The September edition of the latest in financial #AdviserTech kicks off with the news that VRGL (pronounced Virgil) has raised a $15 million Series A round to scale up its tool, which can scan investment account statements and automatically extract the available information about their holdings to analyze the prospect’s performance, risk, diversification, fees and taxes. It also has the potential to greatly expedite the process of developing an investment proposal with the adviser’s recommendations for improvement.

The deal comes on the heels of similar data-gathering extraction tools like Holistiplan, which scans tax returns, and FP Alpha, which scans estate planning documents, as more adviser technology solutions recognize that the real opportunity is not trying to develop artificial intelligence to replace financial advisers but instead to make it easier for advisers to collect all the information they need to better analyze and make their own recommendations to prospective clients, effectively helping advisers to give betteradvice, rather than just trying to make it faster.

From there, the latest highlights also feature a number of other interesting adviser technology announcements including:

• Farther raises a $15 million Series A to try to make a more efficient back-office for advisers to actually be able to take home a 75% payout.

• FMG acquires Vestorly to map its curation capabilities onto FMG’s existing digital marketing tools.

• Future Proof and XYPN LIVE announce the finalists for their FinTechX Demo and AdviserTech Expos to highlight new adviser technology innovation.

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including:

• SmartRIA launches an integration with Kitces.com to help RIAs manage the new IAR CE obligation rolling out from NASAA.

• Orion (re-)partners with Apex Clearing with an integrated financial planning and digital account-opening experience for younger clients with smaller accounts.

In the meantime, we’re also gearing up for several new updates to our new Kitces AdviserTech Directory, including Adviser Satisfaction scores from our Kitces AdviserTech Research and Integration scores from Ezra Group’s research.

And be certain to read to the end, where we have provided an update to our popular Financial AdviserTech Solutions Map as well.

AdviserTech companies that want their tech announcements considered for future issues should submit to TechNews@kitces.com!

Gathering data about a client’s current financial situation is a natural prerequisite to providing them with financial advice about how to make changes to improve their situation and better achieve their goals. Yet the irony is that the data-gathering phase is actually one of the most challenging parts of the financial planning process. In practice, clients often aren’t organized enough tofill out the adviser’s data-gathering forms and share information about their current financial situation. The primary alternative is to simply ask clients to share all of their original financial documents — from account statements to tax returns — with the adviser then engaging in their own time-consuming process to analyze those documents and extract the necessary information.

In recent years, though, a growing number of technology solutions have begun to better automate this data gathering/intake process, from the rise of account aggregation to automatically populate financial values into financial planning software, to Holistiplan automatically scanning a client’s tax return to identify tax planning opportunities, and FP Alpha similarly launching a solution to scan a client’s estate planning documents to identify potential estate planning issues. They’re all built around the idea of expediting the otherwise time-consuming process of poring over a client’s financial documents to try to extract the relevant financial information.

Now, newcomer VRGL aims to help advisers guide clients to better portfolios, (named after Virgil, the Roman writer and guide in Dante’s Inferno). It announced a $15 million Series A capital round to fund its addition to automating data-gathering, with a new solution that can scan a prospect’s account statements. It automatically extracts holdings and their values, along with cost basis information and/or gains and losses, and even fees that are being paid to the extent they’re shown on the statement in the first place. This is then fed into VRGL’s investment analytics tools to provide further analysis of the client’s current investment positions and how they might be improved upon by the adviser with respect to performance, risk, diversification, fees and taxes.

VRGL, similar to other tools that help to automate various components of gathering data and reading clients’ financial documents, is positioned to greatly reduce the time it takes to pore over clients’ existing holdings to find opportunities to make investment recommendations that improve their financial situation. Though it’s similar to other data gathering automation tools used by financial advisers, the end point may not necessarily be a faster process for crafting recommendations, but a richer flow of information that gives advisers an opportunity to go deeper in finding more, new or better investment ideas and improvements than they would have found on their own in limited time. In other words, if an adviser only had an hour or two to analyze a prospect’s holdings, instead of spending most of that time just trying to extract information from statements to understand their holdings, the adviser can spend most of that time going even further in researching better solutions to improve upon what the client has currently.

Ultimately, though, VRGL’s success will be dictated first and foremost by its ability to actuallyread effectively a very wide range of account statements from financial institutions that don’t always do the best job of making the information on their statements clear and understandable in the first place. From varying formats for how positions are stated, how gains and losses and cost basis are reported, and how fees (and other flows in and out of the account) are reported, creating a tool that can extract all the relevant information from anyprospect’s statements, and report back the details accurately, is no small feat. It remains to be seen whether advisers believe that VRGL’s execution can live up to its promise.

Nonetheless, with use cases from advisers gathering investment data with new clients, to creating a proposal for prospects, or even building a lead-generation tool that encourages visitors to upload PDFs of their statements to receive an instant analysis of their own portfolios, VRGL’s solution seems well positioned to help advisers in a key domain of the prospecting process (particularly for the predominant AUM model). It wouldn’t be surprising to see the tool eventually make the scanned/extracted information available via an API tool to export into other investment analytics tools as well. The only question is how effective VRGL can be at truly extracting all the information that advisers would want to glean from a prospect’s investment account statement.

The standard formula for the profitability of an advisory firm is 40/35/25 — 40% of revenue goes to direct expenses for advisers to service clients, 35% goes to the various overhead expenses that it takes to run an advisory firm, and 25% is the net profit margin that results. In the context of individual/solo advisers, this is often equated to a 65% payout rate — where the adviser running their own business earns the 40% of revenue to service their clients, plus the 25% of profits, which is reduced by their 35%-of-revenue in overhead expenses.

Notably, though, the 35%-of-revenue-in-overhead ratio does vary at least a bit from one advisory firm to the next. Larger firms often seek to bulk up and grow organically, or by acquisition, to achieve economies of scale that reduce their overhead expense ratio. Smaller firms — especially solo advisers — often have lower overhead expenses because they don’t have or even need a full staff infrastructure, given the growing capabilities of technology to power highly efficient solo practices.

In between, though, is a dangerous middle zone which can span from $100 million of AUM up to more than $2 billion. This is where advisory firms are too big to be lean tech-efficient solo advisers and have to start hiring up more staff, but are too small to be big and gain any economies of scale as they’re still building out the staff and systems infrastructure it takes to grow the firm to the next stage. In the dangerous middle, margins can and often do decrease as overhead expenses rise.

In this context, it’s notable that last month, Farther announced a $15 million Series A round of capital to build an RIA platform that seeks to help advisers work through this dangerous middle by providing them with centralized staff resources and Farther’s own custom-built technology, and a “75% payout” that in theory should be almost all take-home compensation for the adviser who can leverage Farther’s resources to minimize any further overhead expenses of their own. Unlike most other independent adviser platforms, though, Farther is structured as a W-2 employee model, where advisers are expected to fully plug into the Farther infrastructure to gain the efficiencies that come from Farther’s centralized resources to achieve their 75% payout.

The buzz from the industry about Farther was about its somewhat eye-popping valuation of $50 million in enterprise value, for an advisory firm with just $2.5 million of AUM. This implies a valuation of as much as 20 times revenue assuming a traditional 1% AUM fee, for a firm whose profitability will be greatly limited by the fact that it pays out 75% of its revenue off the top to its advisers, and must still staff all of its adviser support and technology from the 25% that remains. Yet in the end, all Farther’s valuation really implies is the sheer growth rate opportunity its investors see. After all, if Farther is able to quickly attract dozens or even hundreds of advisers, it can quickly grow to billions in AUM, for which its valuation might seem quite reasonable by traditional adviser metrics.

Instead the real question for Farther is simply whether it will be able to attract a material segment ofadvisers with its quasi-independent model, which gives advisers some level of autonomy over their clients but is ultimately structured as an employee model where the advisors are IARs of Farther’s corporate RIA, and whether its 75% payout structure is ultimately compelling. In the end, the reality is that high-income solo advisers can often drive margins of 80% to 90% for themselves by simply focusing in on a small base of high-value clients (where a 75% payout isn’t compelling), and larger multi-adviser firms that are further along into the dangerous middle may not fit into Farther’s still very solo-adviser-centric offering and not be willing to let go of their existing staff to map onto Farther’s infrastructure instead. This means, ironically, that Farther itself may struggle in a form of the dangerous middle where larger advisers netting less than 75% of revenue themselves don’t fit Farther’s model, and smaller advisers who want to stay solo can create better-than-75% take-home margins for themselves with existing technology and platforms.

From the broader industry perspective, though, the really notable aspect of Farther is simply that while it’s building some of its own technology, Farther is arguably a service offering more than an actual tech company or at best, is positioned as a tech-enabled services provider. The company was still able to receive a tech-like multiple and valuation in the hopes of being able to achieve a tech-like growth trajectory by attracting advisers who want to affiliate with the services it provides. So, regardless of whether Farther in particular is the big winner, the broader question is whether tech-enabled services are going to become the new tech for financial advisers.

While most consumers arguably could benefit from financial planning at any particular point in time, in reality most don’t actually seek out a financial planner until something hurts — when they hit a new moment of financial complexity, and/or a life transition, that makes them decide that nowis the time to reach out and hire a financial adviser. As a result, drip marketing has long been a marketing tactic of financial advisers — providing a steady stream of content to prospects so that whenever the consumer doeshave that moment when it’s time to find a financial adviser, the adviser will be visible and top of mind.

Historically, drip marketing for advisers was done in the form of a quarterly newsletter, with various third-party services that would print and mail the adviser’s newsletters to a prospect list the adviser generated by collecting business cards at networking meetings. In recent decades, drip marketing shifted heavily from the physical to the digital, as quarterly print newsletters become monthly email newsletters. But the core throughout has remained the same: providing a steady stream of content to prospects to keep the adviser top of mind. The more relevant the content, the more likely prospects are to engage with it, and the greater the likelihood that the adviser will remain top of mind for future opportunities to convert from prospect to client.

Accordingly, over the past decade, a growing number of AdviserTech solutions have emerged to try to help provide the content for those digital drip marketing strategies. In some cases, the goal was simply to provide a library of content to choose from (e.g., Financial Media Exchange), while others like Vestorly tried to be more effective at selecting and curating the most relevant content foradvisers’ prospects by looking at what prospects clicked on to determine other articles that might be relevant and of interest.

The caveat, though, is that good drip marketing content only matters if advisers can figure out how to get prospects to go to their website and sign up for their email list to be drip marketed to in the first place. In the end, if advisers want to convert prospects into clients, at some point the adviser has to show up and demonstrate their own expertise with their own content, and not just have a solution that shares third-party content. As a result, advisers have often had lackluster results — which in Vestorly’s case, led to its CEO infamously stating that “Vestorly does not attempt nor need to ‘convert’ clients to succeed,” followed unsurprisingly by stalled growth and the ultimate departure of its founding CEO.

Now, the news is out that FMG Suite has acquired Vestorly, with an eye to incorporating its curation capabilities into FMG’s existing marketing systems for advisers which, notably, includes a more robust offering that can generate new prospects for the adviser’s email list (with website design and LeadPilot for lead conversion), marketing automation tools to nurture the adviser’s email list and done-for-you services that allow advisers to more fully outsource their marketing needs for list-building and conversion.

From the FMG perspective, the Vestorly deal makes sense, as the core of Vestorly’s curation engine was always strong. The only issue for Vestorly was that content curation alone couldn’t create marketing success for advisers when it lived on an island, outside of the capabilities to increase how many prospects were signing up forthe email list to be drip marketed to, and a more refined funnel (including adviser-created content that demonstrates expertise on top of third-party curated content) that could actually convert email-list prospects into actual clients. All the while, FMG may be able to leverage Vestorly’s content curation far more broadly across its adviser websites, email marketing automation and social media sharing tools.

More broadly, though, what Vestorly’s challenges and ultimate exit to FMG really highlight is that in the end, advisers will only buy, or keep paying for, marketing technology that drives really marketing success by attracting prospects and converting them to clients. As a result, providers have to either build the full suite of capabilities it takes to drive adviser marketing results or look to merge themselves into platforms that can leverage their technology across the full breadth of capabilities that advisers need to be able to market themselves successfully.

FUTURE PROOF FINTECHX AND XYPN LIVE ADVISERTECH EXPO ANNOUNCE FINALISTS

When it comes to financial advisers, it’s surprisingly difficult for good technology startups to get noticed and gain traction, as the landscape of financial advisers is remarkably bifurcated. On the one end, there’s a very large base of tens of thousands of independent firms, most comprising just one or a handful of advisers, which is very challenging to market to and sell one firm at a time. On the other hand, there are larger enterprises — independent broker-dealers, and then wirehouses, insurance companies and banks — who may have hundreds or even thousands of advisers in each enterprise (and a few hundred thousand in total), but with extremely long sales cycles and arduous due-diligence requirements that startups may struggle to clear.

In other words, most AdviserTech startups are usually caught between a rock and a hard place when it comes to their go-to-market efforts to launch a new solution. In the end, most AdviserTech firms decide not to take on the risk, and long and costly sales cycle, of pursuing enterprises. Instead, they try to build their user base one independent RIA at a time, in the hopes of using their initial traction with RIAs toraise additional capital to hire an enterprise sales team and pivot to larger broker-dealer enterprises in the future. Yet, that still raises the question: how best to get seen efficiently among the highly fractured RIA community, especially when the most common gathering place for advisers — industry conferences — have an exhibit hall pricing model that’s built primarily for asset managers and not technology companies.

In recent years, the emerging alternative is a growing number of AdviserTech competitions and demo stages that offer Adviser Tech companies — and especially newer startups — an opportunity to be seen by advisers, either for free (for those who are selected as winners of the competition), or at least at a greatly reduced price (for a smaller kiosk and a chance for a brief demo to showcase their adviser software).

Two such AdviserTech events have announced their finalists: the new Future Proof conference and its FinTechX Demo stage, and XYPN LIVE and its long-standing AdviserTech Expo (Monday, Oct. 10 in Denver).

The Future Proof FinTechX demos featured a mixture of newer AdviserTech startups like Entrustody (a new RIA custodial platform), Hubly (offering multiplatform workflows for advisers), Onramp Invest (providing data integrations for clients holding crypto-assets), Venn by Two Sigma (investment analytics), and VRGL (which scans client account statements to quickly generate an analysis and investment proposal). There were also a number of existing AdviserTech companies with new offerings, from Intelliflo’s RedBlack (trading and rebalancing) to Skience (with a new compliance oversight solution), Practifi (with a new data analytics solution), Wealth Access (more unified client portal and investment reporting), and more.

In the case of XYPN LIVE’s AdviserTech Expo, the focus is more on newer companies launched in the past 12 months, or still with less than $1 million in revenue. There is also a particular focus on tools that support advice engagement (more deeply engaging prospects and clients into the advice process), including Lumiant (to better engage the less-engaged spouse in the financial planning process), Sora (for debt management), Income Lab (for retirement distribution planning), Econiq (to improve engagement in virtual meeting with clients), and Savology (for more engaging simplified planning tools), along with Hubly and VRGL.

For advisers, the opportunity with events like Future Proof FinTechX and XYPN’s AdviserTech Expo is to be able to scan efficiently a number of new adviser technology solutions all at once in quick succession (as such demo events typically feature relatively limited demo time slots, one after another, making the process very efficient). Such events are also increasingly attracting VC and PE firms that are trying to spot the next big deal opportunity as well.

In the end, though, arguably the biggest benefit is simply for AdviserTech companies themselves, which get an opportunity to be seen at a relatively low, or entirely free, price point, giving them an opportunity in the highly fragmented RIA community to build the initial word of mouth it takes to get going. Hopefully, this means that more adviser conferences will create similar opportunities in the future as well.

One of the biggest ironies of financial adviser regulation is that registered investment advisers, with the highest fiduciary standard of care, have historically had no continuing education obligation to affirm that they’re even still competent to give advice. Also, the bar to obtain the requisite Series 65 license in the first place isn’t much higher, requiring only a relatively basic understanding of economic concepts and investment vehicles, their risks and the laws that will apply as an investment adviser representative of an RIA.

In recognition of this gap, back in November 2020, the North American Securities Administrators Association passed a new model rule for states to begin implementing a new IAR continuing education requirement. This rolled out for Maryland, Mississippi and Vermont in 2022 and is on track to go live in nine more states in 2023. Ostensibly, there will more states thereafter, but with model rules, each state must individually go through its applicable regulatory or legislative process to formally adopt the rule in their state.

The new IAR CE rule will require investment advisers to obtain 12 hours of CE each year, including six hours of products and practice and another six hours of ethics and professional responsibility. IARs are obligated to obtain these as long as they are registered in any state that has the IAR CE obligation, even if their home state has not yet implemented the requirement. For example, if an adviser is based in California but has at least five clients in Maryland such that they must be registered in Maryland, then the California IAR is still required to obtain their 12 hours of IAR CE in 2022 under Maryland’s requirement even if California does not require IAR CE yet.

Consequently, the new IAR CE rule applies far more broadly than just the RIAs based in the three states that have adopted thus far. Many RIAs will have to manage to a mixture of advisers who do have the IAR CE obligation, and others that don’t based on the states in which each individual adviser is registered. In addition, many IARs must also manage overlapping CE obligations from other professional licenses and designations (e.g., CE for CFP certification or other designations, NAPFA CE for members of the association and ongoing CPE for those with a CPA license).

To help fill the void, RIA compliance software platform SmartRIA announced that it was rolling out an IAR CE offering in a partnership with Kitces.com, delivering Kitces’ (IAR and other designations) CE solution to SmartRIA users, with an integration that will pass advisers’ CE information from Kitces back to SmartRIA so chief compliance officers can track the fulfillment of all of their advisers’ CE compliance obligations in one place.

From the individual adviser perspective, the new offering doesn’t necessarily bring anything that advisers couldn’t have already obtained separately from each organization. But at a firm level, as more and more RIAs become multi-adviser, and chief compliance officers have the obligation to ensure that all of their IARs are meeting their regulatory obligations — which now includes IAR CE — the ability to centrally oversee and manage IAR CE across the firm becomes a significant efficiency enhancement.

From the industry perspective, though, the SmartRIA-Kitces integration is a marker of a broader trend of the growing compliance obligations that increasingly multi-adviser RIAs must fulfill and chief compliance officers must oversee. This is bullish for RIA compliance software platforms like SmartRIA (and RIA In A Box, and Red Oak Compliance and Joot) that help to track the firm’s obligations and ensure they’ve been met both with respect to IAR CE, and the full range of compliance obligations. This raises the question of whether RIA compliance software itself may increasingly become a new hub to which other software vendors attach, akin to how RIA custodians and portfolio management software has been in the past.

For the decade of the 2010s, the RIA custody business was dominated by Schwab, Fidelity, TD Ameritrade and Pershing Advisor Solutions, with a long tail of smaller niche custodians like SSG, TradePMR, Trust Co. of America and Folio Institutional. The good news in this relative concentration of RIA custodians is that it allowed them to achieve enormous economies of the scale to the point that most RIAs simply experience RIA custody as a free service. The tiny sliver of revenue that custodians make from client cash spreads, 12b-1 and sub-TA fees from mutual funds, payments for order flow and the like were able to cover the cost of the entire relationship. The bad news was that at such large companies, innovation or even mere technology evolution was excruciatingly slow. When robo-advisers showed up with the ability to allow consumers to digitally open an investment account via their smartphone, some RIA custodians were still executing the same process via fax machines.

Notably, though, many of the early robo-adviser platforms, including Wealthfront, Robinhood, Stash and more, were themselves built as technology layers on top of Apex Clearing. This raised the question of whether Apex could become a competing RIA custodian as well, with the caveat that while it was very API-friendly to support digital account opening, it didn’t have the kind of RIA-friendly interface that advisers were accustomed to. This led to a slew of Apex partnerships with robo-adviser-for-advisers platforms that were willing to build the adviser interface on top of Apex, including AdvisorEngine, Robustwealth and Trizic, in the hopes that their growth would lead to Apex growth.

Except ultimately, most robo-adviser-for-advisers platforms were unable to gain traction, due largely to the fact that advisers in the end said they wanted better digital onboarding and a better client experience, but weren’t willing to pay robo-adviser fees to get it. Instead, they expected that onboarding should simply be part of what RIA custodial platforms already offer. Perhaps more importantly, most RIAs didn’t necessarily want to go to the trouble of repapering client accounts to a new custodian just to get an incremental improvement in their onboarding process.

Nonetheless, Orion announced a new automated account opening solution, building on top of its prior 2020 integration with Apex Clearing to digitize the account opening process, which aims to pair Orion’s simplified financial planning workflows with digital account opening to make it easier for advisers to work with smaller clients who can mostly self-direct through the Orion financial-planning-plus-investments experience.

The caveat, though, is that using a digital robo-style tool to reach next generation clients has never managed to gain traction through any iteration of robo-for-adviser digital tools, owing largely to the simple fact that few advisory firms have a sufficiently broad and scaled marketing ability to generate a material number of next-generation prospects in the first place. Not to mention that consumers who want a largely self-directed technology experience don’t necessarily want or need to hire an advisory firm in the first place when there are already a number of robo-advisers (and robo-managed account solutions from direct-to-consumer brokerage platforms) they can engage with directly.

In addition, RIAs have still shown little willingness to repaper client accounts to access such digital capabilities — as the workload to repaper all of an advisory firm’s existing accounts far outstrips any incremental efficiencies for onboarding new clients more digitally, especially when most RIAs are only adding new clients at a mid-single-digits growth rate. Nor is it even clear that advisers would be willing to add a new RIA custodian to serve small clients more efficiently, given the additional staff training and processes that must be developed to be multicustodial (which is only partially expedited by Orion’s multicustodial capabilities) especially since Schwab itself just released a major efficiency enhancement to its digital onboarding capabilities.

Arguably, the slow pace of RIA custodian innovation — with Schwab only just refining its digital onboarding capabilities, a full decade after robo-advisers like Wealthfront and Betterment first went mainstream in 2012 — suggests a need for more competition to drive custodians to invest more aggressively to compete. Yet at the same time, Apex’s ongoing challenges to gain traction through any of its partnerships — as so many robo-for-adviser solutions tied to Apex have gone by the wayside, and as Orion continues to make incremental improvements and then re-announce the integration — suggests that perhaps digital onboarding isn’t really as big of a deal as the industry has made it out to be. Because in the end, advisers still aren’t voting with their feet for better digital onboarding tools to serve smaller next generation clients, and instead have continued to prioritize the depth of service and support from the larger more established RIA custodians?

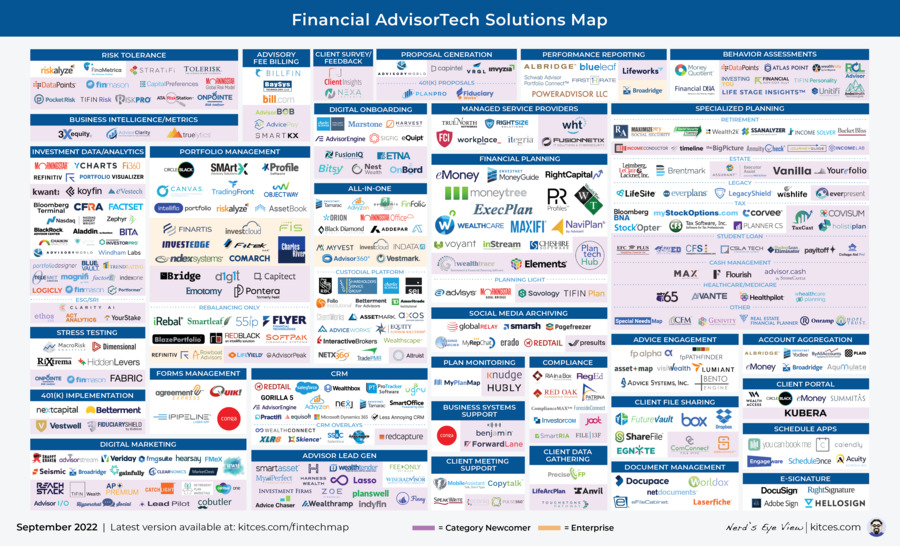

In the meantime, we’ve rolled out a beta version of our new AdviserTech Directory, along with making updates to the latest version of our Financial AdviserTech Solutions Map with several new companies including highlights of the Category Newcomers in each area to highlight new fintech innovation!

So what do you think? Will VRGL’s automatic extraction of key information from a prospect’s investment statements help to go deeper with investment proposals? Can Farther gain traction building with small-to-midsize RIAs that don’t want to deal with their own back-office infrastructure? Will Apex Clearing finally begin to gain traction with RIAs through its partnership with Orion?

Michael Kitces is the head of planning strategy at Buckingham Strategic Partners, co-founder of the XY Planning Network, AdvicePay and fpPathfinder, and publisher of the continuing education blog for financial planners, Nerd’sEye View. You can follow him on Twitter @MichaelKitces.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound