Accord may still leave Uncle Sam still vulnerable, says fund firm boss: 'uncertainty premium'

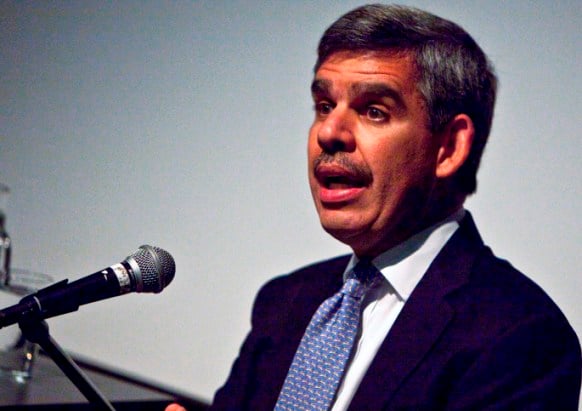

The U.S. government may lose its AAA credit rating even if lawmakers reach a plan to avoid a default, said Mohamed A. El-Erian, whose Pacific Investment Management Co. is the world's largest manager of bond funds.

“In most likelihood, a last-minute political compromise will avoid a default but will leave the AAA rating extremely vulnerable,” El-Erian, 52, the Newport Beach, California-based chief executive officer and co-chief investment officer at Pimco, wrote in an e-mail. “Stock markets around the globe will look to price in a greater uncertainty premium on account of political squabbles in the world's largest economy and the increasing risk that it may lose its sacred AAA rating.”

House Speaker John Boehner plans to press ahead with a shorter-term increase in the U.S. debt limit than President Barack Obama has requested, he told lawmakers yesterday, defying a veto threat and signaling continued stalemate in the Congress as time runs short for a deal. The impasse has boosted the chance Standard & Poor's will lower the U.S. credit rating from AAA within three months to 50 percent, the company said July 21.

Ten-year Treasuries fell, extending last week's drop, as Republicans and Democrats prepared dueling plans for raising the U.S. debt ceiling, unable to break a partisan stalemate. Yields on benchmark 10-year notes rose three basis points, or 0.03 percentage point, to 2.99 percent as of 11:48 a.m. in London, according to Bloomberg Bond Trader prices, after climbing six basis points last week. That's still below the five-year average of 3.72 percent. Thirty-year yields climbed five basis points.

Futures Fall

U.S. stock futures slid today, including the S&P 500 Index, indicating it will probably slump after rallying within 1.4 percent of a three-year high, as failure to raise the federal debt limit intensified concern of a default. S&P 500 futures expiring in September lost 0.8 percent to 1,330, while the dollar weakened 0.1 percent to $1.4376 per euro.

Boehner told rank-and-file Republicans during a conference call yesterday that they needed to pull together as a team to block Obama, who has asked for a $2.4 trillion borrowing boost in the $14.3 trillion debt ceiling, from obtaining the money all at once, without any guarantees of spending cuts. His remarks were described on condition of anonymity by a person familiar with the discussion.

“The debt ceiling debacle unambiguously translates into an intensification of the already-strong headwinds facing U.S. growth and employment creation,” El-Erian said.

Total Return Fund

Pimco's $243 billion Total Return Fund, managed by Bill Gross, has returned 3.76 percent this year, beating 68 percent of its peers. The company revised how it listed asset holdings last month to show that its flagship fund held U.S. government debt. Gross boosted the fund's investment in U.S. government securities to 8 percent of assets in June from 5 percent in May, according to a Pimco report this month.

The U.S. economy probably expanded in the second quarter at the slowest pace in a year as higher fuel costs crimped consumer spending and supply disruptions limited production, economists said before a report this week. Gross domestic product rose at a 1.8 percent annual pace after a 1.9 percent gain in the previous three months, according to the median forecast of 69 economists surveyed by Bloomberg News before the Commerce Department's July 29 report.

--Bloomberg News--