domain of the larger fintech world, and one with far less venture capital funding.

In large part, this is simply due to the more limited market opportunity, when there are more than 100 million U.S. households but just about 300,000 financial advisers, which means even a large adviser technology company can only get so large. Still, though, a growing number of sizable AdviserTech exits, with MoneyGuidePro being acquired by Envestnet for $500 million and TA Associates reportedly seeking a $2 billion valuation for Orion Advisor Solutions last year, means AdviserTech has been attracting more attention lately, including and especially among successful advisers themselves who have intimate knowledge of their own industry and some free cash flow to invest.

A case in point is ScratchWorks, which first launched in 2018 with a Shark Tank-style approach of having prospective AdviserTech startups pitch to a panel of advisory firm founders who are looking to invest. In recent years, ScratchWorks has put dollars into marketing technology Snappy Kraken, Lifeworks digital automation tools and the ReAllocate platform, which aims to facilitate direct investments for advisers into real estate, all of which were early-stage angel or seed rounds. Now ScratchWorks has announced that it’s open for its Season 4 applications, with finalists being invited to pitch their solutions to the investors at Joel Bruckenstein’s T3 Advisor Technology conference in late September.

Ultimately, ScratchWorks only selects 3 finalists for pitches, and in practice not all the companies that present even get an investment at the event, which means many adviser startups will still have to look elsewhere for opportunities for capital and visibility. Nonetheless, when it’s especially hard for AdviserTech founders to get early rounds of angel and seed capital – or even get the attention of VC firms that view the entire AdviserTech vertical as too small of a market opportunity because many companies only exit for tens of millions (and will never be the next unicorn), ScratchWorks fills an important gap in AdviserTech funding, and provides a chance to glimpse the next emerging innovations in AdviserTech.

For those who want to see it for themselves, check out the T3 Advisor Technology Conference in September in Denver. For AdviserTech founders still looking for capital, the application window remains open through June 15!

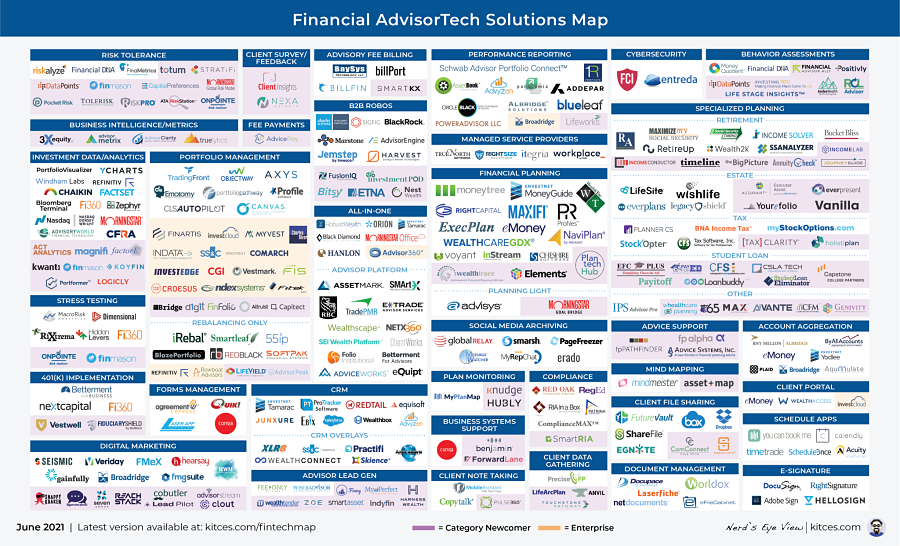

In the meantime, we’ve updated the latest version of our Financial AdviserTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will Zoe Financial and Tifin Group be able to find enough unattached prospects torefer to financial advisers? Will Altruist be able to compete as the next big RIA custodian? Are client testimonials going to become part of the mainstream marketing approach for financial advisers?

Michael Kitces is the head of planning strategy at Buckingham Strategic Partners, co-founder of the XY Planning Network, AdvicePay and fpPathfinder, and publisher of the continuing education blog for financial planners, Nerd’sEye View. You can follow him on Twitter at @MichaelKitces.

Disclosure: Kyle Van Pelt is executive vice president of sales at Skience and on the Advisory Board for OnRamp Invest, both of which were mentioned in this column.

Kyle Van Pelt wrote the following: “Altruist raises $50 million to move past custody to all-in-one RIA Platform,” “Vise raises capital at head-scratching $1 billion valuation as Silicon Valley goes all-in on direct indexing,” “RIA in a Box acquires Itegria as compliance and cybersecurity increasingly overlap,” “InvestCloud acquires Advicent to make NaviPlan its Financial Supermarket gateway for enterprises,” “OnRamp launches platform to help advisers track clients’ held-away crypto holdings,” and “Betterment launches Co-Pilot to surface opportunities to add value to clients.” You can connect with Kyle via LinkedIn or follow him on Twitter at @KyleVanPelt.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound