Deutsche Bank is using artificial intelligence to scan wealthy client portfolios. ING Group is screening for potential defaulters. Morgan Stanley says its bankers are “experimenting” in a “safe and contained environment.” Meanwhile, JPMorgan Chase & Co. is hoovering up talent, advertising for more AI roles than any of its rivals.

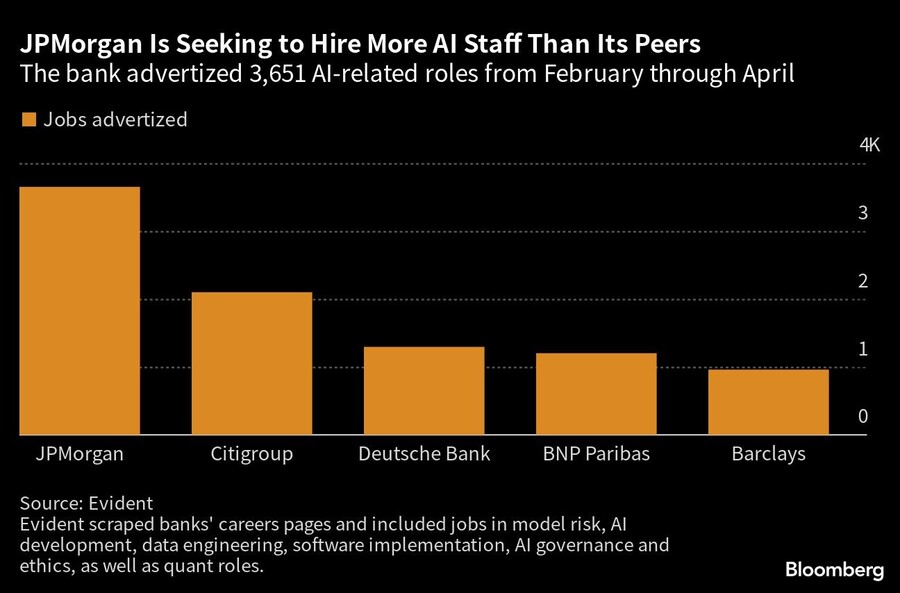

The AI revolution is unfolding on Wall Street as wider interest grows in the evolving technology and its likely impact on business. At the most enthusiastic banks, about 40% of all open job roles are for AI-related hires such as data engineers and quants, as well as ethics and governance roles, according to new data from consultancy Evident.

JPMorgan is leading the way. The biggest U.S. bank advertised globally for 3,651 AI-related roles from February through April, almost double its closest rivals Citigroup Inc. and Deutsche Bank, Evident’s data showed. Eigen Technologies Ltd., which helps firms including Goldman Sachs Group Inc. and ING with AI, said enquiries from banks jumped fivefold in the first quarter compared to the same period a year ago.

The release of Open AI’s ChatGPT in November 2022 has “made everyone — the board, the CEO and the leadership across the banks — much more aware that this is a game changer,” said Alexandra Mousavizadeh, Evident’s chief executive and co-founder. “The price for talent is going up,” she said, describing the situation as an “AI arms race.”

Investor enthusiasm has driven AI-related stocks upwards this year, before the first signs of cooling in the market sent chipmaker Nvidia Corp. lower Wednesday and hit suppliers in Asia.

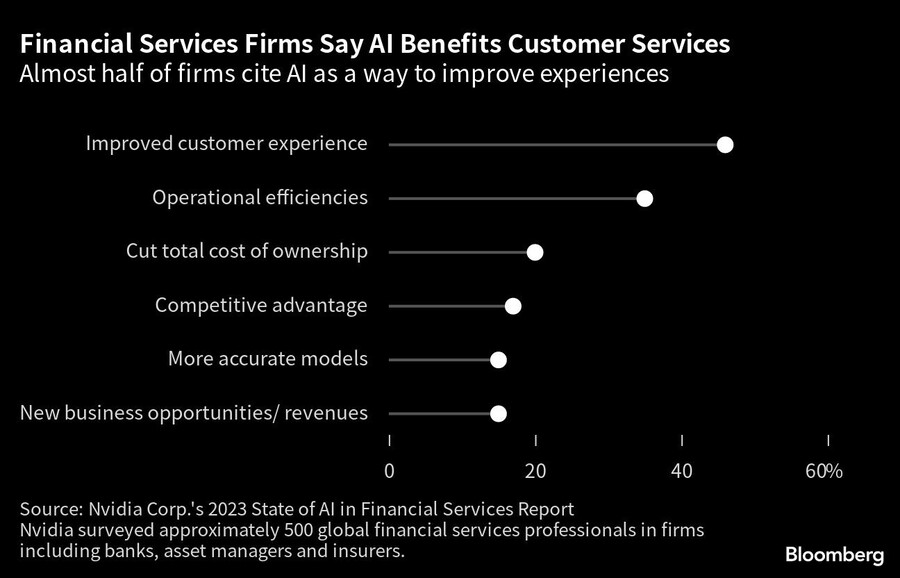

The potential prize for businesses is that everyday tasks will be handled more efficiently and effectively while complex analysis and risk modeling are made easier and faster. That’s particularly tempting in banking, where reams of data underpin increasingly complex investment decisions, despite uncertainties about AI’s eventual capabilities and concerns about how to regulate it.

The process has already begun, according to lawyers advising lenders on technology and regulatory issues. Banks are using AI “to come up with more tailored hedging solutions through instruments like interest-rate swaps and equity derivatives, enabling them to offer better pricing to clients,” said Steven Burrows, a director at Fieldfisher and a former derivatives trader.

Deutsche Bank is deploying so-called deep learning to analyze whether international private banking clients are too heavily invested in a particular asset and to match individual customers with suitable funds, bonds or shares. Subject to regulatory compliance, human advisers then pass on AI-generated recommendations.

“I’m a big fan of combining artificial and human intelligence,” said Kirsten-Anne Bremke, global lead on data solutions at Deutsche’s international private bank.

JPMorgan has similar plans. It filed a patent application in May for a ChatGPT-like service to help investors select particular equities, according to a person familiar with the matter who isn’t authorized to speak publicly. The project is in its early stages.

Morgan Stanley says it’s allowing businesses around the firm to run tests “from the bottom up” using open-source large language models — large AI networks trained using massive amounts of text from all over the internet. In April the bank said it had patented a model using AI and deep learning to interpret whether communications from the Federal Reserve are hawkish or dovish. The goal is to detect the direction of monetary policy.

“Every business, trading desk and investment group tries to understand it deeply,” Yuriy Nevmyvaka, head of the bank’s machine learning research group, said in an interview. “It’s in a safe and contained environment and it’s all within our walls.”

Barclays is still in the “serious study” phase, CEO CS Venkatakrishnan said at a conference on Thursday, with one potential use being to give customer service agents a better overview of client finances. Still, implementing any AI tools across the firm will take “multiple years,” he said.

In fintech, Klarna Bank CEO Sebastian Siemiatkowski told Bloomberg TV on May 25 that all employees at the Swedish buy now, pay later fintech are offered a ChatGPT-4 account and encouraged to experiment with the new tech.

The push has some urging caution, with concerns over transparency and effectiveness. Many — including billionaire investor Warren Buffett — see the eagerness to embrace complex AI systems as a harbinger of future risks.

“When something can do all kinds of things, I get a little bit worried,” the chairman and CEO of Berkshire Hathaway Inc. said at the company’s annual meeting May 6. “Because I know we won’t be able to uninvent it.”

Lenders are no strangers to using tech to gain advantage, recruiting data scientists, machine-learning experts and even astrophysicists in recent years. Those investments are now bearing fruit.

Wells Fargo is using large language models to help determine what information clients must report to regulators and how they can improve their business processes. “It takes away some of the repetitive grunt work and at the same time we are faster on compliance,” said Chintan Mehta, the firm’s chief information officer and head of digital technology and innovation. The bank has also built a chatbot-based customer assistant using Google Cloud’s conversational AI platform, Dialogflow.

French bank BNP Paribas is using chatbots to answer client questions while AI seeks to detect and prevent fraud and money laundering. Similarly, Societe Generale’s Cast uses its computational power to scan for possible misconduct in capital markets. It operates in 26 languages to process 2.5 million hours of conversation and 347 million emails each year, the bank said.

Goldman Sachs analysts estimate that 300 million full-time jobs globally could be exposed to automation by generative AI, according to a report in March. That could include 35% of the business and financial operations industry in the U.S.

Brian Moynihan, chief executive at Bank of America, said in April that AI could have “extreme benefits” and would help to reduce head count, while urging caution. “We have to understand how the decisions are made,” Moynihan said in an earnings call.

Bankers have a fiduciary duty not to trade on unreliable information. That’s an issue as use of AI expands. Alan Blackwell, professor of interdisciplinary design at Cambridge University’s department of computer science and technology, said a bank would need to trawl through information from a very wide range of public sources to train large language models. “For a respectable bank are you really going to say the same thing to your customers that the LLM has found on Reddit?”

AI is also expensive, both to develop and to run. Estimates show the costs of using large language models to answer a question can be as much as $14 per query, compared with $6 via a human lawyer, according to Lewis Z. Liu, founder and CEO at Eigen. That’s because of the extensive cloud computing costs associated with dealing with complex financial documents.

“These large language models are really unwieldy,” Liu said. “You need to be much more targeted and you may want to use smaller models that are better fine-tuned for your use case.”

Memories are still fresh of how blockchain and cryptocurrencies failed to deliver the far-reaching changes talked up by their backers.

Firms need to identify areas where AI can genuinely help and draw up a road map with senior executives, as well as training staff and hiring more experts, said Carlo Giovine, a partner at McKinsey & Co. who works with lenders and insurers. They also need to redesign risk frameworks to deal with intellectual property considerations, an uncertain regulatory environment and the danger of so-called AI hallucinations, where the system fabricates convincing-sounding information.

“We are now in the hype cycle, you can see how quickly the industry is moving,” Giovine said. “Some banks have started to realize what’s required to really scale this, but many are still trying to understand.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound