The July 2023 issue of the latest in financial #AdvisorTech kicks off with the news that Pershing X has announced the launch of its long-awaited (and newly renamed) “Wove” advisor technology platform — which despite purporting to be an open-architecture, multicustodian solution allowing advisors to smoothly integrate all the technology they choose to bring onto it, in reality seems geared toward advisors who want to use Pershing’s custodial and outsourced investment management solutions, along with Wove’s suite of native or partnered software tools … which may be especially appealing as an ‘out-of-the-box’ solution for breakaway brokers that Pershing is likely looking to attract, but raises questions about why Pershing would bother to promote Wove’s open-architecture capabilities in the first place, given that they don’t appear to be what the platform will actually do best?

From there, the latest highlights feature a number of other interesting advisor technology announcements, including:

Read the analysis of these announcements in this month’s column, and a discussion of more trends in advisor technology, including:

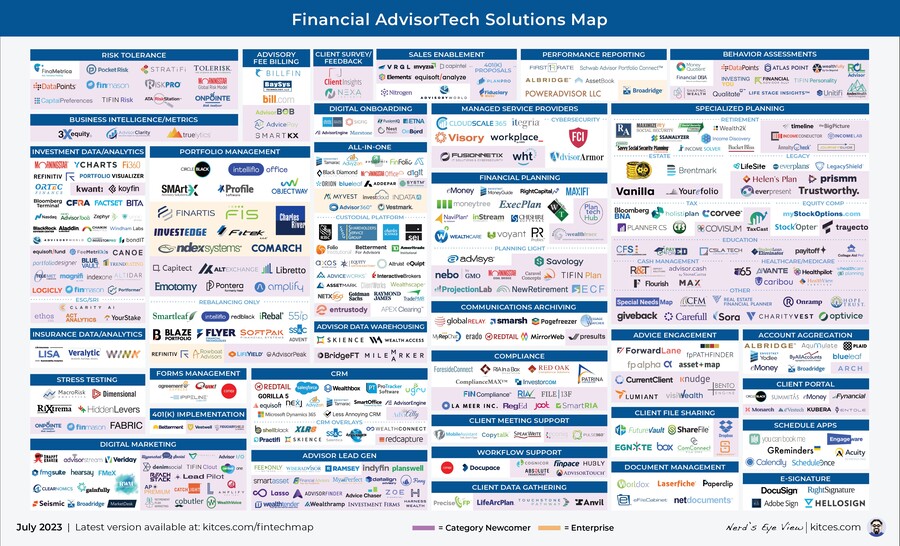

Be certain to read to the end, where we have provided an update to our popular Financial AdvisorTech Solutions Map and added the changes to our AdvisorTech Directory as well!

AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please email TechNews@kitces.com!

As the number of technology solutions for financial advisors has proliferated over the years, one of the primary challenges for advisors in getting the most value out of those tools has been getting them to seamlessly connect with one another. Although each tool might be able to save the advisor some amount of time in theory, that benefit is often negated in practice when an advisor needs to enter the same information into multiple tools and subsequently cross-check those tools’ outputs to ensure they’re consistent, or manage to workflows that start and stop within each vendor’s platform and require the advisor to “swivel chair” from one application to the next to complete a process.

Numerous technology platforms have arisen to solve this problem over the years, coming from both independent, stand-alone technology providers like Orion and Envestnet’s Tamarac (which allow advisors to manage investments through their custodian of choice and typically charge a per-account or per-advisor-user technology fee), as well as custodians or asset managers like Schwab, Fidelity and TDAmeritrade’s Veo (which provide the technology for “free” to advisors as a fringe benefit of keeping their clients’ assets at the custodian, allowing the custodian to earn its “traditional” revenue streams like the interest-rate spread on cash, mutual fund fees, etc.) or AssetMark and SEI (which earn basis points on outsourced investments that are managed on their tech-savvy TAMPs).

At the same time, a growing distinction between the various technology and custodial or asset management platforms is their approach to solving the integration problem. While some provide an open-architecture solution that seeks to serve as a central hub for all of the advisor’s third-party apps (facilitating a classic best-of-breed approach to advisors’ choice of their own technology, but then putting the responsibility on them to patch them into the core), others take more of a “walled garden” approach, in which a curated list of apps are more deeply pre-built into the software (reducing the work for advisors to integrate, in exchange for having a more constrained list of options). The former approach has the benefit of advisors’ being able to choose whatever they believe is the best provider in each category to bring them into the integration platform, albeit limited by the integration capabilities of the individual tools themselves; the latter can assure that all of the apps work well with one another out of the box, but offers little flexibility for the advisor to pick and choose apps that they might like more than the platform’s native software if they disagree with the platform’s preselected choices.

Tech providers have seen success with both approaches, since the choice between open architecture and walled garden is usually a matter of personal preference (similar to the way some people prefer Android phones’ flexibility and customization options while others like Apple’s seamless but tightly controlled environment). Consequently, the success of each type of platform comes down to how well it executes the approach that it’s decided on: for open-architecture platforms, how well they can smoothly integrate a wide range of third-party apps, and for walled gardens, whether their native apps are deeply integrated enough, and good enough within their respective categories, to compete directly with the independent solutions that are available to buy individually.

So it’s notable that after building behind the scenes since 2021, Pershing X, BNY Mellon’s in-house technology developer, is officially launching the newly dubbed Wove, which purports to be next generation of advisor “operating system” that will link (i.e., integrate) together all of an advisory firm’s core functions in an open architecture framework.

In practice, however, despite being open architecture in name, Wove appears to be largely built around a select stack of native applications, including Salesforce for CRM, Conquest for financial planning software, PureFacts for fee billing and Pontera for its 401(k) plan integration, which stack on top of Wove’s own trading and performance reporting capabilities that it states will facilitate portfolio management across multiple custodians (not just Pershing). In turn, advisors can ostensibly substitute any of these with one of their existing tools, although — as is inevitable when bringing third-party tools into a “native” landscape, and as Pershing’s own user experience lead Bryan Hamilton has acknowledged — third-party apps will never be as deeply integrated and seamless as the native apps that Wove has chosen.

Which ultimately raises the question: What business is Wove even in? On one hand, it’s positioning itself as an open-architecture hub reminiscent of TDA Veo; on the other, it’s gone ahead and solved for most of the core functionality of the platform by bringing in its own self-built or preselected tech stack, making it more akin to CircleBlack, which has a similar all-in-one approach combining preselected third-party vendors that are deeply integrated with its own native capabilities.

Additionally, while in some respects being akin to a stand-alone software provider — that would traditionally charge a technology fee to use this product, as CircleBlack does — there’s little or no information given on how Pershing will actually make money from Wove. However, given that Pershing has also highlighted how its new direct index solution (acquired from Optimal Asset Management in 2021) and outsourced investment management capabilities (formerly offered through Lockwood Advisors, which is now tucked under the Wove nee Pershing X division) will also be integrated into Wove, it’s reasonable to wonder whether Wove is, at its core, a true multicustodian technology platform that advisors buy like other software providers — or whether it’s more akin to a tech-enabled TAMP or simply a next-generation RIA custodial platform with its own tech stack. In other words, did Pershing create Wove to sell software to advisors seeking a solution to navigate the challenges of software integration, or to support Pershing’s RIA custodial platform and/or BNY Mellon and its affiliated asset managers in gathering client assets?

From an advisor standpoint, the fact that Wove has selected its own apps and effectively preassembled its own all-in-one solution implies that it will be easier to use for advisors who are more readily able to adopt Wove’s full tech stack out of the gate — namely, midsize to large breakaways from broker-dealers who are otherwise leaving their existing platform and tech stack behind and have to select an entirely new tech stack anyway. That contrasts with existing RIAs, who would need to either migrate over to all of Wove’s native apps, or hope for the best that the third-party integration capabilities are as effective as advertised. Meanwhile, Pershing’s outsourced direct indexing and investment management capabilities also position it to compete against TAMPs like AssetMark.

All of which ironically means that even as Wove is highlighting itself as an open-architecture, multicustodian operating system, it’s likely most appealing to advisors who solely want to use Pershing’s custodial services, outsource to Pershing’s investment management solutions, and go all in on Pershing’s native tech stack – raising the question of whether Wove would be better to advertise itself that way in the first place.

The potential of account aggregation tools has been tantalizing for financial advisors ever since the first tools for pulling in clients’ account balances and positions and transaction data from third-party sources, such as ByAllAccounts for advisors (or Mint.com for consumers), were introduced in the early 2000s. In an ideal world, access to an automatic, up-to-date flow of client data has a host of applications for advisors who want to enhance and scale their value, from performance reporting on held-away assets to automatic updates of financial planning projections to monitoring and categorizing clients’ spending activities. As a result, account aggregation is a standard feature on any technology tool today that makes use of clients’ banking, credit card or investment data, including most financial planning and performance reporting tools.

The challenge for advisors is that in practice, aggregation software rarely lives up to this potential. Data either doesn’t come through cleanly (since there are no consistent standards on, for example, how transactions are reported on asset managers’ websites), or all too often, it doesn’t come through at all (since changes to an institution’s website can disrupt the screen-scraping technology employed by most data aggregation vendors, while multifactor authentication and password reset requirements can break the connection until the client manually resets their credentials, one client and one account connection at a time).

The industry has tried to solve for these issues with the emergence of direct connection technology, with API interfaces allowing data to flow from the source direct to the account aggregator (without needing to rely on a traditional login with the client’s password just to screen-scrape the latest balances). However, most institutions have yet to fully retool their back-end technology to allow for direct connections — and given the cost of making those technology changes (which, if we’re being honest, are often for the purpose of an advisor or other third party encouraging clients to move money away from the financial institution), there isn’t a lot of incentive for institutions to quickly roll out new outgoing direct connection capabilities. The net effect, then, is that that in practice account aggregation turns out to be more account aggravation as advisors find themselves constantly chasing down clients to fix broken links or manually review data that didn’t import correctly.

In this context, it’s notable that all-in-one portfolio management software platform Blueleaf has announced a new solution dubbed aggregation-as-a-service that’s aimed at relieving the data aggregation woes of advisors and their clients. At its core, the solution leverages multiple underlying aggregation sources (for example, allowing users to select either Plaid or Yodlee to pull in data for a particular account to maximize the chances of using the best aggregator available for each particular account type or data source) and, on the back end, normalizes and cross-references data in hopes of eliminating at least some of the data errors that can be algorithmically reconciled against other providers’ data. Additionally, Blueleaf features a direct support team specifically for its aggregation solution, in contrast to many software providers’ support staff, who may be experts in the software itself but are often ill-equipped to handle third-party integration issues.

From an industry standpoint, the announcement is notable because Blueleaf has been around a long time — first as a client portal and investment performance reporting provider, then adding trading, rebalancing and billing capabilities over time, to become an increasingly all-in-one solution for portfolio management — in functions that have required increasingly robust account aggregation into its own system. That means Blueleaf had to solve many of these account aggregation issues for itself, especially when its roots were providing a high-quality performance reporting portal for advisors to share with clients. So by now, Blueleaf appears to have built up such a competency for bundling different aggregation providers that it’s launched the capability as a stand-alone service.

That makes a certain amount of business sense. Clearly a data aggregation provider that can finally live up to the promise of what account aggregation was supposed to be has lot of appeal for advisors.

The question remains, however, how high advisors’ expectations should be regarding Blueleaf’s abilities to help them maintain stable and consistent connections, when Blueleaf is ultimately still relying on third-party aggregation providers (and all the issues around screen scraping and password authentication that they entail, as direct connections remain slow to gain industrywide adoption). Additionally, advisors might be reluctant to add an additional cost for a stand-alone aggregation tool that — as much as it may be an improvement over existing solutions — is unlikely to be a silver bullet for their client data aggregation needs.

Nonetheless, given the proactive advice capabilities — and therefore, opportunities to deepen the advisor’s value and drive new revenue growth — that can come with truly automated account aggregation with high-quality accurate data and links that don’t break, Blueleaf is positioned to benefit — if it can manage to deliver on better aggregation with no (or at least significantly fewer) breakages.

As the saying goes, you can’t manage what you don’t measure. For advisory firm owners, having a set of key performance indicators can help with measuring the financial health of the business and tracking its progress over time to effectively manage growth. However, as firms accumulate clients and assets under management, it becomes more and more difficult to track an ever-widening range of core metrics across multiple advisors and offices. While firms managing client assets may have tools for calculating and tracking certain portfolio metrics (such as performance reporting tools to track the performance of portfolios, and other tools that monitor asset allocation for rebalancing purposes), the data insights provided by existing technology often stop well short of what’s needed to fully monitor the operations and growth of complex modern advisory firms.

The gap for most advisory firms becomes increasingly acute as they add advisors beyond the original founders, and questions begin to arise: Which advisors are growing faster than the others? Which are retaining clients better than others? Do they construct and implement portfolios in a similar manner, or do some advisors tilt their book of clients more aggressively or more conservatively? Are all advisors consistently rebalancing their client portfolios in the same way? Are clients just outright happier with some of the firms’ advisors over others?

To help address this, Riskalyze, which launched as and was historically known for being a risk-tolerance assessment platform, in recent years added an additional layer of portfolio-tracking capabilities for its users by creating firmwide dashboards for enterprise clients that tracked not only whether client portfolios were within the client’s asset allocation targets, but also whether they were in line with the clients’ “Risk Numbers” (generated by Riskalyze’s risk tolerance assessment tools). Over the years, Riskalyze expanded further into additional metrics to track whether portfolios were aligned around risk tolerance, tax efficiency and overall risk/return metrics, such as the company’s own Portfolio GPA score.

In June, Riskalyze — freshly rebranded as Nitrogen — announced that it’s going even further into deepening its firmwide portfolio analytics and other Advisor Insights capabilities, adding new tools to track and compare advisors within each firm, as well as benchmarking tools allowing owners to compare their firm’s overall numbers against those of similar firms, as advisory firms continue to scale up to face these common multi-advisor data tracking and reporting challenges.

The new features dovetail with Nitrogen’s rebranding and transformation from just a risk tolerance and portfolio analytics tool into a “growth company” focused on sales enablement and client success, which given the practical limitations of how many clients any one advisor can serve, is inevitably a multi-advisor management challenge. By adding more metrics to track multiple advisors’ growth trends and asset flows for the business, and the uniformity (or lack thereof) in how one advisor is constructing, implementing, and monitoring client portfolios versus another, along with the ability to benchmark against other firms of similar size, the focus is clearly no longer just on monitoring individual client portfolios to make sure they’re being properly managed from a compliance perspective, but on how firms and their multiple advisors are managing those portfolios across multiple advisors to translate into revenue and profit growth for the firm as a whole.

Notably, this announcement was paired with the unveiling of a new midlevel pricing tier for Nitrogen. While the company historically sold licenses to either to individual advisors (the elite tier) or to enterprise firms (the ultimate tier), there will now be a third tier, dubbed Ignite, that slots in between the two existing tiers and aims to serve midsize firms with two to 10 advisors. The new tier fills what had been a hole in the existing service model, where smaller multi-advisor firms may have wanted the ability to track more data around advisors’ growth success (which wasn’t available under the individual tier), but didn’t need the depth of multi-office enterprise capabilities offered under the enterprise tier. Now midsize firms no longer need to choose between buying Nitrogen’s enterprise tier and potentially paying for a lot of features they wouldn’t need, or sticking with the individual tier and losing the capability to track firmwide metrics.

Looking at the two developments together, it’s clear that Nitrogen sees an opportunity to use its client portfolio and advisor data to provide insights that facilitate not just managing individual portfolios, but also managing the firm’s own advisors as they grow to become increasingly multi-advisor firms — both for compliance oversight purposes, and for leadership to understand where growth is (or isn’t) coming from across the advisor base. That’s increasingly relevant in the multi-advisor firm space, which needs to scale and manage across multiple advisors, but often lacks the resources that bigger enterprises have to customize their CRM (e.g., Salesforce) or build in-house tools to measure (and effectively manage) that growth.

From an industry perspective, Nitrogen’s further expansion into advisory firm growth insights highlights that there’s still a gap in advisor technology that can actually help with tracking and managing a firm’s growth journey — both with regards to advisors bringing new clients on board, as well as managing relationships with existing clients — and a domain for Nitrogen to further lean into the direction of providing tools for sales enablement and client success.

What remains to be seen is whether Nitrogen’s early momentum in these sales enablement and client success categories will inspire a new crop of competitors — as occurred when Riskalyze was seen primarily as a risk tolerance platform — and if so, whether it will have better luck gaining traction than Riskalyze’s competition in the risk tolerance category, where its dominant market share was never seriously challenged (perhaps because it was playing a different game than its competitors in the first place).

Estate planning is a core aspect of financial planning, long existing as one of the pillar “Principle Knowledge Domains” in the CFP education and exam requirements. But for the past 25 years, it’s comprised a steadily declining share of the services actually provided by most advisors. The main reason for this has been the steady increase in the federal estate tax exemption, which has led to a decrease in clients who are potentially subject to federal estate tax (which traditionally made up the main value proposition for financial advisors in providing estate planning strategies, going back to advisors’ roots in selling life insurance policies in ILITs to fund estate tax liquidity for their affluent clients).

However, that isn’t to say there aren’t still reasons to engage in estate planning. While estate tax is one of the main concerns for advisors who practice estate planning, it still matters that (among other things) estate assets are distributed in an orderly (and timely) manner in the right amounts to the right people, that the correct individuals are selected and properly identified as guardians, executors and trustees, and that estate documents are implemented correctly once they’ve been drafted (and that the documents drafted actually align with the client’s intent).

The net result of these shifts in the relative value of estate planning has been an effective bifurcation in estate planning services provided by financial advisors. On one end, “traditional” strategic estate planning continues for the remaining few clients with federally taxable estates (or those with sufficiently high net worth to be very concerned not only with how much money is going to whom, and how it’s distributed, but how much Uncle Sam does or doesn’t get along the way). For those clients, the prospect of both hard-dollar savings (in the form of reduced gift and/or estate taxes) and the peace of mind that the client’s complex affairs are correctly managed present a clear value proposition for advisors who can deliver effective estate advice (and connect clients with qualified attorneys as an additional value-add).

On the other end, however, for the mass affluent. who have fewer estate tax concerns, the focus is often more on simply ensuring that the client’s basic estate documents (typically wills, simple revocable living trusts, and powers-of-attorney and health care proxies) are actually drafted and implemented to begin with. Beyond that, however, most of these clients don’t have the need — or realistically, the desire and willingness to pay more — for additional estate planning services or advice once those basic documents are in order. And given how long and difficult many estate planning conversations can be — which the advisor typically isn’t compensated for any more than their other financial planning services that are bundled into a holistic AUM fee — advisors usually aren’t eager to push for additional estate planning either.

As estate planning services have bifurcated between mass affluent and high-net-worth clients, the tools made to serve advisors in estate planning have diverged in kind. For clients with simple estate planning (primarily estate documentation) needs, Trust & Will, EncorEstate and Wealth.com provide a way for advisors to guide clients through a streamlined online document production process without the need to find their own attorney. For more complex clients, other providers like Vanilla, FP Alpha, Yourefolio and Envestnet’s MoneyGuide Wealth Studios have emerged to try to help analyze and design clients’ estate plans, sometimes going so far as to automate the process (often performed by manually dragging around boxes in PowerPoint) of visualizing complex estate plan diagrams and modeling alternative planning scenarios.

In that context, it’s notable that Vanilla has announced a new “estate advisory” platform, taking its previous technology-supported service of producing estate planning documents for clients through Vanilla’s network of lawyers and pivoting to a stand-alone software solution where advisors can create estate visualizations, project estate tax and beneficiary scenarios, and continuously monitor clients’ balance sheets (and update planning projections accordingly) via account aggregation in an estate advisory (as opposed to just one-time estate planning) approach. On top of that, Vanilla will still offer access to a network of attorneys and a document builder as an add-on service, although the platform will now be officially attorney-agnostic (i.e., if advisors have existing referral relationships with estate planning attorneys, they can keep using those attorneys and even loop them in with Vanilla’s estate analysis and estate monitoring technology by sharing their client dashboard).

Vanilla’s pivot pits it more directly against other estate planning visualization competitors like FP Alpha’s recently unbundled Estate Snapshot and Yourefolio’s advanced illustration tools, and effectively moves Vanilla upmarket in terms of the types of advisory clients its software serves to those that want, need and are willing to pay for more complex analysis and modeling of their higher-net-worth (and more likely federal-estate-tax-exposed) estate. Notably, Vanilla’s previous model — operating as a document preparation solution — would likely have been a nonstarter with many advisors of ultra-high-net-worth clients, who likely already had valuable referral relationships with existing HNW estate planning attorneys that Vanilla could have alienated. And it aligns with Vanilla co-founder Steve Lockshin’s roots as an advisor working with UHNW clientele.

However, given that there is a limited number of clients who either have a taxable estate or have enough assets at stake that they’re willing to pay for estate advice beyond document preparation, it’s not clear how much of a market there is for Vanilla’s ongoing “estate advisory” model. Arguably, Vanilla’s approach may be more geared toward advisors of more numerous “mere millionaire” HNW clients, where there may be an opportunity to open new estate planning conversations for clients who are still worried where their millions will go (enough to “ruin” the children without thoughtful estate planning). Those estate advisory conversations are more feasible with Vanilla’s technology solution than they were in the past. Though that’s still a bet that there are enough dollars at stake with these clients that advisors can charge enough of a premium for solving their estate planning problems of varying complexity to make Vanilla’s software fee worthwhile for the advisor.

With firms increasingly seeking to expand services, and a trend underway of firms expanding deeper into tax and estate advice, Vanilla seems well-positioned to capture a share of that market. However, the remaining question is to what extent advisors can improve their value proposition (and command additional fees) with nontaxable estates to make a big enough estate advisory market for Vanilla to grow from here?

Over a decade ago, robo-advisors launched with the promise of disrupting human advisors by constructing portfolios for a fraction of the advisory fees that human advisors traditionally charged, recognizing that the actual process of constructing and rebalancing portfolios can be heavily centralized and automated at scale with technology. However, the caveat — as robo-advisors soon discovered — was that the reason advisors charge what they do isn’t because of inefficient portfolio design processes, the cost of portfolio management or pure greed, but instead is heavily related to the cost of attracting new clients to begin with (with the most recent Kitces Research on marketing showing typical client acquisition costs of over $2,000 per client, and over $4,000 per client for more experienced advisors).

And for all their innovations in operational efficiency, robo-advisors didn’t actually solve for the high cost of client acquisition. In other words, robo-advisors brought an operational efficiency solution to a lead-gen problem, and before long most of the early consumer-focused robo-advisors were struggling or failing outright. As a result, virtually all robo-advisors eventually pivoted from stand-alone consumer-facing tools to become operational solutions for existing financial advisory firms themselves — an approach that had the most success with the largest incumbents like Schwab and wirehouse firms with their own existing distribution platforms (where robos could simply be cross-sold as another account management solution alongside the rest of the firm’s retail tools and/or via their human advisors).

At the same time, advisors who didn’t have scaled marketing and national brand reach continuously struggled to gain traction with robo solutions, since new breed of B2B robo-advisors still didn’t solve for the lead-generation problem that plagued the original consumer-facing versions. They may have made it easier for next-generation millennial clients to sign up for the advisor’s services (e.g., by putting a button to automatically open an account in between the lighthouse and Adirondack chairs on the firm’s retiree-centric website), but that can only be so effective if the clients never find the advisor’s website to begin with.

The one exception to this rule was Ritholtz Wealth Management. With popular bloggers, podcasters and CNBC talking heads (including founders Barry Ritholtz and Josh Brown, and a growing team of content creators), RWM was one of the few independent RIAs that had enough marketing power to be able to attract a critical mass of robo-ready clients via its own existing content marketing channels that could actually make for a viable robo-enabled RIA solution. So in 2015, Ritholtz launched its Liftoff robo-advisor on top of robo-technology from Upside Advisor, later rebuilding it on the Betterment for Advisors platform in 2019. Earlier this year, Ritholtz bought the remaining retail business of BlackRock’s legacy FutureAdvisor robo-advisor in a sign that it’s continuing to seek ways to grow and scale its robo-advisor offering.

In May it was revealed (not in any formal announcement but via updated Form ADV filings) that Ritholtz has started yet a new robo-advisor offering, called “Good Advice.” Like Liftoff, Good Advice charges an advisory fee of 0.5% (compared to up to 1.25% for Ritholtz’s core portfolio management service); however, unlike Liftoff (whose clients receive only investment management, with no individualized financial planning), Good Advice also appears to come with at least some amount of financial planning services, and also has a slightly higher (but still very low) $15,000 account minimum, and does not indicate any ongoing relationship with other external robo providers, such as FutureAdvisor’s existing business, or Ritholtz’s Betterment for Advisors relationship).

It's possible that Ritholtz plans to roughly mirror Vanguard’s Personal Advisor Services model of offering a choice between a pure, investment-only robo-advisor and a blend of human advice and digital investment management. But with the introduction of Good Advice between Liftoff and its core wealth management offering, it seems most likely that RWM is not launching Good Advice with the aim of having multiple robo-advisor solutions, but instead with a plan for consolidating its existing tools into a repackaged wealth management solution. In light of the recent Future Advisor acquisition bringing increased scale to Ritholtz’s robo-advisor arm (adding another $1.75 billion of robo clients to Ritholtz’s existing $2.9 billion book of business), Ritholtz appears to have decided that it doesn’t need to rely on (and split a portion of its investment management fees with) Betterment’s technology platform anymore, and is looking to in-source its various robo-advisor capabilities into a single Good Advice offering instead. That highlights the way that once advisory firms achieve scale, even traditional investment management solutions — e.g., portfolio management tools like Orion — are quite capable of executing robo offerings to automate portfolio management without a specialized provider (especially as RIA custodians have, finally, increasingly digitized and automation-enabled their own onboarding solutions).

That means that while it’s notable to see the launch of a new robo-advisor nowadays, the news can’t really be called a victory for robo-advice — rather, it’s more of a recognition that ifan advisory firm can successfully scale its marketing distribution at a high enough level, the technology has reached the point where it’s feasible to onboard and service small clients into a tech-enabled offering — as long as the firm has the national-scale distribution reach to get those clients in the first place. Ritholtz Wealth Management is a good case-in-point example of that — and ironically, may be one of the only examples likely to ever emerge, given its incredibly unique marketing approach and success.

Ultimately, what it means is that Ritholtz’s third-generation robo-advisor offering makes sense for Ritholtz itself (which can keep more of its advisory fees from its robo clients without spending additional dollars on external robo tech, while creating an easy path for the robo clients to try out financial planning in anticipation of their becoming higher-paying wealth management clients down the line). But given that few other advisory firms in the country have managed to achieve Ritholtz’s level of marketing scale through its assorted media personalities, it’s difficult to see anyone else replicating the success RWM has found in rolling out a sustainable robo-advisory business.

Various forms of artificial intelligence and its algorithm-driven expert system roots have been around for many years now, but the technology took a newfound focus earlier this year when OpenAI launched its ChatGPT-3 system, and suddenly AI was transformed from a mysterious behind-the-scenes machine that plumbs data and delivers insights into an interface where AI can chat with you like a human being and give answers to your questions like an intelligent conversation partner.

Notably, though, ChatGPT and similar large language models are not really intelligent in the sense that they’re literally learning the underlying subject matter; rather, the breakthrough with ChatGPT’s technology was that it artificially learned how to talk like a human. That meant that even though it doesn’t always know what it’s saying (including “hallucinations” in which the AI recites “facts” like legal citations that in reality are entirely made up), it’s generally clear, straightforward and competent (if not especially colorful) in its prose.

In that light, it’s useful to think of ChatGPT not as an intelligent system that provides reliable answers to questions, but simply as a system that generates human-sounding text in response to request prompts. That makes it something akin to a calculator for words: You provide input with some guidance on what you’re trying to say, and ChatGPT fills in the (literal) blanks to complete the thought.

Accordingly, it follows that as initial ChatGPT-integrated tools have begun to launch in the advisor space, almost none are built to actually provide advice or answer client questions, per se, but instead are using generative AI to fill in common blanks where advisors need to create words on an otherwise empty page. A few recently launched AdvisorTech examples include:

Communication is so wrapped up with the nature of what advisors do (and differentiates us from technology that could easily make calculations for self-directed investors on demand) that few advisors would be likely to hand over 100% of their verbal communication creation to AI. Yet finding the right words to explain concepts, write articles, summarize meetings or sound like a human on social media takes a nontrivial amount of time and a mental toll, particularly when spread across many clients at any given time. That work is greatly reduced when the words are already on the page (even when the advisor then needs to edit and adapt the words into their own voice) compared with writing from a blank slate. At its core, that’s really all that most of the tools described above are doing: capitalizing on the fact that it’s easier to edit than create by quickly serving up advisors something they can readily edit into their own final communication to clients.

That suggests the value of ChatGPT for advisors, then, isn’t that it can help find better planning opportunities or quickly look up a particular tax provision (both of which would likely require extensive vetting before being put in front of or being relied upon to get answers for a client, and eliminating whatever time savings would have been produced by using AI in the first place). Rather, it’s that it frees up more of the advisor’s time for doing that kind of work by eliminating the blocking point of needing to convert their thoughts into words that make sense to another person.

So it’s notable that although other AI-powered tools exist in the AdvisorTech space, the ones that appear to be gaining initial interest so far involve using generative AI to fill in blank spaces and not to give advice or provide answers a la chatbots and recommendation engines. In fact, other tools that have touted their AI capabilities going beyond — in more of an advice-giving or practice management context (including FP Alpha, the struggling Vise.ai and the now-defunct Benjamin) have had more limited success, and appear to face significant headwinds in convincing advisors to trust their output by highlighting their AI capabilities.

At the end of the day, any AI tool is only as smart as the data that underlies it and that the AI can learn from, and AI’s ability to actually digest and retain complex financial planning information, and apply it to individual clients who constitute a sample size of 1 (and thus are the antithesis of “big data” artificial intelligence learning) lags far behind its ability to use language to simply sound like (or generate editable communications for) a human.

It remains to be seen whether other capabilities of AI (and if so, which ones) will find traction, since as the technology improves to the point that it can start to reliably give factual answers, it will inevitably spawn new use cases and innovations. But thus far the success of ChatGPT seems to be less the ability to provide a human chat interface, and more the ability to come up with words for a blank page — which, while being far from Commander Data or HAL 9000 in terms of the power, usefulness and/or evil of the technology, represents a practical problem for advisors that AI has so far appeared well-equipped to solve.

In the meantime, we’ve rolled out a beta version of our new AdvisorTech Directory, along with making updates to the latest version of our Financial AdvisorTech Solutions Map (produced in collaboration with Craig Iskowitz of Ezra Group)!

So what do you think? Is Wove’s open-architecture capability useful if you aren’t already going all-in on its own native apps? How much can Blueleaf do to back up its promise to improve the account aggregation experience for advisors? Have you seen any meaningful time savings from letting AI generate text for you? Let us know your thoughts!

Michael Kitces is the head of planning strategy at Buckingham Strategic Partners, co-founder of the XY Planning Network, AdvicePay and fpPathfinder, and publisher of the continuing education blog for financial planners, Nerd’sEye View. You can follow him on Twitter @MichaelKitces.

Ben Henry-Moreland is senior financial planning nerd at Kitces.com, where he researches and writes for the Nerd’s Eye View blog. In addition to his work at Kitces.com, Ben serves clients at his RIA firm, Freelance Financial Planning.

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound