Private credit is pulling away from the pack as the alternative of choice, taking the baton from crypto, commercial real estate and other so-called noncorrelated assets. The question facing financial advisors now is whether it has stamina to stay in the lead.

Both legs of the 60/40 portfolio failed in 2022, with the S&P 500 falling more than 18% and the iShares Core U.S. Aggregate Bond index dropping 13%. Taken together, the long-heralded 60/40 split lost 17% last year, its worst performance in over 85 years, according to the Leuthold Group. As a result, wealth managers have spent the better part of the past two years racing to find alternative asset classes to supplement the plain-vanilla stocks and bonds in their client portfolios.

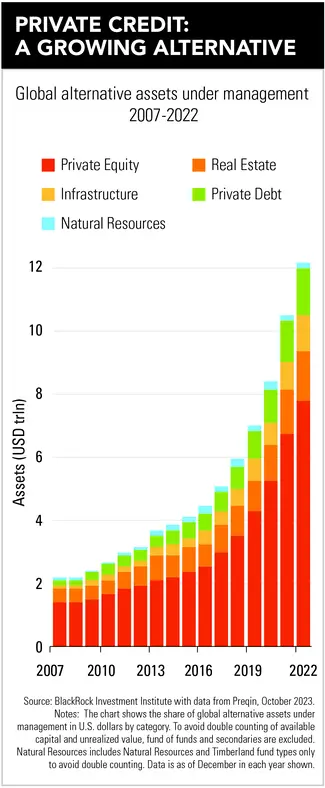

While other options have been front-runners at one point or another, private credit has proven to be the hare in the race, slowly accruing portfolio share and assets.

Excluding real estate, global private credit has grown to roughly $1.6 trillion of assets under management, according to Preqin data as of March. That puts it on par, in terms of size, with some of the widely tracked U.S. high-yield bond and leveraged loan indices, according to asset manager BlackRock. Private credit deployed capital in North America still totaled only about $698 billion as of March.

The wind at its back, pushing it along steadily, has been the rise in interest rates. The yield on the benchmark 10-year Treasury has surged to almost 5%, up from 1.5% in October 2021.

“Private credit funds can be a good option for accredited and institutional investors looking for additional ways to generate income through higher yields. It’s often structured as floating-rate debt, so the rising rate environment has enhanced the yield to limited partners,” said Andrew Graham, founder of Jackson Square Capital.

These loans are also higher in the capital structure and are prioritized over other loans, making them even more palatable for anxious investors and their risk-averse advisors.

“For some time, private credit has been used to access the full spectrum of the opportunity set, which can provide a portfolio with yield enhancement, uncorrelated return streams and even downside protection. Investments in this space can also broaden the overall credit mix or complement traditional-fixed income exposure,” said Jason Edinger, chief investment officer at Boston Wealth Strategies.

Adds Edinger: “The rise in private credit is not merely a fad.”

American banks have shown increasingly less interest in making smaller, less-liquid loans since the 2008 financial crisis ushered in an era of stricter regulations. Not helping the situation has been the effect of rising yields on bank balance sheets and reserves, as evidenced by the collapse of Silicon Valley Bank back in March.

As traditional lenders have pulled back from commercial markets, private credit has “filled the gap,” according to a recent report from BlackRock. And it will continue to do so until the economic circumstances change.

“The overall demand for private credit from high-quality borrowers and the volume of dry powder should provide strong deal flow and allow managers to be highly selective when deploying capital,” according to the BlackRock report. “Given the floating-rate structure of most private credit, moderate rate rises should boost investors’ returns, though they may increase the default risk for some borrowers.”

BlackRock believes that private senior and uni-tranche loans should deliver investors an “illiquidity premium” of between 150 and 300 basis points, compared with publicly traded leveraged loans. And the difference can be even wider for opportunistic, distressed and subordinated debt.

Financial advisors like Scott Bishop of Presidio Wealth Planners say retired clients have shown tremendous interest in products offering such elevated yields, especially since they have been starved of yield for so long.

“This can be a good asset for clients with IRAs if they don’t need all the income now, to defer taxation since it is traditionally all ordinary income,” Bishop said.

Ray Morrill, senior director of wealth management at Choreo Advisors, says private credit has become more accessible to individual investors and is being introduced as a way to diversify their portfolios further while providing the opportunity for increased performance.

“Rising rates, along with increased accessibility and awareness, have led to more capital moving into this space. At the same time, as with every investment, advisors have to determine whether they make sense within the context of the overall asset allocation and financial plan,” Morrill said.

It’s worth noting that while these loans are higher in the capital structure and are prioritized over other loans, they remain loans, which inherently means there is risk involved in owning them. Financial advisors had better make sure they are aware of such risks before introducing private credit to clients.

“I do recommend to some clients that they look into private credit, but I take a lot of care to make sure the issuer does a lot of due diligence and has a lot of experience in both diversifying the portfolio and finding good debt to buy, hold or issue,” Presidio’s Bishop said.

Boston Wealth Strategies’ Edinger also warns advisors about the dangers in the credit selection process, aka default risk. Beyond that, he believes the main challenges are typically the investment terms on these kinds of vehicles, notably their liquidity or lack thereof.

“We believe that in certain cases it makes sense for client portfolios to expand beyond traditional fixed-income and credit exposure, potentially utilizing private credit as a return enhancer or diversifier within the fixed-income sleeve of the overall portfolio,” he said.

No matter how far private credit outpaces other alternative investments in terms of popularity or asset accumulation, Jon Swanburg, president of TSA Wealth Management, is avoiding them altogether. That’s not because of their credit quality today, but because of the direction it may move in the future.

“I worry that issuers are going to continue lowering their lending standards to get the new inflows of cash put to work,” Swanburg said. “Given the limited regulation, the opacity of the underlying loans, and today’s high interest rates, I wouldn’t be surprised to see some sizable blowups in the years ahead.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound