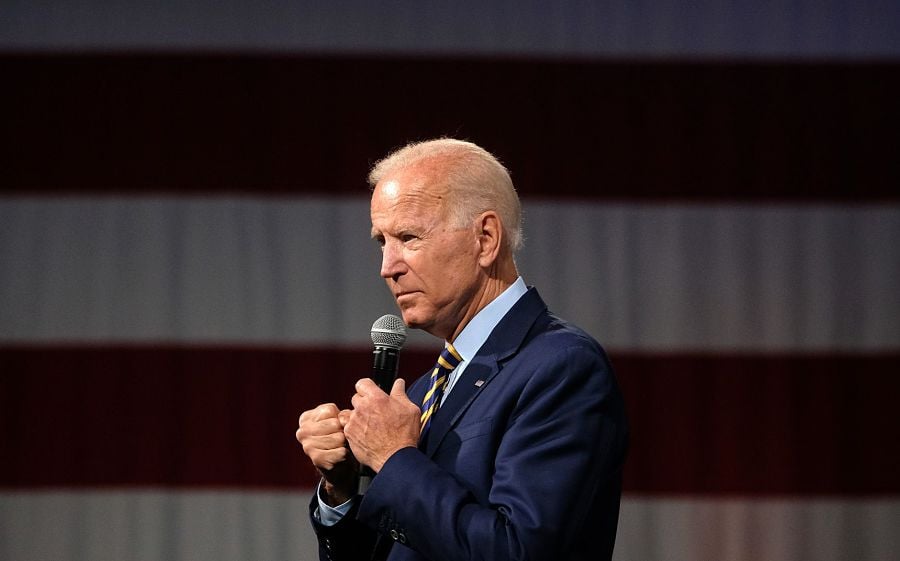

As the Biden administration is ushered into the White House, fintech companies should be bracing for a heightened regulatory atmosphere as the advisory industry continues to adopt and deploy innovations and new technologies, according to experts.

Within the first 100 days, President Joe Biden will likely replace the acting comptroller of the currency as well as the director of the Consumer Financial Protection Bureau, Aaron Cutler, a partner in the government relations and public affairs practice at global law firm Hogan Lovells, wrote in an email. Earlier this week, Biden nominated Rohit Chopra, a member of the Federal Trade Commission, to lead the CFPB.

Soon after Biden's nominees are in place, Cutler anticipates an uptick in enforcement, particularly at the CFPB.

Biden’s appointees for these seats and their policies around innovation could shape the future for fintech. While conventional wisdom suggests a Democratic administration will move to strengthen regulations, there is potential for focus on how fintech can be used as a partner to help accomplish the new administration’s goal of expanding access to financial services, and particularly shrinking the racial wealth gap, said Dan Quan, managing partner at Banks Street Advisory.

“We shouldn't be under the illusion that fintech can fix all our problems, especially in terms of the wealth gap, which is a much bigger economic and social situation than financial services can address,” Quan said during a webinar Dec. 7. “However, fintechs can play a very important role in terms of providing more convenient services, lower costs and delivery systems for consumers.”

For Thomas Curry, partner at Nutter McClennen & Fish and former comptroller of the currency, a new administration begs a much broader question regarding federal standards over fintech. “What’s the national strategy to regulate, or not regulate, fintech and financial technology in general?” Curry said.

Having a federal standard over fintech regulation is an area where a lot of progress could be made if regulatory policy is a part of the economic agenda of the Biden administration, said Paul Watkins, managing director of Patomak Global Partners and founder of the Office of Innovation for the CFPB.

“The key theme here is if we can free financial services from its silo, and we want to approach that organizationally and also through a policy perspective,” Watkins said. “Financial services regulators are isolated from the rest of the executive branch and this creates real problems that I hope the Biden administration will address.”

PREP FOR OVERSIGHT

In anticipation of more regulation, it’s fair for fintechs and advisers to look back to the Obama administration initiatives as indicative of where the Biden administration would take regtech, said Spencer Hoffman, partner at Lovell Minnick Partners.

“For example, our view has long been that increased fee transparency, lower frictional costs, and more demonstrated compliance with regulations are the future of wealth management because it's in everybody's best interest,” Hoffman said. “There will probably be more federal oversight, too, whereas over the last four years there have been less.”

In that light, fintechs should prepare to spend more on compliance, Hoffman said. “If for no other reason, increase spend to make sure that you're staying on top of what you need to be on top of.”

Firms can also begin to prepare for requests for executives to participate in congressional oversight hearings, according to a Hogan Lovells report on the 2020 election. This is especially true for larger financial institutions and leading fintech companies. “Taking time to prepare a potential witness before receiving a hearing invitation is always a good idea,” the law firm wrote.

TOP OF MIND

A lot of the initial attention will likely be on reversing Reg BI, which House Financial Services Committee Chairwoman Maxine Waters, D-Calif., has already pushed. What’s up next on the docket is data security, especially as the nation’s remote work environment has increased cybercrime, said Hoffman.

The debate over data privacy is far from over as major financial services firms have recently inked data-sharing deals that keep lawmakers skeptical.

Most recently Wells Fargo teamed with Envestnet to link consumer accounts and bring more than 1,400 financial apps to its banking customers. But even as the deal opens up access to important tools for consumers, Envestnet's business has garnered attention from Congress, lawmakers and consumers expressing concerns about the potential for consumers’ personal data to be compromised. Envestnet and its subsidiary, financial data aggregator Yodlee, was slapped with a data security lawsuit in August.

Envestnet, for one, is working directly with Capitol Hill in an effort to bring transparency to its data aggregator, which, in turn, could enable a federal standard for data privacy laws, company CEO Bill Crager said during the CB Insights Future of Fintech conference in November.

Crager is hopeful that once regulators can understand how Envestnet and its subsidiaries use and store consumer data, they can work together to build a federal standard.

In fact, what could keep moving the needle on data security and privacy concerns is if the government zeroed in on playing more of a facilitator role working with fintechs on a federal rule to govern data usage, Quan said.

“When a fintech signs a data-sharing agreement with a bank, they have detailed onerous requirements,” Quan said. “The problem is once you have this agreement with one bank and try to partner with another bank, those requirements are not identical.”

To that end, there needs to be more information from regulators on how these guidelines work, Quan said. “From the OCC, FDIC or the CFPB -- there needs to be some real clarity on how these guidances work, and unfortunately regulators, for whatever reason, haven't really focused on this issue.”

Reputational risk should also be a heightened concern for fintechs and advisory firms with regards to data security, Hoffman said.

“Wealth managers or asset managers do not want to be in the headline for having a data breach, for being in violation of a regulation or for doing something that is unsightly with respect to fees they are charging because, maybe they were in compliance, but they weren't transparent, and they weren't really representing their clients' interests first.”

That kind of reputational risk is as important as just pure regulatory compliance, Hoffman said. “That's where having access to market-leading technology and expertise is critically important.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound