Retiring early can be an attractive option for many, but before taking the plunge, there’s one important question to consider: how does early retirement affect Social Security benefits?

In this client education article, InvestmentNews explains how leaving the workforce before full retirement age (FRA) can impact the payouts you’re set to receive. We will also break down the pros and cons of early retirement and the factors you need to consider before making a decision.

If you’re planning for your financial future and want to make the best choices for your retirement, you’ve come to the right place. Read on and find ways to maximize your Social Security benefits in this guide.

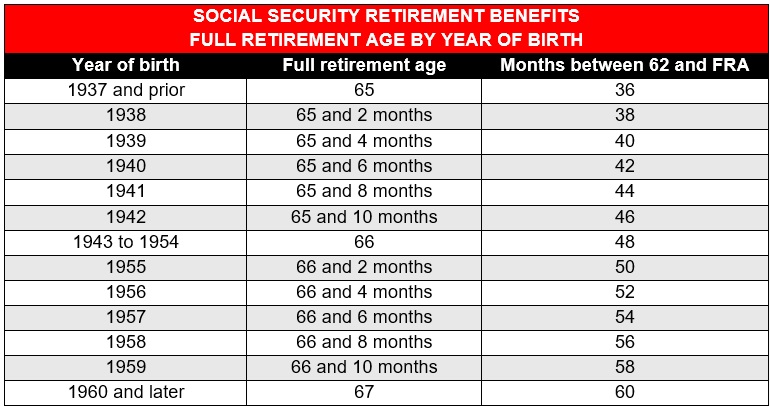

Everyone who has worked at least 10 years and contributed to the program can start collecting Social Security benefits at age 62. This age requirement also applies to Social Security spousal benefits. The FRA, however, is between 65 and 67, depending on the year you were born.

Here’s a summary of the FRAs – sometimes referred to as normal retirement age (NRA) – based on the year of birth, according to the Social Security Administration’s (SSA) website.

Learn more about how to claim your personal retirement payouts in this guide to understanding Social Security benefits.

To calculate how much Social Security benefits you’re entitled to, the SSA uses a formula based on your income in your 35 highest earning years. This amount is then indexed for inflation. Early retirement, however, has a direct impact on your Social Security payments. Let’s explore the different scenarios:

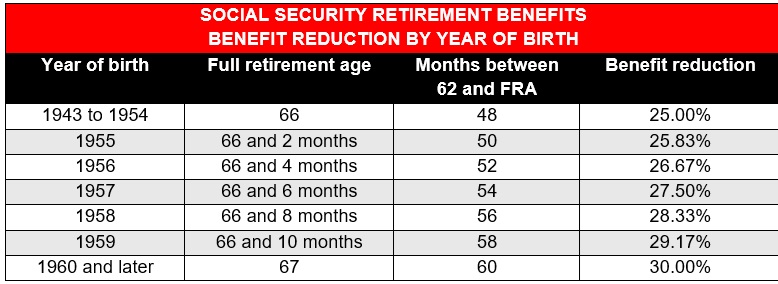

If you start claiming Social Security benefits before normal retirement age, your monthly payouts will be permanently reduced by a certain percentage for every month before your FRA:

Here’s how much early retirement can affect your monthly Social Security benefits, according to the SSA.

If you were born between 1943 and 1954, for example, and filed for retirement benefits at age 62 – the earliest possible – your monthly payments would be reduced by 25%. Let’s say you were set to receive $1,800 in Social Security benefits had you waited for FRA. Because you claimed as soon as you were eligible, you would only get $1,350 in monthly benefits.

Here’s the calculation:

$1,800 x 25% = $450

$1,800 - $450 = $1,350 (monthly Social Security benefits at age 62)

The SSA bases your retirement benefits on your 35 highest earning years. If you retire with less than 35 earning years, however, those years without work count as zeroes in the SSA’s benefit calculation. This can significantly reduce the benefit amount you can receive.

But even if you have completed 35 years of gainful employment, some of those may be low-earning years. Because your benefits are based on your average earnings for this period, the years when you earned low income can also affect your Social Security payouts.

You can access the SSA’s retirement estimator to get an idea of how much retirement benefits you will receive based on your personal situation.

When you file for retirement benefits before FRA but continue to work, you’re subject to the Social Security earnings test if your income exceeds a certain threshold. Also called the retirement earnings test (RET), this temporarily reduces your monthly benefits.

If you’re not going to hit FRA for the whole year, the SSA deducts $1 from your retirement benefit for every $2 you earn above the annual income limit. The income threshold for 2024 is $22,320. This means that if you’re earning $40,000 for the year, the SSA will deduct $8,840 from your yearly retirement benefits. Because of this, you may end up not receiving payouts for the first few months.

But if you’re reaching FRA within the year, the SSA deducts $1 in benefits for every $3 you earn exceeding a different limit. This year, the higher income limit is $59,520. Note that the SSA only counts income up to the month before your full retirement age, not the entire year.

Let’s say you will be at FRA in October and expect to earn $65,000 from January to September or $5,480 above the higher exempt amount of $59,520. During this 10-month period, the SSA will withhold about $1,827 ($1 for every $3 above the limit) of your retirement benefit.

You can, however, recoup most of the withheld payments once you reach normal retirement age.

The SSA’s retirement earnings calculator can help provide an accurate estimate of how much Social Security benefits you can receive if you plan to file and continue to work before FRA.

Learn more about how the Social Security earnings test works in this guide.

If you’re a stay-at-home or lower-earning spouse, you can claim benefits up to 50% of your working or higher-earning partner’s Social Security benefits. The amount you can receive depends on when you decide to claim the spousal benefits. You can get the maximum amount if you wait until full retirement age before filing.

If you claim the benefits too soon, there are drawbacks. The SSA permanently reduces spousal benefits by 25/36 of 1% for each month before reaching FRA. This applies if you’re reaching full retirement age within 36 months. If you retire more than 36 months before normal retirement age, the agency will slash 5/12 of 1% for the exceeding months.

This means that if you file upon reaching 62 years old, you can end up receiving payouts just 32.5% of your working or higher-earning spouse’s retirement benefits.

Find more information about Social Security benefits for a nonworking spouse in this guide.

While the best way to maximize your benefits is to delay retirement, this may not be a viable option for everyone. If you’re thinking about the effects of early retirement on Social Security benefits, it may help if you consider these benefits and drawbacks:

Claiming retirement benefits early can give you quick access to cash. This is important if you have no other means to cover your daily living expenses.

If you’re in poor health or don’t expect to live long enough to enjoy your benefits, it may be a good idea to claim the benefits sooner rather than later. This is especially true if you’re single and don’t have to worry about how early retirement affects Social Security survivor benefits.

Early retirement also triggers spousal benefits, which can provide the family with two sources of income if the need arises. The benefit amount, however, depends on how much each spouse earns. Find practical but effective Social Security strategies for married couples in this guide.

Early retirement permanently reduces your monthly payouts. You can end up getting between 25% and 30% less than what you’re supposed to if you wait until full retirement age.

Apart from smaller monthly benefits, you will get less on a dollar basis for future Social Security COLA. To illustrate, beneficiaries in 2024 are receiving a 3.2% increase in COLA from 2023. This means that if you were born between 1943 and 1954 and receive a $2,000 monthly payout, you will get an additional $64 every month. But if you retired at age 62, your benefit would have been reduced by 25% to $1,500 for a COLA of $48 in 2024. Because COLA compounds over time, this difference will continue to widen each year.

If you’re under FRA and file for retirement benefits but decide to continue working, your monthly payouts will be reduced if you earn too much. Depending on your income, you may be subject to a retirement earnings test, which can slash a significant amount from your benefits. You can, however, get the lost benefits back once you reach FRA.

Because each person’s circumstances are unique, there’s also no single best age for claiming Social Security benefits that suits everyone. Before filing for retirement, there are several factors that you need to consider, including:

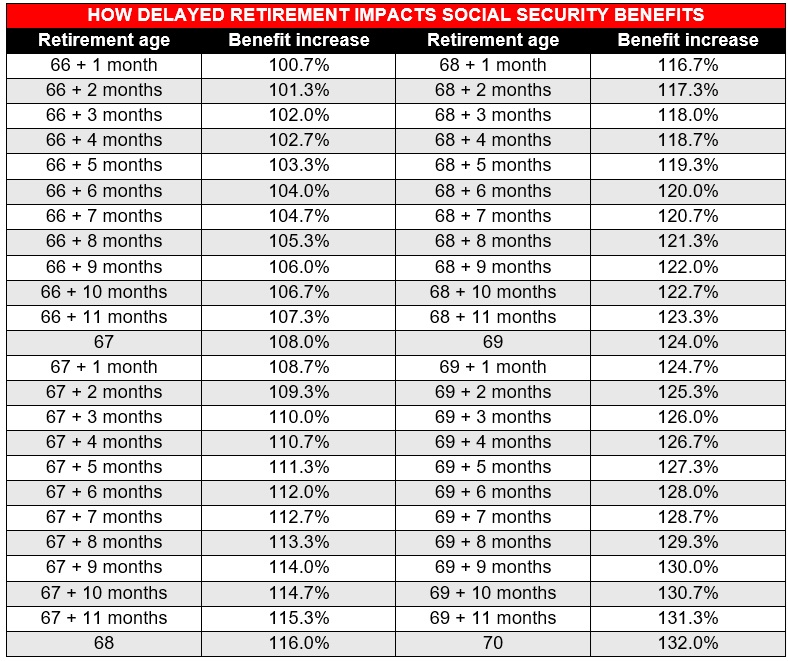

Often, the best and most effective way to maximize your Social Security benefits is to delay retirement. You can earn an additional 8% in benefits for every year after your FRA. This means that if your FRA is 67, you can earn 124% of your monthly retirement benefit by holding off claiming until age 70.

Here’s how much your Social Security benefits can increase for every month you delay retirement until age 70, according to the SSA.

Visit our Retirement Planning News Section for more information about Social Security benefits. Be sure to bookmark this page to access breaking news and the latest industry updates.

Post-election poll unpacks expectations around the S&P 500, odds of a correction, and strategies to navigate market risks.

"Cash options are in use because people don't know that there's a better option," one fintech CEO said.

Notes from the November meeting indicate broad support for a gradual approach as a cloudy view on the neutral rate complicates policymaking efforts.

Amid its aggressive global push, lax procedures at the firm led to one-fourth of international accounts being flagged as high-risk for money laundering, according to a 2023 document.

Ages Financial Services had about 60 financial advisors registered under its roof.

Streamline your outreach with Aidentified's AI-driven solutions

This season’s market volatility: Positioning for rate relief, income growth and the AI rebound