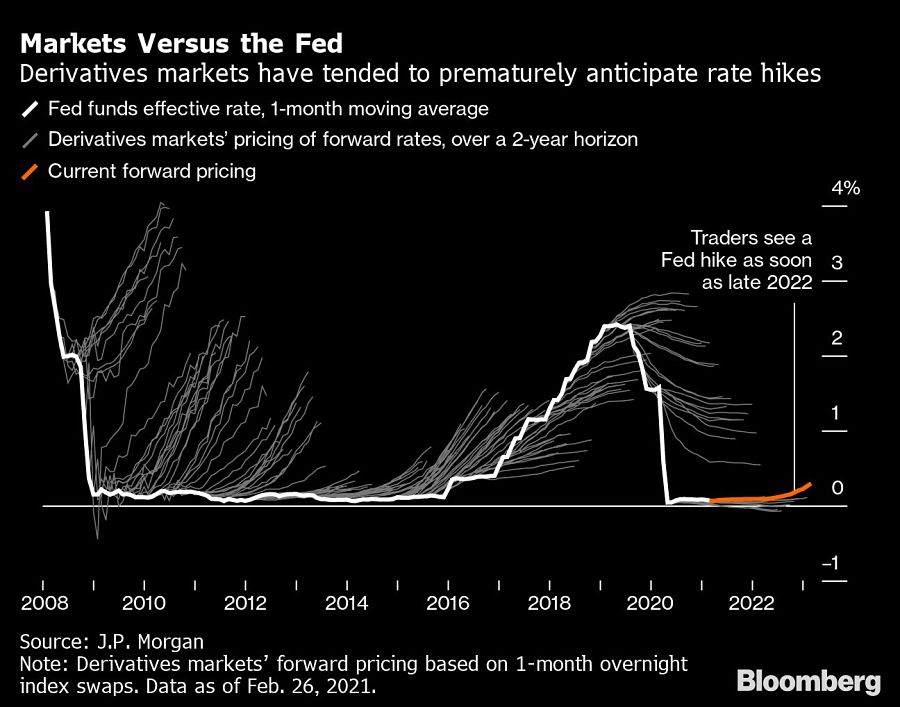

A word of warning for all those bond traders banking on a Federal Reserve rate hike as soon as next year: Since 2008, markets have underestimated how patient officials can be in lifting borrowing costs from zero.

After the Fed first slashed rates that low during the financial crisis, hedgers and bettors in money-market derivatives established a track record of being consistently too aggressive about the timing of the first move higher, according to JPMorgan Chase & Co. In late 2008, traders already saw several hikes in the following couple of years, even though it ultimately took officials until 2015 to tighten, the bank’s analysis shows.

That pattern may be happening again -- the savviest speculators in interest rates are looking at trillions of dollars in stimulus and an accelerating vaccination campaign and they’re concluding that there’s no way rates can stay this low without inflation getting out of control.

Swaps and futures now reflect almost a quarter-point of tightening late next year, and fully price in three increases of that size in total by the end of 2023.

To be clear, the Fed hasn’t always stuck with its plans for the path of rates. But Wall Street strategists warn that the likely outcome this time is that the market ultimately blinks first. It’s a game of chicken that carries risk for both sides, not just traders with money on the table.

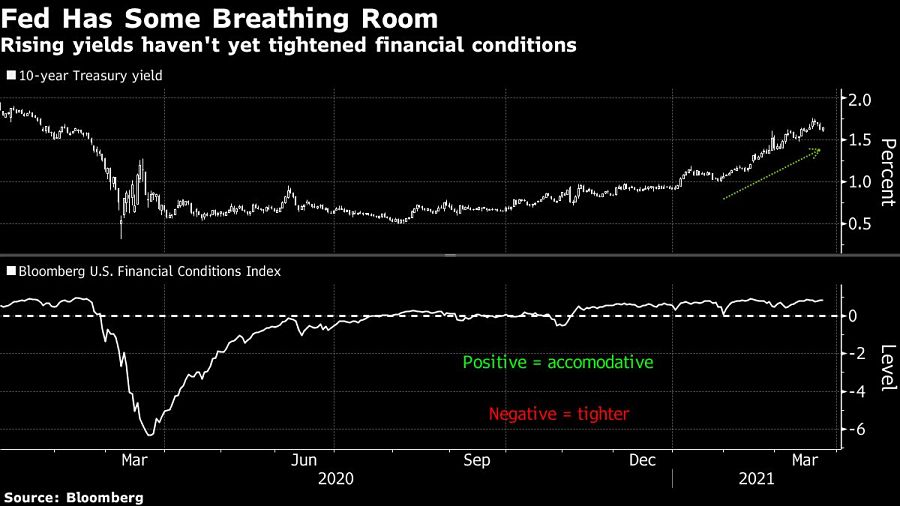

For the Fed, the standoff threatens to complicate its entire policy framework. The peril is that its message of patience will continue driving up long-term Treasury yields, already near the highest in more than a year, and eventually tighten financial conditions by rattling stocks or jacking up corporate financing costs.

“The market has its pricing and perceptions, and what happens can differ from that and has,” said Alex Roever, head of U.S. rates strategy at JPMorgan. The market has been testing the Fed by “trying to push further forward the first hike. But Fed officials don’t seem to be having any of it.”

Traders were reluctant to align their wagers with the speed of increases officials were penciling in after the central bank began its last tightening cycle. That was in part because after its 2015 liftoff, the Fed failed to deliver the multiple hikes it had projected for 2016. It eventually tightened only once that year as the Brexit vote dimmed the growth outlook. The dynamic shifted in early 2017, when traders had to scramble to price in a hike in response to Fed signals.

The Fed said last week that it will keep rates near zero until the labor market reaches maximum employment and inflation is on track to moderately exceed 2% for some time.

Governor Lael Brainard said this week the approach implies “resolute patience.” Chair Jerome Powell has also said he wants to see actual inflation data, and in testimony this week played down the risk that growth would spur unwanted price pressures.

That hasn’t quelled investors’ inflation angst, which has jolted most Treasury maturities. The sell-off has been particularly acute in the so-called belly of the curve, such as the five-year note -- which is closely linked to the Fed’s path over that horizon.

The yield on the five-year reached about 0.9% this month -- its highest since March 2020. That spurred a reassessment of one of the bond market’s premier reflation trades, the curve steepener. The rate has since settled back to around 0.8% as traders mull the Fed’s next step.

Traders may have reason to hope that their rate-hike bets will pay off. In projections released last week, seven of 18 officials predicted higher rates by the end of 2023, compared with five of 17 in December. A handful saw a move in 2022, and Dallas Fed President Robert Kaplan said he’s in that group.

Still, the median Fed projection is for rates to remain on hold through 2023, so for some analysts the move has been too far, too fast.

“Markets are in general forward-looking, but the Fed’s new framework by design is backward-looking, and Powell made clear they’ll be guided by realized data, not forecasts,” said Guneet Dhingra, head of U.S. interest-rate strategy at Morgan Stanley. “Some disconnect between markets and the Fed policy is understandable, but the degree of disconnect now is simply glaring. It’s more likely that the market comes to the Fed than the Fed comes to the market.”

Given the Fed’s playbook is to begin tapering its bond buying before lifting rates, as it eventually did after the 2008 crisis, tightening is a long way off, Dhingra said. He recommends wagering on further curve steepening, specifically between 5- and 30-year yields, on the view that tightening expectations will fade.

That spread peaked at around 166 basis points this month, near the widest since 2014, before narrowing back to around 150 basis points as the market shifted toward earlier rate increases.

To some degree, the market itself is telling the Fed it can settle for merely monitoring the bond tumult for now. Financial conditions, a way of looking at the overall level of stress in markets, have held steady in the face of rising yields. Stocks aren’t far from record highs, for example.

At JPMorgan, the thought is that the Fed holds steady until 2024. So the bank aligns with Morgan Stanley’s view, seeing the reckoning ahead coming from traders ultimately stepping back from tightening bets.

For now, the bond market is at a crossroads after absorbing a tough stretch, with longer maturities in particular entering a bear market amid mounting inflation expectations. The market’s outlook for consumer price growth over the coming decade surged this month to an almost 8-year high of 2.34%.

“One thing the Fed also has to be careful about is that it’s very hard to get the market to completely comply with everything they want at the front end of the curve when there’s a bear cycle in the back end,” said Alan Ruskin, chief international strategist at Deutsche Bank.

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound