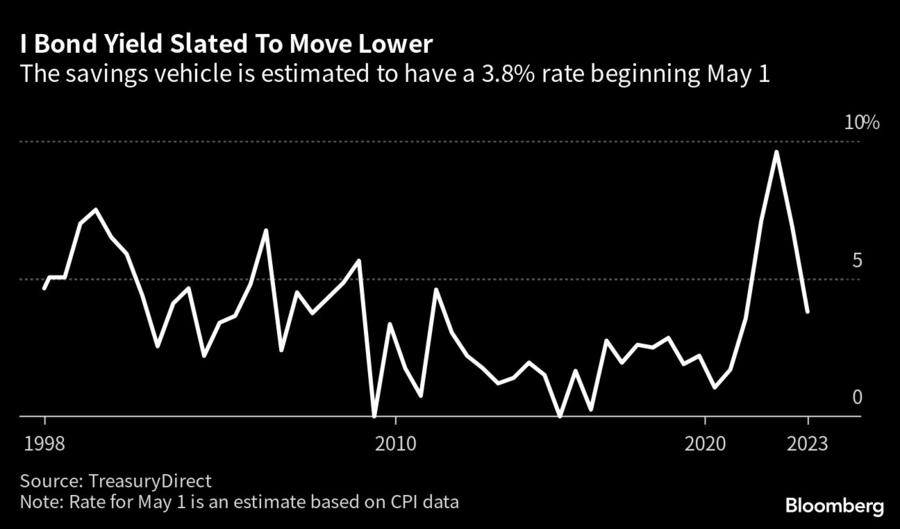

The golden age of the I bond appears to be over. Yields on the popular Series I savings bonds are set to slump after a key measure of inflation showed signs of softening Wednesday. Just a few months ago, I bonds offered a historic 9.62% rate. Now that figure is expected to fall to 3.8%, putting the return closer to what you can get on certificates of deposit, high-yield savings accounts and money-market funds.

Low-risk, inflation-linked I bonds soared in popularity over the past two years as investors looked for ways to shield their cash from rising prices. In the 15-month stretch beginning in November 2021, when I bond rates rose above 7% for the first time since 2000, sales topped $40 billion, according to the Treasury Department.

“From May of 2020 until October of 2022, if someone said, ‘Should I buy an I bond?’ the answer was, ‘Yes,’” said Jeremy Keil, a financial adviser at Keil Financial Partners in New Berlin, Wisconsin. “Today the answer is, ‘Maybe.’”

Bloomberg News asked financial advisers across the country whether people should consider purchasing I bonds now, later or never. This is what they told us.

The new yield is primarily tied to the semiannual inflation rate from September to March, which cooled from the previous six-month period, plus a somewhat enigmatic fixed rate that’s determined by the Treasury Department. So while it’s possible to estimate the new I bond rate — under the assumption that the fixed rate won’t change — investors won’t know for sure until it’s announced on May 1.

Still, anyone seeking certainty on their rates for the next 12 months should consider making an I bond purchase before the end of April.

That’s because of the nature and timing of I bond rates. They’re made up of two parts: the fixed rate that never changes over the life of the bond and a variable rate set twice a year that rises and falls with the consumer price index. The Treasury Department sets the rate on the first day of May and November each year.

Because of the twice-yearly resets, the date investors purchase their I bonds can make a big difference to their returns. Bonds purchased before the end of April will provide six months of the prevailing rate of 6.89%. Then, six months from their purchase date, they’ll take on the estimated 3.8% rate for the subsequent six months. But someone who waits until May will take on the 3.8% rate for six months, and then the still-unknown rate, to be set Nov. 1, for the following six months.

“If you only plan to hold the bonds for one to two years, it may be sensible to go ahead and lock in the 6.89% for six months,” said George Jameson, owner of Capital Wealth Group in Columbia, South Carolina.

There is a case to be made that some investors should wait until May to buy I bonds, which have a 30-year maturity. If the Treasury decides to increase the fixed rate, which remains the same for the life of the bonds, it could offset a lower variable rate.

“My belief is it will go up,” said Shane Sideris, co-founder of Synchronous Wealth Advisors in Santa Barbara, California. “A higher fixed rate is very attractive since it stays with you for the life of the bond.”

Currently, the fixed rate is 0.4%. It increased in November from 0%, a surprise to many close observers. But over time, the fixed rate for I bonds has fluctuated from zero to as high as 3.6%. And while the Treasury provides its formula for the variable rate, the fixed rate is something of a mystery.

“There’s all sorts of speculation that it tracks X or Y, but the reality is nobody knows,” said Jennifer Lammer, founder of advisory Diamond NestEgg in New York and host of a YouTube channel that features popular videos about I bonds.

Lammer’s plan is to hedge: She’ll buy half of her I bonds in April and the other half once the new rate takes effect, just in case the fixed rate rises. U.S. citizens, residents and government employees can purchase up to $10,000 in I bonds per calendar year. (Those who use their federal income tax refunds may purchase an additional $5,000, which would bring the annual limit to $15,000.)

Investors should get their financial houses in order before investing in I bonds, said Brandon Welch, a financial adviser at Newport Wealth Advisors.

He points out that a 3.8% yield pales in comparison to the roughly 20% interest rates on credit card debt, which investors should prioritize paying off first. Also, people who put their money in I bonds without maxing out their workplace 401(k)s are missing out on free money if their employers match contributions.

Jonathan Shenkman, a financial adviser and portfolio manager at Shenkman Wealth Management in Woodbury, New York, said investors should look at I bonds in a wider context.

“One thing that gets lost in all the buzz around inflation and I bonds is that they are not a path to wealth,” he said, pointing to the limits on how much investors can buy and the likelihood that they’ll underperform stocks as inflation cools. “This big-picture perspective is important when ascertaining whether I bonds are a good fit for your portfolio.”

Relationships are key to our business but advisors are often slow to engage in specific activities designed to foster them.

Whichever path you go down, act now while you're still in control.

Pro-bitcoin professionals, however, say the cryptocurrency has ushered in change.

“LPL has evolved significantly over the last decade and still wants to scale up,” says one industry executive.

Survey findings from the Nationwide Retirement Institute offers pearls of planning wisdom from 60- to 65-year-olds, as well as insights into concerns.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound