Underneath UBS Group’s Zurich headquarters, where black Mercedes sedans drop off and retrieve their passengers, lies a zone by the elevators furnished with a cylindrical ashtray. It is here that Iqbal Khan, the powerful head of UBS’ wealth business, has been known to retreat for a subterranean smoke.

The area has become a discreet corner where Khan can take a drag on his cigarette and casually chat with colleagues. Among UBS employees, one topic of late has been the direction of the bank. From the airier confines of his third-floor office, UBS Chief Executive Ralph Hamers has been pushing his vision of a new style of banking, one fit for the digital age.

The Dutch-born CEO — widely viewed as a surprise pick when he joined two years ago — wants to harness automated tools, streamline the byzantine executive ranks and improve the company’s standing in the U.S., where UBS is eclipsed by local rivals. Meeting those goals requires the embrace of lower-margin robo-advice via algorithms and mobile apps, not an easy ask of a breed of bankers accustomed to providing a personal touch.

Hamers and Khan have come to symbolise divergent paths into UBS' future. Khan is a private banker known for bringing bespoke services to the world's wealthiest people. Hamers, conversely, is eager to open the gilded gates of UBS to less demanding clients, namely those who merely reside in the foothills of great wealth.

But those attuned to Khan’s more traditional way of doing business are concerned about diluting a cherished brand built over 160 years around banking for the rich. And Khan’s disciples have a compelling reason for their loyalty: the business that the 46-year-old oversees has generated more than half of total revenue for the bank in the past three financial years.

In September, Hamers suffered a strategic setback when the $1.4 billion purchase of U.S. robo-adviser Wealthfront championed by the CEO abruptly collapsed. UBS sent out three thin sentences late on a Friday night that provided no reason for the retreat. The reversal has added to the impression inside the bank of a CEO who hasn’t fully established himself as leader and has yet to put the contours of his digital-banking push into clearer focus. Khan, meanwhile, has only asserted his position.

The dynamic playing out at the top has created fissures inside UBS, where several factions have formed in recent months. One has coalesced around Khan, who leads UBS’ vastly lucrative wealth franchise. Another bloc has emerged among 200 or so most senior managers, who run the day-to-day business and have a lot to lose in the flattening of hierarchy that Hamers, 56, is implementing. Then there’s Colm Kelleher, the new executive chairman with an appetite to shape the bank’s direction, whose task is to moderate between the forces of disruption and conservation.

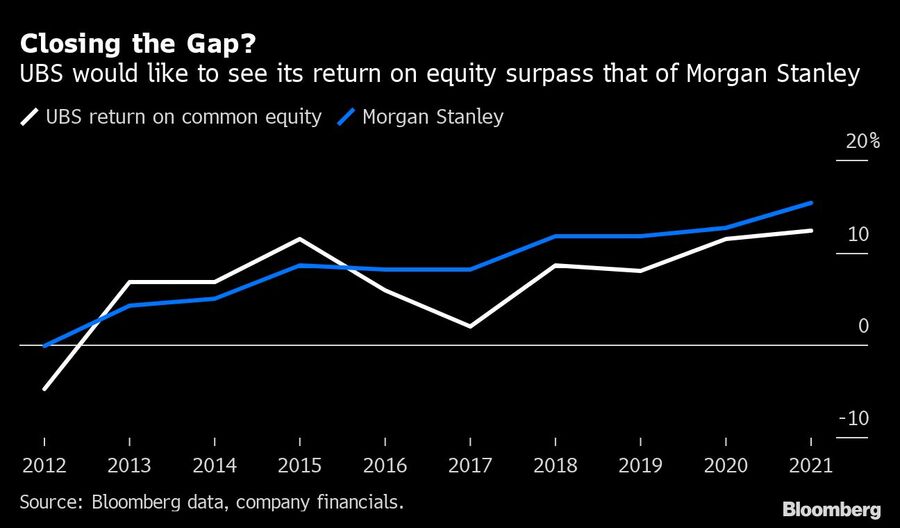

Compared with the profound upheaval unfolding a short stroll away on Paradeplatz at Credit Suisse Group, UBS would be forgiven for appearing outright drama-free. More than a decade after UBS required a government bailout during the financial crisis, the bank has become a bastion of stability and solid returns: It racked up more than $18 billion in profit between 2019 and the end of last year, and investors value it more highly than any other major European bank. The share price has gained 34% in the last two years, outperforming Deutsche Bank, which has gained 7% in the period. Credit Suisse has lost almost half its value since then.

But such steadiness also means that strategic shifts require a greater degree of justification to employees, who might question the need for change when times are good. That, in turn, calls for a reliable power base to garner support. And at UBS, there's no shortage of ambitious contenders looking to guide the direction.

This story is based on interviews with people familiar with UBS’ inner workings, who requested anonymity discussing private deliberations. UBS declined to provide comment for this story.

This past July, Khan secured himself a big break when the star banker assumed full oversight of UBS’ wealth business. The ascent solidified Khan’s position on the executive board as co-head Tom Naratil, a three-decade UBS veteran, moved into retirement.

The promotion hands Khan considerably more sway over UBS’ most important business. As UBS’ most senior private banker, Khan has carved out spheres of influence that allow him to circumvent the corporate pecking order. He has direct access to the biggest billionaire investors in the world, including client-shareholders of the bank in the Middle East.

Ever the consummate networker, Khan likes to host gatherings at his lake-view villa in Zurich, where he mingles with influential business leaders, clients and shareholders.

He makes regular use of the corporate jet to crisscross the globe and visit customers. As Khan said at a conference last month, “everything we do starts with clients.” But how exactly that connection is created is where the fault line runs. On one trip to the U.S. this month, Khan encouraged employees in Los Angeles to build advisory relationships "not with machines, but people," according to one person who attended the gathering.

Hamers, on the other hand, has said clients tell him that UBS has great products and the best advice, but that the bank must improve on its digital delivery.

Khan's dynamic with his boss garners internal attention in part because of how he arrived at UBS. Previously a star banker at Credit Suisse, his relationship with then-CEO Tidjane Thiam at the crosstown rival became strained when Khan was passed over for a promotion. Tension between the two men eventually broke into the open, and prompted Khan to start talks with banks including UBS, people with knowledge of the matter said at the time.

Khan left Credit Suisse for UBS in 2019 in a messy separation that included his former employer spying on its once-prized banker. It’s part of the reason why Khan keeps a lower public profile, including his garage retreats while other employees enjoy their cigarettes on the sidewalk.

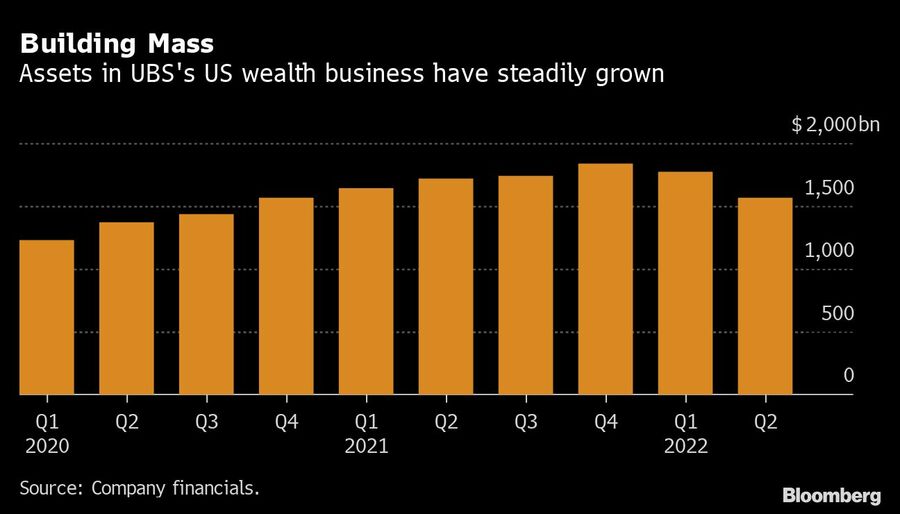

Among Khan’s fellow smokers is Christian Bluhm, UBS’ chief risk officer, who has become an important colleague. Working closely with Bluhm, Khan has helped build up UBS’ loan portfolio to rich clients, which brought in a wave of interest fees — about $10.5 billion in net interest income in the last two years and a half — a level of success that is hard to ignore inside the bank.

Khan also clicks with Kelleher. The two men both pursue a no-nonsense, numbers-driven approach, often focused on immediate performance, people familiar with their relationship said.

Hamers still retains better access to the bank’s board of directors by virtue of his position. In his first year, rather than a wholesale makeover of the senior ranks to build a hand-picked team, Hamers focused on promoting executives he inherited from his predecessor, Sergio Ermotti. Among them is the bank’s head of technology, Mike Dargan, who’s been in the job for more than half a decade.

The CEO has brought on some new talent, among them CFO Sarah Youngwood and general counsel Barbara Levi. But Hamers has neither an operations officer nor a permanent chief of staff, two roles that typically help the CEO execute tough decisions and enforce the leader’s directives among recalcitrant subordinates.

Khan is widely seen as the heir in waiting, and some of his peers have grumbled that he can carry himself as such, according to people close to the situation. Executives who have been left stalling for time in meetings while awaiting Khan, even in some that Hamers attended, have griped about what they perceive as a power move within UBS' hierarchical culture, the people said.

For Hamers, the Wealthfront deal, while not massive in size, held the promise of achieving several of his aspirations. The asset would have brought the Swiss bank more than 470,000 additional U.S. clients, and importantly a younger crop still accumulating wealth. It would furthermore have boosted UBS’ presence in the biggest market for rich clients, and would have given the bank’s digital push a jolt, at a time when the shift in that direction could benefit from an encouraging nudge.

The CEO is taking a page from the playbook he brought over from ING Groep, the Dutch lender Hamers infused with a dose of digitization during his seven years at the helm. In his mind, the banking industry has to adapt now if it wants to remain relevant.

“Let’s not wait for somebody to eat our lunch, let’s do it ourselves,” Hamers said in an interview earlier this year where he discussed his digital strategy. “Do you dare to cannibalize your own business? You have no choice.”

But creating new mobile applications, building business lines and upgrading customer interactions are not ticking along as swiftly as Hamers would like, say people familiar with the situation.

The recently launched Circle One app, an immersive tool that allows clients to interact with one another on similar ideas or check out the latest UBS insights on market and sector strategies, is only available in Asia for the time being.

Even getting the app launched in its limited capacity required UBS to hire an external team of developers that could whip up the tool in under 12 months — less than half the time it would have taken in-house programmers. But while outsourcing accelerated the push, it alienated UBS tech employees who felt they were being bypassed.

The section of the headquarters occupied by the CEO’s strategists and consultants is derided by some bankers as home to employees who now churn out diagrams and pretty presentations brimming with buzzwords like “agile,” “purpose” and “flywheel,” expressions previously unknown and ultimately meaningless to the traditional UBS banker.

Some employees view Hamers as pontificating. Bankers complain they’re being pushed through endless workshops on change that they view as distractions, leading to growing resentment among some in the rank and file, according to people familiar with the situation. Others bristle at the constant memos from Hamers that urge them to work differently, when underlying processes and policies force them to stick to the bureaucratic past.

As chairman, Kelleher relishes the clout that Switzerland’s corporate governance structure provides. The way the role is defined, the executive chairman sets strategy that his CEO then executes.

On the surface, Kelleher and Hamers couldn’t be more different. A straight-talking Irishman, Kelleher is brash and direct, while Hamers expresses his thoughts in a premeditated, collected manner. At the same time, the different approach and styles let both men learn from one another, people familiar with their relationship say.

As a result, Kelleher has taken on coaching Hamers to refine his approach to employees and investors, though he is careful not to overstep.

At its heart, Hamers' challenge is trying to bring a new-age mindset to an institution steeped in the tradition of the Swiss army. His management style has irked some old-school senior managers accustomed to endless hours in the office. Their CEO likes to start the day with an early-morning swim in Lake Zug near his home, followed by catching up on emails, documents and reports, sometimes from home.

For Hamers, it’s an expression of his belief that long days at the desk are overrated, and that he can run the business from his mobile devices. He also joined the bank in a year marked by global pandemic lockdowns, hampering his efforts to connect with the bank’s 70,000 employees spread across the globe.

UBS is built equally around a hierarchical corset and the lure of upward mobility. Within that framework, a select group of some 200 managing directors has earned some cherished privileges, from round-the-clock access to the headquarters to a private gym and car services.

Within months of his tenure, Hamers decided to do away with what he viewed as impermeable layers of management. As a result, all vice chair and group managing director titles were stripped down, and some perks are being phased out or opened up to a wider group of employees.

Hamers had originally sought to remove all ranks — from managing director all the way down to more junior titles — before he was discouraged by his advisers, who foresaw the revolt the move might create.

But as the CEO continues to do away with long-revered perks, posts and policies, he risks ceding ground to Khan, the man with a loyal support base who is gradually extending his reach all the way from the smoking corner in the basement to the very top of the bank.

Former Northwestern Mutual advisors join firm for independence.

Executives from LPL Financial, Cresset Partners hired for key roles.

Geopolitical tension has been managed well by the markets.

December cut is still a possiblity.

Canada, China among nations to react to president-elect's comments.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound